ZFX Broker Review

Choosing the right Forex broker is a pivotal decision for anyone looking to venture into the world of currency trading. With the Forex market’s vastness and complexity, having a reliable broker can significantly impact your trading success. It’s not just about finding a platform to execute trades; it’s about securing a partner that offers favorable trading conditions, robust security measures, and the tools you need to thrive in the Forex market.

ZFX Broker stands out as a notable player in the competitive Forex brokerage industry. Operating as an NDD (No Dealing Desk), STP (Straight Through Processing), and ECN (Electronic Communication Network) broker, it has carved a niche for itself since its inception in 2016. Headquartered in London and regulated by the reputable British FCA (Financial Conduct Authority) and the Seychelles supervisory authority FSA, ZFX Broker is committed to offering transparent and efficient trading experiences. This regulatory backing not only underscores its credibility but also assures clients of a trading environment that is both secure and conducive to their investment goals.

In this comprehensive review, I’ll dive deep into ZFX Broker’s offerings, shedding light on what sets it apart from others. From exploring the variety of account options to dissecting the deposit and withdrawal processes, commission structures, and more, my goal is to provide you with a thorough understanding of ZFX Broker. By integrating expert analysis with feedback from actual traders, this review aims to furnish you with all the critical information needed to decide if ZFX Broker aligns with your trading aspirations.

What is ZFX Broker?

ZFX Broker, positioned as an NDD (No Dealing Desk), STP (Straight Through Processing), and ECN (Electronic Communication Network) broker, has been a pivotal player in the online FX and CFD trading sector since 2016. With its headquarters in London, ZFX has established a strong regulatory foundation, being overseen by the British FCA (Financial Conduct Authority) and the Seychelles supervisory authority FSA (Financial Services Authority). This dual regulation not only boosts its credibility but also ensures a high level of operational integrity and client security.

Catering to traders from Europe, Asia, and Africa, ZFX offers a broad spectrum of trading instruments including currency pairs, indices, stocks, and commodities. This diversity enables traders to explore and capitalize on various market opportunities through a single platform. As a part of the Zeal Group of fintech companies, ZFX benefits from specialized liquidity solutions, enhancing its service offerings to regulated markets globally. This affiliation underlines ZFX’s commitment to providing its clients with robust and reliable trading environments, backed by innovative technology and comprehensive market access.

Benefits of Trading with ZFX Broker

Trading with ZFX Broker has offered me a streamlined and efficient trading experience, primarily due to their direct market access provided through NDD, STP, and ECN models. This setup ensures that my trades are executed swiftly, with minimal slippage and without the interference of a dealing desk, which is crucial for implementing fast-paced trading strategies.

Another significant benefit I’ve experienced is the competitive spreads, especially on ECN and Professional accounts. These tight spreads are particularly advantageous for trading major currency pairs, reducing my trading costs and enhancing potential profitability. The diverse range of trading instruments, including currency pairs, CFDs on stocks, indices, and commodities like oil and precious metals, has allowed me to diversify my portfolio effectively.

Moreover, ZFX’s regulatory compliance with both the FCA in the UK and the FSA in Seychelles offers a layer of security and peace of mind. Knowing that my funds are segregated and protected adds confidence to my trading activities. The absence of withdrawal fees (excluding potential third-party charges) further maximizes my investment returns, making ZFX an attractive broker for traders prioritizing cost-efficiency and regulatory security.

ZFX Broker Regulation and Safety

ZFX Broker operates with strict adherence to the regulations set forth by the Financial Conduct Authority (FCA). Its foundation in England and Wales situates it within the Zeal Group, which encompasses Zeal Capital Market (Seychelles) Ltd, governed by the Financial Services Authority of Seychelles (FSA). This dual regulation is a cornerstone of ZFX’s global credibility, assuring traders of the broker’s commitment to compliance and ethical business practices.

A standout feature of ZFX is its client fund security protocol. By segregating client funds from corporate assets and holding them in separate accounts at major banks, ZFX ensures an exceptional level of safety and transparency. For professional traders, there’s the added benefit of compensation eligibility under the Financial Services Compensation Scheme (FSCS), providing an additional safety net. ZFX’s dedication to legal compliance and the integrity of its operations is evident in its rigorous adherence to contractual obligations, reinforcing its status as a trustworthy partner in the trading industry.

ZFX Broker Pros and Cons

Pros

- Low spreads on ECN accounts.

- Options for high leverage.

- Regulated by both FCA and FSA.

- Access to more than 100 trading assets.

- Direct trade execution without dealing center interference.

- Mini account option with a low entry deposit.

- Diverse account types to suit different traders.

Cons

- Restrictions on the number of open positions for some accounts.

- Lack of a web-based trading platform.

- ECN accounts require a substantial initial deposit.

ZFX Broker Customer Reviews

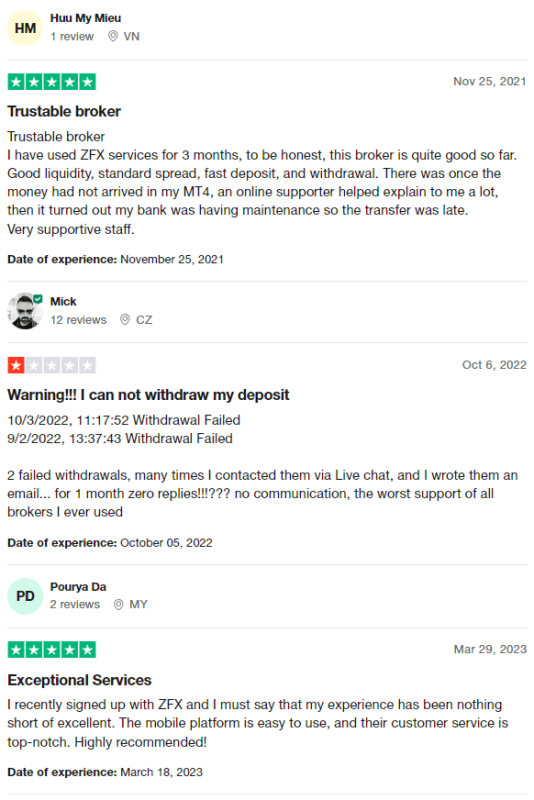

Customer reviews of ZFX Broker reveal a mixed response towards its services and customer support. Some traders have praised the broker for its good liquidity, standard spreads, and quick deposit and withdrawal processes. Instances where issues arose, like delayed transfers due to external bank maintenance, highlighted the helpfulness and supportiveness of the online support staff, contributing to a positive trading experience.

On the other hand, there are reports of dissatisfaction, particularly regarding customer service responsiveness. A few traders have experienced difficulties with withdrawals and noted a lack of communication from the support team, including unaddressed emails and live chat inquiries for extended periods. This contrast in experiences suggests that while ZFX offers commendable trading conditions, there may be room for improvement in its customer support consistency.

ZFX Broker Spreads, Fees, and Commissions

In my experience trading with ZFX Broker, I’ve noticed that the spreads and commissions vary significantly across different account types and currency pairs. ZFX doesn’t charge a fixed brokerage commission, which I found quite advantageous. For those trading on ECN and Professional accounts, the spreads can be incredibly tight, starting from just 0.2 pips. This is particularly appealing for traders like me who are looking for cost-effective trading conditions.

On the Standard STP trading account, spreads begin at 1.3 pips, while the Mini Trading Account offers spreads starting from 1.5 pips. Although these are not the tightest spreads on the market, they are relatively competitive, especially for traders not ready to commit to the higher balances required by ECN accounts. It’s also worth mentioning that while depositing and withdrawing funds is generally free, which is a significant plus, transactions on ECN accounts might incur additional commissions. Moreover, any fees charged by payment systems or the receiving bank are something to be mindful of, as these can add to the overall trading costs.

Account Types

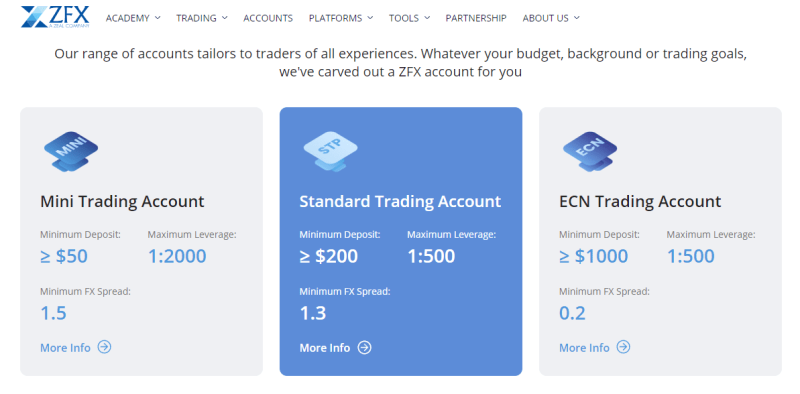

All trading accounts are designed to cater to different levels of trading experience and capital availability, from entry-level to professional trading scenarios:

- Mini Trading Account: Tailored for novice traders, this account can be opened with a minimum deposit of 50 USD. It offers exceptionally high leverage of 1:2,000, allowing traders with smaller deposits to open multiple positions simultaneously. Spreads start from 1.5 pips, and the stop-out level is set at 20%, making it a suitable starting point for those new to the Forex market.

- Standard STP Trading Account: Targeted at more experienced traders, this account type is the most popular choice. With a 200 USD minimum deposit, traders can access leverage up to 1:500. Spreads begin at 1.3 pips, and the stop-out level is 30%, offering a balanced trading environment for those with some trading background.

- ECN Trading Account: Designed for direct access to the Forex market through an electronic communications network (ECN), this account eliminates broker intermediation. Spreads are ultra-tight, starting from 0.2 pips, though additional commissions on the lot size may apply. A higher minimum deposit of 1,000 USD is required, and the stop-out level is 50%, catering to traders seeking efficient market execution.

- Professional Account: This is an advanced ECN account for professional trading, requiring a minimum deposit of 10,000 USD. Spreads are floating and commence from 0.2 pip. The leverage available is up to 1:100 for currency pairs, designed for seasoned traders with substantial capital.

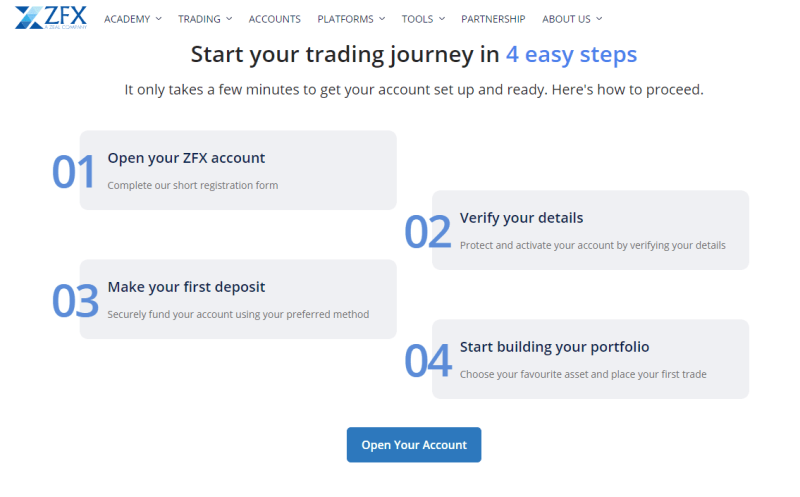

How to Open Your Account

- Start by navigating to the ZFX official website and locate the “Open an account” button at the top of any page to initiate the account opening process.

- Fill out the registration form with your personal details, including your email address, country phone code, and mobile number, and then create a strong password for account security.

- After registration, access your personal account by selecting MyZFX, where you will need to enter your email address and password to log in.

- Complete the verification process by providing required identification documents, such as a passport or ID card, and a proof of address to comply with regulatory requirements.

- Choose the type of trading account you wish to open, considering your trading experience and the capital you’re willing to invest.

- Make your initial deposit based on the minimum requirement of the chosen account type, using one of the available funding methods.

- Download the trading platform offered by ZFX to your computer or mobile device to start trading.

- Finally, customize your trading environment by setting up your trading preferences and tools on the platform to match your trading style and strategies.

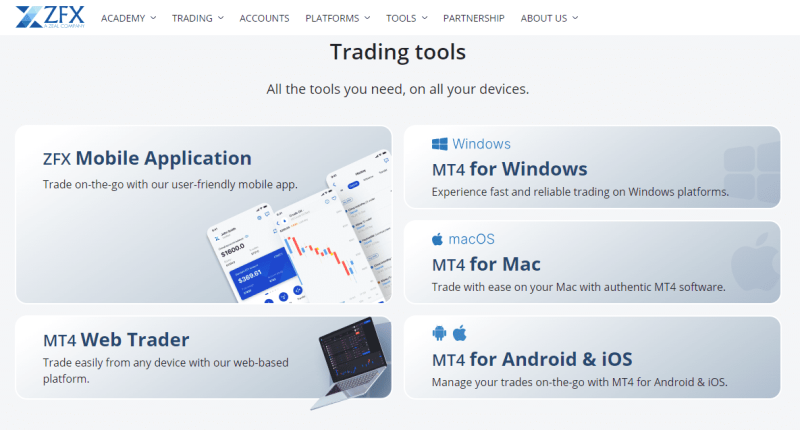

ZFX Broker Trading Platforms

In my trading journey with ZFX Broker, I’ve exclusively used the MetaTrader 4 (MT4) platform. This platform stands out for its user-friendly interface and comprehensive analytical tools, catering to traders of all experience levels. MT4 supports a wide array of order types, charting tools, and indicators, enabling detailed market analysis and effective strategy execution. My experience with MT4 through ZFX has been seamless, offering reliable performance and access to essential trading functionalities, making it an ideal choice for those looking to engage in Forex and CFD trading.

What Can You Trade on ZFX Broker

Through my trading experience with ZFX Broker, I’ve had the opportunity to explore a diverse range of trading instruments. The platform offers an extensive selection of currency pairs, allowing traders to delve into major, minor, and exotic pairs, catering to a wide spectrum of forex trading strategies.

In addition to forex, ZFX provides access to CFDs on stocks, enabling traders to speculate on the price movements of leading companies without owning the actual shares. This is particularly appealing for those looking to leverage market volatility in major global markets.

Moreover, trading CFDs on indices and commodities like oil, gold, silver, and copper is available, offering a broadened investment horizon. These instruments are ideal for diversifying trading portfolios and hedging against currency risk or market fluctuations. My experience with these instruments on ZFX has been enriching, providing a comprehensive trading environment suited for both novice and seasoned traders.

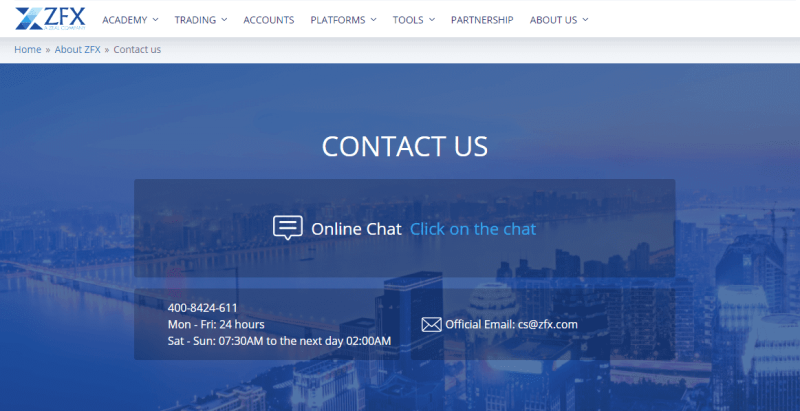

ZFX Broker Customer Support

In my time trading with ZFX Broker, I’ve noted the variety of customer support channels they offer, tailored to the client’s status and the specific unit selected. As a professional client, I had the privilege of contacting their support team directly via phone and email. This direct line of communication provided prompt and detailed responses to my queries, enhancing my trading experience significantly.

For retail traders, ZFX facilitates support through online chat, email, and a pre-designed contact form found in the “Contact us” section. This tiered approach ensures that traders at all levels have access to the help they need. Unregistered users aren’t left out either; they can reach out to the company via chat, phone, email, and even through messenger services on social platforms like Facebook, Instagram, Twitter, or LinkedIn. My interactions across these channels have been largely positive, with ZFX staff being notably helpful and responsive, although there have been instances where response times could improve, especially for complex issues requiring detailed attention.

Advantages and Disadvantages of ZFX Broker Customer Support

Withdrawal Options and Fees

Withdrawing funds from ZFX involves a straightforward process. First, I filled out an application form in the MyZFX cabinet on their website. It’s noteworthy that withdrawals can be requested even with open positions. However, if the withdrawal leaves insufficient funds to cover the margin, positions might be closed due to a Margin Call.

Before initiating a withdrawal, it’s crucial to ensure that verification procedures are complete and approved. This step is essential for a smooth withdrawal process. ZFX processes withdrawals through bank transfer, bank card, and e-wallet for retail clients, while professional traders can only use bank transfer. Impressively, the broker credits the money within 24 hours after the withdrawal request is approved.

The minimum withdrawal amount is set at 15 USD, and no commission is charged, which I found quite reasonable. Additionally, there’s an option to convert funds to cryptocurrency during withdrawal, offering flexibility in how you receive your funds.

ZFX Broker Vs Other Brokers

#1. ZFX Broker vs AvaTrade

ZFX Broker specializes in Forex and CFD trading with a focus on providing direct market access and a straightforward trading environment since 2016. AvaTrade, established in 2006, offers a wider range of over 1,250 financial instruments across Forex, CFDs, and cryptocurrencies, catering to a global audience with its multiple regulations and offices worldwide. While ZFX shines with its NDD, STP, and ECN services for efficient execution, AvaTrade stands out for its comprehensive educational resources, diverse trading platforms, and extensive instrument selection.

Verdict: AvaTrade is better for traders looking for a wide variety of trading instruments and extensive educational support. ZFX is more suited for those prioritizing efficient trade execution through ECN and STP models.

#2. ZFX Broker vs RoboForex

RoboForex boasts a vast array of over 12,000 trading options across eight asset classes since 2009, offering a broad selection of trading platforms and personalized trading conditions. ZFX Broker, while newer, focuses on streamlined Forex and CFD trading via MetaTrader 4. RoboForex’s strength lies in its platform diversity, including MetaTrader, cTrader, and RTrader, and its ability to cater to various trading styles with customized solutions.

Verdict: RoboForex is superior for traders seeking a wide range of trading instruments and platform choices. ZFX offers a more focused trading experience, ideal for traders who prefer MetaTrader 4 and direct market access.

#3. ZFX Broker vs Exness

Exness is known for its high monthly trading volume, offering a wide range of trading instruments, including over 120 currency pairs and CFDs on stocks, metals, and energies, since 2008. It provides conditions favorable for both beginners and professionals, such as low commissions and infinite leverage on small deposits. ZFX Broker focuses on providing a no-frills trading environment with competitive spreads and access to Forex and CFD markets.

Verdict: Exness edges out for traders seeking variety in trading instruments and the option of infinite leverage. ZFX is a strong candidate for those looking for a straightforward Forex and CFD trading platform with efficient execution.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH ZFX BROKER

Conclusion: ZFX Broker Review

Based on my insights and user feedback, ZFX Broker stands as a robust platform for traders focusing on Forex and CFD markets, particularly appealing to those who appreciate direct market access through NDD, STP, and ECN models. Its competitive spreads, especially on ECN and Professional accounts, alongside a variety of account types, cater to both novice and seasoned traders. The regulatory oversight from both the FCA and FSA provides a layer of trust and security, ensuring that client funds are handled with utmost integrity.

However, potential users should be mindful of the limitations, including the exclusive phone support for professional clients and the absence of a web-based trading platform, which may deter traders who seek flexibility and comprehensive support. The broker’s focus on MetaTrader 4, while beneficial for those familiar with the platform, might limit users looking for a wider range of trading platforms.

Also Read: NS Broker Review 2023 – Expert Trader Insights

ZFX Broker Review: FAQs

What trading platforms does ZFX Broker offer?

ZFX Broker offers the MetaTrader 4 (MT4) platform exclusively, known for its analytical tools and user-friendly interface.

Are there any withdrawal fees at ZFX Broker?

No, ZFX Broker does not charge any commission on withdrawals, but payment system or bank fees may apply.

Is ZFX Broker regulated?

Yes, ZFX Broker is regulated by the Financial Conduct Authority (FCA) in the UK and the Financial Services Authority (FSA) in Seychelles.

OPEN AN ACCOUNT NOW WITH ZFX BROKER AND GET YOUR BONUS