Position in Rating | Overall Rating | Trading Terminals |

263rd  | 3.0 Overall Rating |  |

Zero Markets Review

Zero Markets is a trading platform offering a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies. It provides traders with access to competitive spreads, advanced tools, and the popular MetaTrader 4 and MetaTrader 5 platforms. The platform caters to both beginners and experienced traders with its user-friendly interface and comprehensive educational resources.

A key feature of Zero Markets is its flexible account options, which include Standard and ECN accounts tailored to different trading needs. Traders can benefit from low commissions, high leverage, and fast execution speeds. The platform also supports multiple funding methods, ensuring convenience and accessibility for a global audience.

What is Zero Markets ?

Zero Markets is an online trading platform designed to provide access to a variety of financial markets, including forex, commodities, indices, and cryptocurrencies. It offers traders advanced tools and features through the widely trusted MetaTrader 4 and MetaTrader 5 platforms, ensuring a seamless trading experience for both beginners and experienced users.

With Zero Markets, traders can choose between Standard and ECN account types, catering to different trading styles and strategies. The platform is known for its competitive spreads, high leverage options, and fast trade execution, making it a reliable choice for those seeking efficiency and affordability in trading.

Zero Markets Regulation and Safety

Zero Markets prioritizes regulation and safety to provide a secure trading environment for its users. It is regulated by the Australian Securities and Investments Commission (ASIC), ensuring compliance with stringent financial standards. This regulation helps protect traders by enforcing transparency and accountability in the platform’s operations.

To enhance safety, Zero Markets uses advanced encryption technology to secure client data and transactions. Additionally, client funds are held in segregated accounts, keeping them separate from the company’s operational funds. This structure minimizes risk and ensures financial integrity for its Zero Markets clients.

Overall, Zero Markets demonstrates a strong commitment to maintaining a safe and trustworthy trading platform. Its regulatory adherence and advanced security measures while facilitating financial transactions efficiently make it a reliable choice for traders worldwide.

Zero Markets Pros and Cons

Pros

- Low Spreads

- Multiple Assets

- Fast Execution

- User-Friendly

Cons

- Limited Education

- No Crypto Trading

- Restricted Regions

- No 24/7 Support

Benefits of Trading with Zero Markets

Zero Markets llc offers numerous benefits to traders, making it a competitive choice in the financial markets. One key advantage is its access to a wide range of assets, including forex, commodities, indices, and cryptocurrencies, allowing traders to diversify their portfolios. Additionally, it provides competitive spreads, fast execution speeds, and high leverage, catering to both beginners and experienced traders.

The platform supports advanced tools through MetaTrader 4 and MetaTrader 5, enhancing technical and fundamental analysis and strategy implementation. Flexible account options, including Standard and ECN accounts, ensure traders can select the best fit for their trading style. Furthermore, Zero Markets offers multiple funding methods and 24/5 customer support, making it convenient and reliable for global users.

Overall, Zero Markets stands out for its robust features, flexibility, and trader-centric approach. Its emphasis on affordability, advanced technology, and accessibility makes it a strong choice for anyone looking to optimize their trading experience.

Zero Markets Customer Reviews

Customer reviews of Zero Markets highlight its competitive features and reliable trading environment. Many traders praise the platform for its tight spreads, fast execution speeds, and access to advanced tools like MetaTrader 4 and MetaTrader 5. Users also appreciate the variety of account types, which cater to both beginner and experienced traders.

Another commonly noted benefit is the platform’s responsive customer support, available 24/5 to address inquiries and technical issues. Many customers commend Zero Markets for its transparent pricing and secure trading environment, emphasizing its regulatory adherence and segregated client funds. However, some traders suggest that additional educational resources could further enhance the experience.

Zero Markets Spreads, Fees, and Commissions

Zero Markets offers competitive spreads, fees, and commissions designed to suit different trading needs. For Standard accounts, spreads start from 1.0 pip with no additional commissions, making it ideal for beginners. For ECN accounts, spreads are as low as 0.0 pips, with a commission of $3.5 per lot per side, catering to professional traders seeking tighter spreads.

The platform maintains a transparent fee structure with no hidden charges, ensuring traders can accurately calculate their costs. Additionally, Zero Markets offers low overnight swap rates and zero fees on deposits and withdrawals, providing further cost efficiency.

Account Types

A variety of Zero Markets account types offered designed to suit different trading needs. Each account type provides unique features tailored for beginners, intermediate, and advanced traders, ensuring a seamless trading experience.

Standard Account

The Zero Markets Standard Account is ideal for beginners, offering low spreads and no commissions. This account type is user-friendly, providing access to all major instruments without overwhelming trading fees.

Super Zero Account

The Super Zero Account is tailored for more experienced traders, featuring ultra-tight spreads starting from 0.0 pips. With a small commission per trade, this account ensures cost efficiency for high-frequency traders.

Demo Accounts

Zero Markets offers a demo account for traders to practice in a risk-free environment using virtual funds. It provides access to live market conditions and the full range of platform features, including MetaTrader 4 and MetaTrader 5. This demo account type is ideal for beginners learning to trade and for experienced traders testing new strategies.

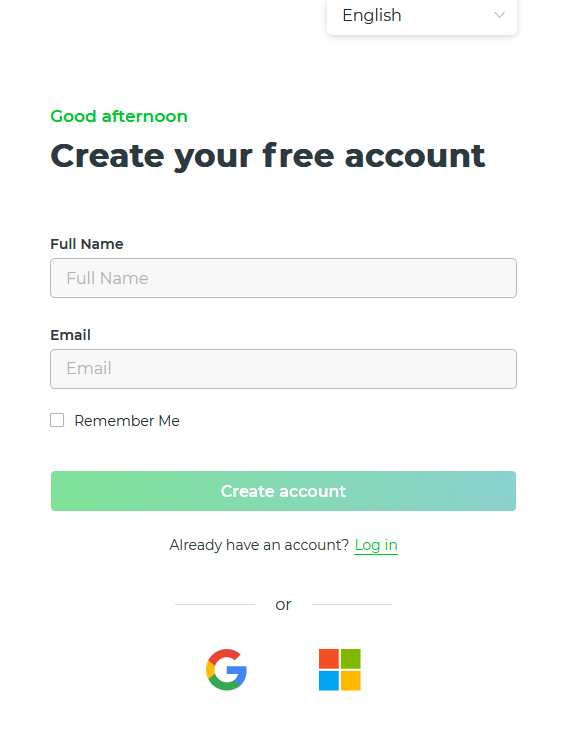

How to Open Your Account

Opening an account with Zero Markets is a straightforward process designed to ensure accessibility for traders of all experience levels. Following the required steps carefully will allow you to start trading quickly and efficiently on the platform.

Step 1: Visit the Official Website

Go to the Zero Markets official website to begin your account registration. Look for the “Sign Up” button, typically located on the homepage, and click it to start the process.

Step 2: Complete the Registration Form

Fill in the registration form with your personal details, including your name, email address, and phone number. Ensure all information provided is accurate to avoid any verification issues with Zero Markets.

Step 3: Verify Your Identity

Upload the required identification documents, such as a government-issued ID and proof of address. Zero Markets ensures this process complies with KYC (Know Your Customer) standards to protect your account.

Step 4: Fund Your Account

Select your preferred payment method and deposit funds into your trading account. Zero Markets offers various deposit options to accommodate global traders.

Step 5: Start Trading

Once your managed account is funded, access the trading platform to begin your trading journey. Explore the tools and features offered by Zero Markets operates to enhance your trading experience.

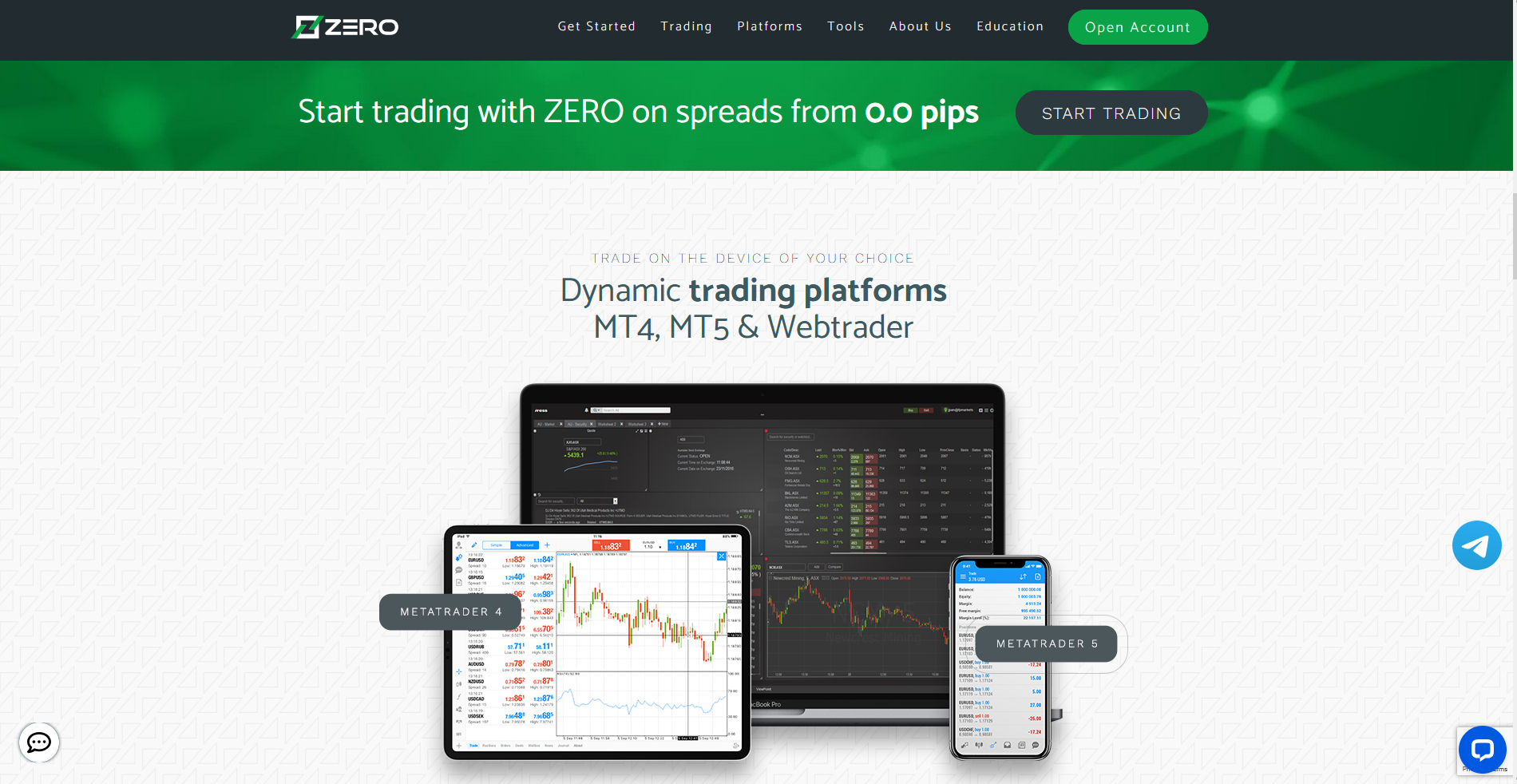

Zero Markets Trading Platforms

Zero Markets provides traders with access to the widely recognized MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. Both platforms are equipped with advanced charting tools, technical indicators, and automated trading capabilities through Expert Advisors (EAs). These features make them suitable for both beginner and experienced traders.

The platforms offered by Zero Markets are available on desktop, web, and mobile devices, ensuring flexibility and convenience for traders on the go. With fast execution speeds and user-friendly interfaces, they support efficient and seamless trading across various asset classes, including forex, indices, and cryptocurrencies.

What Can You Trade on Zero Markets

Zero Markets provides a diverse range of trading instruments to cater to different investor preferences. The platform allows users to trade forex, commodities, indices, stocks, and cryptocurrencies, offering flexibility for both beginners and experienced traders.

Forex Trading

Zero Markets offers a variety of currency pairs, including major, minor, and exotic options. Traders can take advantage of tight spreads and fast execution to capitalize on market movements.

Commodities Trading

Users can trade popular commodities like gold, silver, crude oil, and agricultural products on Zero Markets. These instruments provide a way to hedge against inflation and diversify trading portfolios.

Indices Trading

Zero Markets enables trading on global indices such as the S&P 500, NASDAQ, and FTSE. This allows traders to speculate on the overall performance of major stock markets.

Stock Trading

With Zero Markets, traders can access shares from leading global companies. This includes opportunities to trade CFDs on well-known brands across various sectors.

Cryptocurrency Trading

Zero Markets supports trading on popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin. The platform offers competitive pricing and tools to analyze the volatile crypto market.

Zero Markets Customer Support

Zero Markets provides reliable customer support to address the needs of its global traders. The support team is available 24/5, offering assistance via live chat, email, and phone. This ensures traders can quickly resolve issues or get answers to their questions during trading hours.

The platform is known for its prompt and professional customer service, catering to both technical and account-related inquiries. Zero Markets also provides multilingual support, reflecting its commitment to serving a diverse client base. Overall, its customer support is a key feature that enhances the trading experience by ensuring timely and effective assistance.

Advantages and Disadvantages of Zero Markets Customer Support

Withdrawal Options and Fees

Zero Markets offers multiple withdrawal options to ensure flexibility and convenience for its traders. Methods include bank transfers, credit/debit cards, and popular e-wallets. These options cater to a global audience, providing seamless access to funds across different regions.

The platform does not charge withdrawal fees, making it cost-effective for traders. Processing times vary by method, with e-wallets typically being faster than bank transfers. Zero Markets ensures secure transactions, prioritizing user convenience and financial safety. This transparency and flexibility make its withdrawal process a standout feature.

Zero Markets Vs Other Brokers

#1. Zero Markets vs AvaTrade

Zero Markets focuses on offering tight spreads and low-cost trading, making it an ideal choice for scalpers and high-frequency traders. Its platform options, including MT4 and MT5, cater to both beginners and experienced traders, with advanced tools and algorithmic trading support. In contrast, AvaTrade emphasizes broader market accessibility with proprietary platforms like AvaTradeGO and strong educational resources. While AvaTrade offers fixed and variable spreads, making it predictable for beginners, Zero Markets edges out for cost-conscious traders due to its competitive pricing model.

Verdict: For traders prioritizing low costs and advanced trading tools, Zero Markets is a superior choice. However, those seeking comprehensive education and diverse platform options may find AvaTrade more appealing.

#2. Zero Markets vs RoboForex

Zero Markets provides a user-friendly trading experience with competitive spreads starting at 0.0 pips, multiple account types, and access to MetaTrader platforms, making it appealing to forex traders. RoboForex, on the other hand, offers a broader range of financial instruments, including over 12,000 assets and proprietary trading platforms like R StocksTrader, catering to diverse trading styles. While Zero Markets focuses on transparent pricing and ECN execution, RoboForex excels in its asset variety and bonus programs, including cashback rewards, which may attract traders looking for additional incentives.

Verdict: For traders seeking a straightforward forex trading experience with low spreads, Zero Markets is a solid choice. However, those prioritizing asset variety and additional perks may find RoboForex more suitable.

#3. Zero Markets vs Exness

Zero Markets offers a variety of trading platforms, including MetaTrader 4 and MetaTrader 5, and is known for its competitive spreads and low commission structure, making it appealing to cost-conscious traders. Exness, on the other hand, provides unlimited leverage for select accounts, catering to high-risk traders, and supports an extensive range of deposit and withdrawal methods with no fees. While Zero Markets emphasizes a transparent fee structure and robust educational resources, Exness stands out with its real-time data analytics and proprietary tools designed for advanced trading strategies. Both brokers are regulated, but Zero Markets prioritizes ASIC compliance, while Exness is regulated under CySEC and FCA, appealing to different trader demographics.

Verdict: Zero Markets is better suited for traders focused on cost-efficiency and education, while Exness caters to those seeking high leverage and advanced trading tools. Choosing between them depends on the trader’s risk tolerance and preferred platform features.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH ZERO MARKETS

Conclusion: Zero Markets Review

In conclusion, Zero Markets stands out as a reliable and versatile trading platform that caters to traders of all experience levels. With competitive spreads, multiple account types, and access to advanced tools like MetaTrader 4 and MetaTrader 5, it offers a robust trading environment. The platform’s strong regulatory framework and secure practices further enhance its credibility.

Key features such as responsive customer support, cost-effective withdrawal options, and a focus on user convenience solidify Zero Markets as a trusted choice for global traders. Its combination of affordability, flexibility, and advanced technology makes it an excellent option for optimizing trading strategies emphasizing fundamental and technical analysis.

Zero Markets Review: FAQs

What is Zero Markets?

Zero Markets is an online trading platform offering access to forex, commodities, indices, and cryptocurrencies. It is known for its competitive spreads, advanced tools, and user-friendly interface.

Is Zero Markets regulated?

Yes, Zero Markets is regulated by the Australian Securities and Investments Commission (ASIC), ensuring compliance with stringent financial standards for safety and transparency.

What trading platforms does Zero Markets offer?

Zero Markets provides MetaTrader 4 (MT4) and MetaTrader 5 (MT5), offering advanced charting tools, technical indicators, and automated trading capabilities.

OPEN AN ACCOUNT NOW WITH ZERO MARKETS AND GET YOUR BONUS