Zacks Trade Review

In stock and options trading, choosing the right broker is crucial to a trader’s success and overall experience. A broker acts as the intermediary between traders and the financial markets, impacting aspects such as trade execution speed, account security, and fee structures. Choosing a reliable broker with competitive spreads and strong customer support can set traders on the right path toward achieving consistent profitability.

Zacks Trade is a standout choice for seasoned traders due to its range of advanced trading tools, competitive margin rates, and in-depth research options. As a subsidiary of LBMZ Securities, Zacks Trade partners with Interactive Brokers, which allows it to offer access to global markets and detailed analytics. This focus on extensive research tools, along with reliable broker-assisted trade options, makes Zacks Trade particularly attractive to self-directed investors who seek a platform with low fees and comprehensive support.

In this review, AFM’s team explores Zacks Trade’s unique benefits and potential drawbacks, offering a thorough evaluation of its various account types, deposit and withdrawal processes, fee structures, and other essential aspects. By combining expert analysis with insights from actual users, this review aims to provide all the necessary information for traders considering Zacks Trade as their brokerage of choice.

What is Zacks Trade?

Zacks Trade is a low-cost brokerage designed for active traders and investors who need a range of investment options and robust research tools. It stands out with free broker-assisted trades and a low $1 minimum per trade on stocks, ETFs, and options. For those looking for advanced insights, Zacks Trade offers access to premium research and news from sources like Morningstar, Benzinga, Dow Jones, and Zacks Investment Research, Inc., making it ideal for self-directed investors aiming to make informed decisions.

Additionally, Zacks Trade offers some of the lowest margin rates available, starting around 3.59%, which appeals to margin traders. The platform includes three trading portals that offer customizable interfaces, allowing traders to manage complex trades seamlessly. Though Zacks Trade is a discount brokerage, it encourages personal interaction through broker-assisted services, providing flexibility not commonly found with other online discount brokers.

Zacks Trade Regulation and Safety

Zacks Trade operates under strong regulatory oversight as a division of LBMZ Securities, meaning it is regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC). These top-tier U.S. regulators enforce stringent standards that prioritize investor protection and market integrity, giving users confidence that their funds are held in a secure and well-regulated environment. In addition, Zacks Trade accounts are protected by the Securities Investor Protection Corporation (SIPC), covering up to $500,000 in securities (including up to $250,000 in cash) if the broker were to fail.

While Zacks Trade offers substantial protections, it does not include negative balance protection, which is something traders should keep in mind when trading on margin, as losses can exceed deposited funds in volatile markets. For experienced investors, these regulations and protections offer peace of mind, allowing them to trade with greater confidence that stringent U.S. standards are in place to protect their assets and trades.

Zacks Trade Pros and Cons

Pros

- Low-cost trades across stocks, ETFs, and options

- Free broker-assisted trades add support without extra charges

- Wide global reach with access to 91 international exchanges

- Robust trading platforms with tools for desktop, web, and mobile

- Low margin rates starting around 8.83%

- In-depth research with proprietary Zacks rankings and insights

- No inactivity fees for accounts over $25,000

- One free monthly withdrawal for added flexibility

Cons

- Commissions on U.S. stock and ETF trades

- $250 minimum deposit could be a barrier for beginners

- Monthly inactivity fee on accounts under $25,000 or less than $15 in commission fees per month

- No commission-free trades on U.S. securities

Benefits of Trading with Zacks Trade

Trading with Zacks Trade brings several advantages for those who want low-cost trades combined with robust support. From our experience, the broker’s free broker-assisted trading is a standout feature, allowing us to access expert support without the typical additional fees seen elsewhere. With Zacks Trade, I appreciated the range of trading tools offered across its desktop, web, and mobile platforms, which provided us with the flexibility to trade and monitor our account from anywhere.

Zacks Trade also has some of the most competitive margin rates available, starting at around 8.83%, which is especially appealing for margin traders seeking low-cost borrowing. Additionally, their in-depth research resources, including proprietary Zacks rankings, and the Zacks Rank Trading Tool, add significant value, helping traders make informed decisions without needing extra subscriptions. This combination of tools, research, and low fees makes Zacks Trade a practical choice for active traders.

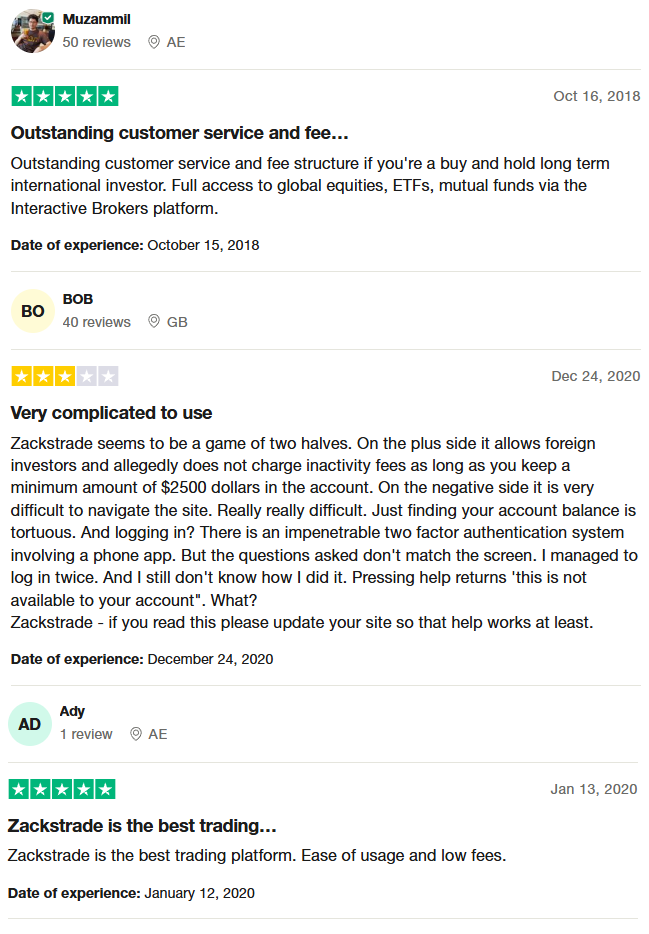

Zacks Trade Customer Reviews

Zacks Trade reviews reflect a mixed experience among users, often influenced by account needs and platform usability. Many long-term, international investors appreciate the comprehensive access to global equities and low fees, especially those who aim to buy and hold with minimal trading. However, users have noted that the platform’s interface can be challenging to navigate, with complicated login procedures and support options sometimes difficult to access or use effectively. While some praise the affordability and research tools provided through the Interactive Brokers platform, others feel the technical complexities make Zacks Trade less user-friendly for newer investors.

Zacks Trade Spreads, Fees, and Commissions

Zacks Trade’s fee structure is designed with active traders in mind, offering low commission rates on stocks and ETFs. For U.S. stocks over $1, the fee is $0.01 per share with a minimum of $1 per trade, while stocks below $1 are charged at 1% of the trade value. Options contracts start at $1 for the first contract and 75 cents for each additional contract, which is cost-effective for frequent traders. However, mutual fund trades come with a higher fee of $27.50, making this platform less appealing for those focused primarily on mutual funds.

There is also a $15 monthly inactivity fee for accounts with balances under $25,000, which is waived for $15 in commission fees per month or higher balances. One free withdrawal is provided each month, with subsequent withdrawals incurring additional fees depending on the method. Overall, the fee structure at Zacks Trade is competitive for those who trade U.S. stocks, ETFs, and options frequently, but some fees may be restrictive for less active or beginner investors.

Account Types

Cash Account

- Designed for day trading and investing with personal funds, the Cash Account requires a minimum deposit of $250. Commissions vary based on asset type, with a minimum trading fee of $1. Pattern day traders need a minimum balance of $25,000, and this account type does not support leveraged trades.

Margin Account

- This account offers leverage, up to 4:1 for intraday trades and 2:1 for overnight positions. To qualify, clients must first open a Cash Account and maintain a balance of at least $2,000. This option allows traders to enhance their purchasing power for short-term trades.

Portfolio Margin Account

- Tailored for professional investors, the Portfolio Margin Account provides leverage up to 6:1. It requires a substantial minimum deposit of $110,000, with the balance consistently kept above $100,000. This account type suits those looking to maximize leverage in more advanced trading strategies.

IRA Accounts (for U.S. residents)

- Zacks Trade offers multiple retirement account types, including Traditional IRA, Roth IRA, Rollover IRA, and SEP IRA, all benefiting from tax deferral. These accounts are administered by Interactive Brokers as trustees, with no added fees for account servicing, providing a tax-advantaged way to invest for retirement.

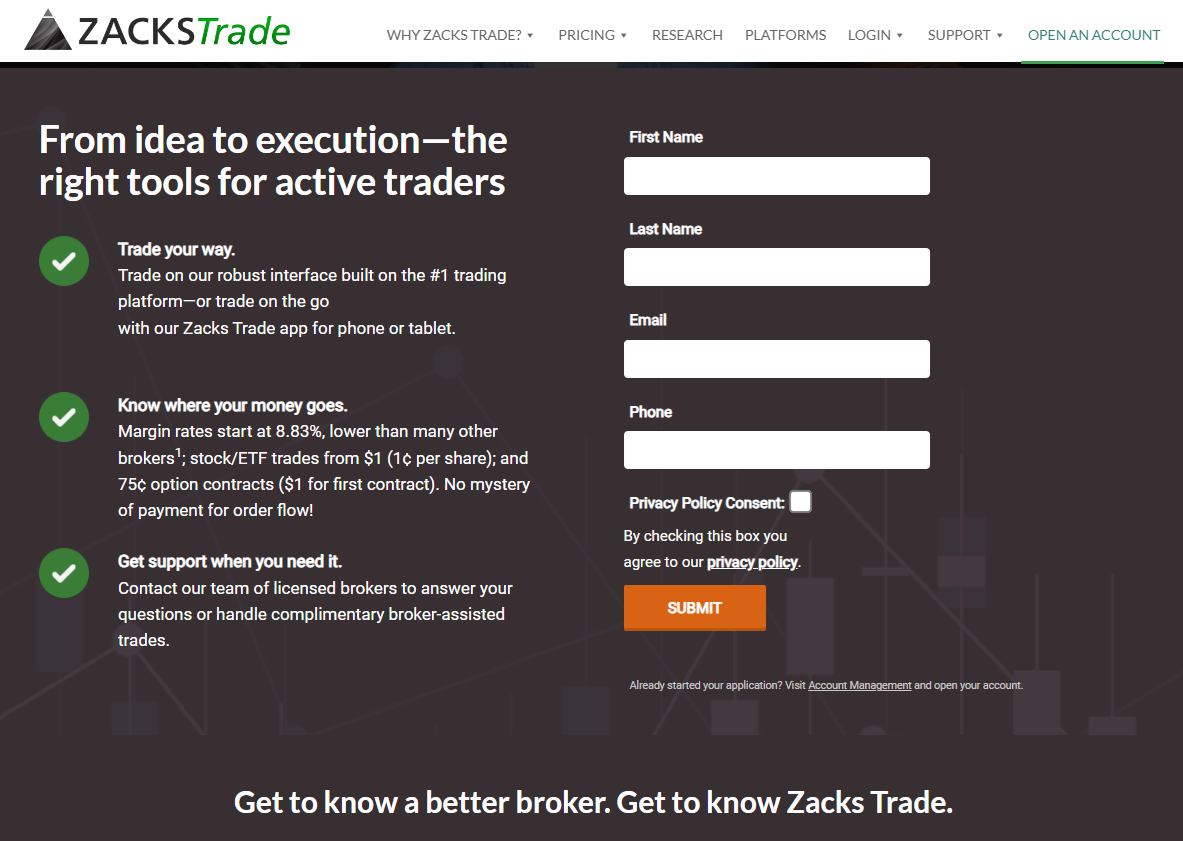

How to Open Your Account

- On the Zacks Trade homepage, click the “Open an Account” button.

- Complete the initial registration form by entering your first and last names, phone number, and email address.

- Select the type of account you wish to open, such as individual, joint, retirement, or trust.

- Create a username and password and fill in your country of residence and email for verification.

- Specify the customer type by choosing either individual, joint, retirement, or trust account.

- Enter your personal details exactly as listed on your government ID, including date of birth and taxpayer ID number (TIN or social security number).

- For non-U.S. residents, upload a scanned copy of your passport and complete additional sections to specify nationality, residency, and country of issuance.

- Finally, submit an IRS W-8 form to confirm your tax residency if you are a non-U.S. resident.

Zacks Trade Trading Platforms

The Asia Forex Mentor team notes that Zacks Trade offers two solid platforms to suit different trader needs: Zacks Trade Pro and the Client Portal. Zacks Trade Pro is the main platform, designed for active traders. It offers customizable layouts, multiple watchlists, and real-time alerts for price, time, margin, and volume. Supporting stocks, options, bonds, and funds, it includes tools like Market Scanners, Options Strategy Lab, and Volatility Lab, making it ideal for those needing advanced trading features and analysis tools.

The Client Portal is a simpler, web-based interface aimed at traders who prefer ease of use. It allows users to place basic trades, check account documents and balances, and manage settings. This platform works well for traders handling straightforward tasks and managing their accounts efficiently.

Both platforms are available on mobile through the Zacks Trade app, which lets users place orders, track executions, and monitor portfolios on the go.

What Can You Trade on Zacks Trade

Zacks Trade offers a wide range of trading instruments, catering to various investment preferences. It provides access to stocks, options, ETFs, and bonds across major U.S. and international markets. Each asset type is structured with straightforward fees, although certain products like mutual funds have higher transaction costs.

The broker’s access to global exchanges means traders can also tap into international stocks and closed-end funds, offering significant breadth for global trading strategies. The inclusion of fractional shares and traditional stock trading remains fully available for complete share purchases only. With this variety, Zacks Trade makes a strong choice for those interested in both U.S. and international markets, as well as active traders needing reliable access to options and fixed-income assets.

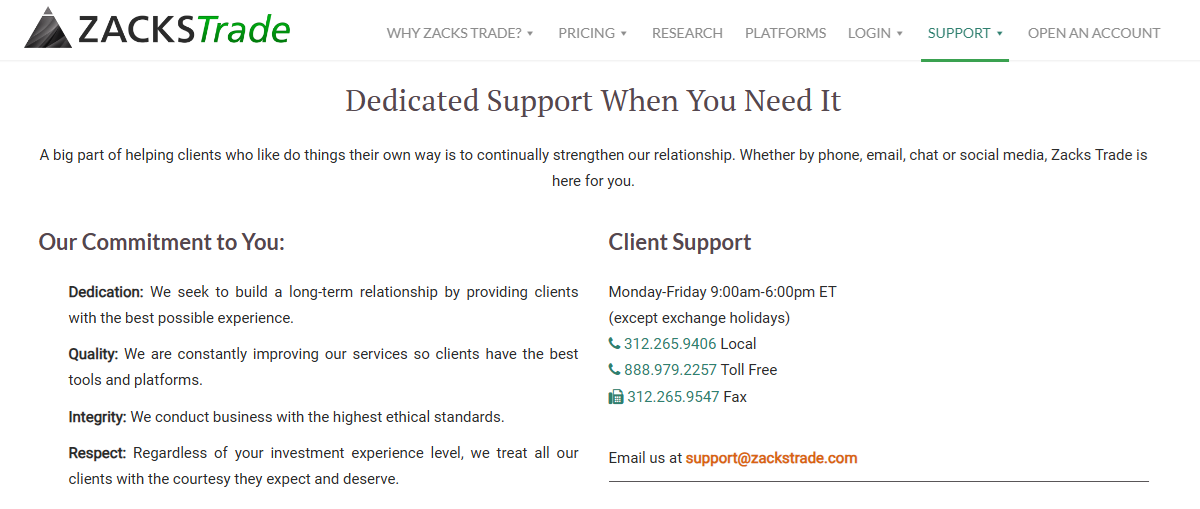

Zacks Trade Customer Support

Zacks Trade offers customer support through phone, email, and fax during regular business hours, Monday to Friday, 9:00 am to 6:00 pm ET. Based on our experience, their dedicated team is accessible via both local and toll-free numbers, which made resolving questions straightforward. The commitment to quality service shows in their responsive email support as well, making it easy to get prompt assistance even outside direct phone hours. Zacks Trade ensures traders receive respectful, professional service regardless of their experience level, which adds value to the overall trading experience.

Advantages and Disadvantages of Zacks Trade Customer Support

Withdrawal Options and Fees

Zacks Trade provides several withdrawal options with straightforward fees. Clients can withdraw funds via ACH transfers, checks, or wire transfers. Each month, the first withdrawal is free, which adds flexibility and can save on fees for occasional withdrawals. For any additional withdrawals in the same month, fees apply: $1 for ACH transfers, $4 for checks, and $10 for wire transfers, which is standard compared to similar platforms.

Withdrawals through ACH require a processing time of up to four business days, while wire transfers and checks typically complete within three days. ACH transfers might take longer if there is a bank mismatch between the deposit and withdrawal institutions. This structure supports users who may need regular access to funds while keeping withdrawal fees minimal for most users, especially with the free monthly option.

Zacks Trade Vs Other Brokers

#1. Zacks Trade vs AvaTrade

Zacks Trade, known for its advanced trading tools and international market access, primarily serves seasoned traders looking for a variety of instruments like stocks, bonds, options, and mutual funds. In contrast, AvaTrade focuses on Forex and CFDs, offering over 1,250 assets and catering to global clients, except those in the U.S. AvaTrade is highly regulated across multiple jurisdictions and provides beginner-friendly trading platforms. However, Zacks Trade has more account types and caters to investors seeking direct global market access, especially U.S. exchanges, which are not supported by AvaTrade.

Verdict: Zacks Trade is better suited for those needing direct access to the U.S. stock market and who value a broader selection of investment options. AvaTrade, with its wide CFD and Forex offerings and ease of use, is a strong choice for new traders or those focused primarily on Forex trading.

#2. Zacks Trade vs RoboForex

Zacks Trade stands out for its low-margin rates and access to U.S. and global markets, ideal for experienced investors seeking long-term investments in stocks and bonds. RoboForex, on the other hand, appeals to a wide range of traders by offering a broad selection of assets, including Forex, CFDs, and commodities, across various platforms like MetaTrader and cTrader. RoboForex’s unique feature, ContestFX, and its availability of high-leverage options make it attractive for active traders interested in frequent trading or contests.

Verdict: RoboForex is better for traders seeking high leverage, diverse platforms, and a fast-paced trading environment, while Zacks Trade is a better fit for long-term investors focused on global equity and bond markets.

#3. Zacks Trade vs Exness

Zacks Trade provides access to various U.S. and international securities, with competitive rates on margin accounts suited for long-term traders. Exness, however, specializes in Forex and CFD trading with high liquidity and immediate order execution, plus unique perks like unlimited leverage on small deposits. Exness is particularly suited for traders who want a high-leverage environment and fast execution, supported by a user-friendly platform experience.

Verdict: Exness is the better choice for Forex-focused traders looking for high leverage and low fees on small accounts. Zacks Trade is more suitable for seasoned investors prioritizing access to U.S. markets and broader investment types.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH ZACKS TRADE

Conclusion: Zacks Trade Review

Zacks Trade is a solid option for experienced traders seeking a wide range of investment options and access to international markets, including U.S. exchanges. Its competitive margin rates, extensive research resources, and free broker-assisted trades make it ideal for active traders and long-term investors. However, beginners may find the platform challenging, as it is tailored more for advanced users familiar with complex trading tools and global market access.

Despite its strengths, Zacks Trade does have some limitations, like higher fees for mutual fund trades and limited customer support hours. The platform also has a high minimum deposit and an inactivity fee, which could be a drawback for less active traders. Overall, Zacks Trade is a great choice for serious investors who need a comprehensive platform, but beginners or low-frequency traders might prefer a more straightforward broker.

Zacks Trade Review: FAQs

What types of accounts does Zacks Trade offer?

Zacks Trade offers individual, joint, trust, custodial, and a variety of IRA accounts, catering to both individual and institutional clients.

Are there fees for withdrawals on Zacks Trade?

Yes, Zacks Trade offers one free withdrawal per month. Additional withdrawals cost $1 for ACH, $4 for checks, and $10 for wire transfers.

Is Zacks Trade suitable for beginners?

Zacks Trade primarily caters to experienced traders due to its complex interface and high minimum deposit, making it less ideal for beginners seeking simplicity.

OPEN AN ACCOUNT NOW WITH ZACKS TRADE AND GET YOUR BONUS