Powell Suggests Potential Rate Cuts

Jerome Powell indicated improving economic conditions, paving the way for the Fed’s first rate cut since the rate hikes began in 2022. He emphasized that the Fed would not wait until inflation hits the crucial 2% mark before lowering rates, noting that monetary policy has a variable lag.

Powell mentioned that the committee is seeking consistent economic data, as parts of the labor market show signs of easing, growth has moderated, and inflation continues to decline.

US Dollar Remains Strong Despite Lower Inflation Figures

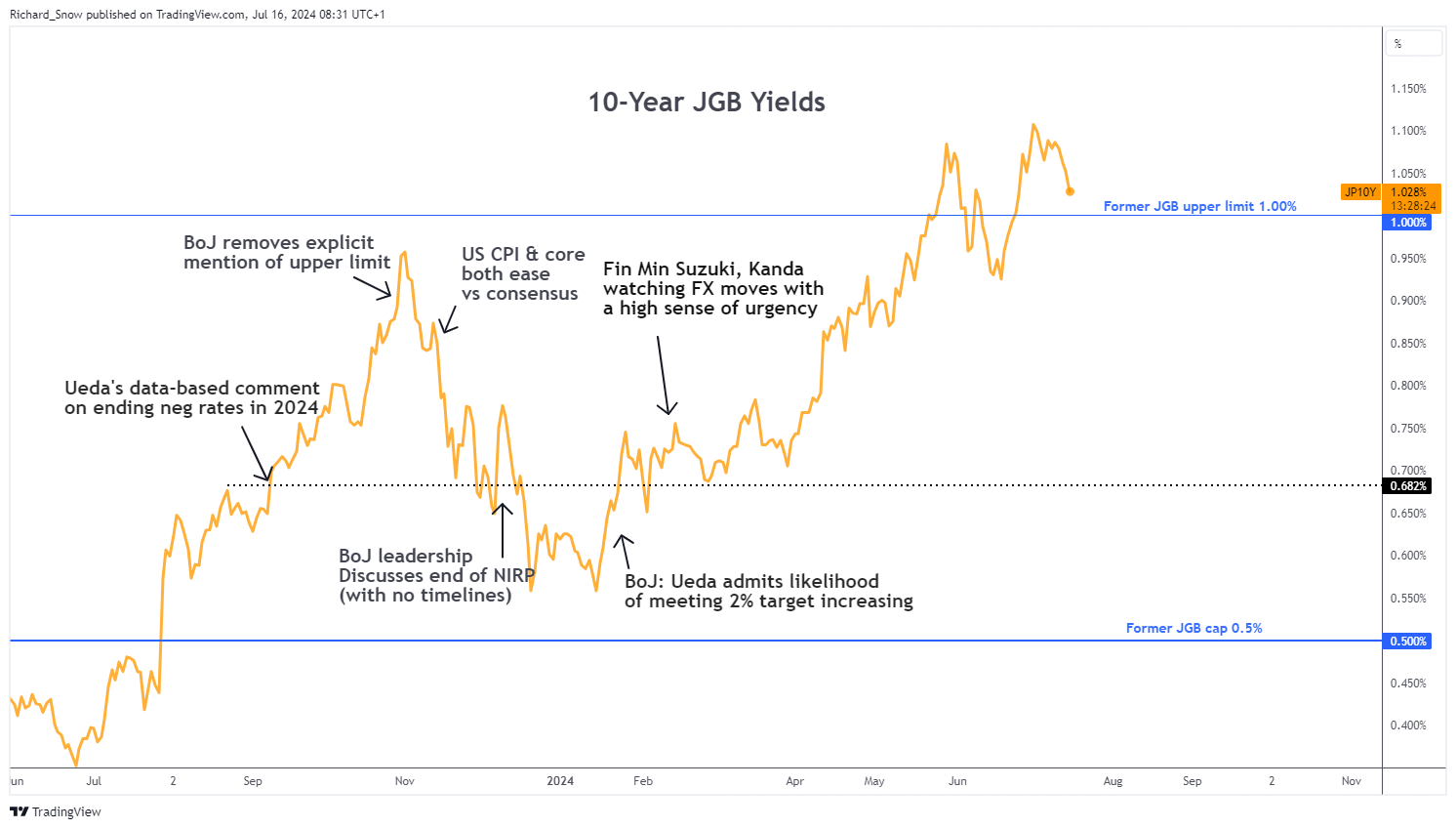

Despite a sharp selloff in response to last week’s lower US inflation figures, the US dollar has remained resilient. This morning, US yields led the decline, with Japanese government bond yields following suit. The 10-year yield now trades near a three-week low, approaching the previous cap of 1%. The Bank of Japan (BoJ) will meet later this month to potentially hike rates and provide more details on their bond tapering plans.

Debate Over BoJ's Actions on USD/JPY

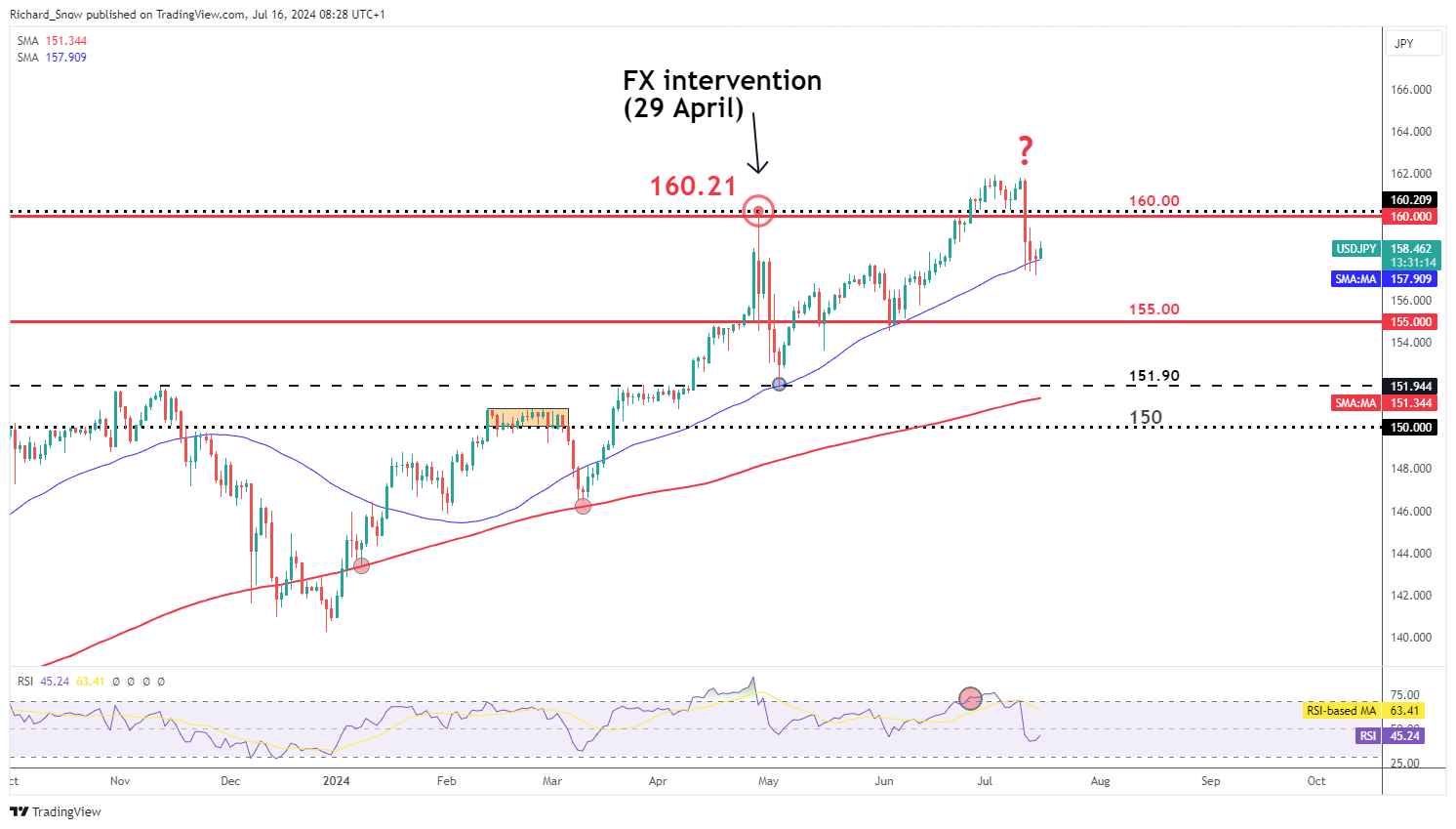

The USD/JPY pair has sparked much debate after official BoJ data suggested that 3.57 trillion yen might have been used to strengthen the yen. Officials did not confirm whether this was a targeted FX intervention and reiterated that recent yen weakness is undesirable.

The pair has found temporary support at the blue 50-day simple moving average. A bullish continuation could push it back to the 160.00 mark. If further signs of a Fed rate cut emerge, the pair might consolidate and trade sideways, though this seems less likely given the interest rate differential remains unfavorable for the yen. In any scenario, 155.00 is the next level of support.