In trading, it's tempting to follow the crowd—buying in bull markets and selling in bear phases. However, seasoned traders often capitalize on unconventional strategies like contrarian trading. This method involves going against the prevailing market mood to exploit potential shifts, often using tools like IG client sentiment to gauge crowd psychology and identify possible reversal points.

Contrarian indicators alone are not foolproof but become powerful when combined with technical and fundamental analysis. This holistic approach helps reveal deeper market insights often overlooked by those following the crowd.

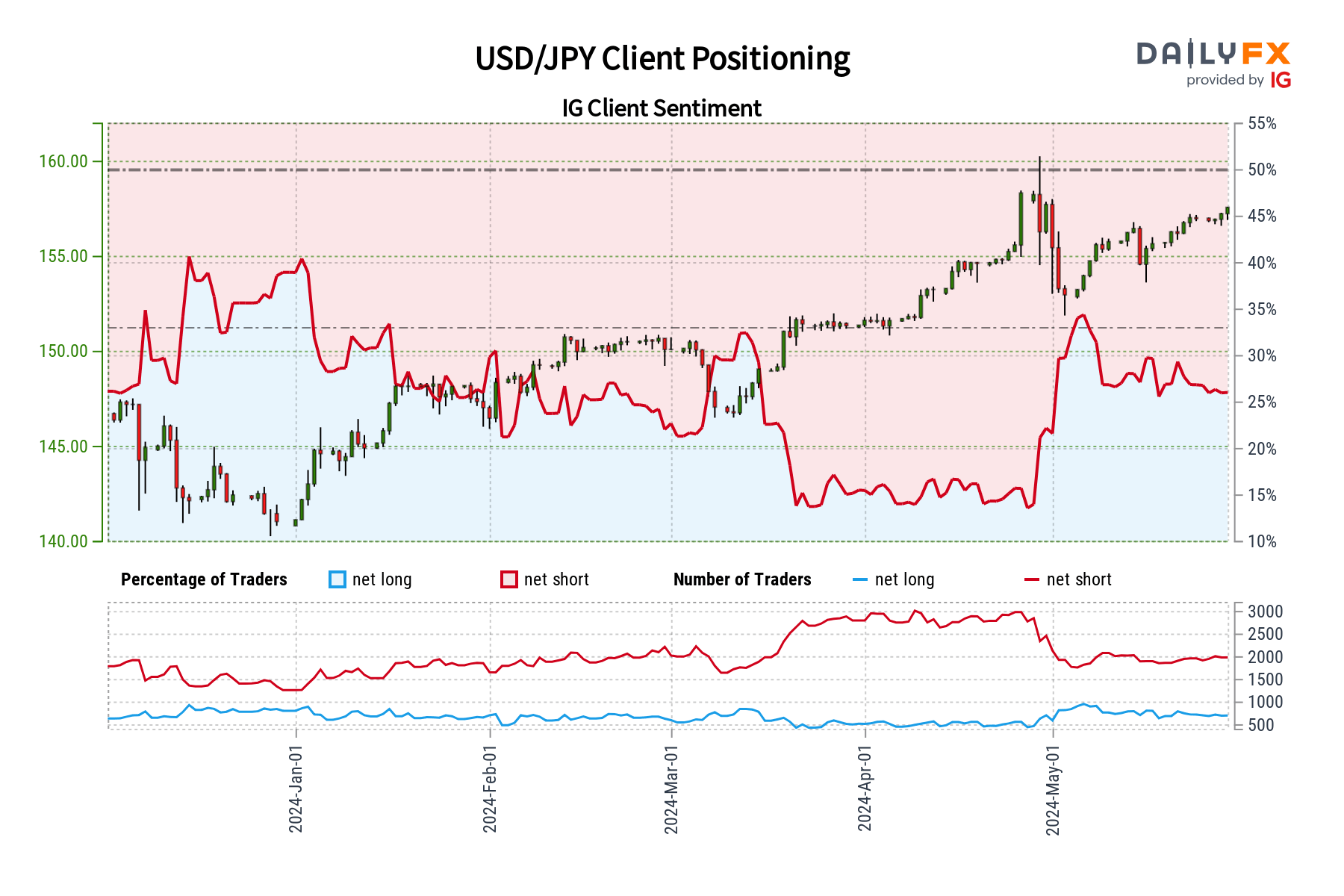

USD/JPY Market Sentiment

Currently, IG client data indicates that 72.46% of traders are bearish on USD/JPY, with a short-to-long ratio of 2.63 to 1. There's a slight decrease in bearish positions compared to yesterday, but an increase from last week, while bullish positions have risen significantly in the same periods.

This mix of decreasing shorts and increasing longs suggests that the usual bullish contrarian signal might hint at potential downside risk instead.

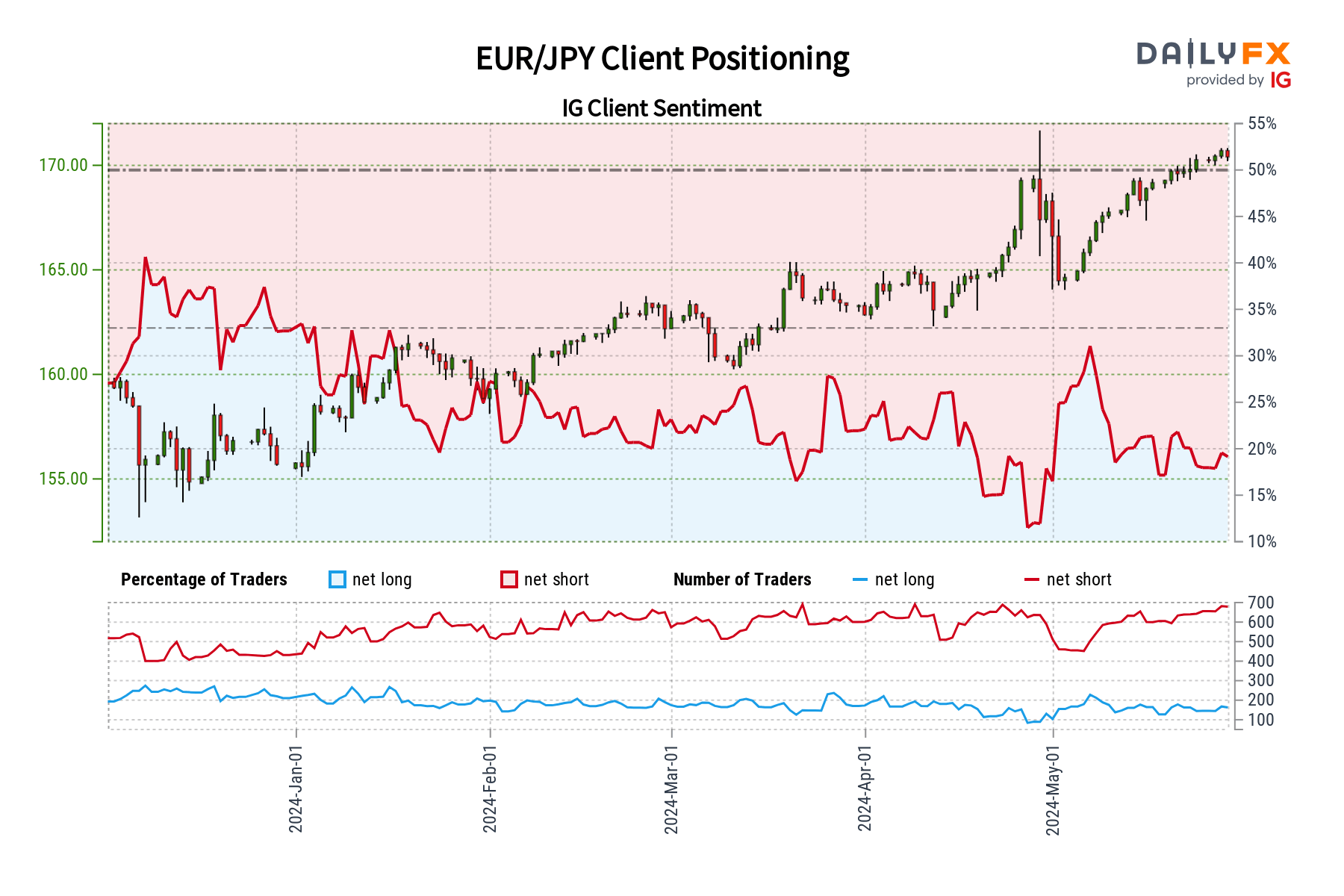

EUR/JPY Market Sentiment

For EUR/JPY, 83.15% of traders are expecting a pullback, with a short-to-long ratio of 4.93 to 1. There’s been a noticeable increase in bearish sentiment recently, which typically suggests a potential upside according to contrarian views.

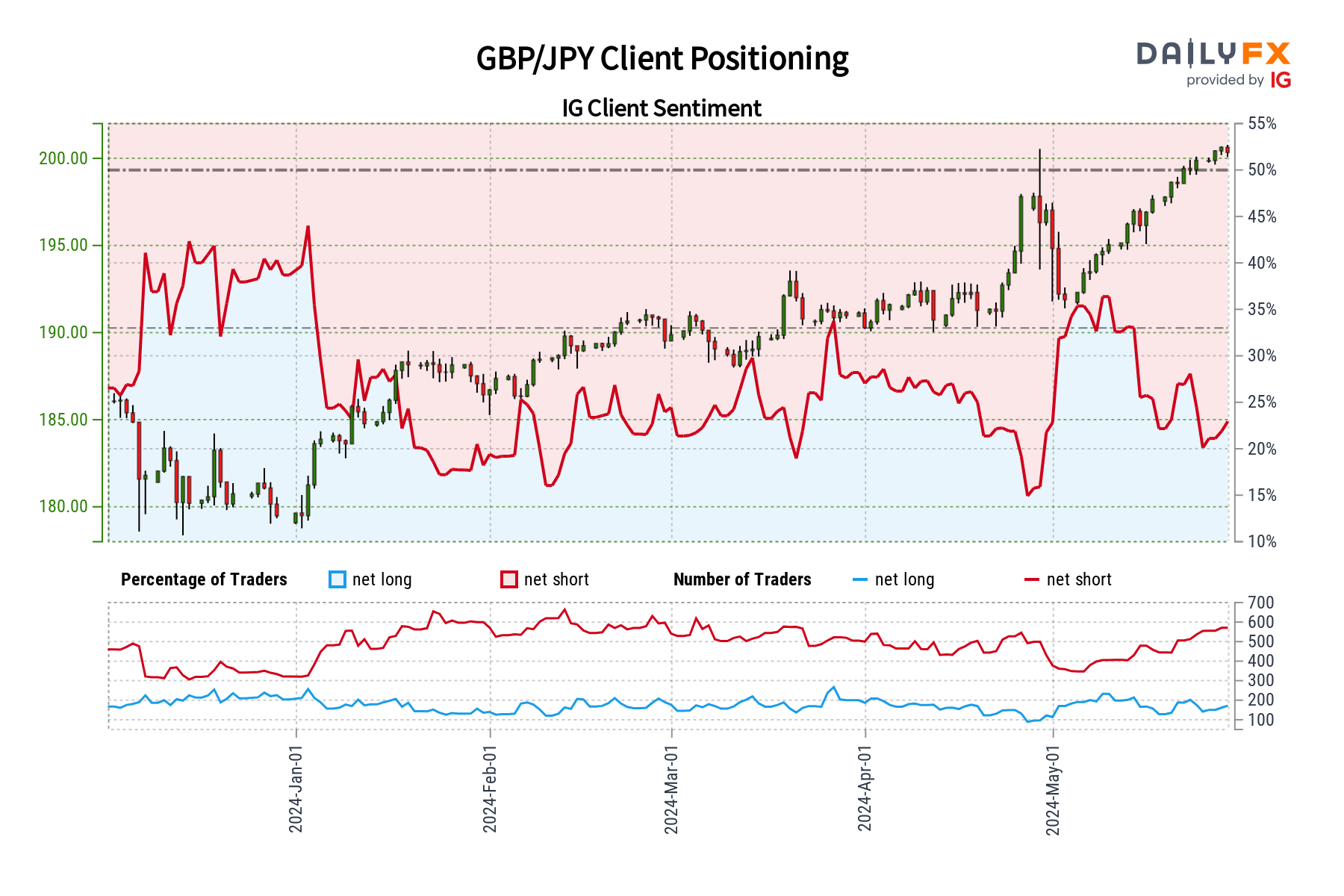

GBP/JPY Market Sentiment

In the case of GBP/JPY, 79.63% of traders are bearish with the ratio of sellers to buyers at 3.91 to 1. Bearish sentiment has intensified recently, which from a contrarian perspective, could indicate a stronger potential for upward movement.

Each of these examples demonstrates how contrarian analysis can offer unique insights into market dynamics, challenging the more straightforward interpretations of bullish and bearish trends.