In trading, the temptation to follow the masses is strong, buying during bullish trends and selling in bearish ones. However, experienced traders often find that the best opportunities come from unconventional strategies. One effective approach is contrarian trading, which involves moving against the dominant mood of the moment to capitalize on potential market shifts.

Contrarian strategies aren’t just about opposing the majority for the sake of it. It's about pinpointing times when the consensus might be wrong and exploiting those situations. Tools such as IG client sentiment offer valuable insights into crowd psychology, identifying periods of extreme optimism or pessimism that may indicate a reversal is near.

Despite their usefulness, contrarian signals alone don't ensure success. They become truly powerful when used as part of a comprehensive strategy that includes both technical and fundamental analysis. This combination allows traders to uncover deeper market dynamics that those following the crowd often miss.

To put this into practice, let's look at how IG's client sentiment data and current retail investor positioning can influence trading decisions for three major Japanese yen currency pairs: USD/JPY, EUR/JPY, and GBP/JPY.

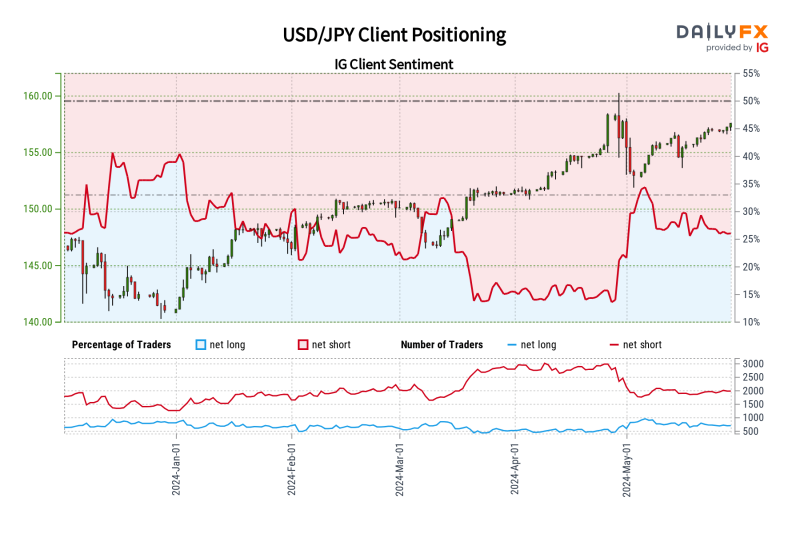

USD/JPY Sentiment Analysis

IG data shows that 72.46% of clients trading USD/JPY are bearish on the pair, with the ratio of short-to-long clocking in at 2.63 to 1 at the time of writing. The number of sellers is 1.92% lower than yesterday and 1.68% higher than last week, while the count of those holding bullish positions has increased by 8.30% and 4.13%, respectively, in those two timeframes.

Traditionally, heavy retail shorts might indicate potential upside for USD/JPY given our unique interpretation of crowd mentality. However, the decline in selling pressure over key periods weakens this contrarian signal. With that in mind, recent sentiment shifts, with a rise in longs, could actually foreshadow a future downside move.

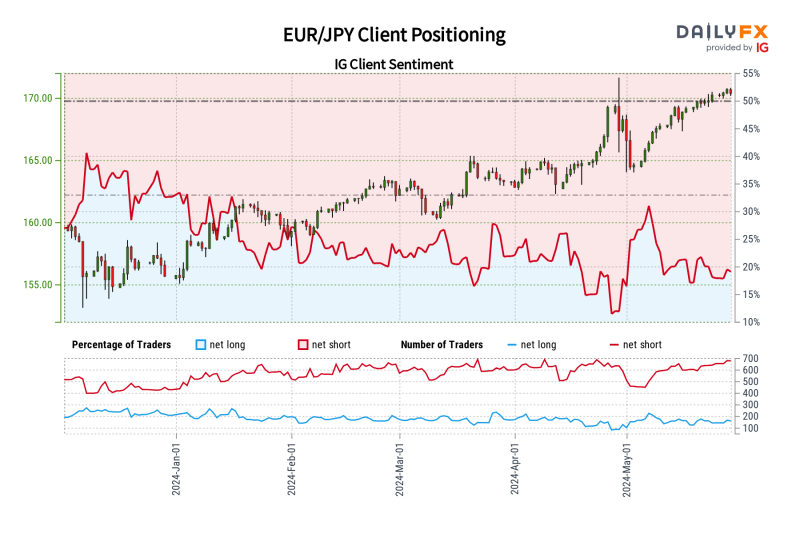

EUR/JPY Sentiment Analysis

According to IG proprietary data, 83.15% of clients speculating on EUR/JPY are positioned for a pullback, resulting in a ratio of short-to-long of 4.93 to 1. The percentage of retail traders selling the pair has increased by 0.89% since the previous session and by 7.24% compared to last week. At the same time, the number of buyers has dropped by 4.83% and 24.59% over these respective periods.

Our strategy typically involves countering crowd sentiment, and the overwhelming net-short position of traders points to a potential rise in EUR/JPY in the near term. Accelerating selling activity since yesterday and last week, combined with current sentiment, reinforces our bullish contrarian bias on EUR/JPY.

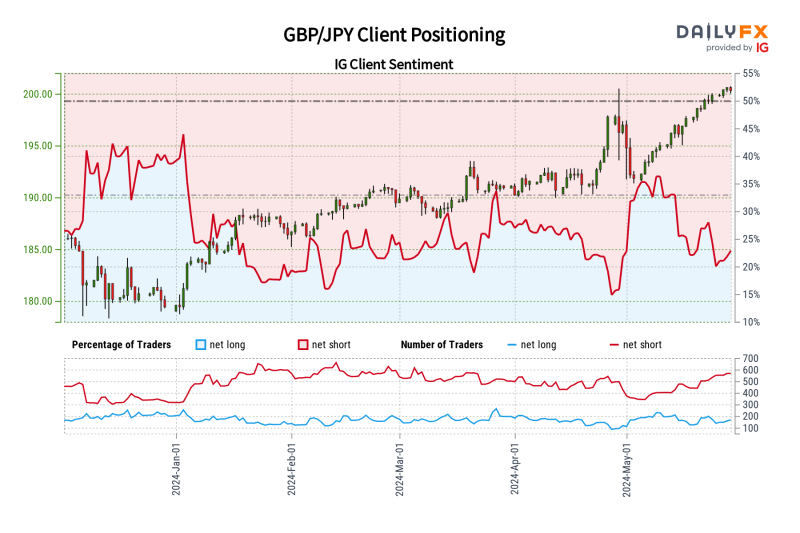

GBP/JPY Sentiment Analysis

IG data shows that 79.63% of clients with positions in GBP/JPY have a bearish bias, with the ratio of sellers to buyers currently at 3.91 to 1. The count of clients anticipating weakness has risen by 1.85% since the previous session and soared by 20.48% compared to last week. Meanwhile, bullish positions have dropped by 16.22% and 27.57% over these two periods, respectively.

Our usual stance involves taking a contrarian view against sentiment. The prevailing pessimism around GBP/JPY's outlook among the retail crowd signals additional upside potential. Traders are even more net-short than they were yesterday and last week, and the interplay between current positioning and changes in market wagers strengthens our bullish contrarian bias on the pair.