YaMarkets Review

When we talk about Forex trading, selecting the right broker is crucial. A reliable broker acts as a gateway to the markets, offering tools, resources, and essential support. It’s not just about the trading platform; it’s about trust, reliability, and understanding the nuances of the Forex market.

YaMarkets, established in 2016 and headquartered in Saint Vincent and the Grenadines, has quickly made its mark. What sets it apart? Its regulation by the Financial Services Commission of Mauritius (FSC) and the Vanuatu Financial Services Commission (VFSC) speaks volumes about its credibility. Offering four different account types and a minimal deposit requirement of just $10, YaMarkets is accessible to a wide range of traders.

As someone who has a great expertise when it comes to trading, I delve into the intricacies of YaMarkets, examining its strengths and weaknesses. We’re not just skimming the surface. We’re diving deep into its features, commission structures, account types, and transaction procedures. This article synthesizes expert insights and real trader experiences, providing you with a balanced view to make an informed decision.

What is YaMarkets?

YaMarkets is a user-friendly online forex broker that caters to various trading needs. It offers a diverse range of trading instruments, including CFDs on currency pairs, cryptocurrencies, indices, commodities, and metals. This versatility makes it suitable for traders with different interests and strategies.

One of the key features of YaMarkets is its low entry barrier, with a minimum deposit requirement of just $10. This makes it accessible for beginners or those cautious about investing large sums initially. Additionally, the broker offers high leverage options of up to 1:1000, attracting traders interested in maximizing their trading potential.

The broker’s operations are based in Saint Vincent and the Grenadines and are overseen by reputable regulatory bodies like the Financial Services Commission of Mauritius (FSC) and the Vanuatu Financial Services Commission (VFSC). This regulatory framework provides a level of security and credibility to its users.

YaMarkets also excels in its trading platform offerings. Traders have access to popular and robust platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and WebTrader. These platforms are known for their advanced features, user-friendly interfaces, and compatibility with various devices, enhancing the trading experience.

Benefits of Trading with YaMarkets

Trading with YaMarkets has been a notable experience, and I’ve observed several benefits firsthand. One of the most appealing aspects is the low minimum deposit of just $10. This feature makes it accessible for beginners or those not willing to commit a large amount of capital at the outset. Additionally, fees are only applicable on ECN accounts, and the spreads can be as low as 0 pips, which is particularly advantageous for cost-conscious traders.

YaMarkets offers a range of account types, including four live trading accounts and a demo account. This variety caters to different levels of trading experience and strategies. What’s more, the broker ensures instant order execution, a critical factor for traders who value timely and efficient trade placements.

The broker’s deposit and withdrawal processes are streamlined and efficient. Deposits are credited instantly, and withdrawal requests are typically processed on the same day they’re submitted. This speedy process is vital for traders who need quick access to their funds.

Leverage is another key benefit when trading with YaMarkets. The leverage ratio varies depending on the asset and account type, with the maximum reaching up to 1:1000. This high leverage offers traders the opportunity to increase their trading position size, potentially leading to higher profits.

Lastly, YaMarkets’ copy trading service stands out. It’s highly regarded by experts and offers a unique opportunity for less experienced traders to learn from and replicate the strategies of more seasoned traders. This feature not only serves as an educational tool but also as a way to diversify trading strategies.

YaMarkets Regulation and Safety

Understanding the regulation and safety measures of a broker is essential in Forex trading, and YaMarkets scores well in this area. After trading with them, I’ve learned that they are regulated by multiple authorities: the Financial Services Commission of Mauritius (FSC), the Vanuatu Financial Services Commission (VFSC), and the National Futures Association (NFA). This multi-tiered regulatory framework is a significant indicator of YaMarkets’ commitment to maintaining high standards of operational integrity and client security.

Being regulated by these reputable organizations means that YaMarkets adheres to strict guidelines and practices. This adherence ensures the safety of traders’ funds and personal information. It also implies that they operate with transparency and fairness, which are critical aspects for any trader seeking a reliable Forex broker.

For traders, knowing that YaMarkets is regulated by entities like the FSC, VFSC, and NFA provides a layer of trust and security. This information is crucial because it reassures traders that they are engaging with a broker that is monitored and held accountable by established financial authorities. It’s this level of regulation that contributes significantly to the overall reliability and credibility of YaMarkets as a Forex broker.

YaMarkets Pros and Cons

Pros

- Responsive 24/5 multilingual technical support.

- Expert-rated copy trading service.

- Quick deposit and same-day withdrawal processing.

- Flexible leverage up to 1:1000.

- Over 80 financial instruments available.

- Minimum deposit only $10, with low fees on ECN accounts.

- Instant order execution with four account types plus a demo.

Cons

- Technical support not available on weekends.

- Full training access restricted to registered traders.

- Higher spreads on Ultimate and Standard accounts.

YaMarkets Customer Reviews

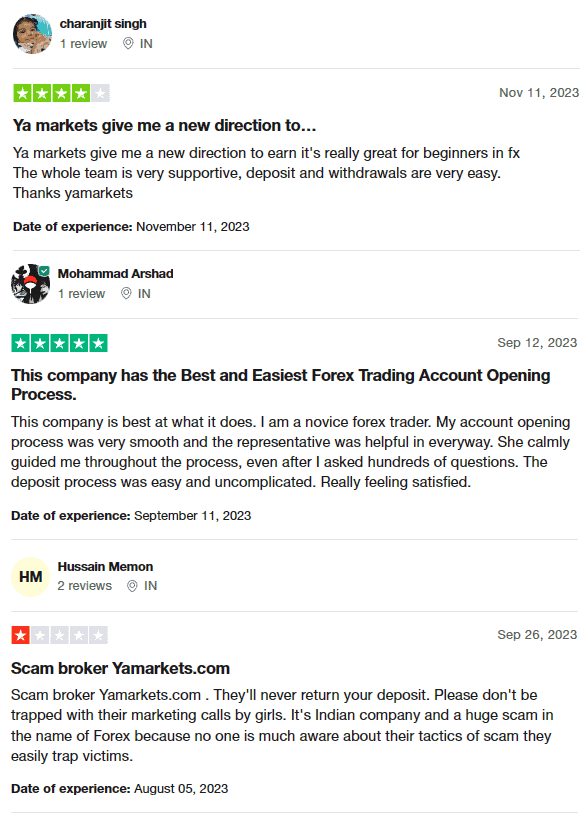

YaMarkets currently holds a 3.8-star rating on Trustpilot, reflecting mixed customer experiences. Some users appreciate the platform, particularly beginners, praising its supportive team and straightforward deposit and withdrawal processes. They highlight the ease of account opening and the helpfulness of the representatives, especially for those new to forex trading.

On the contrary, there are critical reviews labeling YaMarkets as a scam, with allegations of difficulty in getting deposits returned and deceptive marketing practices. This range of feedback suggests varied experiences among its users, indicating that while some find value in YaMarkets’ services, others have had negative encounters.

YaMarkets Spreads, Fees, and Commissions

In my experience trading with YaMarkets, I’ve found that they don’t charge specific trading fees. Instead, the cost to traders primarily comes from the spreads, which vary depending on the account type. Detailed information about these spreads for each account is clearly outlined on the YaMarkets website, making it easy for traders to understand what they might be paying.

For the Ultimate account, the spread is set at $1.8, and there is a charge on withdrawals. In the case of the Standard account, the spread is slightly lower at $1.5, but it also includes a withdrawal commission. The Royale account offers a more competitive spread of $1, again with a withdrawal commission. The most notable is the ECN account, which has a very low spread of just $0.1, although it too comes with a withdrawal commission.

This tiered structure of spreads across different account types allows traders to choose an option that best aligns with their trading style and financial preferences. The clarity and straightforwardness of YaMarkets’ spread and commission structure are aspects I particularly appreciate as a trader.

Account Types

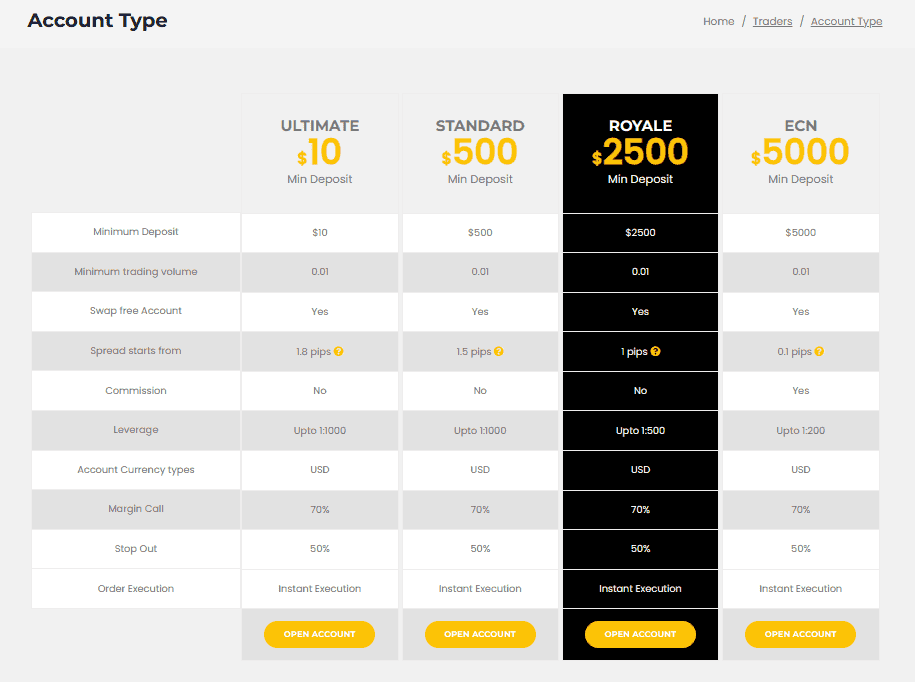

After testing the various trading account types offered by YaMarkets, I found that each caters to different levels of trading experience and financial commitment. Here’s a breakdown:

Ultimate Account

- Minimum Deposit: $10

- Minimum Spread: 1.8 pips

- Trading Fee: None

- Maximum Leverage: 1:500

- Suitability: Ideal for novice traders due to its low entry threshold.

Standard Account

- Minimum Deposit: $500

- Minimum Spread: 1.5 pips

- Trading Fee: None

- Maximum Leverage: 1:500

- Characteristics: A universal choice offering moderate leverage, suitable for a wide range of traders.

Royale Account

- Minimum Deposit: $2,500

- Minimum Spread: 1 pip

- Trading Fee: None

- Maximum Leverage: 1:300

- Designed For: Professional traders, with more extensive opportunities and a higher initial deposit.

ECN Account

- Minimum Deposit: $5,000

- Minimum Spread: 0.1 pips

- Trading Fee: Yes

- Maximum Leverage: 1:200

- Features: Shares common characteristics with other ECN accounts, suitable for experienced traders seeking lower spreads but higher initial investment.

Additionally, YaMarkets offers a demo account, allowing traders to practice and get a feel for the platform before committing real funds. This variety in account types ensures that traders at all levels can find an option that fits their trading style and financial capabilities.

How to Open Your Account

- Visit the YaMarkets website and select your preferred language from the top right corner.

- Click on the “Login” button and choose either “MT4 Register” or “MT5 Register” based on your desired trading platform.

- Select the account type you prefer and fill in your first name, last name, email, and password.

- Re-enter your first and last names, add your date of birth, and provide your mobile phone number.

- Input your registration address including the postal code.

- Accept the terms of service, complete the anti-bot verification, and click “Register”.

- After registering, verify your account by uploading documents to confirm your identity and entering your personal and banking details.

- Wait for the verification process to finish to gain full access to your account and start trading.

YaMarkets Trading Platforms

Based on my experience, YaMarkets offers its clients a choice of three robust trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and WebTrader. Each platform caters to different trading preferences and strategies.

MetaTrader 4 (MT4) is a widely recognized platform known for its user-friendly interface and comprehensive analytical tools. It suits both beginners and experienced traders. MT4 is particularly renowned for its automated trading features and a vast array of technical indicators.

MetaTrader 5 (MT5), the successor to MT4, offers more advanced features, including enhanced charting tools, more timeframes, and additional technical indicators. It is ideal for traders looking for more depth in analysis and greater flexibility in trading.

WebTrader, on the other hand, allows for trading directly through a web browser without the need to download any software. This platform is convenient for traders who prefer accessibility and simplicity, as it can be accessed from any device with an internet connection.

What Can You Trade on YaMarkets

During my time trading with YaMarkets, I’ve explored a diverse range of trading instruments they offer. This variety caters to different trading interests and strategies, making it a flexible platform for various types of traders.

YaMarkets provides the opportunity to trade Contracts for Difference (CFDs) on currency pairs, allowing traders to speculate on the changing values of currencies without actually owning them. This is ideal for those who have a keen interest in the forex market.

The platform also offers CFDs on cryptocurrencies, a sector that has gained immense popularity in recent years. Trading crypto CFDs is an excellent option for those looking to engage in the dynamic and rapidly evolving cryptocurrency market.

In addition to these, YaMarkets allows trading CFDs on indices and commodities, providing a way to diversify one’s trading portfolio beyond currencies and crypto. Indices offer insights into the broader market trends, while commodities enable trading in essential goods like oil and gold.

Lastly, trading in CFDs on precious metals is another option available on YaMarkets. This can be particularly appealing for traders interested in more stable assets, often used as a hedge against inflation or currency devaluation.

YaMarkets Customer Support

YaMarkets provides a comprehensive range of options for customer support, ensuring that traders can easily get assistance when needed. Their approach to customer service is multi-channel, catering to various preferences for communication.

The call center is a direct way to speak with a YaMarkets representative for immediate assistance. It’s particularly useful for urgent queries or complex issues that might require a detailed conversation. Additionally, the availability of WhatsApp support adds a layer of convenience, allowing for quick and informal communication.

Email support and live chat are also available, providing more written forms of communication. The live chat, accessible both on the website and in the user account, is handy for real-time solutions while trading. For less urgent issues, creating tickets on their webpage is an efficient way to track your queries and their resolutions.

Following YaMarkets on social networks like Facebook, Instagram, and YouTube is beneficial for staying updated with the latest news and developments. These platforms often share useful information and can be a quick way to get updates about the broker’s services and features.

Advantages and Disadvantages of YaMarkets Customer Support

Withdrawal Options and Fees

In my experience with YaMarkets, withdrawing earnings is a straightforward process, whether those earnings come from individual trading, copy trading, or their referral program. The flexibility to withdraw at any time is a significant advantage, especially for traders who need quick access to their funds.

Submitting a withdrawal application is simple and can be done anytime. YaMarkets processes these applications promptly, usually on the same day, except on weekends. This efficiency in processing is something I particularly appreciate as it minimizes waiting time.

Regarding withdrawal options, YaMarkets offers a variety of choices, including bank cards and e-wallets, catering to different preferences. It’s worth noting that withdrawing funds to bank cards incurs no fee, which is a cost-effective option. However, other withdrawal channels may have associated fees, so it’s advisable to consider this when choosing your withdrawal method.

YaMarkets Vs Other Brokers

#1. YaMarkets vs AvaTrade

YaMarkets and AvaTrade are both prominent in the online Forex and CFD brokerage space, but they cater to different trader profiles. YaMarkets, with its low minimum deposit requirement and multiple account options, is more accessible for beginners and small-scale traders. In contrast, AvaTrade, established in 2006, boasts a larger global presence, serving over 300,000 customers with a vast array of over 1,250 financial instruments. AvaTrade’s heavy regulation and multiple global locations make it a more robust choice for traders seeking a wide-ranging trading experience and higher security standards.

Verdict: AvaTrade is preferable for traders seeking a more extensive range of instruments and stronger regulatory oversight, making it suitable for both beginners and experienced traders. YaMarkets, while offering a commendable service, may be more suited to those just starting out or with lower capital.

#2. YaMarkets vs RoboForex

YaMarkets and RoboForex both offer diverse trading services, but with distinct focuses. YaMarkets provides a straightforward, accessible platform ideal for new and average traders. On the other hand, RoboForex, operating since 2009, stands out with its extensive range of over 12,000 trading options and eight asset classes. RoboForex’s wide selection of trading platforms and its ContestFX feature, offering contests on demo accounts, are particularly appealing for traders looking for variety and the opportunity to test strategies without risk.

Verdict: RoboForex is a better choice for traders seeking a broader range of trading options and platforms, catering well to both novice and experienced traders. YaMarkets, while competent, is more tailored towards those with straightforward trading needs.

#3. YaMarkets vs Exness

When comparing YaMarkets to Exness, the latter’s international presence and high trading volume are notable. Exness, started in 2008, offers a wide range of CFDs, including over 120 currency pairings and a selection of stocks, metals, and energies. Exness is known for its low commissions, instant order execution, and the unique feature of unlimited leverage on small deposits up to $999. This makes Exness an attractive option for traders looking for flexibility and diverse trading conditions.

Verdict: Exness is a better choice for traders who prioritize a wide range of trading instruments and the flexibility of high leverage. YaMarkets, though offering a solid platform, is more suited to traders who prefer a more straightforward, easy-to-navigate trading experience.

Conclusion: YaMarkets Review

In conclusion, YaMarkets presents a viable option for traders, particularly those who are just beginning or operating with smaller capital. The low minimum deposit requirement, diverse account types, and user-friendly trading platforms make it accessible and appealing to a wide range of traders. The ability to choose from a variety of withdrawal methods and the availability of multilingual support are additional benefits that enhance the trading experience on this platform.

However, it’s important for potential users to be aware of some drawbacks. The limited customer support availability on weekends and higher spreads on certain account types may not suit all trading styles. Moreover, mixed user reviews, including some critical feedback, suggest that while many find value in YaMarkets’ services, others have had less satisfactory experiences.

Also Read: Admiral Markets Review 2024 – Expert Trader Insights

YaMarkets Review: FAQs

What is the minimum deposit required to start trading with YaMarkets?

The minimum deposit required to open an account with YaMarkets is $10, making it accessible for beginners or those looking to start with a smaller investment.

Does YaMarkets offer multiple account types?

Yes, YaMarkets offers a variety of account types, including Ultimate, Standard, Royale, and ECN accounts, each catering to different trading needs and experience levels.

Are there any withdrawal fees on YaMarkets?

Withdrawals to bank cards are free of charge on YaMarkets, but withdrawing through other channels may incur fees.