XTB Review

Broker’s reliability is every trader’s first preference. With FCA authorization and over 20 years of history, XTB fits the criteria on all grounds. They are also registered with the Warsaw stock exchange. The company has served over 500000 users over the last 20 years. Their expansion in the EU region has been astounding.

However, XTB had to face heat after some of their users complained about predatory withdrawal charges charged by the broker. XTB was prompt at answering the queries, regarding it as spam callers who use XTB’s name to defraud people. Nonetheless, the withdrawal problems have damaged their reputation and left traders vulnerable.

Are you looking to sign up with XTB? If yes, you shouldn’t miss the article. In this blog, we shall discuss XTB’s history, charges, fees, technical performance, and customer support. The details shall help you analyze the broker’s long-run viability and whether you should sign up. Let’s go!

What is XTB?

XTB is one of the most popular brokers in Europe; their recent promotional campaign with Connor McGregor has added to their popularity. The promotional campaign wasn’t new for XTB. They have also partnered with famous sports personalities like Jose Mourinho. XTB offers over 2100 different securities for its traders, including stocks, Forex, commodities, indices, and Crypto.

XTB was founded in 2002 and is owned by the XTB Group of companies. The parent company also owns XTB limited and XTB SA. Each subsidiary is designed to comply with specific jurisdictions and operate in a controlled environment. XTB Group of companies is based in Mauritius and is regulated by FSC Mauritius.

The company also has an FCA license that is named under XTB limited. The FCA license ensures that XTB maintains a compensation fund to pay its users in case of solvency. However, as the company operates separately, the compensation fund may not apply to every user.

Over the last few years, XTB’s primary focus has been to enhance its security portfolio and add newer regions to its lists. In 2021, XTB established XTB MENA in Dubai to cater to the rising interest in the Asian region.

Their promotional campaigns in south-Asia have been effective, and they recorded over 400,000 users in late 2021. XTB’s rapid audience expansion and reliability bought them ‘the best forex broker’ award from Rankia in 2022.

XTB has marketed its offerings as a fit-for-all; its services don’t limit them to a particular audience segment. The minimum deposits and offerings are varied to take regional variations into account.

Advantages and Disadvantages of Trading with XTB

Benefits of Trading with XTB

XTB has emerged as a popular broker in the European region, and its services have excelled to the test of time. The broker has been prompt at improving its securities, trading platforms, and features to provide the best trading experience for its users.

Our favorite benefit of trading with XTB is their XStation trading platform. The broker has recently shifted from MetaTraders completely, and in many regions, Xstation 5 is used by traders for their regular trading.

XTB’s Xstation 5 is a complete package for its users; the app contains technical indicators, tools, a research dashboard, security analysis, community connections, and of course, standard trading features. Xstation stands out from other competing platforms due to its user-intuitive interface.

Once you log onto the platform, you won’t feel alien to it. Most critical features are available on the main screen, and if you need to try a technical tool, they are available in the side menu. Hence, any user can use and benefit from the application regardless of their proficiency.

XTB has also developed a web portal and mobile app for its users. They come with the necessary features for an impressive trading experience. Another advantage of signing up with XTB is their educational features; although most brokers offer educational videos, they are only in English, and non-native users need help comprehending them.

Hence, XTB has gone ahead by providing a trading academy where traders can find multilingual trading courses to be more technologically advanced. However, the trading academy’s English videos aren’t optimal for traders, and XTB should revamp them.

Finally, another benefit of an XTB account is 2100+ asset offerings that let investors diversify their portfolios and maximize their returns. XTB has developed a state-of-art asset collection where traders can trade stocks, crypto, Forex, and CFDs.

Hence, it allows investors to benefit from movements in different trading markets and protect their investments if a market crashes. Apart from these benefits, XTB online trading is regulated by authorized regulators worldwide, which adds to their trustability.

XTB Pros and Cons

Pros

- Advanced trading platform with charts and indicators

- Over 15 years in trading industry and 500000 users

- Regular updates about Market news and movements

- 30-day demo account with real-time experience

Cons

- Accusations of funds extortion

- Customer service is below par

XTB Customer Reviews

XTB has an audience of about 500000 users and a history of over 20 years. Their reputation has been largely positive in the industry, and experts regard them as a satisfactory broker. XTB is one of the most reviewed brokers on Trustpilot. They have accumulated a rating of 3.5 stars, with a favorable rating of over 78%.

XTB’s existing customers appreciate the broker due to its remarkable trading services; the general notion suggests that traders have highly benefited from XTB’s diverse offerings that allow them to transfer their funds to more profitable assets.

Some users are also impressed by the Xstation and its execution rate during high market fluctuations. Overall, traders also appreciate the trading courses offered by XTB’s trading academy; users claim that the courses help novice traders understand the market and develop a keen sense of strategizing their trades.

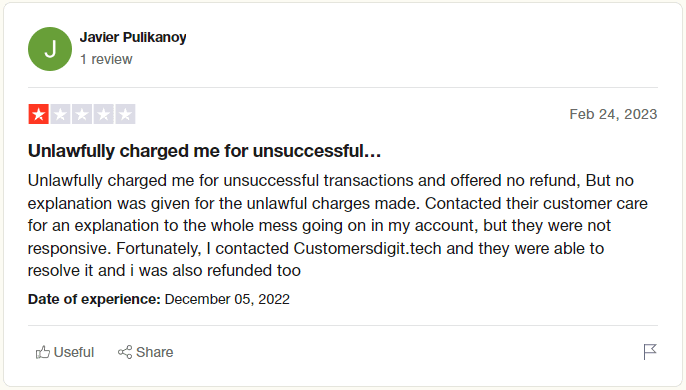

However, as with every broker, XTB has also had a fair share of negative reviews that dents its reputation. Some users claim that their funds were extorted by XTB unlawfully, and they couldn’t retrieve it despite multiple requests.

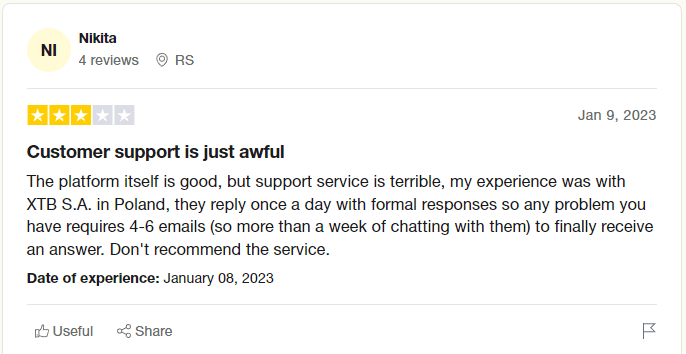

Most customers from Poland also complain that customer support is below par, and it takes several days to receive an actionable response to a query. Nonetheless, these disadvantages are in no way near the scam accusations on the broker.

XTB is accused of charging an undue commission on withdrawals to discourage investors from withdrawing their income. Traders claim that no such policies were cited before their admission.

Overall, we couldn’t find any legitimacy in the negative reviews that accuse XTB of unlawful transactions. Most such reviews looked like a marketing campaign for some chargeback funds. The reviews may be fake because the reviewer does not contain any history. However, for the customer support problems, there has been a massive chunk who are disturbed by the situation.

XTB Spreads, Fees, and Commissions

XTB’s services and trading platform are commendable, offering various features that attract a broad audience. However, a broker’s viability is based on their costs because even good trading strategies won’t make sense if the prices are high.

XTB has separate spreads and commissions for its EU, UK, and international clients. They have previously offered three account types for all regions, but now, only international clients have two account options, and UK and EU clients can only use the standard account.

The spreads written on the website are per unit, which is against the industry norm as they can be mistaken for spreads per lot. The average spreads for the standard account are under 1.5 pips; the lowest spreads are 0.5 pip per lot.

The spreads constantly change, and it can be difficult to predict exact spreads. However, existing users suggest that spreads for EURUSD are typically 1 pip per lot. The same 1 pip per lot spread goes for EUR GBP and AUD USD; other popular pairs offer a spread of around 1.2 pips.

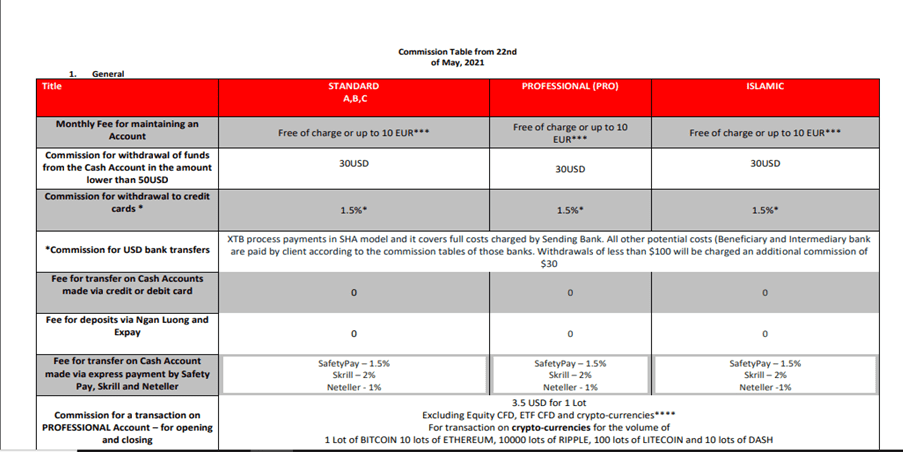

The standard account doesn’t have an explicit commission; however, the agents confirmed the broker charges a portion of the spread as commission. For most Forex and CFDs, the commissions are usually 0.3%. The broker also charges a 3.5 EUR commission on setting up trades for a professional account.

XTB also has a fee of 10 EUR per month for maintaining accounts; however, the cost is levied on inactive investors or traders with high investments. X Trade Brokers also charge swap and withdrawal fees that vary based on your specific conditions.

In our view, XTB should publicize its charges. The information should be presented alongside spreads to better estimate total trading costs.

Account Types

As XTB is a multinational broker, there are several complications in their account types. The broker has distributed their forex trading audience into three sections: UK, EU, and international.

Previously, all regions had three account options for traders; however, it has changed since 2019 due to legal complications. Now, only international clients are offered standard and swap-free accounts.

- The standard account is available for all regions. It has a minimum deposit of $1, but the broker recommends about $200 for efficient trading. It allows leverage of 1:500 and has a minimum spread of 0.5 pips. XTB has also offered segregated funds to ensure investor’s fund safety. It doesn’t include any commissions on Forex, crypto, or CFDs.

- The Swap-free account isn’t a different account type but an extension of the standard account. It has the exact minimum deposit requirements and leverage options. However, the minimum spread for the account type is set at 0.7 pips per lot to compensate for no swap fees. The account has no set-up fee.

XTB’s account types aren’t diverse, but fewer options mean investors won’t confuse themselves while deciding.

Some regions also support a professional account, where traders can deposit money, and XTB manages their funds. The professional account has commissions and other additional maintenance fees.

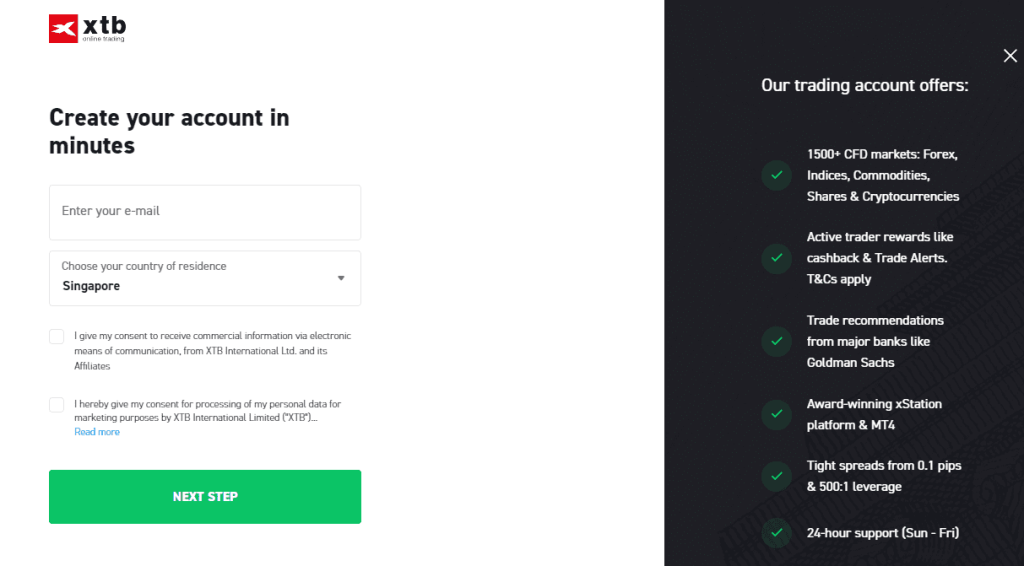

How To Open Your Account?

XTB’s services are designed for the masses. Although there are few personalizations, the standard account has sufficient features to support your trading journey.

If you’ve made up your mind to sign up with XTB, the sign-up process is simple, and you can get started in less than 10 minutes.

- You can start by clicking the ‘create account’ button on the official site. It will direct you to a form requiring your name and email.

- Once you proceed with the form, you’ll be mailed an email to verify the email. As you tap on the link, you’ll be directed to another form where you will add information such as your phone number, XTB email, and password.

- Finally, you can complete the form and use your email and password to log into your XTB trading portal. To make a deposit, click on the side menu and select ‘deposits.’

XTB supports over 10 methods for making a deposit, including e-wallets, crypto, and bank cards.

The account registration process can be completed within 10 minutes, while the deposits will take about 2 hours to show up, depending on your preferred method.

What Can You Trade on XTB

XTB has diverse offerings to suit different investors. They offer over 2100 stocks, crypto, Forex, CFDs, and indices; the forex offerings include all major pairs such as EURUSD, USD JPY, and USD GBP.

The stock collection is based on underlying assets, and you can trade CFDs for Apple, Tesla, Google, and other leading firms. XTB’s crypto offerings are also broad; it includes popular cryptocurrencies such as Bitcoin, Ethereum, and Dogecoin. Nonetheless, it also has various other cheaper offerings for low-capital investors.

While discussing asset offerings, we must note that many brokers have an extensive range of assets; however, these assets may come at higher spreads than usual, making it unfavorable for traders to trade in them. Nonetheless, XTB spreads are reasonable for most of their offerings; the Forex spreads align with industry leaders. The CFD spreads are justifiable as well, but the crypto spreads may put traders at a disadvantage.

The asset offerings for XTB investors are consistent in particular legislation. Still, they may vary if you switch jurisdictions.

Some CFD assets are discouraged by FCA due to their high risks, but they may be available in regions outside the UK. Hence, you must connect with the broker to determine the asset pool for your legislation to make a better decision.

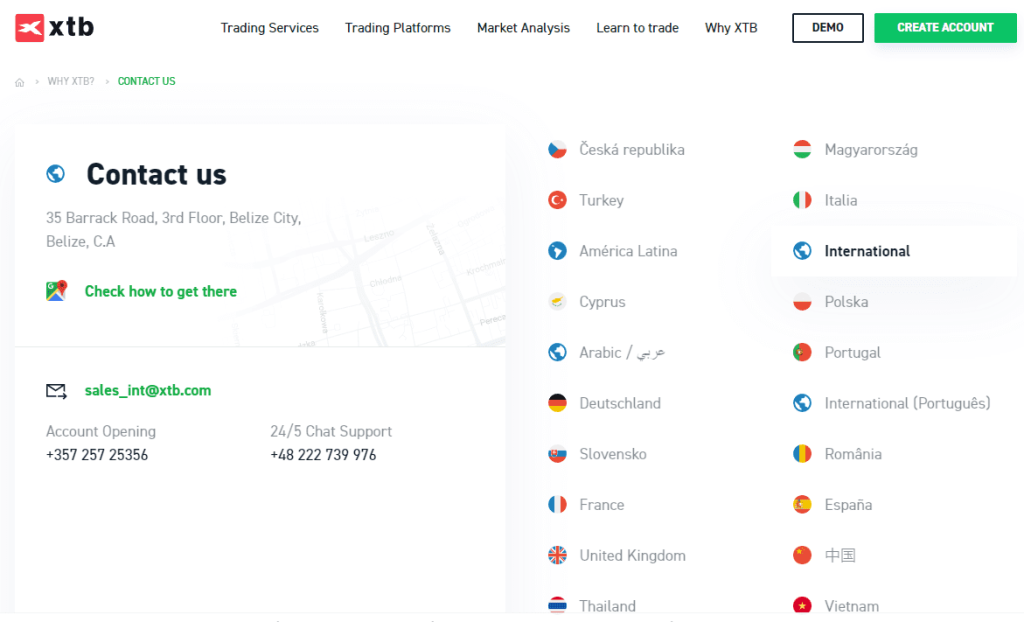

XTB Customer Support

Our evaluation criteria pay special attention to customer support; we have often seen promising traders suffer from inefficient customer support. Therefore, we test customer support based on its knowledge and response rate to provide valuable insights for interested traders.

Our experience with XTB brokers has been good; the responses were quick, and the information was helpful. XTB has also used AI to manage customer queries with limited audiences.

Most common questions are responded to with a generic response, but if you want something more specific, you can connect with an agent at the same tab. The phone responses are reasonable; however, email responses should be quicker as they take longer than most other brokers.

Most of the existing customers have had an unsatisfactory experience with XTB, which is a major dent in their reputation. Customers report that the customer service agents were neither professional nor knowledgeable.

We have had multiple reports where customers failed to drive any solution for their queries despite repeated attempts. Customers have also had a poor experience of contacting through emails. Users highlight that it took around 7 days to get any of their queries answered through email.

As per our research, most customer service problems arise in Poland and its neighboring regions. It suggests that XTB’s polish department has failed at catering to the high demand, and they should hire more people to solve the crisis.

Forex trading is a market of fluctuations and every second counts. We have seen multiple instances where a wrong decision costs people their fortunes. XTB should ensure that it enhances its customer service for retail CFD accounts to enhance user experience.

Advantages and Disadvantages of XTB Customer Support

Security for Investors

Withdrawal Options and Fees

A trader’s primary investment goal is to generate a positive return and have their funds when needed. Although many brokers promise excellent results, most of them make it impossible to withdraw money. X Trade Brokers have a long history and over 500000 investors. We couldn’t trace any ‘real and verifiable’ withdrawal difficulty for any investor. Hence, XTB can be regarded as safe for withdrawals and payments.

XTB offers multiple options for withdrawing your funds. You can use MasterCard, Visa, Skrill, and leading payment providers. The intermediary costs vary between 2.5-4% depending on your method and withdrawal amount.

Unlike other brokers, XTB has a complex fee structure for withdrawals. For any withdrawal less than $100, a $20 fee is charged. It is incredibly high and contributes to about 20% of the total withdrawal amount.

If a trader has to withdraw less than $100, they are at a severe disadvantage, as any profit they may have made will be charged in withdrawal fees. Fortunately, the percentage shrinks as your withdrawal amount increases, and large withdrawals may have a significantly lower proportion of costs.

In our view, XTB should remove its withdrawal fee, as it makes the XTB platform unfavorable for most traders. The market sentiment regarding withdrawal fees isn’t positive, and the broker’s legitimacy turns questionable if these fees rise.

XTB Vs. Other Brokers

#1. XTB vs. AvaTrade

AvaTrade is at the top of every trader’s mind when they are looking to sign up with a broker. They have made a history of offering remarkable services at a reasonable price. XTB is a close contestant against AvaTrade, and their comparison may quiz most traders. Let’s start the comparison by considering their security licenses.

AvaTrade is a highly regulated broker across different jurisdictions; they have an operating license from Japan and South Africa and comply with UK and US regulations. XTB is no lesser in regulations, and they have permits from FCA and FSC Mauritius.

Avatrade leads the race in legitimacy due to a 4.7-star rating at Trustpilot compared to XTB’s 3.5. Avatrade offers an MT4/5 trading platform alongside a web portal and mobile app. XTB’s platform features are similar, and it’s difficult to give an edge to either of them.

However, Avatrade takes the lead due to its social trading features; Avatrade not only offers social trading features through its platform but is also listed with Zulutrade, allowing traders to make a passive income. On the contrary, XTB doesn’t offer social trading features, meaning investors have to spend more time finding the right trades.

Another essential comparison is the trading costs; Avatrade has multiple account types; the standard account has a minimum spread of 0.9 pips, while the pro account has a minimum spread of 0 pips, but a commission is charged. XTB offers slightly higher spreads for currency pairs in comparison, but they compensate for the difference by providing a wider variety of assets than Avatrade.

In our viewpoint, XTB and Avatrade are close competitors, but Avatrade takes the lead against the former based on customer service and user reviews. Avatrade has had better reviews and acknowledgments from users; therefore, it is our recommendation.

#2. XTB vs. Roboforex

Roboforex’s rapid expansion in the last decade has brought the attention of traders worldwide; hence, they often compete against XTB in a trader’s mind. XTB has better licensing than Roboforex; XTB is registered in different jurisdictions and is traded on the Warsaw stock exchange.

Roboforex has a license from SVG, but the trading community doesn’t hold it in high regard. However, Roboforex takes the lead against XTB in terms of asset offerings. While XTB offers 2100 different assets, Roboforex has over 6 times larger collections with about 12000 foreign assets under its portfolio.

Roboforex is also a better choice for passive traders; the broker doesn’t only offer MT4/5 and Ctrader, but it also has EA bots that can help traders manage their funds. Roboforex has been an industry leader in innovation, and its trading platforms are significantly better than XTB.

Nonetheless, XTB compensates for its reduced innovation by offering lower spreads. Although XTB’s spreads aren’t the industry-lowest, they are sufficiently lower than Roboforex. While Roboforex’s standard account spreads, start with a minimum of 2.0 pips, the lowest spread for XTB’s standard account is 0.5 pips. The typical spreads with XTB are also lower than Roboforex.

Nonetheless, lower spreads don’t necessarily mean lower trading costs. Roboforex doesn’t charge a deposit or withdrawal fee; they also have no maintenance fee, which reduces overall trading costs with the broker. XTB doesn’t have similar services, putting XTB traders at a disadvantage.

In our viewpoint, Roboforex will be a better option than XTB for most traders. The availability of social trading alongside intelligent platforms ensures professional traders can make the most of their investments by investing limited time.

#3. XTB vs. Alpari

Alpari and XTB are located and registered in the same jurisdictions. Both of them are licensed by the FSC Mauritius. However, XTB has additional licenses from FCA, while Alpari relies on a single license. Alpari also has a lower 2.7-star rating at Trustpilot which makes them slightly less reliable than XTB.

However, Alpari has been a user favorite due to its account diversification. The broker has six different account types for users, and traders can sign up for an account for as low as $1 and as high as $5000. Each account type is designed to suit a specific audience, and their specifications suit their usage.

On the contrary, XTB doesn’t offer different trading accounts for forex trading; hence, all traders have a single choice. However, XTB leads against Alpari through its trading platform. Although both brokers don’t support social trading, XTB’s trading platform is far superior to Alpari’s.

The Xstation is also available on mobile, which provides traders with helpful information on the go. Alpari’s mobile app doesn’t have advanced functionality and is for limited use. XTB is also a better option due to its asset offerings; XTB broker offers 2100 different assets for traders, while Alpari only offers 100.

The massive difference between offerings can be costly for traders as it will hurt their risk minimization strategy. The trading costs of XTB and Alpari are similar. While XTB charges lower spreads, Alpari has no significant additional charges over its spread and commissions; thus, the overall costs have minimal difference.

Another difference between the two brokers is educational resources. XTB has founded a trading academy that lets traders find the latest information about trading CFDs, stocks, crypto, and Forex. Alpari has no similar video collection, and traders must rely on third-party data and strategies to fulfill their needs.

Overall, Alpari and XTB are close contestants, and choosing a clear winner is difficult. We believe XTB will be a better option for low-capital investors setting their first steps in the investment world. Alpari will be better for professional traders planning to take the market by storm.

Conclusion: XTB Review

XTB is a commendable broker that has some solvable deficiencies. The advantage of signing up with XTB is their trading platform. The X Station trading platform has the necessary features and frills to enhance the user experience and assist in the technical analysis of securities.

Another perk is their licenses from financial conduct authority that adds to their legitimacy and provides a leeway for investors if the broker defaults.

However, XTB’s main problems can be summarized under two heads. Firstly, the retail investor accounts offer no diversity, and there are no differences for traders with various expertise.

Similarly, the broker offers a single platform that may only suit some users. Secondly, their withdrawal fees are questionable; they charge a significant portion of your total withdrawal, which makes it illogical for investors to withdraw their investment.

XTB should focus on solving the issues to add to its audience and become a top choice for investors. Their offerings and educational resources are impressive, giving them a differential amongst their competitors.

We believe new investors will benefit more from an XTB trading account than advanced traders. However, it takes nothing away from XTB trading platforms or their offerings.

XTB Review FAQs

Is XTB regulated?

XTB was founded in 2002. It is a subsidiary owned by the XTB Group of companies. The company has obtained multiple licenses across its subsidiaries; hence, their operations are regulated in most regions.

XTB Group has an FSC Mauritius and FCA license; they also maintain a financial services compensation scheme that prevents traders from losing their investments.

What is XTB minimum deposit?

XTB doesn’t have a minimum deposit requirement, and investors can start a real-time account for as low as $1. However, we advise traders to invest about $200 to experiment in different market conditions and profit from their experience.

Is XTB a reliable broker?

XTB has a history of over 20 years, and they have successfully catered to about 500000 traders from different parts of the world. They host numerous experienced traders who use the advanced trading platform for everyday trading.

XTB Limited also offers negative balance protection for EU and UK accounts that prevents their account from going negative.