XM Review

XM is an online broker owned by XM Global Limited, a global CFD, and FX broker. The first thing that is worth mentioning about this platform is that it has five global licenses: FSC (Belize), FCA (UK), CySEC (Cyprus), ASIC (Australia), & DFSA (Dubai).

XM Broker is perfect for traders looking for a professional trading platform with high order processing speed and low commission fees. Another thing worth mentioning is the types of accounts XM offers, and the same quality of execution is available on all of them — which means instant order overlaps, slippages, and minimum requotes.

XM Group’s leverage level meets or exceeds European standards (including the MiFID directive that all CySEC licensees work in accordance with). Notably, in the Singapore market, XM Group offers an even higher maximum leverage of 1000:1, catering to the diverse needs of traders. XM Group is a MetaTrader-centric broker that offers an array of high-quality market research and educational resources. In addition, this platform is good for beginner traders.

In this detailed review of XM, we will discuss the various aspects of this broker, starting with its introduction and pros and cons. So, let’s get started!

What is XM?

XM stands as a prominent global online financial trading platform, boasting an extensive array of trading instruments that encompass Forex, Cryptocurrencies, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, Energies, Shares, and Thematic Indices. Headquartered in Cyprus, XM adheres to stringent regulatory standards upheld by esteemed financial authorities such as CySEC, FCA, ASIC, DFSA, and FSC.

Notably, in the Singapore market, XM Broker operates under the regulation of the Belize license – Financial Services Commission (FSC-Belize), ensuring a secure and transparent trading environment. This versatile platform caters to diverse trading preferences and offers a variety of account types to accommodate traders of varying experience levels.

XM was founded in 2009 and has become a leading online financial trading platform with over 10,000,000 clients from more than 190 countries. XM is dedicated to providing its clients with the best possible trading experience.

XM offers retail investors forex trading, cryptocurrency, shares, stock CFDs trading, turbo stock trading, commodity CFDs trading, equity index CFDs trading, precious metals CFDs trading, energy CFDs trading, and thematic indices trading. XM also allows investors to trade on margin, with leverage of up to 1000:1.

Advantages and Disadvantages of Trading with XM

There are tons of reasons to trade with XM, and below are the main advantages that make this broker one of the best in the industry although XM is a great online broker, there are also a few disadvantages that traders should be aware of.

Benefits of Trading with XM

Trading with XM has a number of benefits that make it an attractive option for online traders. Like, the spreads on XM can be as low as 0.01% on major currency pairs. And, there are no requotes or rejections of orders — which means that you can trade with XM without worrying about your orders being executed at a different price than what you initially agreed to.

Another great benefit of XM is its market order execution time of less than 1 second. The forex market is more liquid than stock and futures markets, so you can always execute an order.

Moreover, there is a no-rejection policy for all orders, so you can trade with XM without worrying about your order not being executed. Lastly, XM is one of the most trust-worthy regulated online brokers, meaning your money is safe, and you can trade confidently.

XM Pros and Cons

Pros

- The top 5 well-known regulators license XM including the Belize license issued by the Financial Services Commission (FSC-Belize) for the Singapore market.

- Although the classic MT4 and MT5 platforms have been modified, they are still recognizable to most traders.

- Availability of micro accounts and Ultra Low accounts for beginner traders and great educational tools.

- Traders can get free forex market analysis, free signals, and protection against negative balance.

Cons

- Non-EU clients are not protected under investment law.

- Average stock and forex index CFD

- A typical account’s spread is significantly higher priced than other providers in the industry.

Analysis of the Main Features of XM

4.6 Overall Rating |

4.6 Execution of Orders |

4.5 Investment Instruments |

4.5 Withdrawal Speed |

5.0 Customer Support |

4.5 Variety of Instruments |

4.5 Trading Platform |

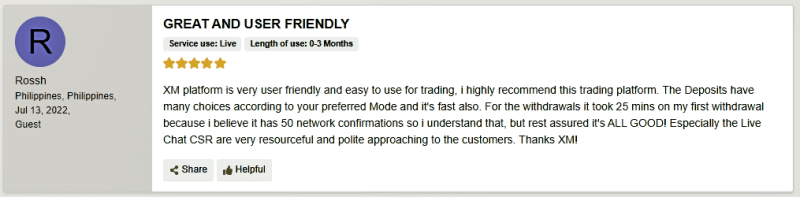

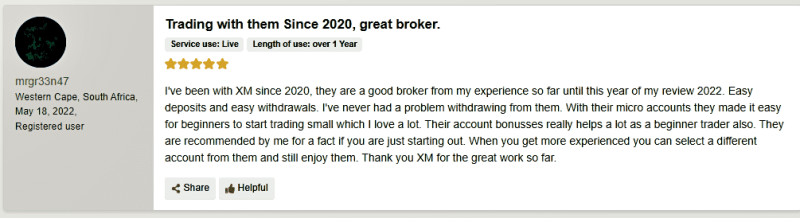

XM Customer Reviews

The customer reviews for XM are generally positive. Most reviewers cite the broker’s low spreads, fast execution speeds, fast withdrawals, and excellent customer service as the main reasons for their positive experiences. However, a few reviewers have had negative experiences with the broker, citing issues such as delayed withdrawals and lack of customer support on weekends.

XM Spreads, Fees, and Commissions

Let’s discuss XM spreads, fees, and commissions in detail:

XM Spreads

The average spread for a major pair such as EUR/USD is 0.1 pips, but XM operates with variable spreads that can start as low as 0.0 pips depending on the account type opened.

All XM account types don’t have any hidden fees or commissions. XM promises same-day withdrawals, and it covers all transfer fees. Additionally, fractional pip pricing lets clients gain from the tiniest movements.

Deposit Fee

The deposits on XM are processed instantly in any currency, and there is no deposit fee. In addition, the traders only need a minimum of 5 GBP/USD/EUR to open an account on XM.

Traders can easily make the payment in any currency that is automatically converted into the currency as the base currency they choose while opening an account.

Accepted for transactions includes Debit/Credit Cards, Online Bank Transfer, E-wallet , International Bank Wire Transfer, Skrill, Neteller, Perfect Money, Google Pay, and Apple Pay, providing traders with a comprehensive range of options for their financial transactions. However, PayPal and other crypto options are not currently accepted by this broker.

Withdrawal Fee

Most withdrawal requests on XM will be processed within 24 hours. If you’re requesting a wire transfer and the amount is less than 200 USD, there may be a fee associated with your request. The minimum withdrawal sum is 5 USD.

Traders must submit a color copy of an official identifying document, like a passport or driver’s license, to process deposit and withdrawal requests. This is in line with standard KYC regulations; a recent utility bill is no more than three months old as proof of their current address.

Different withdrawal methods have varying maximums. Reviewers tend to speak positively about withdrawals. If you’re having trouble withdrawing or validating your account, contact customer support for help.

XM Trading Fee

Before we discuss the XM trading fee, let’s take a look at how the XM trading fee is calculated. We have reviewed several brokers and found trading and non-trading fees. Not only that, but there are also commissions, spreads, conversion fees, and financing rates. However, according to traders, the non-trading fees include withdrawal or inactivity fees.

In the below sections, we will discuss the XM fee for different assets so let’s start with the XM trading fee first.

XM offers four distinct account types: Standard, Micro, Ultra Low, and Shares accounts. Traders looking for zero swap charges and tighter spreads might find the Ultra Low account preferable to the Standard and Micro options. Notably, the Shares account is the only one that involves commission charges. This variety of account types allows traders to choose the option that best suits their trading style and needs.

We chose instruments that were popular within each asset class:

- Forex: GBP/USD, EUR/CHF, EUR/USD, EUR/GBP, and AUD/USD

- Cryptocurrencies: BTC/USD, XRP/USD, ETH/USD,

- Stock Index CFDs: EUSTX50, SPX

- Stock CFDs: Vodafone, Apple, Amazon

- Turbo Stocks: Adidas, Facebook, Google

- Commodities: COFFE, WHEAT, SUGAR, SBEAN

- Equity Indices: JP225, DJIA, S&P500, DAX

- Precious Metals: Gold, Silver, Platinum

- Energies: NGAs, OIL

- Shares: BMW, Amazon

Trades are usually defined as buying a leveraged position, holding it for around one week, and then selling. To give you an idea of volume, we chose a $2,000 position for the stock index and stock CFDs and $20,000 for forex transactions.

We used the following leverage to calculate the fees:

- 5:1 for stock CFDs

- 30:1 for forex

- 20:1 for stock index CFDs

Non-trading/Non-activity Fees

If your account is inactive for more than 90 days, XM will charge a monthly inactivity fee of 5 USD. In addition, a $15 one-off maintenance fee will be charged after one year of inactivity. If the account remains inactive, there will be a $5 monthly fee.

The account inactivity fee charges registered brokerage clients who don’t meet their broker’s trade activity requirements. For example, an inactivity fee may be charged if a client goes without buying or selling activity in their account for the broker-dictated amount of time.

Not only do online trading accounts have inactivity fees, but many financial service companies also charge them. So please check your broker’s website and ensure you are comfortable with all the services and fees that come with it. That way, there won’t be any surprises down the road. Then, to avoid being charged any additional fees, close your trading account with the broker’s customer support and make sure to get confirmation.

XM Commissions

According to XM users, there are no secret commissions, and you won’t be charged for withdrawing or depositing money. If you choose to shift your transactions to the next day, however (a process called ‘swap’), there is a commission that changes based on market conditions and an i-e average of $6.

How XM Fees Compare to other Brokers

Account Types

Currently, XM offers four different types of live trading accounts, allowing up to 200 open/pending positions per client. Below are the four account types of XM:

Micro Account

At number first comes the micro accounts and these accounts use USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, and ZAR as the base trading currency. Users can trade with a deposit as low as USD 5. Spreads start at one pip, and one micro lot is equivalent to 1,000 units of the base currency.

Standard Account

A Standard account allows you to use USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, and ZAR as your base currency. You can begin trading with only $5 USD. 1 standard lot is equal to 100 000 units of whichever base currency you have chosen. Lastly, spreads on all majors are low – starting from 1 pip only!

Ultra Low Account

The XM Ultra Low Account presents traders with a range of features designed to enhance their trading experience. With the option to select from multiple base currencies, including EUR, USD, GBP, AUD, ZAR, and SGD, this account type offers a diverse and flexible trading environment. The minimum deposit is also $5 USD. Like the Standard account, one standard lot equals 100,000 units of the chosen base currency. Spreads are very low, too, starting at 0.8 pips.

Shares Account

A Shares account allows you to use USD as the base currency only. Unlike the other types of account, there is high minimum deposit $10,000 USD. Its contract size includes one share with charged commission fees, and the maximum number of positions that you can open is only 50.

According to XM customers, they can have a maximum of eight trading accounts open at once. All account management is done through the XM members area on their website. Additionally, an Islamic account is available upon request for those who need it. The only downside is that XM does not offer PAMM accounts.

Demo Account

XM users can open a demo account, test the XM platform, and get accustomed to the forex market. The demo account is available for 30 days and comes with $100,000 virtual money. After the 30 days are up, the account will automatically close.

To open a demo account, go to the XM website and sign-up for the paper trading solution by filling out a quick online form. You can use the demo account on both MT4 and MT5 trading platforms.

The demo account offers an authentic trading experience without the risk of incurring real losses. In addition, you can continue learning at your pace by keeping a demo account open even after activating a live account.

How to Open your Account?

XM now offers One-Click Registration which makes it easier for new traders to register an account. In addition, your account will be verified on the same day with the required documentation. Moreover, you can choose between 27 other languages except for English. The process of account opening on XM is as follows:

- Visit the official website and click on ‘Open an Account’

- Then, enter your name, email address, and chosen password, check their agreement box and click “REGISTER”

- A verification email will be sent to your email inbox for you to verify and set up your XM profile

- In the next step, you will be given a choice to open a Demo Account or a Real Account

- Now add your personal data, like your address and date of birth

- You will then be asked about your financial details

- Next, you will be asked about your preferred platform, type of account, leverage, base currency, and if you want to receive an account bonus

- Finally, you will be asked to verify your account for KYC purposes

The quickest and easiest way to verify your identity and residency is by uploading a copy of your national ID, passport, or driver’s license. If you don’t have any of those documents, another form of acceptable proof is utility bills or bank statements.

What Can You Trade on XM?

XM offers various assets that can be traded on its platform. Here is a list of all the available assets:

- Forex Trading: 50+ global currency pairs, including majors, minors, and exotics, are available.

- Cryptocurrencies: Up to 31 cryptocurrencies including BTC, ETH, and XRP

- CFD Indices: XM offers CFDs on various assets, including indices, energies, metals, and more.

- Equity Indices: Trade up to 24 equity indices including JP225, DJIA, S&P500, DAX, and more.

- Turbo Stocks: Trade up to 7 turbo stocks including Apple, Amazon, Facebook, and more.

- Commodities CFDs: Trade CFDs on sugar, cocoas, wheat, and more.

- CFDs on Stocks: Trade over 1200+ global stocks from companies like Apple, Google, and more.

- CFDs on Metals: Precious metals, including gold, silver, and palladium, are available.

- Energies CFDs: Trade CFDs on energies like natural gas, oil, and more.

- Thematic Indices: Trade popular thematic indices such as AI Index, Crypto 10, Blockchain & NFT and more.

In addition to those assets, crypto trading is not available on XM (under the EU-regulated group entity).

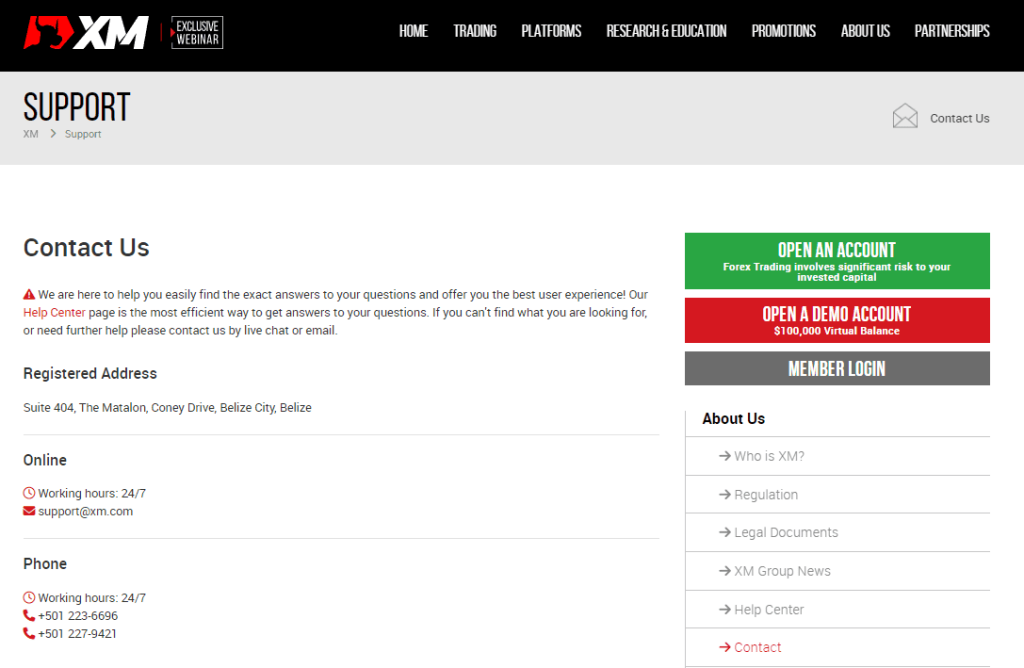

XM Customer Support

XM offers customer support in a variety of languages 24/7. In addition, the customer service team can be reached via live chat (24/7), email, and phone.

According to XM traders, they don’t have to wait long for a response from customer support, and the team is very helpful. Their answers are quick, and relevancy is also OK. For more detailed answers, you should go for email support, as it has great reviews, and you’ll get responses within a day.

XM Singapore has recently enhanced its client support by introducing a dedicated Telegram channel. This initiative is aimed at ensuring that clients and potential traders stay informed about XM’s latest updates, educational programs, new features, and attractive promotions.

The channel offers a platform for users to join the XM community and engage with the content actively shared by XM Singapore. It’s a valuable resource for anyone interested in forex trading, providing timely information and insights directly through Telegram. Subscribers to this channel can benefit significantly from the regular updates and support offered by XM Singapore.

Overall, XM’s customer service is excellent, and they are always willing to help their clients.

XM Customer Support Advantages and Disadvantages

Below are a few of the advantages and disadvantages of XM customer support according to its user reviews:

XM Contacts Table

Security for Investors

As mentioned earlier, XM Broker is licensed by three leading international regulatory bodies: FSC (Belize), FCA (UK), CySEC (Cyprus), ASIC (Australia), & DFSA (Dubai). The CySEC license, in particular, means that the broker falls under the European legal framework regulated by MiFID I and II. All customer accounts are held with segregated European banks, meaning they are kept separate from brokerage operating accounts.

In the Singapore market, XM is overseen by a renowned international license, namely the Belize license issued by the Financial Services Commission (FSC-Belize).

Withdrawal Options and Fees

XM offers a variety of withdrawal options to its clients. These include bank wire transfers, credit/debit cards, and e-wallets. In addition, you can find out how to restock and withdraw money from your Personal Account.

The broker’s internal documents regulate the withdrawal procedure, which is prioritized as follows: credit and debit cards first, then electronic wallets. XM will begin processing your payment request within 24 hours, and you can anticipate receiving your withdrawal within five business days.

You can easily withdraw your money without limit to the number of requests. Plus, the currency you deposit is always the same as what you’ll get back- ensuring easy transactions. If there’s a discrepancy between currencies, don’t worry! The broker automatically converts it to market value.

The only time you’ll be charged a commission is when you’re withdrawing or replenishing funds that are over 200 US dollars.

XM vs Other Brokers

#1. XM vs Avatrade

XM is a great broker for those looking for various account types with low spreads. On the other hand, AvaTrade is best for those who want a broker that offers multiple platforms and instruments.

Both brokers are well-regulated and offer negative balance protection. XM also offers a higher maximum leverage of 1000:1 compared to AvaTrade’s 400:1. In addition, XM has lower minimum deposit requirements at $5, while AvaTrade requires a minimum deposit of $100. When it comes to customer support and investor protection, both companies are on par with each other.

Out of the one hundred variables we tested, analyzed, and researched, AvaTrade is our top pick for the best MetaTrader broker. However, with a low minimum deposit of $5, XM is a better choice for small account holders.

#2. XM vs Roboforex

XM is the better choice for those looking for a broker with multiple account types and low spreads. Roboforex is best for traders who want an ECN account-compatible broker that offers the cTrader platform.

Both brokers offer negative balance protection and are well-regulated. However, XM’s leverage is higher at 1000:1 while Roboforex’s is 30:1. Minimum deposit requirements are also lower at XM at $5, while Roboforex requires a minimum deposit of $100.

According to customer reviews, XM is comparatively better regarding customer service and order execution. XM also has a wider range of deposit and withdrawal options. Overall, XM is the better choice for online forex trading.

#3. XM vs Alpari

Alpari has been a reliable forex broker for over 20 years, providing tightly fixed and variable spreads and speedy order execution. Alpari offers three account types: Standard, ECN, and Pro.

On the other hand, XM is a great choice for beginner and intermediate traders as it is user-friendly and has a wide range of educational content. Moreover, it is a regulated broker with a strong presence in several countries. Moreover, they offer customer support in 27 languages.

XM is the better choice for those looking for a regulated broker with multiple account types and low spreads. Alpari is best for traders who want a reliable and well-established broker.

In terms of leverage, XM offers a maximum leverage of 1000:1 while Alpari’s is 3000:1. Minimum deposit requirements are also lower at XM at $5, while Alpari requires a minimum deposit of $1. So, overall, XM is the better choice for online forex trading.

When it comes to customer reviews, Alpari is a better choice as it has been around for longer and is a more established broker. However, XM is the better choice for those looking for a regulated broker with multiple account types and low spreads.

How XM Trading Options Compare against other Brokers

Conclusion: XM Review

XM is a great forex broker with a solid reputation, high-quality trade execution, and a wide range of tradable assets. The broker is also very well-regulated by some of the most respected financial authorities in the world. Our experts liked the low fees for stock CFDs and withdrawals. Opening an account is easy and free of trouble, and the broker offers a broad range of high-quality educational tools.

Despite XM’s perks, there are some cons to consider as well. It only offers forex and CFDs, so the product range is limited. In addition, its fees for forex and stock index CFDs are mediocre, and non-EU customers have no investor protections.

XM’s customer support is excellent and always willing to help their clients. Moreover, If you’re looking for a CFD and forex broker that uses MetaTrader trading platforms, we recommend giving XM a try. You can register for a demo account to test it out. Overall, we believe XM is a great choice for experienced and beginner forex traders.

XM Review FAQs

Is XM safe and legit?

Yes, XM is safe and legit. The broker is licensed by three leading international regulatory bodies: ASIC (Australia), FSC (Belize), CySEC (Cyprus), FCA (UK), and DFSA (Dubai). In the Singapore market, XM is regulated by a well-known global license which is the Belize license – Financial Services Commission (FSC-Belize). Therefore, it is secure and regulated.

Can you make money with XM?

Many traders have found success with XM. However, it is important to remember that trading on the financial markets will not make you rich overnight. If you take the time to educate yourself about trading, practice with a demo account, and carefully plan your trades, you will increase your chances of success. You should never trade with money that you cannot afford to lose.

CFDs are complex instruments and can be risky; 77.74% of retail investor accounts lose money when trading CFDs with this provider. Before investing in a CFD, make sure you understand how it works and whether or not you can afford to risk losing your money.

Is XM a good broker?

Our experts concluded that XM is a reliable broker with trading conditions appropriate for various types of traders, quick and excellent service, and beginner-friendly educational content — all while having some of the lowest deposit requirements in the industry.

In addition, it is regulated by top-tier financial authorities, providing an additional level of protection for its clients. However, this means XM falls under regulation from a jurisdiction that can hold the broker responsible for its actions; or, at best, play an arbitration role in case of bigger disputes.