Woxa Review

By allowing traders to begin their trading journey, Woxa stands out for the very reason that you as a potential trader can gain access to a wide range of trading tools and opportunities while doing it with minimal financial investments. This approach makes it comfortable for beginner traders and even master traders to start trading and enter Forex market without requiring a large initial capital. Moreover, Woxa offers 24/7 customer support to ensure that all your queries and issues are handled properly.

Our team’s objective in this article review is to offer a comprehensive assessment and technical analysis of what woxa offers, emphasizing its distinctive strengths, potentials, and weaknesses. We’re going to provide you with all the necessary details regarding woxa ltd, including the following: account options, account opening process, deposit and withdrawal methods, trading conditions, competitive spreads, financial instruments and details about what is Woxa and why it is worth trying. The knowledge required to make an informed decision regarding Woxa as your favored brokerage service provider will be provided to you through the integration of expert opinions and actual trader experiences in this balanced approach.

What is Woxa?

In 2019, Woxa quickly made its name as a leading social trading platform. With a client base of 1,500, it offers a unique trading platforms designed for both web and mobile users. Woxa mainly focused on creating an intuitive interface and accessible trading experience in that caters to both beginners and experienced traders.

In 2019, Woxa quickly made its name as a leading social trading platform. With a client base of 1,500, it offers a unique trading platforms designed for both web and mobile users. Woxa mainly focused on creating an intuitive interface and accessible trading experience in that caters to both beginners and experienced traders.

While offering a broad range of features that support social trading in which traders can follow and replicate the strategies of more experienced traders, Woxa’s web-based trading platform is designed to have a user-friendly interface. This combination of innovation and ease of use makes Woxa a competitive spread for anyone who’s looking to enter the trading industry for tradable assets.

Woxa Regulation and Safety

Woxa is a regulated broker by the Financial Services Commission (FSC) of Mauritius under an Investment Dealer License. The FSC is categorized under a tier-3 regulatory framework, which means it may not provide the same level of regulatory oversight and fund protection as stricter jurisdictions like the FCA (UK) or CySEC (Cyprus). Although the regulatory environment may not be as rigorous, Woxa offers features to protect traders, such as ensuring that their losses do not exceed their initial investment during high market volatility.

Woxa is a regulated broker by the Financial Services Commission (FSC) of Mauritius under an Investment Dealer License. The FSC is categorized under a tier-3 regulatory framework, which means it may not provide the same level of regulatory oversight and fund protection as stricter jurisdictions like the FCA (UK) or CySEC (Cyprus). Although the regulatory environment may not be as rigorous, Woxa offers features to protect traders, such as ensuring that their losses do not exceed their initial investment during high market volatility.

Despite being under FSC regulation, Woxa has implemented safeguards to enhance trader security, particularly during volatile market conditions. This feature helps protect traders from incurring losses beyond their deposited funds, offering an additional layer of safety that may not be standard with other tier-3 regulated platforms.

Woxa also adheres to Know Your Customer (KYC) procedures, requiring users to verify their identity through a verification link before accessing the trading platform. This process helps prevent fraudulent activities like money laundering and identity theft, ensuring that only legitimate traders can utilize the trading platform.

Woxa Pros and Cons

Pros

- Market Volatility Protection

- KYC Compliance

- Negative Balance Protection

Cons

- Tier-3 Regulation

- Potential Higher Risk

- Not Insured by Top-Tier Schemes

Benefits of Trading with Woxa

Woxa offers several advantages which caters to a diverse range of traders. Woxa’s trading platform provides a Multi-Asset Platform, that enables forex traders to trade in various markets such as stocks, ETFs, cryptocurrencies and commodities, which then gives traders and future traders the flexibility to diversify portfolios. Woxa also offers a 0% commission on trades which ensures that both long-term and short-term traders can operate cost-effectively wherein you as a potential trader of Woxa can maximize your potential returns. The Social Trading of Woxa’s feature also allows traders to access financial markets while copying the strategies and deals of other expert traders, making it easier for beginners to grow and benefit from experienced traders.

Woxa offers several advantages which caters to a diverse range of traders. Woxa’s trading platform provides a Multi-Asset Platform, that enables forex traders to trade in various markets such as stocks, ETFs, cryptocurrencies and commodities, which then gives traders and future traders the flexibility to diversify portfolios. Woxa also offers a 0% commission on trades which ensures that both long-term and short-term traders can operate cost-effectively wherein you as a potential trader of Woxa can maximize your potential returns. The Social Trading of Woxa’s feature also allows traders to access financial markets while copying the strategies and deals of other expert traders, making it easier for beginners to grow and benefit from experienced traders.

Woxa’s trading platform also employs a modern technology and user-friendly tools to facilitate and enjoy trading for the very reason that it was established in 2019. Its platform also prioritizes data security by employing robust protocols to safeguard the users’ financial and personal data from potential threats. Woxa has some extra features to help you trade. Woxa also offers an account that follows Islamic law, ensuring compliance with Sharia principles for Muslim traders in Malaysia and Indonesia.

Another highlight of advantage when trading with Woxa, its flexible options wherein it is beneficial for both beginner and expert traders because they can trade with low starting requirements and high leverage. They also have a well-structured educational content such as trading strategies, e-books, articles, webinars and video tutorials. Woxa also offers an ideal setting for individuals who is interested with acquiring knowledge and developing their skills by practice trading strategies through provisions of educational resources and demo account.

Woxa Customer Reviews

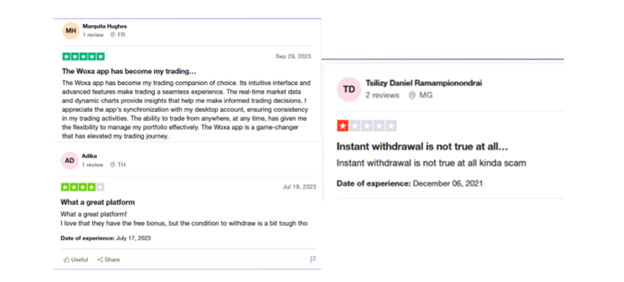

Woxa has received a mixed reviews from customer and broker ratings, wherein some users report that it is a scam, withdrawal is high, instant withdrawal isn’t real. On the other hand, some reviews contain how great the Woxa app is for their choice of trading, there is a free bonus, opening an account is fast and easy.

Woxa has received a mixed reviews from customer and broker ratings, wherein some users report that it is a scam, withdrawal is high, instant withdrawal isn’t real. On the other hand, some reviews contain how great the Woxa app is for their choice of trading, there is a free bonus, opening an account is fast and easy.

Woxa has been well known for its higher-than-average fees on certain assets like forex pairs and stocks which is a concern for frequent traders. Moreover, the platforms educational resources and its customer support are considered as average compared to other brokers, which makes it less ideal for beginners who wants or who might need more learning materials and guidance.

Woxa appears to be a legitimate broker with a standard feature however it does not stand out well in areas such as regulatory protection or its comprehensive educational content. Woxa is recommended in regions like Vietnam, Malaysia, and Indonesia as a basic trading solution, but it isn’t the best choice for traders who are seeking for extensive support and low fees.

Woxa Spreads, Fees, and Commissions

Compared to other brokers, Woxa’s fees are a bit higher, especially for popular currency pairs like euros and dollars. This can make trading more expensive. Additionally, Woxa doesn’t offer the kind of accounts that are popular with people who trade very quickly, as they usually have lower fees.

On the plus side, Woxa doesn’t charge you to deposit or withdraw money, or even if you don’t trade for a while. And for things like cryptocurrencies, its fees are pretty competitive.

Account Types Standard Account

Standard Account

Basic account with access to all trading instruments, standard spreads, and moderate leverage. Suitable for beginners and intermediate traders.

VIP Account

Offers lower spreads, higher leverage, a dedicated account manager, and priority support. Designed for experienced traders with larger capital.

Islamic Account

Swap-free account compliant with Sharia law, without interest or hidden fees. Ideal for Muslim traders seeking ethical trading options.

Demo Account

Risk-free account with virtual funds for practicing and testing strategies. Perfect for beginners and those exploring the platform.

How to Open Your Account

Step 1: Visit the Woxa Website

Go to the Official Woxa website and click the “Open account to get free $50!” or “Register” button on the upper left corner of the homepage.

Go to the Official Woxa website and click the “Open account to get free $50!” or “Register” button on the upper left corner of the homepage.

Step 2: Fill Out the Registration Form

Enter your basic details such as email address and password and choose your country of residence.

Enter your basic details such as email address and password and choose your country of residence.

Step 3: Verify Your Email

Once You’ve filled out the Registration form, check your email inbox for a verification message from Woxa and click on the link in the email to confirm your registration.

Step 4: Log In to Your New Account

After the verification, you can log in using your email and password.

Step 5: Complete the KYC Process

Once you’ve logged on, Upload the necessary documents for Know Your Customer (KYC) verification, such as a government-issued ID and proof of address. This step is mandatory to ensure compliance and security.

Step 6: Select your Trading Account

If you’re new to trading, you can start with a Demo Account to practice with virtual funds, but you can choose the type of account you wish to open (Standard, VIP, or Islamic) especially if you’re an expert trader who wants to trade with Woxa broker.

Step 7: Deposit Funds

If you are done choosing account type that suits you the best go to the “Deposit” section and choose your preferred payment method (e.g., bank transfer, credit card, or e-wallet). Enter the amount you wish to deposit and complete the transaction.

Step 8: Start Trading

Once your deposit is successful, navigate to the trading platform. Choose the financial instrument you want to trade, and you’re ready to start trading!

Step 9: Contact Support if Needed

If you encounter any issues during the registration process, you can reach out to Woxa’s customer support via live chat or email for assistance.

Woxa Trading Platforms

Woxa provides several trading platform options to meet the needs of different traders. The following are:

- Proprietary Web Platform: Proprietary trading, or “prop trading,” occurs when a financial institution or commercial bank trades financial assets for its own profit, rather than earning revenue through commissions by executing trades for clients. In this approach, the firm uses its own capital to engage in market activities, aiming to generate substantial returns from its investments instead of relying on the smaller, more predictable profits from client trading fees. This strategy can involve trading a variety of instruments, such as stocks, bonds, commodities, and currencies, as the firm seeks to capitalize on market opportunities to increase its own wealth directly.

- Mobile Trading platform: A mobile trading app is a specialized application built for smartphones and tablets, enabling users to access and trade in various financial markets from their mobile devices. Financial institutions, like brokerage firms, offer these apps as either their own proprietary platform or integrate widely used trading software such as MetaTrader 4. These apps provide a convenient way for traders to monitor market trends, execute trades, and manage their accounts anytime and anywhere, ensuring they stay connected to the markets even while on the go.

- Social trading platform: It is an online trading that allows traders to connect and share information, strategies, and insights on investment decisions. The main aim of social trading is to help traders improve their trading performance and make more profitable trades by connecting with other traders and sharing information.

What can you trade on Woxa

Woxa provides a wide selection of financial instruments for trading, which caters to a variety of investors and traders:

- Forex: Major, minor, and exotic currency pairs.

- Stocks: Shares of major global companies.

- Commodities: Gold, silver, oil, and other raw materials.

- Indices: Major global indices like the S&P 500, NASDAQ, and FTSE.

- Cryptocurrencies: Bitcoin, Ethereum, and other digital assets.

- ETFs: Exchange-Traded Funds that track different sectors or assets.

Woxa Customer Support

Woxa provides a dedicated and supportive customer service team ready to assist with any trading-related inquiries or issues you may encounter. You can reach out to them through live chat, email, or phone, depending on your preference and the urgency of your question. Their team is equipped to handle a variety of topics, including resolving technical problems, navigating the platform, and even offering general trading advice to enhance your experience.

In addition to direct support, Woxa offers a comprehensive FAQ section on their website, where you can find answers to common questions and solutions to typical issues. This resource is ideal for those who prefer to troubleshoot independently. To get in touch with their customer service, simply visit the Woxa website and navigate to the “Contact Us ” section, where you’ll find all the necessary contact information and options to connect with their support team.

Advantages and Disadvantages of Woxa Customer Support

Withdrawal Options and Fees

Withdrawal options:

Woxa typically offers a variety of withdrawal options, including bank transfers, credit/debit cards, e-wallets like Skrill or Neteller, and cryptocurrency wallets for those trading digital assets. These options provide flexibility for users to choose the method that best suits their needs.

Fees:

The cost of withdrawing money from Woxa depends on how you do it. Bank transfers usually have a fixed fee, while credit or debit cards have a small percentage fee. E-wallets are often cheaper or free, and cryptocurrency withdrawals have fees that can change. For the exact fees, check Woxa’s website or ask their customer service.

Woxa Vs Other Brokers

#1. Woxa Vs AvaTrade

Woxa offers a diverse range of trading instruments with a focus on social and copy trading features, making it ideal for beginners who want to follow experienced traders. However, its high leverage up to 1:400 and relatively higher spreads may pose risks, especially for inexperienced traders. In comparison, AvaTrade provides a broader asset selection, including more currency pairs and global stocks, along with lower trading costs and support for multiple platforms like MetaTrader 4 and 5, making it a more versatile option for various trading strategies.

Woxa offers a diverse range of trading instruments with a focus on social and copy trading features, making it ideal for beginners who want to follow experienced traders. However, its high leverage up to 1:400 and relatively higher spreads may pose risks, especially for inexperienced traders. In comparison, AvaTrade provides a broader asset selection, including more currency pairs and global stocks, along with lower trading costs and support for multiple platforms like MetaTrader 4 and 5, making it a more versatile option for various trading strategies.

While Woxa’s unique social trading tools and high leverage options cater to traders seeking dynamic, high-risk environments, AvaTrade’s comprehensive market access, lower fees, and robust trading platforms offer a more balanced and cost-effective trading experience. Ultimately, the choice between Woxa and AvaTrade depends on the trader’s priorities, whether it’s high leverage and social trading or lower costs and advanced trading tools.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

#2. Woxa Vs RoboForex

Woxa and RoboForex are two trading platforms that cater to different trader needs. Woxa focuses on social trading features and offers high leverage options up to 1:400, making it suitable for traders looking for dynamic and high-risk environments. However, its regulatory credentials and educational resources are limited, which might not be ideal for beginners seeking comprehensive learning tools. The platform is generally beginner-friendly with a low minimum deposit of $25, but its high spreads could be a downside for cost-conscious traders.

Woxa and RoboForex are two trading platforms that cater to different trader needs. Woxa focuses on social trading features and offers high leverage options up to 1:400, making it suitable for traders looking for dynamic and high-risk environments. However, its regulatory credentials and educational resources are limited, which might not be ideal for beginners seeking comprehensive learning tools. The platform is generally beginner-friendly with a low minimum deposit of $25, but its high spreads could be a downside for cost-conscious traders.

On the other hand, RoboForex provides a broader range of educational resources and advanced tools, such as daily market analysis and a heatmap tool for identifying market correlations. It offers significantly higher leverage up to 1:2000 and supports popular platforms like MetaTrader 4, MetaTrader 5, and its proprietary R StocksTrader. RoboForex is better suited for both novice and professional traders looking for diverse trading options and advanced research tools, but its offshore regulation may raise concerns for some users regarding safety and investor protection. Ultimately, the choice between these two brokers will depend on your priorities, whether it’s Woxa’s social trading focus or RoboForex’s advanced features and broader asset range.

Also Read: RoboForex Review 2024 – Expert Trader Insights

#3. Woxa Vs Exness

Woxa primarily targets traders interested in high-risk, high-reward strategies by offering leverage up to 1:400 and features like social trading, where users can copy trades from more experienced investors. The platform has a simple proprietary trading app but lacks support for popular platforms like MetaTrader 4 and 5, which might limit the options for traders seeking advanced tools. Additionally, its regulatory coverage is relatively limited, which may be a concern for those who prioritize strong investor protection and broader market access.

Woxa primarily targets traders interested in high-risk, high-reward strategies by offering leverage up to 1:400 and features like social trading, where users can copy trades from more experienced investors. The platform has a simple proprietary trading app but lacks support for popular platforms like MetaTrader 4 and 5, which might limit the options for traders seeking advanced tools. Additionally, its regulatory coverage is relatively limited, which may be a concern for those who prioritize strong investor protection and broader market access.

On the other hand, Exness provides a broader range of trading platforms, including MetaTrader 4 and 5, along with its proprietary Exness Trade app. Exness offers significantly higher leverage, up to 1:2000, and has a more comprehensive product range, including nearly 100 forex pairs, cryptocurrencies, and commodities. Additionally, Exness offers competitive spreads, lower trading costs, and multiple account types, including commission-free and zero-spread options. The broker is regulated by multiple authorities, including the FCA and CySEC, providing a higher level of regulatory assurance for traders. This makes Exness a better choice for those seeking advanced trading tools and lower costs.

Also Read: Exness Review 2024 – Expert Trader Insights

Conclusion: Woxa Review

In summary, Woxa is a trading platform that caters to traders looking for high-leverage opportunities and social trading features. It offers leverage up to 1:400, which can be appealing for those seeking higher returns, but it also comes with increased risk, making it less suitable for beginners. The platform’s emphasis on copy trading allows new traders to follow and replicate strategies from more experienced investors, creating a more accessible way to engage in complex markets. However, its lack of support for popular platforms like MetaTrader 4 and 5 may limit its utility for advanced traders seeking robust analytical tools.

Woxa’s regulatory framework is relatively limited, as it is only regulated by the Financial Services Commission (FSC) of Mauritius. This may not offer the same level of investor protection as more stringent regulatory bodies, which could be a concern for those prioritizing strong oversight and fund security. Despite these limitations, Woxa remains a viable option for traders focused on high-risk strategies and social trading, particularly within its supported regions.

Woxa Review: FAQs

What is the minimum deposit required to start trading with Woxa?

The minimum deposit for opening an account with Woxa is typically $25, making it accessible for beginners.

Does Woxa offer a demo account?

Yes, Woxa provides a demo account with virtual funds, allowing users to practice trading and test strategies without risking real money.

What trading platforms does Woxa support?

Woxa offers a proprietary web-based trading platform and mobile app, but it currently does not support popular platforms like MetaTrader 4 or 5.

OPEN AN ACCOUNT NOW WITH WOXA AND GET YOUR BONUS