Windsor Brokers Review

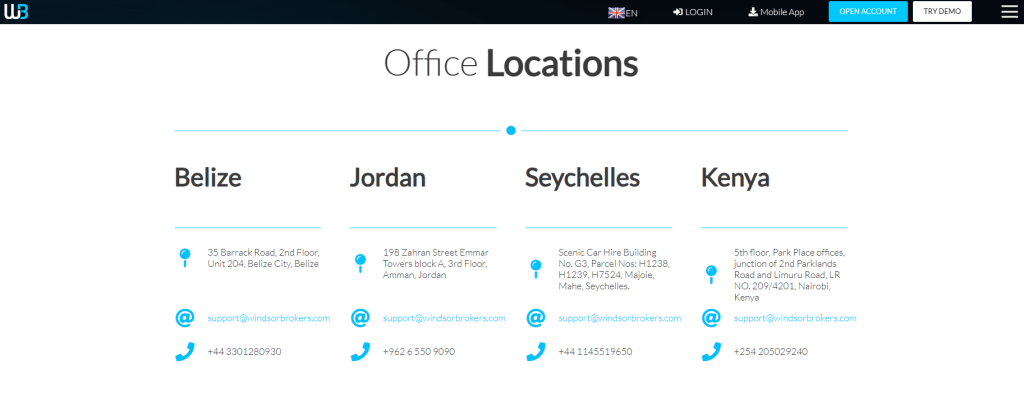

Forex brokers are platforms that provide individuals and institutions the ability to trade foreign currencies. These platforms act as intermediaries between retail traders and the interbank forex market. Windsor Brokers is one such platform, based in Cyprus and renowned for its digital tools designed to aid traders. It is licensed and regulated by the International Financial Services Commission (IFSC), enhancing its reputation as a credible trading platform.

As an expert trader, I’ve analyzed various platforms to determine which best meet my needs. I’ve decided to turn my attention to Windsor Brokers, offering a comprehensive review for traders considering this platform. This article combines my expert analysis with customer reviews, examining Windsor Brokers’ features, commissions, account types, and more. My goal is to provide a well-rounded viewpoint that will help you make an informed decision about using Windsor Brokers for your forex trading needs.

What is Windsor Brokers?

Windsor Brokers is a forex trading company situated in Limassol, Cyprus. Founded in 1988, the firm holds the distinction of being one of the industry’s longest-serving brokers. It is authorized by the International Financial Services Commission (IFSC) in Belize, making it eligible to serve clients globally, excluding the USA, EU, and Belize.

The company doesn’t just stop at IFSC regulation. It also holds licensing from the Cyprus Securities and Exchange Commission (CySEC). Operating under the entity WindsorBrokers.EU, Windsor Brokers primarily caters to traders in the European region.

In terms of trading options, Windsor Brokers offers a broad spectrum. With over 600,000 financial instruments, traders have access to forex, cryptocurrencies, CFDs, futures, metals, and bonds. This wide range of trading instruments provides traders with the flexibility to diversify their portfolios.

Windsor Brokers has not only been around for a long time but has also gained notable recognition. It has received various industry awards, underscoring its commitment to quality and its ability to adapt to the changing needs of traders.

Advantages and Disadvantages of Trading with Windsor Brokers?

Benefits of Trading with Windsor Brokers

After trading with Windsor Brokers, it’s clear that one of its standout features is its reliability and good reputation. Being in the industry since 1988 has allowed it to build trust among traders, an essential asset in the volatile world of forex trading. The company’s longevity is a testament to its ability to maintain a solid standing in the market.

Another benefit I noticed is the variety of account types available, coupled with flexible pricing options. Whether built into commission or spreads, Windsor offers diverse pricing schemes to suit different trading styles and budgets. This flexibility can be particularly beneficial for both novice and seasoned traders.

Windsor Brokers also excels in the platform options and professional education it offers. Traders aren’t limited to one way of accessing the market, giving them the freedom to choose a platform that best suits their needs. Additionally, the company provides educational resources tailored for professional trading, helping traders make well-informed decisions.

Windsor Brokers Pros and Cons

Pros

- Established and regulated in multiple jurisdictions

- Global presence covering Australia, Asia, MENA, Africa, and Europe

- Competitive trading terms

- Several industry accolades

- Cyprus-based, known for tech excellence

Cons

- Limited to Forex and CFDs

- Varying account types based on jurisdiction

- Website lacks Russian language support

- Absent customer service

- No educational content

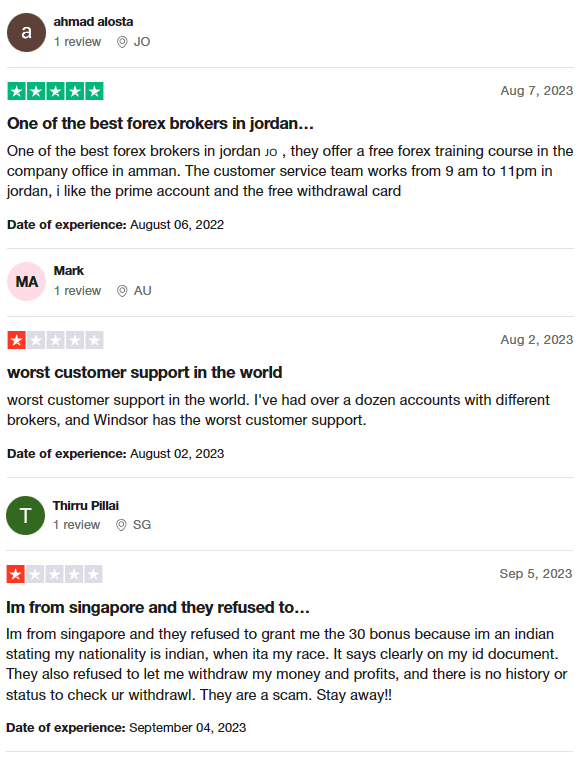

Windsor Brokers Customer Reviews

Windsor Brokers has mixed reviews from its customer base, currently holding a 2.5-star rating on Trustpilot. Some users praise the company for its localized services, like its office in Jordan offering free forex training courses and extended customer service hours. However, others criticize the platform for poor customer support and issues related to account management and withdrawals, particularly citing discriminatory practices. These contrasting experiences suggest that while Windsor Brokers has strengths, there are areas needing improvement.

Windsor Brokers Spreads, Fees, and Commissions

In my experience trading with Windsor Brokers, one of the things that stood out is the low starting spreads. Spreads can go as low as 0.0 pips, which is a competitive offering. However, it’s crucial to remember that these rates can fluctuate based on the trading instrument you choose and current market conditions.

Another aspect to consider is the additional fees for deposits and withdrawals. These costs can add up and impact your overall trading profitability. While the exact fees aren’t fixed and can vary, it’s advisable to check Windsor Brokers’ official website or get in touch with their customer support for the most current information on fee structures.

On the bright side, Windsor Brokers doesn’t charge inactivity fees. This is a plus for traders who may not be trading regularly or those who keep their accounts open but less active. You won’t get penalized for maintaining a lower level of activity, making it more flexible for various types of traders.

Account Types

After testing the account types offered by Windsor Brokers, here’s what I found. The broker offers two distinct account types: Zero Account and Prime Account, each catering to different trading needs and preferences.

Zero Account

This account type is ideal for traders who prioritize tight spreads and direct market access. The Zero Account features low or even zero commissions, competitive spreads, and variable leverage options. Do note that margin call requirements and minimum deposits can change based on the trading instrument and market conditions.

Prime Account

For those looking for a more feature-rich experience, the Prime Account is the way to go. It offers competitive spreads and commission structures, along with extra perks like personalized customer support and advanced trading tools. Like the Zero Account, the Prime Account also has variable leverage options, margin call requirements, and minimum deposits, dependent on trading instruments and market conditions.

Before choosing an account type, it’s essential to assess your trading strategies and risk tolerance. For the most up-to-date information, consult Windsor Brokers’ official website or reach out to their customer support.

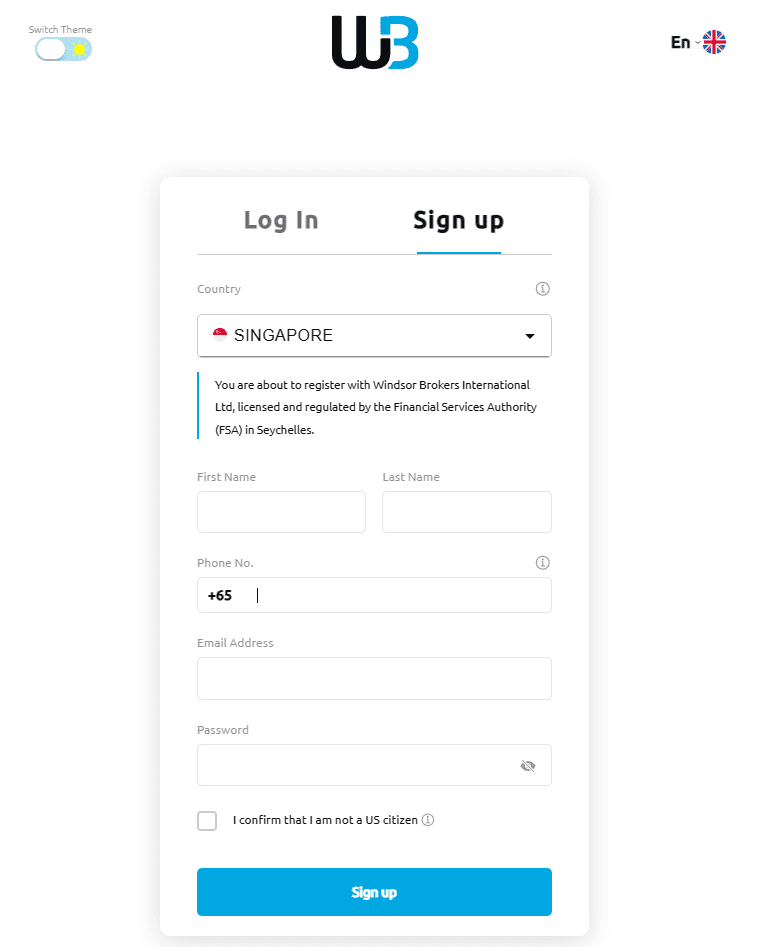

How to Open Your Account

- Go to Windsor Brokers’ official website using your preferred web browser.

- Click the “Open Account” or “Register” button on the homepage to go to the account registration page.

- Select the account type that fits your trading preferences, considering factors like minimum deposit and leverage options.

- Fill out the registration form with your personal details like name, email, country, and contact information.

- Complete the verification process as required by Windsor Brokers, typically submitting ID and proof of address.

- Review and agree to the broker’s terms and conditions, including legal agreements and risk disclosure statements.

- Fund your account using one of the payment methods offered, such as bank transfer, credit cards, or e-wallets.

- Log in to your funded account to access Windsor Brokers’ trading platforms and tools, and start trading.

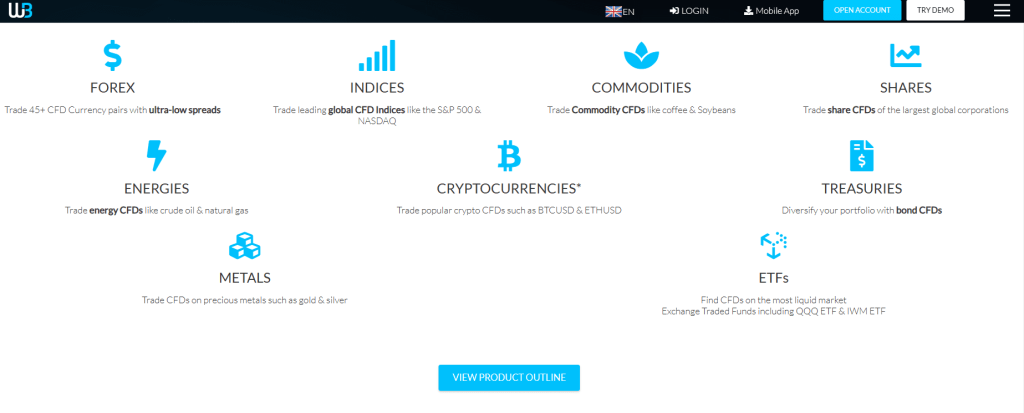

What Can You Trade on Windsor Brokers

Based on my experience, Windsor Brokers offers a wide variety of trading instruments that can appeal to different types of traders. Their mission from the start has been to make global markets accessible to investors. With a range that includes over 600,000 financial assets, the broker provides flexibility and options for diversification.

The assets you can trade span various categories, including Forex, Cryptocurrencies, CFDs, Futures, Metals, and Bonds. This diverse offering not only allows traders like me to engage in different markets but also offers the opportunity to diversify investment portfolios. It’s evident that Windsor Brokers has invested in providing a comprehensive trading environment.

Windsor Brokers Customer Support

In my experience, Windsor Brokers offers commendable customer support that is both responsive and effective in handling client queries. Their support team is multilingual, offering assistance in languages such as English and Chinese, which broadens their reach to traders across different regions.

The broker offers multiple avenues to get in touch. You can use live chat for real-time interaction, phone support for a more direct connection, or email for detailed inquiries. These options make it easier to get immediate and appropriate assistance for any trading-related issues or questions.

Overall, Windsor Brokers’ customer support serves as a reliable resource for traders. They aim to provide timely and effective solutions for any queries or concerns, ensuring that traders can focus more on their trading activities and less on resolving issues.

Advantages and Disadvantages of Windsor Brokers Customer Support

Security for Investors

Withdrawal Options and Fees

Windsor Brokers offers free withdrawals, but some payment systems do have fees. For instance, bank cards and Neteller charge $3, €3, £3 per transaction, while WebMoney has a 0.8% fee and Skrill charges 3%. UnionPay has no fee.

You can use several withdrawal methods, including bank transfers, MasterCard and Visa, and various e-wallets like WebMoney, Neteller, and Skrill. These methods are the same as the deposit options. If you use a bank card for your transactions, be aware that you must withdraw your deposit within six months. Failing to do so will require a bank statement for the money to be transferred back to your account.

The processing time for withdrawals depends on the method used. E-wallets and bank cards usually take 24 hours, while bank transfers may take longer. Currency options for both withdrawals and deposits include USD, EUR, GBP, COP, INR, KWD, and CNY. Keep in mind that verification is mandatory before you can deposit or withdraw funds.

Windsor Brokers Vs Other Brokers

#1. Windsor Brokers vs AvaTrade

Windsor Brokers and AvaTrade both cater to a global audience but have different strengths. Windsor Brokers excels in offering a range of financial instruments including over 600,000 assets and does not charge inactivity fees. AvaTrade is heavily regulated and has a broader customer base, with a strong focus on helping people trade confidently. AvaTrade has been in business longer, since 2006, and is registered in multiple global jurisdictions.

Verdict: AvaTrade is better for traders looking for a well-established, heavily regulated broker with a diverse international presence. Windsor Brokers might be more suitable for those who want a vast range of trading instruments and are concerned about inactivity fees.

#2. Windsor Brokers vs RoboForex

Windsor Brokers and RoboForex both provide various trading instruments, but their offerings and platforms differ. RoboForex focuses on cutting-edge technology and has a wide selection of trading platforms. They also offer more trading options with over 12,000 assets across eight classes. Windsor Brokers shines in providing free withdrawals and offers no inactivity fees.

Verdict: RoboForex is the better option for traders seeking a wide variety of trading platforms and a greater range of asset classes. Windsor Brokers is more favorable for traders concerned about withdrawal fees and inactivity charges.

#3. Windsor Brokers vs Exness

Exness and Windsor Brokers both offer a wide array of trading instruments. Exness has a high monthly trading volume and offers benefits like low commissions and instant order execution. They even offer infinite leverage on small deposits up to $999. Windsor Brokers, on the other hand, focuses on not charging inactivity fees and has varying spreads starting from as low as 0.0 pips.

Verdict: Exness is better for traders who are looking for low commissions, instant order execution, and high leverage, especially on small deposits. Windsor Brokers may be more suitable for those who are concerned with inactivity fees and want lower spreads.

Conclusion: Windsor Brokers Review

Based on insights and user feedback, Windsor Brokers stands out for its range of over 600,000 financial assets. This makes it a go-to platform for traders interested in a wide array of trading options, from Forex to cryptocurrencies and bonds. Another strength lies in its account types, offering flexibility to traders with different needs and risk tolerances.

Customer support is responsive and multilingual, easing the trading journey for global clients. However, it’s worth noting that there are language limitations and availability concerns. The support is not 24/7, which could be a drawback for some traders.

When it comes to security, the broker stores client funds separately and offers protection against negative balances. But there are shortcomings too, as small traders may find it challenging to get their claims reviewed by regulators. The broker does require verification for deposits and withdrawals, ensuring an extra layer of security but also an additional step for users.

Windsor Brokers offers free withdrawals, which is a significant advantage. However, users should be aware of specific payment system fees. The broker also sets a time limit for withdrawing deposits made through bank cards, which could be inconvenient for some.

Also Read: InterTrader Review 2023 – Expert Trader Insights

Windsor Brokers Review: FAQs

What assets can you trade with Windsor Brokers?

You can trade over 600,000 financial assets including Forex, cryptocurrencies, CFDs, futures, metals, and bonds.

Is customer support available in multiple languages?

Yes, the customer support team offers assistance in multiple languages including English and Chinese.

Are there any withdrawal fees?

No, Windsor Brokers does not charge a fee for withdrawals, but payment system fees do apply.