Introduction To The Williams Alligator Indicator

The Alligator indicator is one of the many trading tools by Bill Williams. it is a market trend following technical analysis indicator developed by Bill Williams, an early pioneer of market psychology.

The Alligator indicator was developed as Bill Williams believed that markets trend 15-30% of time and moves sideways 70-80% of the time.

Bill Williams was also believed that traders were to collect their profits mostly during the trending periods.

Hence, Bill Williams designed the alligator indicator to spot market trend be it sideways, up or down.

Contents

- Williams Alligator Indicator For Beginners

- The Significance Of Using The Williams Alligator Indicator

- Feasibility Of The Williams Alligator Indicator

- How To Use The Williams Alligator Indicator

- Trading With The Williams Alligator Indicator

- Pros and Cons of the Williams Alligator Indicator

- Analysis Of The Williams Alligator Indicator

- Williams Alligator Indicator Conclusion

- FAQ About The Williams Alligator

- Williams Alligator Indicator Infographic

Williams Alligator Indicator For Beginners

The Alligator indicator uses three smoothed moving averages of different colours to depict an alligator’s jaw, teeth and lips.

The smoothed moving averages have periods that are of Fibonacci numbers.

The periods are set to 5, 8 and 13, smoothed by 3, 5 and 8 respectively.

The Alligator’s jaw is represented by a blue line of period thirteen smoothed by eight bars, the Alligator’s teeth is represented by a red line of period eight smoothed by five bars and the Alligator’s, lips is represented by a green line of period five smoothed by three bars.

One of the biggest problems among beginner traders is the identification of the market trend.

Since that is the case, the Alligator indicator helps to identify and differentiate market trends for beginners and guide them so that they won’t face the problem of losing money rapidly in the market during the start of their trading career.

As such, the alligator indicator allows beginners to easily identify and trade any financial markets of their choice, such as the foreign exchange market, in alignment with the strongly trending periods.

The Significance Of Using The Williams Alligator Indicator

The Williams Alligator is easy for traders of any level to grasp since it provides visuals to the market by showing various phases of the market, like from when the alligator sleeps to when it wakes up to feed.

The Williams alligator also differs from any other moving averages in its application.

The indicator is able to provide a more reliable confirmation as compared to using moving averages.

Also, compared to moving averages which defines the trend direction widely, the Williams Alligator gives a narrower and shorter termed perspective to trend identification, giving a better scope for day traders.

Other than providing a more precise way to identify trends in the market, the Williams Alligator also provides better market signals or in this case, awakening signals.

As we all know and agree, moving averages are unable to give the best and most precise entries when trading in forex trading, or any other security.

However, the Williams alligator is able to narrow down the entries and provide better confirmed entries with a higher win rate as it takes into account the different small trends in the market such as consolidations or pull back which the moving averages do not.

Feasibility Of The Williams Alligator Indicator

The Williams alligator is a feasible technical analysis tool as it provides entry, exit and also increased accuracy in terms of responding as support and resistances in the market.

This is due to the usage of Fibonacci numbers when deciding the periods of the indicator.

The market responds rather accurately to Fibonacci ratios and numbers.

However, unlike the other Fibonacci technical indicators, the Bill Williams alligator provides a more dynamic approach to identifying the key areas of support and resistances in the market.

This meant that it has the capability to identify key areas based on Fibonacci and also factoring in the price fluctuations in the market.

How To Use The Williams Alligator Indicator

To use the Alligator indicator, the basic understanding of the market such as identifying support and resistance and also understanding how the indicator works is crucial.

The use of support and resistance is important to setting stop losses in this trading strategy.

On the other hand, understanding the indicator itself is the key to this trading strategy.

Trading discipline is important to avoid unnecessary risks.

The alligator does this by avoiding trades when the market is in a sideways consolidation.

When in a sideways consolidation, the alligator will be sleeping and thus will not provide any trading signals allowing the trader to avoid unnecessary or over trading.

Furthermore, the understanding of the three smoothed moving averages, the red line, green line and the blue line, or the alligator’s jaw, teeth and lips is also a basic prerequisite to using the strategy.

In a nutshell, trading only when there is an awakening signal is a one of the keys to successfully use and apply this strategy.

Trading With The Williams Alligator Indicator

To trade with the Williams alligator, entry signals are identified when the alligator is awake and is starting to feed. This is also known as the awakening signal.

An awakening signal is given when the green line moves and crosses over the blue and red ones, showing an alligator opening its jaw.

When the lines cross upwards, buy signals are provided. On the other hand, sell signals are provided when the lines cross downwards.

Exit signals are provided when the candle of the opposing strength closes beyond the teeth of the alligator.

Stop losses are to be set below or above the recent support or resistance accordingly.

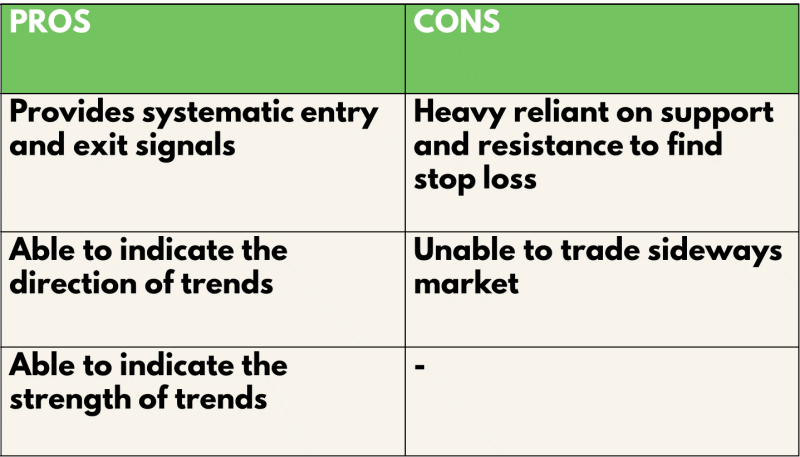

Pros and Cons Of The Williams Alligator Indicator

The pros of using the Williams Alligator is that it provides a systematic way of entering and exiting the market, therefore contributing to the aspect of risk management.

On top of that, it also is able to indicate the direction of trends in the market specifically.

Furthermore, it is able to indicate the strength of the trends, whereby the stronger the trend, the larger the alligator’s mouth would open, shown by the divergence between the moving averages.

However, the cons of using this indicator is that like most indicators, it relies heavily on the basics of support and resistance to determine the risk.

It is also unable to trade the sideways market and may result in giving mixed signals.

Analysis Of The Williams Alligator Indicator

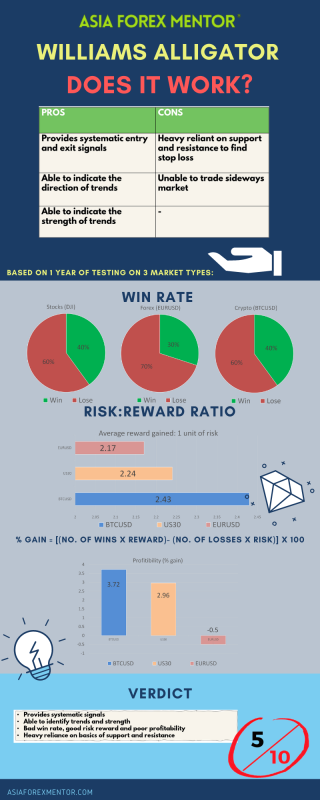

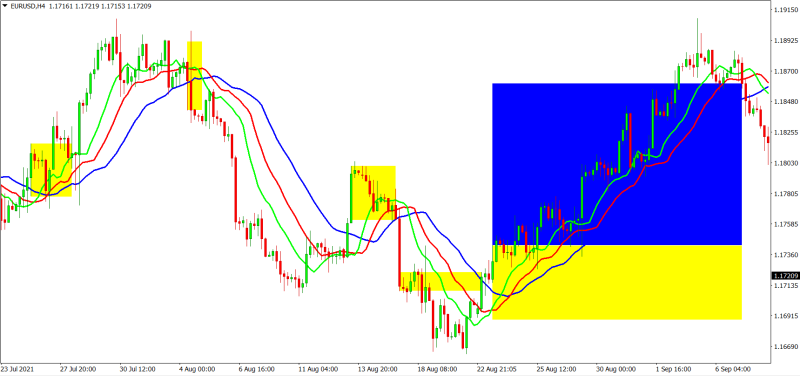

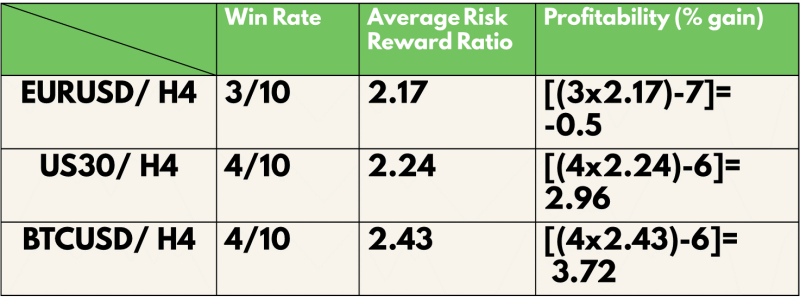

To find out the profitability of the Bill Williams alligator strategy, we decided to do a back test based on the past 10 trades from 19 September 21 on the H4 timeframe.

The rules for entry will be the same as what was mentioned above.

We will be back testing this throughout 3 types of trading vehicles, namely, EURUSD for forex, US30(DJI) for stocks and BTCUSD for cryptocurrency.

For simplicity, we will assume that all trades taken have a risk of 1% of the account.

Definitions: Avg Risk reward ratio= ( Total risk reward ratio of winning trades/ total no. of wins)

Profitability (% gain)= (no. of wins* reward)- (no of losses*1) [ Risk is 1%]

An example of the application of the strategy is as shown:

For the Back test results, trades with blue and yellow zones indicate an overall win with the blue zone as reward and the yellow zone as the risk taken.

As shown in our back test, the win rate of this strategy for EURUSD (Forex) is 30%, US30 (Stocks) is 40% and BTC (Crypto) is 40%.

The average risk reward ratio of this strategy for EURUSD (Forex) is 2.17 US30 (Stocks) is 2.24 and BTC (Crypto) is 2.43.

The profitability of this strategy for EURUSD (Forex) is -0.5, US30 (Stocks) is 2.96 and BTC (Crypto) is 3.72.

Williams Alligator Indicator Conclusion

In conclusion, the Williams alligator is a overall reliable indicator in theory, however the application of it still requires some experience and knowledge of the market as well as the characteristics of the pairing.

It definitely will not work well with a volatile pairing that constantly tests the support and resistance heavily.

However, it is capable of identify the trends very well regardless of time frames.

Hence, this would explain the good risk to reward ratio despite the bad win rate.

Overall it is still profitable to a certain extent with most pairs.

Though win rate is not fantastic, the trading strategy is still able to work profitably with other less volatile pairs.

FAQ About The Williams Alligator

In our article we answered the following Frequently Asked Questions about the Williams Alligator:

- How to trade the Williams alligator?

- Is the Alligator indicator the best?

- What is the alligator strategy?

- How does the Alligator indicator work?

Williams Alligator Indicator Infographic