What is Swap in Forex?

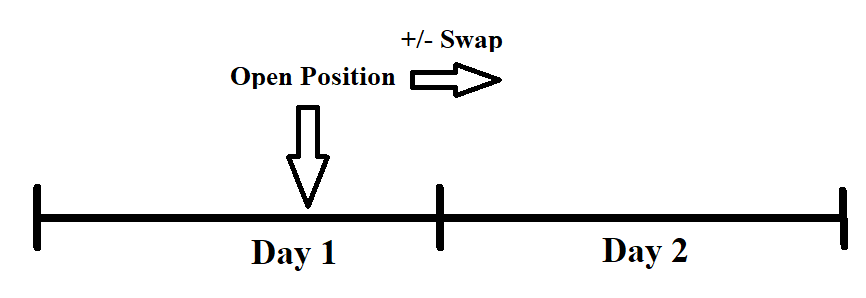

A swap, which is also known as the rollover fee, is the cost you need to pay if you keep a position open overnight. Basically, a swap is the interest rate differential between the currencies in the pair that you are trading. The interest rate for each currency is determined by the country’s central bank. How much you need to pay for the swap depends on whether your position is long or short.

Contents

- How to Avoid Swap Forex?

- What is Swap Free in Forex?

- What is Swap on MT4?

- How to Avoid Swap Fees Forex?

- Negative Swap Forex

- What about FX Swap Near Leg and Far Leg?

- FX Swap Example

There are two currency swap types. It is a long swap if you want to buy a currency pair and keep it open overnight. A short swap is when you want to sell your currency pair for longer than a day.

To calculate swap, the following formula is used:

Swap = [position size x (interest difference – broker’s commission) / 100] x (price / days per year)

It seems like complicated math. Thankfully, you do not have to worry much about operating the calculator yourself. The swap rate would be included in the platform by your broker already. So you can tell at a glance how much you need to pay for the swap.

The value of the swap can either be positive or negative. If it is negative, you would lose money. If it is positive, your broker will put some money into your account instead. This occurs at the end of every trading day.

Keep in mind that if you have a position open overnight from Wednesday to Thursday, the swap amount triples. This is because Forex contracts have a settlement period of two days. So, a forex contract occurred on Monday is settled on Wednesday. When you have a position open overnight from Wednesday to Thursday, you would settle the contract on Thursday. So, the contract occurs on Thursday and settles on Saturday. But since banks are closed on Saturday and Sunday, the contract would roll over through the weekend, settling on Monday, a total of 3 days. The swap fee is therefore tripled.

Many factors influence the swap value other than the interest rate of the currencies. Your broker’s commission rates, the day when you open the position, the price movement of the currencies, and other swap indicators from your broker can all alter the actual value of the swap.

How to Avoid Swap Forex?

There are a few ways to avoid swap in Forex. The simplest thing to do would be to stick to intraday trading and close all your positions by 5pm. Without any positions open, you do not have to worry about any costs incurred in your account. Although, the downside is that you would need to stick to intraday trading, which is not something everybody can do.

What is Swap Free in Forex?

Nowadays, some brokers offer swap-free accounts or Islamic accounts. Brokers do not debit any cash from an Islamic account when they have a position open overnight. These are called Islamic accounts because these accounts are intended for Muslims who are not permitted by Islamic law to trade using long-term strategies. Therefore, another way you can avoid a swap fee is to simply open an Islamic account.

What is Swap on MT4?

Both MT5 and MT4 tells you the swap value. You can find it under the “swap” column of the “trade” tab. You can also find it right before you open a position. Right-click the instrument you want to trade in the “market watch” window, then click on “specification” from the drop-down menu. There, you will see a box with various information about the instrument, including the swap value.

How to Avoid Swap Fees Forex?

Another way to avoid swap fees in Forex trading is to be picky about your currency pair. Go for the currency pair that has a positive swap only. That way, you would still receive money if you leave your positions open overnight. In fact, this is one way to make money in Forex. This is called carry trading, although attempting to turn a profit after the day passes alone is a long game many people cannot play.

Carry trading is a trading strategy in which traders sell a currency with a low-interest rate and use the proceeds to acquire currencies with higher interest rates. The goal is to profit from the differences in interests. Therefore, you want to find a currency pair with a large difference in interest. These include USD/CHF, USD/JPY, AUD/JPY, AUD/CHF, GBP/JPY, GBP/CHF, NZD/CHF, NZD/JPY, CAD/JPY, and CAD/CHF.

From the selection above, currencies with high-interest rates are USD, NZD, AUD, GBP, and CAD. Those with low rates are JPY, CHF, and EUR. USD, AUD, and NZD are the most popular option for high yielding currencies.

For example, suppose you want to make a profit by banking on USD/JPY currency pair. The rate for USD is 2% and the Yen is -0.1. If you have a buy position open overnight on USD/JPY, you would have a positive swap. The profit would be larger if the trade is moving in your favour.

But this requires you to play the long game and see the bigger picture. Even if you earn a few pips a day, there is no point in going for that currency pair if it moves against you by 100 pips every week. Carry trade is only profitable if you can hold the position open for a long time.

If you really want to earn from carry trading, here are a few tips:

- Look for a currency pair with the biggest difference in interest rate

- The currency pair should be stable or in favour of an upward trend for the currency with the high-interest rate

- Know your risk before entering the trade

- Do your research and understand the economic conditions of the countries for that currency pair

Also read: What is Margin in Forex?

Negative Swap Forex

Whether the swap fee is positive or negative depends on how much you pay in interest in the currency you sell and the interest of the currency you buy. If the interest in the bought currency is higher than the interest in the sold currency, then you end up with a negative swap.

Here’s a quick example. Suppose that you are buying EUR/USD (Buy Euros, sell Dollars) and have a position open overnight. You get interest from buying Euros and have to pay the interest when selling Dollars. If the Dollar has a higher interest rate than the Euro, you have a negative swap, which means you would lose money when you have that position open overnight.

The exact moment when your broker charges you for the swap varies between brokers. Usually, this happens around 23:00 or 00:00 server time when a new day begins. You can ask your broker directly to know when the swap fee is charged or look at the contract specifications. That way, you can close out all your positions before the swap fee hits.

What about FX Swap Near Leg and Far Leg?

You also might have heard of the terms “near leg” and “far leg” in Forex trading. You see, Forex swap is a transaction of currency done in two parts, or two steps, hence why the term “leg” is used. This transaction is used to swap or shift the value date of a Forex position to another date, which tends to be more far out into the future.

So, on the near leg date, you change “swap” one currency for another at an agreed-upon exchange rate, which is called Spot Rate. This rate is determined at the time when the contract is made. On the far leg date, you will need to swap the currency back at an agreed forward foreign exchange rate, which is again agreed upon during the formulation of the contract.

This is a common strategy used by big companies with very deep pockets.

Read up more on forex and it’s the complete guide to How to Start Forex Trading

FX Swap Example

Here is a quick example of how a currency swap works. Suppose that you go long on EUR/JPY position for 1 mini lot (10,000 units). That means you are buying Euros by selling your Japanese Yen. Therefore, your position’s value is 10,000 yen.

Assuming that the EUR/JPY asking price is 119.20, the interest rate for EUR is 4.10%, and the interest rate for JPY is 3.5%. Since you are buying Euros and selling yen, you have a positive swap since the interest for your bought currency (EUR) is higher than the interest rate for your sold currency (JPY). So if you keep the position open until the next day, your broker will add some money into your account. But by how much?

We will use this formula:

Swap = [position size x (interest difference – broker’s commission) / 100] x (price / days per year)

Your position size is 10,000. The price for the currency pair is 119.20. The interest difference is 0.6% (4.10% – 3.5%). The broker’s commission varies, so let’s assume that it is 0.15%. Finally, there are 365 days in a year.

So, you have this equation:

Swap = [10,000 x (0.6 – 0.15) / 100] x (119.20/365) = 14.70 JPY

Again, since the interest for the Euro (bought) is higher than the Yen (sold), the swap is a positive value. The amount would be credited to your account the moment your position moves to the next day.

Let’s flip the script. If all variables are the same, but you are selling Euros and buying Yen, then the interest difference would go into the negative (3.5 – 4.1 = – 0.6). Then, the equation would look like this:

Swap = [10,000 x (- 0.6 – 0.15) / 100] x (119.20/365) = – 24.49 JPY

The negative value comes from your broker’s commission and the interest difference. Even with brokers that offer “no commissions”, the swap value would still be negative. Therefore, that amount would be deducted from your account when it moves to the next day.