There are two ways to determine the price of a stock you are trading, and that is the market order and the limit order. If you use market orders, then you are trading for the going price. While the advantage of limit orders is that you dictate the price. The trade is realized if the stock hits your price.

The crucial difference between a market order and a limit order is in the price. That’s why each option is appropriate for a given situation.

Contents

- Current Market Price

- When is Market Order Used?

- Example of a Market Order

- Should You Use a Market Order for Stock Price?

- How to Place a Market Order?

- Advantages of Market Order

- Disadvantages of Market Order

- Limit orders at Specified Price

- Market Order vs Limit Price

- Buy or Sell Order

- Conclusion

- Frequently Asked Questions

Current Market Price

Market orders are realized straight away, no matter the price. Orders for a stock in a trading day are arranged by price. On the top you can locate the best ask price. These is the highest price. The bid price or the lowest price is at the lowest level of that column. Incoming orders are realized at these best prices.

When an order with a more affordable bid price arrives, it climbs the list. If a market order is accepted it goes in front of unresolved orders. And receives the highest or lowest price available. By submitting a market order to purchase a stock, you pay the larger price. When submitting a market sell order, you recive the smallest price on the market.

Also read: How To Trade Power Hour Stocks

When is Market Order Used?

Market orders are used for assets with a significant trade volume. Shares with median daily volumes are not in wanted for market orders. Their bid-ask spreads are wide, because they have lower volume of trade. Trades for thinly traded stocks can cause large trading costs. They are realized at unplanned prices.

Example of a Market Order

Let’s take a example in which the bid-ask prices for the stock of a hypothetical company Fast Computers are $5 and $10. When a hundred shares are offered. If a market order to buy is made on 500 shares. Just the initial 100 will be realized at $10.

The following 200 orders will be executed at the following price that is more beneficial for the sellers of the next 200 shares. The first expectation is that the shares of the company is lightly traded. These indicates a low trading volume. The next 200 orders will probably be realized for $15 or more.

For this type of assets limit orders are more appropriate. There can be unplanned and large costs the reason is traders do not practice a serious control. After all, market orders are made at prices offered by the stock market.

Should You Use a Market Order for Stock Price?

Investors need to decide if they need to use a market or limit order to buy or sell a stock. When completing a trade is a priority, then a market order is the best option. But if you want to get a specific price, then a limit order is the better option. You should take into account that your opinion can change as the market develops. You might set a limit order to buy a stock at an attractive price. But if that trade doesn’t execute, you can cancel the limit order and place a market order instead.

Making a deciding which order type to use can be a daunting task. Investors prefer market orders. They are simpler and guarantee that your trade will be executed. Using market orders makes it easy to build wealth. By buying and holding for the long term only the stocks of quality companies.

How to Place a Market Order?

If you are using an online broker, you can modify the order type on the screen of your device. Most software uses the market order as a primary option. You need to remember to ensure that you are making the type of order that you wanted. When a stock is traded. The online market order will be realized instantly. The exception is if there is a trading at high volume on a given share in the moment.

In dynamic markets, the instantaneousness of online orders is not assurance that you will get the price at which you place your order. You can get near the buy or sell price you observed in the initial moment you made the market order. When a given share is especially active, you may get more or less for it.

The market order will go over other pending orders. You will have to be on standby and wait for any market orders made before you. A market order that was submitted previously will realized before your order. The problem you can encounter is that with each execution the price of the stock is affected.

If there are orders that need to be process before yours, the risk is greater than the price of the stock can change drastically.

Also Read: Best Day Trading Stocks

Advantages of Market Order

Both order type can carry out your trade. One may offer more success in one type of circumstances than the other. Here are some of the positive and negative sides of using a market order.

You are trading the stock of a big company. The shares of corporations are more liquid, when there is small difference between the bid and ask prices. In relations to the market at that moment you can receive the most recent price.

You want to get the trade done now, regardless of price. It’s important to note that on thinly traded stocks, this could move the price up or down significantly. You are trading small amounts of shares. In these cases, you will not move the price, what happens if you transact thousands of shares.

Disadvantages of Market Order

You can receive a wild price. If you make a market order after the usual hours of trading have finished. Then it will be realized the next trading day. If circumstances change in the meantime, you may receive a different price than wat you laned for. You need to cancel the order.

You can move the market drastically if you do not investigate the bid and ask prices. In this case you can receive price that’s different from the prevailing market price. This is true for moderately traded stocks.

Limit orders at Specified Price

The advantage of the limit order is that you have the opportunity to dictate the price. If the stock gets to that price, the order will be filled. They are circumstances when your broker will execute your order at a better price. You can make a stipulation to execute a limit order up to three months in advance. This makes it easier for you and you don’t have to monitor the market to get your price.

The disadvantage of limit orders is that you have no guarantees of a successful trade. The stock may not reach the specified limit price. That means the trade will not realize. Your stock can reach your limit. If there is no interest in the surety the order will not be filled.

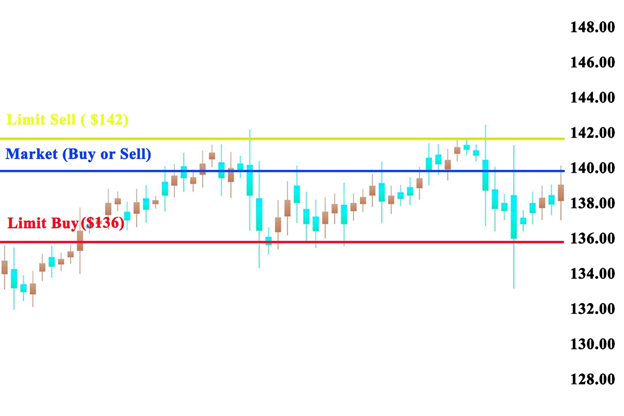

Market Order vs Limit Price

Investors need to determine whether to use a market or limit order to buy or sell a stock . A market order is the best option if the most important thing for you is to complete the trade. If you want to get a specific price, then a limit order is the better option. Preferences change with time.

This is a factor even for the same stock. You can set a limit order at an attractive price. But if that trade doesn’t execute, you can cancel and make a market order.

Buy or Sell Order

When using a buy or sell order, the choice of a market order means you will be paying the higher price out of all the existing sell orders. While a market order to sell means you will get the lowest price from the existing buy orders. When the stock is attracting a lot of activity, you may find that a strategy built upon market orders becomes a buy-high, sell-low investment strategy. Stock’s price varies over time and a market maker offers prices that don’t always depend on past performance or future performance.

Conclusion

Most investors use a market order, but some prefer to use a buy limit order. Securities and exchange commission monitors activities and their decisions on the stock market can influence the purchase price. Corporate finance is dependent on fast-moving markets. Investors generally use online brokers that offer affordable prices. Some prefer to use a sell limit order, but most prefer market order at the bid-ask spread.

Frequently Asked Questions

What is an example of a market order?

The investor enters an order to buy 200 shares of a company. Because the investor decides to buy the stock at the current price, the transaction will be realized fast at the present price of that asset.

What is a market order in business?

A market order is an instruction to purchase or sell a share at the moment at the going price. The market order is a common transaction made in the stock markets.

What is the best definition of a market order?

It’s an order to buy or sell securities at the best price on the market.

What is a market order day?

A day order is a condition placed on an order to a broker to realize a trade at a given price that expires at that trading day if it is not completed.