What is Margin in Forex?

Let’s get this out of the way first. Margin is not a commission fee or a transaction cost. When you trade in Forex, you only need to put up a small amount of money to open and maintain a new position. That amount of money is called the margin.

Contents

- What is Margin Percentage in Forex?

- How is Margin Calculated in Forex?

- What is Free Margin in Forex

- What is Margin Call in Forex

- What is Safe Margin Level Forex?

For instance, suppose that you want to buy $200,000 worth of USD/GBP, you do not need to do away with the entire amount. Instead, you can just put up a small portion. The amount varies between forex broker or CFD provider. So, some may require only a $3,000 deposit whereas others demand $3,500.

You can think of it as a good faith deposit or collateral . It is like an assurance that you can afford the trade. Being able to open and maintain a position without spending a single penny is a recipe for disaster, after all. At least, with margin as part of the entire Forex system, the bar of entry becomes pretty low and you do not need a deep pocket to get into the game.

One can also say that margin is a part of your funds. Your broker deducts a certain amount from your account balance so to keep your trade open and ensure that you can still cover your loss of the trade should it happen. This capital is locked so long as the trade remains active. After it is closed, that money is returned to your balance and can be used again for another trade.

What is Margin Percentage in Forex?

Margin can be expressed either as a percentage or a specific amount.

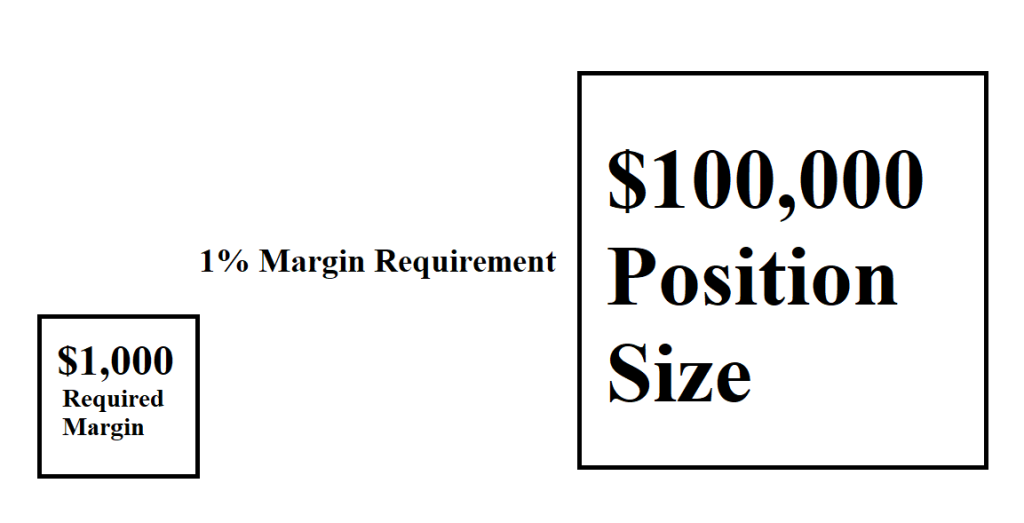

If the margin is in percentage, then it is “margin requirement”, and the percentage is of the full portion size or the notional value of the position you want to open. The amount varies between brokers and currency pair, with some going at 0.25% and others going higher than 10%.

If the margin is a specific amount instead, then this is the “required margin”. This time, the amount varies depending on the position you open. So one position will have a different required margin compared to the next.

Here’s a quick example. Suppose that you have $2,000 in your account and plan to go long in EUR/AUD by opening 1 mini lot, or 10,000 units, position. So how much margin do you need for this position?

Assuming that your account balance is in USD, then you first need to know what the price for EUR/USD is. Suppose that it is at 1.12000. Then, we look at the base currency, which is EUR, and the mini lot at 10,000 euros, then the position’s notional value is $11,200. If the margin requirement is 3%, then the required margin would be $336. So, $336 would be deducted from your account and frozen temporarily until the position is closed.

How is Margin Calculated in Forex?

Calculating margin is pretty simple. The amount of margin you need to open and hold a position is calculated as a percentage of the position size or notional value. The required margin is based on the base currency of the currency pair. That is the left currency type in the currency pair.

In the example above, we used a base currency that is different from the trading account’s currency. In such a case, the required margin would be converted to the account denomination. With this in mind, here is how you calculate margin.

If your account’s currency is the same as the base currency, use this formula:

Required Margin = Notional Value x Margin Requirement

However, if your account’s currency is different from the base currency, use the same formula as above but multiply the result by the exchange rate between the base currency and the account’s currency.

What is Free Margin in Forex

We can’t talk about free margin unless we also talk about used margin. These are the two states of margin. Here’s an example.

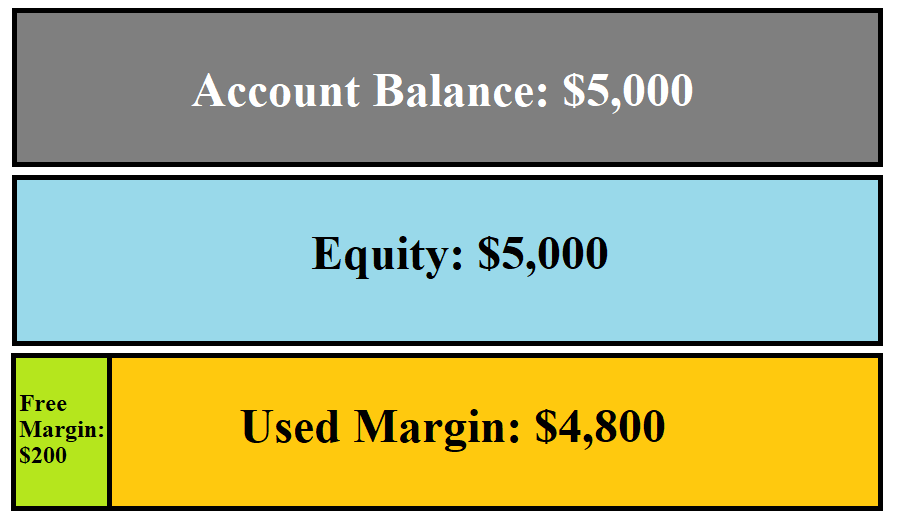

Suppose that you have $5,000 in your account. The current equity then is also $5,000. But if you open a position and the margin is $300, then you open another position and its margin is $500. So, the used margin would be $800 and the free margin is $4,200. Suppose that your free margin is only $200, you cannot open another position with a margin requirement of $201 and up.

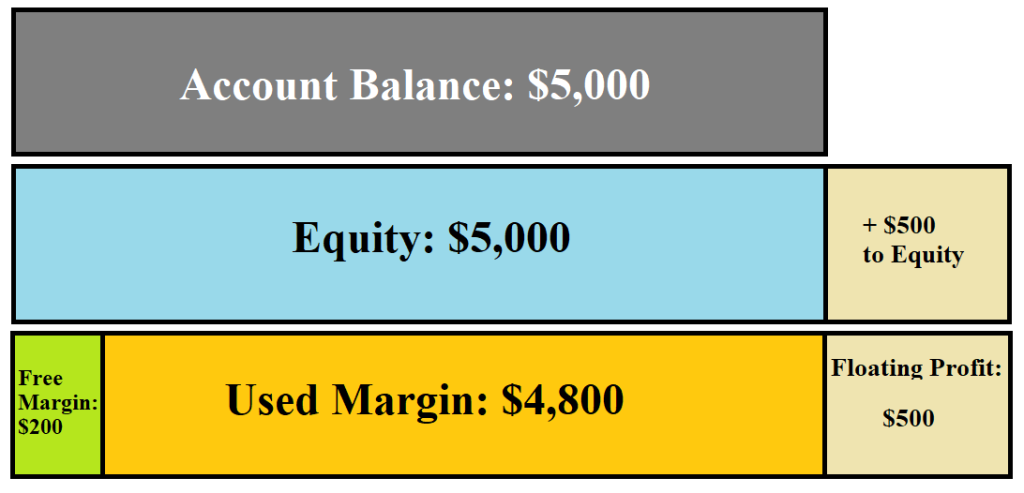

You might also hear the term “Equity” thrown around. You can think of equity as the balance of your account or the sum of your used and free margin. You can also say that equity is the sum of your account balance and floating profit or losses.

Floating profit or losses, or floating P/L refers to the profits or losses that are held in your current open positions. These values are not deducted from your account yet unless the positions are closed. Floating P/L changes with the current market prices if you have an open position in said market. This also influences your equity and how much you can trade.

So, balancing equity is quite simple until you start to have an open position. The value of your equity fluctuates depending on the floating P/L, which also influences your free margin. Used margin is a fixed value. All these values are independent of your balance until you close the position.

What is Margin Call in Forex

Think of the margin call level, as a safety mechanism. It is a threshold for the margin level that, when reached, means that you are at high risk of having some or all of your positions liquidated or forcibly closed.

“Margin level” is a variable, meaning that its value changes constantly. Think of it like water level. So the margin level goes up from 0% to over 200% for example. You can also say that the margin level is the difference between your equity and your used margin.

The “margin call level” is a specific value, say at 100%, when an event would occur. The level varies between brokers.

Maybe that is a bit confusing. So, think of it like taking an exam. To pass, you need 50 out of 100 points. The margin level is the score, which can be any number such as 12, 27, 87, etc. The margin call level is 50, which is a specific value. The margin call is the event when the margin level hits the margin call level.

So what happens when your margin levels hit the margin call level? Your trading platform will let you know about it. You will feel the sting because you cannot open any new positions. You can only close the ones that you are holding.

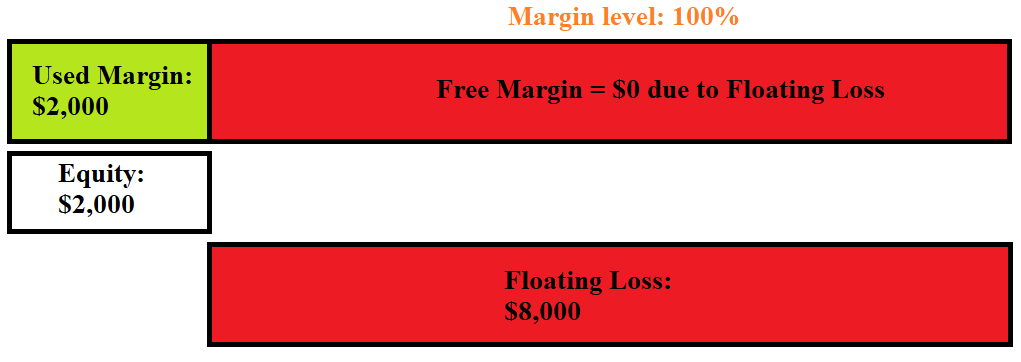

Here is an example. Suppose that you have a $10,000 account and you open a USD/EUR position with 1 mini lot, or 10,000 units, with a 20% margin requirement, or $2,000 required margin. It’s a ludicrous requirement, but it’s to ease calculation in this example. When this happens, you have one position open. Your used margin is $2,000 and your free margin is $8,000. So, your margin level is at a healthy 500%.

All is good so far until things start going south very quickly. Suppose that you made a bad trade and start losing money, big time. Let’s say that you are down 8,000 pips. Assuming it is $1 a pip, you have a floating loss of $8,000.

Your equity plummets to only $2,000, which is your used margin. Your margin is at a critical level of 100%. You cannot open any more trade since you do not have any more free margin. You have two options. You can either wait until the market swings back in your favour or boost your equity so it is greater than your used margin.

If the first event does not happen, then your only option is to pad your equity. You can do this by pumping more funds into your account, or take the loss and close your positions. Your used margin is freed up and you have a free margin of $2,000, which also happens to be your equity and new account balance.

But some people do not admit defeat and bail before things get worse. There is always a possibility of a market reversal, after all. If you continue to wait and the trade continues to go against you, what happens?

There is another margin call level called the Stop Out Level. This level is different between brokers. This is the game over card. If the margin level hits the Stop Out Level, your broker will forcibly close your position. That means you would lose even more money than you would if you just bail out when your margin level hits 100%.

Also read: What is swap in forex

What is Safe Margin Level Forex?

What is considered to be a “safe” margin level depends on your account size and your own risk tolerance. A good question to ask yourself is how much money are you willing to lose if the position turns out to be a bad trade? No one wants to lose money, but there are always risks in trading and you have to accept losses sometimes.

A good starting point would be that you could do away with 2% of your account balance if a loss does occur per trade. For instance, if you have $1,000 in your account, then you should not allow your loss to be any greater than $200.