One frequently used method to invest in the financial markets is divergence. The name is an indication of its purpose, and the concept relates to the moment when the price action and the do not manage to converge.

Simply said, in a normal situation, the oscillator and the price action will move in an identical course. The oscillator reacts to the movement of the price action.

And when the price makes a low, the oscillator follows suit. The same applies to a new high in the price that gets answered by a high in the oscillator.

Divergence is the leading indicator of price action. Basically, if you identify divergence, chances are pretty good that there will be a reversal in that price action.

However, traders need to learn that there are various forms of divergences. Divergences get classified as hidden and regular divergences.

Recognizing regular divergence is not difficult, but traders need to gain some experience to properly spot hidden divergences which tend to be rare.

Another crucial consideration is that hidden divergence can manifest as both bullish and bearish divergence.

Also Read: What Is the Accumulation Distribution Indicator?

Contents

- What Is Divergence?

- How to Identify Hidden Divergence

- Difference Between Regular and Hidden Divergence

- When to Use Regular or Hidden Divergence

- How Does the Hidden Bullish Divergence Works?

- How Does a Hidden Bearish Divergence Works?

- Oscillators for Hidden Divergence

- Disadvantages of a Hidden Divergence

- Is Hidden Divergence Reliable?

- Tips for Hidden Divergence

- Mistakes Traders Make When Trading Divergences

- Conclusion

- FAQs

What Is Divergence?

As a technical tool divergence gets identified on price charts, if the asset’s price goes in an opposite course of a technical indicator. It is a signal that the present trend is losings its potential and can reverse.

Divergence indicates that a positive or negative price move can occur at any time. Positive or bullish divergence indicates that prices can rally, while negative or bearish divergence informs traders that the prices may decline.

If bullish divergence gets observed on charts, investors that are at that moment shorting an asset will prepare to close the position.

Investors that are long the asset will attempt to improve the long position because positive divergence indicates an imminent rally.

How to Identify Hidden Divergence

Identifying hidden divergence can be problematic for traders that don’t have experience with the pattern.

Still, with the appropriate training, novice investors will learn to recognize and trade the divergence with positive results.

Regular and hidden divergence can get observed on every chart time frame. Creating multiple opportunities to gain experience with identifying divergence in various charts.

The key element in spotting divergence is using a technical indicator. Any oscillator is applicable for the task.

Remember that increasing the number of oscillators will not generate more precise signals. Select an oscillator that you trust. And remember that you can use the identical indicator for spotting both regular and hidden divergence.

Difference between Regular and Hidden Divergence

Hidden divergence predominately signals the trend continuation, while regular divergence indicates an upcoming reversal in a trend.

Classical or regular divergence happens if the price of an asset stays on the upper trajectory and forms higher highs, while the indicator produces lower highs.

Assume that the trend of an asset is upward, yet prices begin declining, while the RSI is forming a higher high.

In this situation, the investor can identify the positive hidden divergence and can raise the inventory by purchasing on the dip.

The prices will begin rising, and all of a sudden the RSI will begin forming lower lows.

In this case, the trader has to be vigilant, because a bearish regular divergence is forming, and a price reversal is a possibility.

When to Use Regular or Hidden Divergence

There is a subtle difference between regular and hidden divergence, making choices for traders a little bit difficult.

Regular divergence is usually located after a long trend and indicates a new corrective stage.

While hidden divergence is predominately observed during the conclusion of a consolidation stage and indicates that the consolidation will end and the original direction of the trend will return.

The regular divergence gets implemented at the end of a long trend. While the hidden divergence gets used after consolidation.

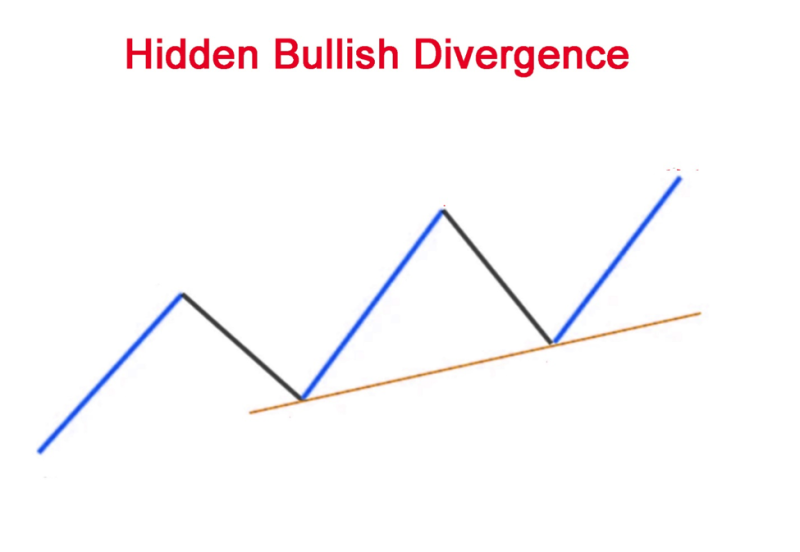

How Does the Hidden Bullish Divergence Works?

The hidden bullish divergence gets founded on the principle of the lows in price and the oscillator’s lows. To sport the divergence, traders must use an oscillator. In this situation, every type of oscillator will do the trick.

Which doesn’t mean traders have to limit themselves to the previously mentioned. As we said, most oscillators are a solid option for this application.

The hidden bullish divergence method can get implemented in an existing trend in several ways. Because it’s a leading indicator, it can reveal what will occur with the price. Typically if a hidden bullish divergence gets created, traders should open a long position.

But not every hidden bullish divergence is productive. There are multiple cases of unsuccessful hidden bullish divergence.

The best position for the pattern to form is after a downtrend. While close to the bottom end of the downtrend, it is a strong trading signal.

Investors have to realize that in practice, the by-the-book model of the hidden bullish divergence does not work identically.

Because of this, there is a need for a degree of flexibility. The price will move even higher after the emergence of the hidden bullish divergence.

Following the creation of the price’s higher low, the price will attempt to form a peak.

It’s important to remember that the hidden bullish divergence can emerge at any point in the trend. Usually, the hidden bullish divergence is found in the uptrend.

The highs in the price action are the most obvious sport for the forming of the pattern.

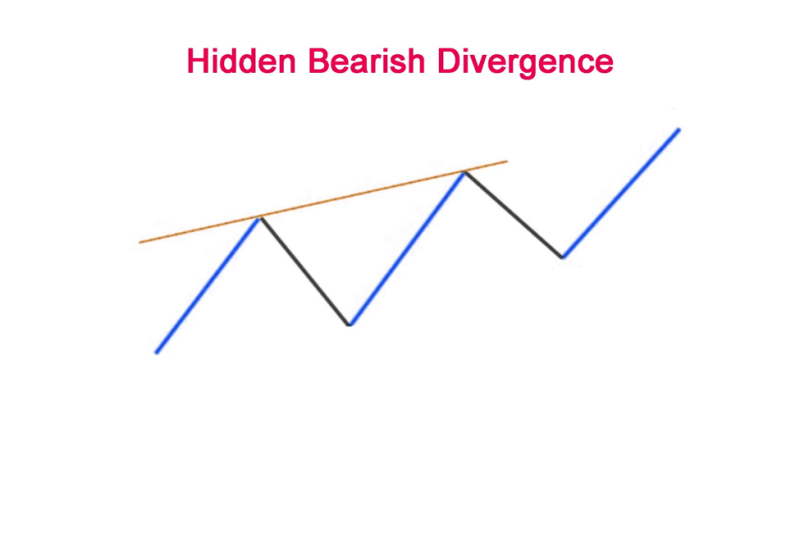

How Does a Hidden Bearish Divergence Works?

Bearish hidden divergence occurs if the price action creates increasingly lower highs in the presence of increasingly higher highs formed by the indicator.

This signals that a downtrend is happening, and the reaction is solely for profit-taking and no not for the appearance of strong buyers. In this case, investors can select to go short and sell the given asset.

Oscillators for Hidden Divergence

The choice of the appropriate tool to recognize hidden divergence on the chart is crucial. The common option among investors is the relative strength index (RSI), MACD indicator, or the stochastic oscillator.

Most traders recommend the RSI indicator for identifying divergence. Investors prefer to combine indicators when trading to verify the information, but some advice the use of only a single indicator at a time.

For some traders, it complicates things when they incorporate several indicators into a trading strategy that focuses on locating divergence.

Also Read: Bill Williams Awesome Oscillator Trading Strategy

Disadvantages of a Hidden Divergence

Traders that have devoted the time to learning the pattern can easily locate hidden divergence on a price chart. But several limitations have to get accounted for.

In hindsight is easy to locate a divergence pattern but in real-time it’s more problematic.

The reason for this is that sentiment in the market will get you thrilled about a bullish bump, just to disappoint you, and soon when you discover it was a bearish hidden divergence.

Investors should stay calm when trading hidden divergence, that way feelings will not cloud reasonable analysis of the current market situation.

When hidden divergence emerges late in a trend, there is a reduced degree of risk-to-reward ratios.

At this point, the trend is nearly over, and by waiting for the price to diverge from the oscillator, you will find yourself joining the trend at the most disadvantaged point.

The price patterns for a smaller asset are not as reliable as those for larger markets. Interest for smaller markets is lacking among buyers and sellers, indirectly exposing it to volatility.

Is Hidden Divergence Reliable?

Divergence is a reliable signal for a change in the course of a market’s movement, but it should not get implemented in isolation.

Novice traders must concentrate on regular divergence before starting to work with hidden divergence.

It’s crucial to know that divergence does not guarantee a reliable reversal. Some analysts have come to the opinion that divergence indicators are frequently useless and are not able to forecast significant changes in price action.

It can turn out to be a case of the price starting sideways consolidation following a divergence. A consolidation cites the horizontal price movement where the asset’s price gets traded in a steady range.

Because of this, it’s important to mix trading strategies, and the reason is simple, a single indicator cannot evaluate the entire market context.

Implementing a couple or more indicators at the same time makes it possible for investors to create a reliable strategy.

Ensuring that it will produce quality data about a trend and make it possible to select the correct decisions.

Traders may get surprised if implementing more indicators, and receive varying results signaling contradictory market conditions.

When this happens take a break and go back to the previous step to see the points where the contradicting signals are strong. If you can confirm them then avoid the asset for some time.

Tips for Hidden Divergence

To minimize false signals, one option for hidden divergence is to use it on longer time frames where it’s more accurate.

In longer time frames, the pace of the market is slower giving trader’s time to see if the patterns are highs and lows.

The limitation is that bigger time frames produce smaller trades and fewer divergences.

However, in shorter time frames both bearish regular divergence, and bullish hidden divergence may happen in the same period.

Making it important to select an appropriate time frame to increase the profit and reduce confusion.

Keep in mind that regular divergence indicates a change in the direction of a trend and can get traded after the trend.

Yet hidden divergence implies that the trend is gaining strength and can get traded at the start of the trend. If trading divergence, on the price chart there will be clear ups or downs for a trend that is real.

Mistakes Traders Make When Trading Divergences

A frequent mistake that inexperienced investors make when trading is the moment they spot the hidden RSI divergence, they take the trade correspondingly.

Novice traders and veteran investors have to verify the hidden RSI divergence and expect future price action.

Conclusion

When a bearish and bullish hidden divergence occurs they are significant patterns that can get observed at the conclusion for consolidation. It indicates a continuation of the primary trend.

Professional investors prefer to use divergence in trading strategies that make profits. Multiple indicators can get harnessed to trade divergence. Just as with any trading strategy, indicators about divergence are not free of risk.

The crucial factor is to recognize the indicator that gets implemented, understand the nuances, and practice using it, before starting to trade with them.

Keep in mind that divergence does guarantee profits. It’s an indicator that signals when there is a change in the course of the present price trend. Investors should keep in mind the context before starting to trade with regular or hidden divergence.

FAQs

What does a Hidden Bullish Divergence Mean?

A hidden bullish divergence occurs when the price is making a higher low, and the oscillator is displaying a lower low.

Is Hidden Bullish Divergence Good?

When the trend is up, then traders search for bullish hidden divergence, and the MACD line will print a lower low but the price shows a higher low. If the trend is down, then observe for a bearish hidden divergence.

What does Hidden Divergence Indicate?

Hidden divergence happens when the oscillator creates a higher high or low when the price action does not. This frequently happens in a current trend and usually indicates that there is more potential in the dominant trend and the trend will continue.

Is Hidden Divergence Better than Regular Divergence?

Both divergence types offer an edge if traders know how to implement them correctly for the best results when trading an asset in the market. However, hidden divergence is better because enables traders to trade with the trend.