Currency pairings are traded in the vast financial ecosystem known as the foreign exchange market, or Forex as it is also called. The largest financial market in the world, it has a daily turnover of trillions of dollars. In this worldwide market, which involves the buying and selling of numerous currencies for a variety of reasons, including commerce, tourism, and the desire to benefit from currency value swings, banks, corporations, governments, and individual investors participate.

Many of the unusual jargon used in the world of Forex trading might be intimidating to new traders. The word “pip” stands out among these as being of the utmost significance. To successfully manage the complex dynamics of currency trading, Forex traders need to understand this fundamental concept.

The term “point in percentage,” or pip, refers to a standardized unit of change in an exchange rate. It is, in essence, the lowest price change that a certain exchange rate is capable of. Both new and seasoned traders must understand what a pip is, how it functions, and its importance in relation to the larger world of Forex trading.

This article delves into the world of Forex trading, focusing on the concept of a pip. We will explore what a pip is, its role in Forex trading, how its value is calculated, and its various applications in risk management and Forex trading strategy development. This understanding will not only demystify the world of Forex trading but also provide a solid foundation upon which new and experienced Forex traders can build and refine their trading strategies.

Basic Forex Market Concepts

The Forex market is founded on the concept of currency pairs. There are three major types of currency pairs:

Major currency pairs

These are the most traded pairs, which include a combination of the US dollar with other major global currencies like the Euro, British Pound, and Japanese Yen.

Minor currency pairs

Also known as cross-currency pairs, these do not include the US dollar. Examples are EUR/GBP and GBP/JPY.

Exotic currency pairs

These include a major currency and the currency of a developing economy, such as USD/ZAR (US Dollar vs. South African Rand).

The basis of Forex trading is the constant fluctuation of currency valuations. Traders aim to profit from these fluctuations by buying a currency pair when they anticipate the base currency will strengthen against the quote currency, and selling when they anticipate it will weaken.

The bid, ask, and spread are key components of currency valuation. The bid is the price at which a trader can sell a currency, and the ask is the price at which they can buy. The difference between these two prices is known as the spread, which is typically measured in pips.

Also Read: Understanding Currency Pairs

Understanding a Pip in Forex

In the realm of Forex trading, a “pip” is an acronym that stands for “Point in Percentage“. It represents the smallest incremental price move that a currency can make in the currency exchange market. In most currency pairs, a pip corresponds to the fourth decimal place (0.0001). For pairs involving the Japanese Yen (JPY), which are quoted to two decimal places, a pip corresponds to the second decimal place (0.01).

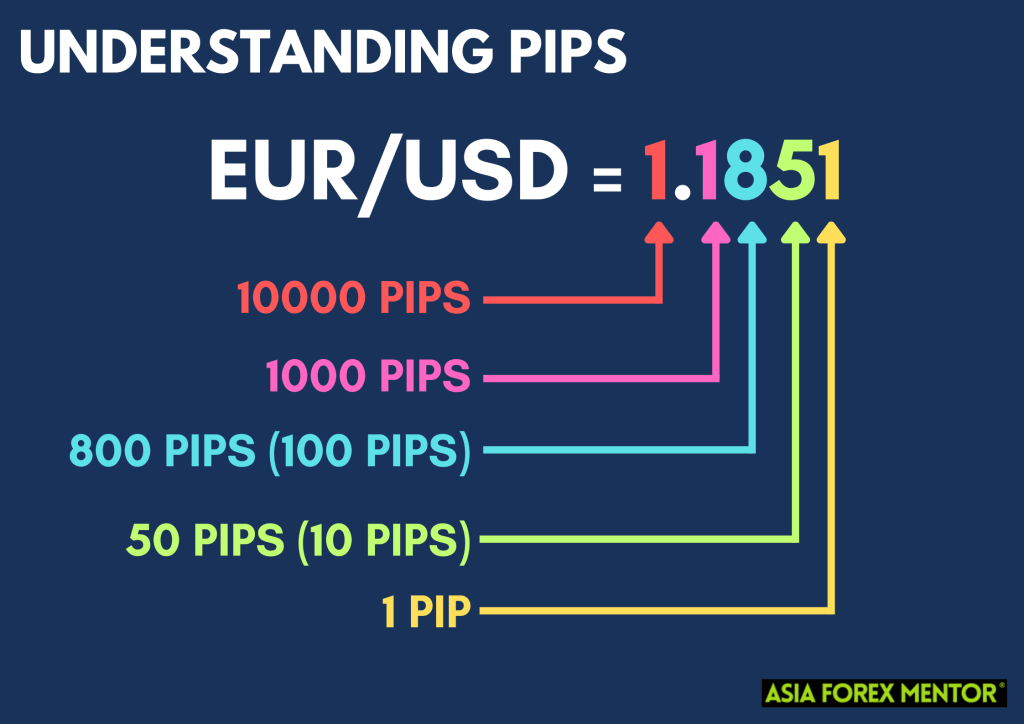

To illustrate the concept, let's say the EUR/USD pair is trading at 1.1850, and then it moves to 1.1851 – this is a one-pip increase. Conversely, if the pair moves from 1.1850 to 1.1849, that's a one-pip decrease. This tiny unit of measure, though it seems insignificant at first glance, plays a fundamental role in the evaluation of Forex trading.

Pips also function as a standardized unit of measurement across all currency pairs and market conditions. This universal applicability of pips facilitates seamless comparison between different currency pairs or trading strategies.

Furthermore, pips are pivotal in the calculation of the spread – the difference between the buy (ask) price and the sell (bid) price quoted by a Forex broker. The spread is typically quoted in pips, allowing traders to easily understand the cost of entering a particular trade.

Significance of Pips in Forex Trading

Pips are significant in Forex trading due to their impact on the potential profits and losses a trader can incur. The number of pips that the price of a currency pair moves directly correlates to the trader's profit or loss. For instance, if a trader goes long on a currency pair and the price moves up by 50 pips, the trader gains 50 pips in profit. Conversely, if the price drops by 50 pips, the trader incurs a loss.

Additionally, pips play a crucial role in risk management. Traders often set stop loss and take profit orders in terms of pips. A stop-loss order could be set, for example, to close a trade if the price goes against the trader's position by a certain number of pips. This protects the trader from incurring excessive losses.

Take profit orders, on the other hand, allow traders to lock in profits once a certain number of pips in profit has been reached. Both these order types are essential tools in a trader's risk management strategy and are often set based on the trader's risk tolerance and market volatility.

Moreover, the concept of pips allows traders to assess and strategize their trading activities. Traders use pips to calculate performance metrics like the risk/reward ratio (the potential profit for every pip risked) and to set trading goals. By quantifying trading outcomes in terms of pips, traders can keep emotion out of trading decisions and follow a more systematic trading approach.

Understanding Pipettes

In Forex trading, finer measurements than pips are sometimes needed for more precise quoting and tighter spreads. This is where “pipettes“, or “fractional pips” come into play. A pipette or fractional pip is one-tenth of a pip and is, therefore, the fifth decimal place in a currency quote for most pairs, or the third decimal place when JPY is in the pair.

For example, if the EUR/USD pair moves from 1.18500 to 1.18501, that is a move of one pipette. The extra digit representing a tenth of a pip allows for a finer granularity of the price, which can be particularly important in the case of large trades or high volatility.

While pips remain the standard unit of measurement for price changes, pipettes provide an additional level of precision. This can be especially beneficial to scalpers and high-frequency traders, who aim to profit from very small, rapid price changes and therefore need as much detail as possible. Using pipettes can result in more accurate stop loss and take profit levels, as well as more precise measurement of the spread.

How to Calculate the Value of a Pip

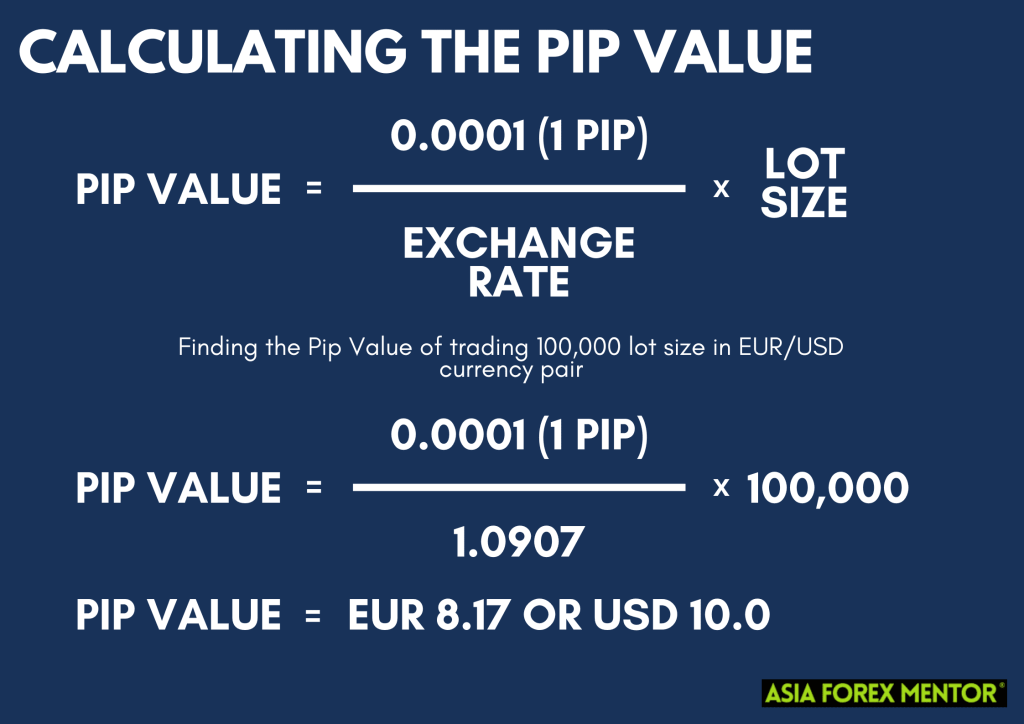

The value of a pip varies depending on several factors: the size of the trade (also known as the lot size), the currency pair being traded, and the exchange rate.

To calculate the pip value for a pair where the USD is the quote currency (the second currency in the pair), the formula is simple:

0.0001 (which is 1 pip) * the lot size.

For instance, if you're trading a standard lot size of 100,000, then the pip value would be:

$10 = (0.0001 * 100,000)

However, for pairs where the USD is the base currency (the first currency), or when trading in a non-USD account, the pip value calculation is a little more complex. It involves converting the value of the pip in the quote currency back to USD (or the currency of your trading account). This can be done using the current exchange rate.

This pip value has a direct influence on your potential profits and losses. For example, if you trade a 0.01 lot of EUR/USD, where the value of a pip is around $0.10, a 30-pip movement in your favor would lead to a profit of approximately $3.

Use of Pips in Forex Trading Platforms

Forex trading platforms display currency pairs to four or five decimal places (the latter in the case of pipettes). The last significant figure displayed is typically the pip value, and if there's a fifth decimal place, it represents the pipette value.

Traders use this pip information when deciding on trade size, setting stop losses, or taking profit levels. For instance, a trader may decide to place a stop loss at a level 20 pips away from the entry price. If the entry price is 1.1850 on the EUR/USD pair, the stop-loss could be set at 1.1830 for a long position or 1.1870 for a short position.

Additionally, traders might define their risk-reward ratios in terms of pips. For example, they might aim for a profit target (take profit) of 60 pips while being prepared to risk 20 pips (stop loss), yielding a risk-reward ratio of 1:3.

Conclusion

Pips serve as an essential unit of measurement in the Forex market, enabling traders to track price movements, calculate profits and losses, and set risk management parameters. Understanding the function and calculation of pip values is a fundamental aspect of Forex trading, directly impacting trading strategies and potential profitability.

Whether it's to calculate the spread, set stop-loss and take-profit levels, or gauge market volatility, pips serve as the backbone of any trading decision. Pipettes offer an extra layer of precision, particularly relevant for scalpers and high-frequency traders.

FAQs

What is a pip in Forex trading?

A pip, short for “Point in Percentage,” is the smallest standardized increment of price movement in the Forex market.

What is the difference between pips and pipettes?

A pipette is one-tenth of a pip. It offers a more precise measurement of price changes in a currency pair.

How is the value of a pip calculated?

The value of a pip depends on the size of the trade, the currency pair being traded, and the exchange rate.

How are pips used in risk management?

Traders use pips to set stop-loss and take-profit levels, helping to control potential losses and lock in profits.

What is the importance of pips in trading strategies?

Pips enable traders to gauge market movements, calculate potential profits or losses, and compare the performance of different trading strategies or currency pairs. They're instrumental in making informed trading decisions.