What Does Spread Mean in Forex?

It is quite tricky to find a “no commission” broker nowadays. If you have been in the Forex game for a while, you might be wondering why does your broker not charge you a fee for every trade you make. After all, they are a business and they also need money to support themselves. How do they sustain their business? What does their business model look like? This is where spread comes in.

Contents

- Spread in Forex PDF Explained

- How does Spread Affect Profit in Forex?

- How to Calculate Spread in Forex

- What is the Best Spread in Forex

- Why do Forex Spreads Widen at 10pm?

- Forex Spread Calculator

- When do you Pay the Spread in Forex?

Spread in Forex PDF Explained

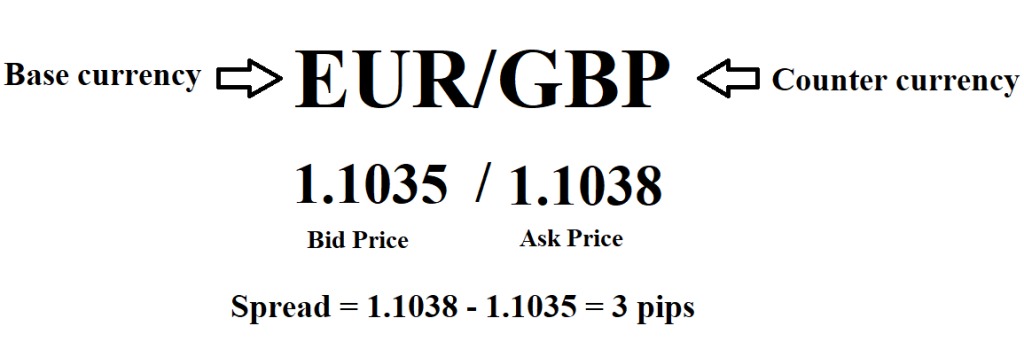

Your Forex broker will give you two different prices for a currency pair. The first is the bid price, which is the price that you can sell the base currency. The second is the ask price, which is the price that you can buy the base currency. You will notice that there is a slight difference between the two prices, maybe by a few pips. This difference is the spread, sometimes referred to as the bid/ask spread. This is how your broker makes money.

They do not charge you a fee for every trade you make. Instead, they just include this fee into the buy and sell price of the currency pair you are interested in. No one can blame them for this since they provide a service and they also need to make money one way or another.

Using this model, your broker has two ways of making money. They get a profit by selling the currency to you for more than what they paid for it. They also get a profit by buying the currency from you for less than what they would get when they sell it. The little difference between the two price points is the spread.

Sounds confusing? Here’s an example.

Suppose that you want to sell your old car to a used car dealer. To turn a profit, the dealer needs to buy your car for a price that is lower than the price it will sell for. So if the car is $10,000, then the best deal you will get from the dealer is $9,999. The $1 profit, or difference, is the spread.

Many brokers claim their service does not come with a commission fee. This is rather misleading. Sure, there is no separate transaction or commission fee, but you still pay them a fee nonetheless. It is just a hidden cost.

How does Spread Affect Profit in Forex?

Think of spread as the trading cost of opening a position. You want to minimize it as much as possible by choosing a broker with minimal spread. That way, you can reduce your trading costs and turn a larger profit every time you close your position.

The spread tends to be minuscule, often measured in pips. While it seems small to an average person, many traders know that a large spread can cut into their profit very quickly when you trade in large quantities. Therefore, you would need to be trading through a broker who has a minimal spread, and you can find a number of them online.

Spread can also widen during volatile events. It might become a lot more expensive to trade for that currency pair, but there is also a higher reward if you know what you are doing. The risk reward ratio is also higher during highly volatile events, which entice many Forex traders. Play your cards wrong, however, and you can lose a lot of money very quickly.

How to Calculate Spread in Forex

Calculating spread is pretty simple. You just need to know the value per pip and the number of lots you are trading. Certain trading platforms would do the calculation for you, although the number may be a bit small to see.

Here’s an example:

Suppose that you are trading the EUR/USD market. The buy price is 1.34790 and the sell price is 1.34771. So, if you buy and immediately close the position, you would incur a loss of 1.9 pips.

To quickly reiterate, a pip equals 0.0001 in many currency pairs or 0.01 in certain currency pairs. If the currency value has 3 or 5 decimals, then the last digit is considered a pipette, or a fractional pip. In this case, the value exceeds the conventional 4 decimals, but we’ll just count the pipettes as tenths of a pip for ease of calculation.

To calculate the total spread cost, you just multiply the cost per pip by the number of lots. So if you trade in mini lots, or 10,000 units, and if the value per pip is $1, then the transaction cost would be $1.90 to open the position.

Keep in mind that the spread cost is linear, meaning that it increases steadily according to the number of lots you are trading. So if the spread is 1.9 pips and you trade 5 mini lots, or 50,000 units, then the transaction cost would go up to $9.5.

Pretty simple stuff, right? Again, you don’t have to worry much about doing the math here since many platforms would automate the entire process for you.

What is the Best Spread in Forex

Spread is usually pretty small and depends on the broker. The spread is normally around 2 to 3 pips for the EUR/USD currency pair, which is where most traders focus on. It is the same story for other currency pairs, with some going below 1. Of course, you do not want to trade a currency with a 12 pip spread as it will eat into your profit pretty badly. The spread tends to widen when the market is highly volatile as well, so do keep an eye out for the spread when that happens.

Many professional traders go for forex platforms that give “raw” spreads. Raw spreads can be as low as 0 pips, which is given to you directly from your broker’s liquidity provider. That way, your broker cannot widen the spread even more. Even so, the spread can still differ from one broker to the next because they have different liquidity providers . At least, with raw spreads, you take away one variable and minimize spread further.

So, it is important to go for a broker that offers deep liquidity access via excellent providers that offer very competitive spreads. This little change will go a long way in helping you minimize spread. Even so, there are a few other factors to consider when choosing your broker such as execution speed, latency, as well as slippage (order filled at a price different from what is requested).

The good news is that it is not too difficult to find a Forex broker that offers all of the above. The number of Forex traders continues to increase by the day, which results in a large market size for Forex brokers. Many of them would go to great lengths to get you to open an account with them as the market now becomes very competitive. No matter how sweet the deal is, you should go for a broker that offers all of the above.

Why do Forex Spreads Widen at 10pm?

The spread widens beyond normal levels could mean that there is high volatility in the market or there is low liquidity, the latter can be caused by out-of-hours trading. Although the Forex market is decentralized and can run 24 hours on end, the infrastructure needs to be cycled across the globe to keep the market going. The four main locations are London, New York, and Tokyo. The time expressed below is in GMT.

London is open at 8am and closes at 4pm. At 1pm, New York is open and closes at 10pm. Sydney opens at 10pm and closes at 6am. Tokyo is open from 12am to 8am.

Most financial centers have overlapping operating hours, except for the transition between New York to Sydney. New York closes at 10pm and Sydney is just starting to open, leading to low liquidity and higher spread. The spread usually remains this way until the Tokyo market opens.

Forex Spread Calculator

The Forex market is always fluctuating. The currency values change pretty quickly, and so does the spread. It can be daunting to pull out a calculator or even do the mental math on the fly whenever the spread changes, especially when you are a day trader.

Thankfully, you do not have to be good at math to calculate the spread. Many platforms include a Forex spread calculator for you which tells you the current spread in pips and other details. The interface varies between platforms, so it might take a while to get used to the layout. But it should become second nature and you can trade with ease after a while.

Also read: What does leverage mean in forex?

When do you Pay the Spread in Forex?

You “pay” the spread when you buy and sell your currency through your broker. Technically, you place your orders through your brokers, and they will charge you the spread when they put your order through. So, your broker makes money when you open and close a position, regardless of whether you actually make a profit or not. That might seem selfish, but they are a business and their main way of making money is to relay your orders, not banking on your trades.