What Does Leverage Mean in Forex?

Leverage is the ratio of the amount of money needed in a transaction to the required deposit. With that, traders can trade at a notional value much higher than the current capital they actually have. The use of leverage is much more popular in Forex than in other markets such as stocks or commodities. This is because traders can get much higher leverage in the Forex market.

Contents

- What is a 1:500 Leverage?

- Forex Leverage for Beginners

- What is the Best Leverage for 100 Dollars?

- Best Forex Leverage for Beginners Tutorial

- How to Calculate Leverage in Forex

- Advantages and Disadvantages of Leverage in Forex

- Forex Leverage Calculator

What is a 1:500 Leverage?

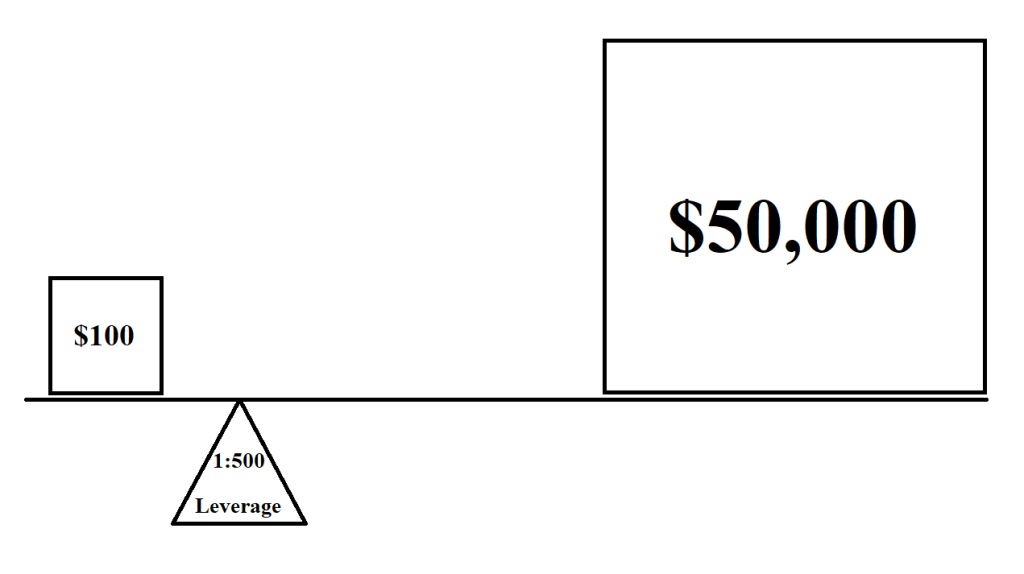

Leverage varies between brokers. Some offer 1:5 whereas others go as high as 1:1000, or even more than that. Here’s a quick example.

Suppose that your broker offers a 1:500 leverage. What does that mean for you? That means, for every $1 in your account, you have $500 to trade with. If you have $100, you would have $50,000. Many brokers offer 1:500 leverage as the maximum, which is why you see this number being thrown around a lot.

Forex Leverage for Beginners

First, let’s talk about how you have a lot more money to trade with even though you deposited a much smaller amount of capital. The extra money needed for leverage to work comes from your broker. In other words, you borrow your broker’s money. However, your broker would not just let you use this leverage for free. You often need to fulfil a margin requirement, which is a small deposit you need to make for the transaction before you can open and hold the position.

You can find our article explaining margins and equity in detail. Read here: What is margin in forex? But for a quick recap, the margin is tied to your account’s equity, which is the outstanding value of your account. Think of margin as collateral for your broker. That amount would be frozen and you get it back after closing the corresponding position.

Since margins freeze a portion of your account’s capital, there is a limit to how many positions you can open at a time. In other words, you are still more or less restricted in how much you can trade based on the actual amount of money you put into your account. Still, leverage allows you to do so much.

What is the Best Leverage for 100 Dollars?

With leverage, many traders can get started trading even with a small amount of capital. Even if you only have $100 in your pocket, you can get a massive profit from leverage. Many people recommend going for the maximum leverage of 1:500 or whatever is the maximum your broker provides.

Of course, this comes with a risk. If the trade goes against you, you would lose a lot of money. If you play your cards right, you can massively boost your capital in a single good trade. Leverage of 1:500 would mean that you have $50,000 to play with.

But before you start an account and jump in, you should first create a demo account with your broker. Many offer such an account and this allows you to trade using virtual money so you can learn how everything works without putting your actual capital at risk. When you have a firm grasp of the game, you can get started.

Best Forex Leverage for Beginners Tutorial

There are a lot of big numbers used in leverage, but for a rookie Forex trader, where to begin? There are many accepted rules that you should keep in mind going forward:

- Keep leverage level low

- Reduce downside and protect your capital with trailing stops

- Each position taken should not amount up to more than 1% or 2% of total capital

In reality, the right leverage level depends on your risk tolerance. The higher the leverage, the more profit you can make, but also the more loss you need to deal with should the trade go against you. Go for the level that you feel comfortable with. If you do not like taking many risks or if you are just starting out, something like 1:10 or 1:5 leverage would be better.

How to Calculate Leverage in Forex

As mentioned before, your broker requires you to make a small deposit as collateral before you can make use of leverage. This is known as margin, which is expressed as a percentage of the full value of the position.

For example, let’s say that the margin is 1% and you want to trade a mini lot of USD/JPY, which is $10,000. Then, the margin would be $1,000. The margin-based leverage is 1:100. You can calculate margin-based leverage by dividing the total value of the transaction by the margin required.

However, margin-based leverage may not be the strongest indicator of profit or loss. Instead, you would need to calculate real leverage, which is done by dividing the total value of the transaction by the total trading capital.

For instance, if you have $1,000 in your account and you want to open a $10,000, a mini lot, then you would be trading with the leverage of 1:10, or ten times leverage on your account.

Advantages and Disadvantages of Leverage in Forex

Leverage is an amplifier. This makes it clear why leverage is so great in Forex. It allows traders to turn a decent profit from a price change of only a few pips. A pip is usually the last decimal in a currency value. In the US dollar currency, a pip would be equivalent to a hundredth of a cent, or $0.0001. This is a very minuscule amount, so if you trade without leverage, you would need a very large capital to turn a decent profit. However, many people do not have deep pockets. So, they use leverage to their advantage.

Here is a quick example. Suppose that you are trading in GBP/USD, and the price moves by 100 pips from 1.9400 to 1.9500. That is only a cent in price change. However, if you use leverage, it can transform that minuscule profit into something much more substantial. Suppose that you have 1:1000 leverage, that means your 1 cent profit turns into a $10 profit, and that is for only 1 GBP. What if you have 1,000 GBP? That turns into $10,000 in profit.

But leverage does not only amplify profits. It also does the same to losses, which is why leverage is also considered to be a double-edged sword. Here’s an example.

Trader A and Trader B have USD 10,000 at their disposal. Their broker has a 1% margin deposit and they both decided to go for the USD/JPY market. They believe that the currency pair would hit a top and drop off in value very soon. So, they go short at 120.

Trader A went with 50 times leverage by shorting $500,000 USD/JPY ($10,000 x 50), going all in. Since USD/JPY stands at 122, a pip for one standard lot is about $8.30, or $41.50 for five standard lots. If USD/JPY goes up to 123, Trader A would lose 100 pips, which is $4,150. In other words, this little price change costed Trader A up to 40% of their total trading capital.

Trader B also went all-in but decided to take a more conservative approach. Instead of 50 times leverage, they only go for 5 times. So, they just short $50,000 worth of USD/JPY ($10,000 x 5). That $50,000 is only half of a standard lot. If the USD/JPY moves up to 123, Trader B would also lose 100 pips, but it would only cost them $415. This loss represents only 4.15% of their balance, a much more acceptable loss.

It is fine if you follow Trader A’s path so long as you know what you are doing and can turn a profit. But the higher the leverage, the higher the risk and reward. If you don’t play your cards right, you will feel the burn when you suddenly lose a lot of money thanks to leverage.

At this point, you might be afraid of using leverage. Don’t be. As long as you know how to manage it, you should be fine. The only time when you should not use your leverage is when you are not at the table. Proper management is needed to work with leverage to turn a profit.

The only tip here is to go easy on leverage. Do not just go as high as you can. Go for a smaller, more comfortable level to give yourself some breathing room. A highly leveraged trade can conclude your career if it goes against you since you would rank up a large loss thanks to the larger lot size. You should start with a small level and work your way up to a comfortable level.

Forex Leverage Calculator

There is no online calculator for leverage, but luckily the math is easy enough to do. You want to use real leverage as it better reflects your profit and loss. This is done by simply dividing the total value of the transaction by the total trading capital.

Another thing to look out for is the risk expressed as the number of pips. If you know this, you can determine how much money you could lose. Your loss should not be more than 3% of the total amount of money in your account. If the losing position is leverage at a level that magnified the loss to, say 30%, then you should reduce the leverage. Again, 3% is only a general guideline and many traders have different risk tolerance and have different rules.