If you’ve been trading forex for as long as I have, you know that the markets can be a wild ride. One minute, everything’s calm and predictable, and the next, you’re scrambling to protect your capital from unexpected swings. This is why stablecoins have become a crucial part of my trading strategy, offering a safe haven amidst the chaos. Whether you’re deep into forex, crypto, or a mix of both, understanding stablecoins and knowing how to use them can make a significant difference in your trading success.

What are Stablecoins: The Basics

Stablecoins are a type of cryptocurrency designed to have a stable value, typically pegged to a reserve of assets like the U.S. dollar, gold, or other commodities. Unlike Bitcoin or Ethereum, which can swing wildly in value, stablecoins are engineered to remain relatively steady. This stability makes them incredibly useful, especially in volatile markets, which, as a forex trader, I deal with every day.

Take March 2020, for example, when the COVID-19 pandemic triggered massive market sell-offs. I vividly remember the panic as asset prices dropped sharply, and volatility spiked across all markets. During this period, I turned to stablecoins like USDT (Tether) and USDC (USD Coin) to protect my capital. These stablecoins maintained their value while everything else was fluctuating wildly, allowing me to sidestep potential losses and wait for the dust to settle.

But stablecoins aren’t just about playing defense. They also offer unique opportunities for traders looking to take advantage of market inefficiencies, reduce transaction costs, or even earn passive income. Let’s explore the top five stablecoins that I rely on and why they should be part of your trading toolkit.

Top 5 Stablecoins to Use

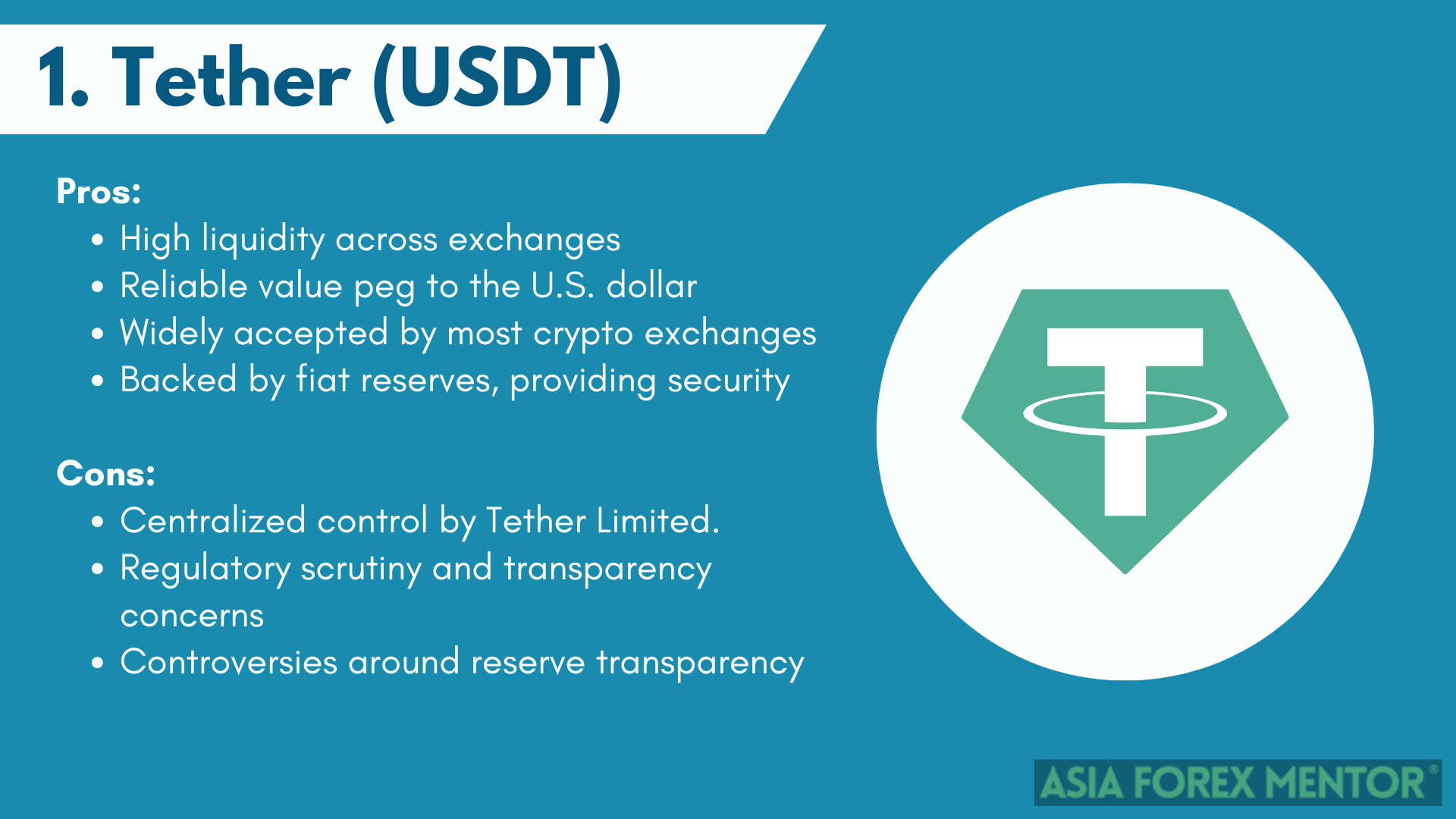

1. Tether (USDT)

Tether (USDT) is perhaps the most well-known stablecoin in the cryptocurrency market. Launched in 2014, Tether was one of the first stablecoins to gain widespread adoption, and it remains the most widely used to this day. Its primary appeal lies in its simplicity and reliability: each USDT token is pegged 1:1 to the U.S. dollar, meaning that for every Tether issued, there is an equivalent amount of U.S. dollars held in reserve. This stability allows traders to move quickly between cryptocurrencies without the risk of value loss, making USDT a crucial tool for maintaining liquidity across exchanges. Over the years, I’ve used USDT extensively to lock in profits during volatile market conditions, particularly during the 2017 Bitcoin boom when prices were skyrocketing. The ability to quickly convert assets into a stable currency without exiting the crypto space entirely was invaluable, allowing me to avoid the dramatic corrections that followed the surge.

Despite its widespread use, Tether has not been without controversy. The stablecoin has faced significant scrutiny regarding its reserves and whether it has always maintained a 1:1 backing. These concerns culminated in a legal battle with the New York Attorney General’s office, which was resolved with Tether agreeing to more transparent reporting of its reserves. Despite these challenges, USDT has maintained its dominance in the market, largely due to its unmatched liquidity and acceptance across nearly all major cryptocurrency exchanges. As a trader, the liquidity and wide acceptance of USDT make it indispensable, even as the industry continues to demand more transparency from Tether.

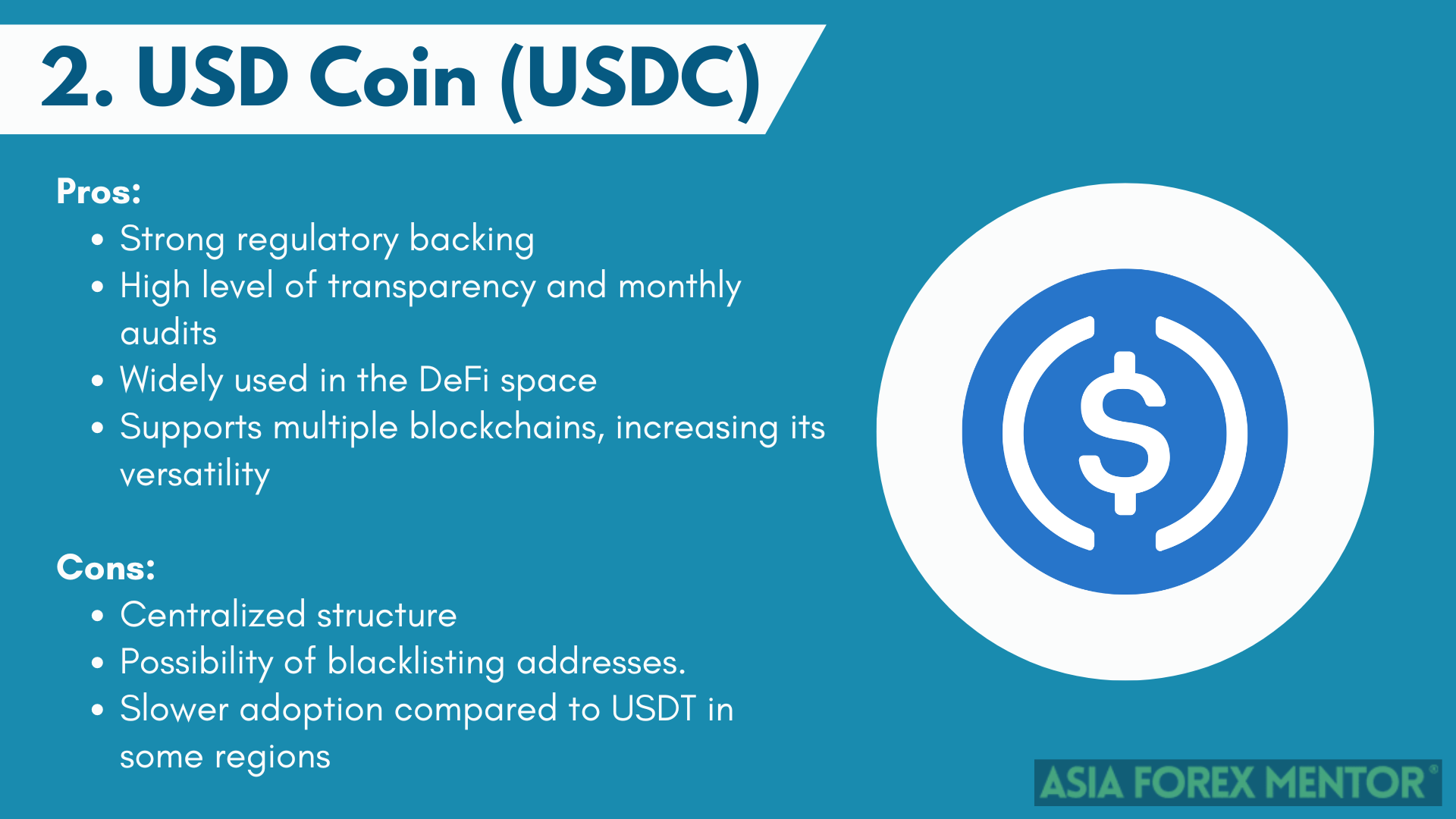

2. USD Coin (USDC)

USD Coin (USDC), launched in 2018 by Circle and Coinbase, has quickly become one of the most trusted and widely used stablecoins in the market. What sets USDC apart from other stablecoins is its strong emphasis on transparency and regulatory compliance. Each USDC token is backed by a U.S. dollar held in reserve, and these reserves are audited monthly by a major accounting firm, ensuring that the stablecoin maintains its 1:1 peg to the dollar. This commitment to transparency and compliance has made USDC a preferred choice for institutional investors and businesses looking to engage with the crypto space while minimizing risk. Personally, I’ve found USDC to be an excellent choice during times of regulatory uncertainty, such as in 2021, when increased government scrutiny made it crucial to hold assets in a stablecoin with strong regulatory backing.

USDC’s adoption has been further bolstered by its integration with a wide range of DeFi (Decentralized Finance) platforms. This has opened up new opportunities for earning passive income through lending, staking, and yield farming, all while enjoying the stability of a U.S. dollar-backed asset. The fact that USDC is compatible with multiple blockchains, including Ethereum, Algorand, and Solana, has only increased its utility in the crypto ecosystem. For me, the combination of regulatory backing and DeFi integration makes USDC a versatile and secure option in my trading strategy, especially when I need a stable, reliable store of value in the ever-changing crypto landscape.

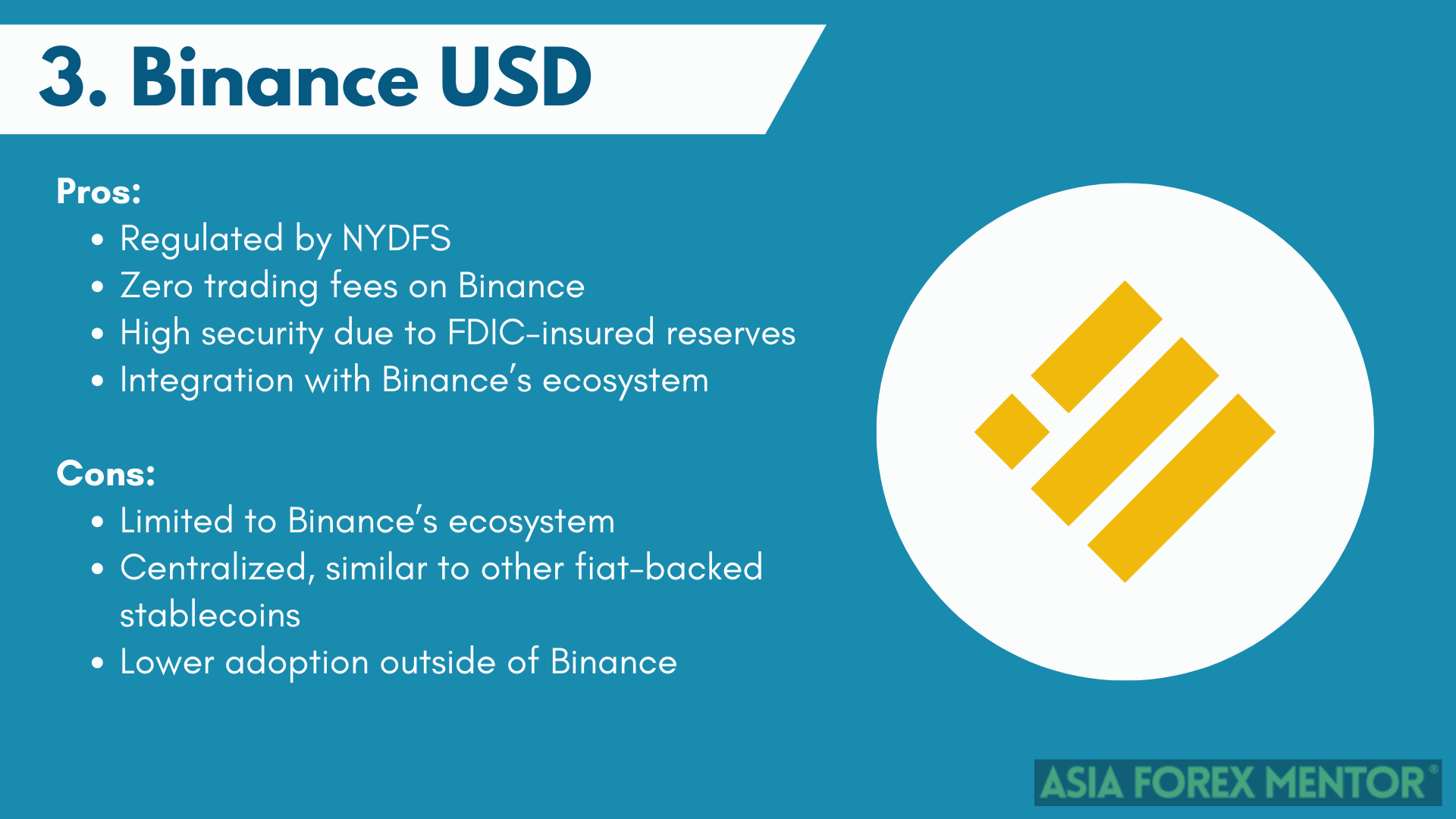

3. Binance USD (BUSD)

Binance USD (BUSD) is a stablecoin issued by Binance, in partnership with Paxos, and is pegged 1:1 to the U.S. dollar. Launched in 2019, BUSD has quickly become a popular stablecoin due to its strong regulatory backing and integration within the Binance ecosystem. As a regulated stablecoin approved by the New York State Department of Financial Services (NYDFS), BUSD offers a high level of security and trust, which is crucial for traders like me who prioritize the safety of their assets. The fact that BUSD is backed by reserves held in FDIC-insured banks adds an additional layer of confidence, making it a reliable choice for storing value and conducting transactions within the Binance exchange and beyond.

BUSD’s integration with Binance’s vast array of services, including zero-fee trading pairs, staking, and lending options, makes it a versatile tool for traders. I frequently use BUSD when trading on Binance due to its zero trading fees and seamless conversion between different cryptocurrencies. Additionally, BUSD’s presence on multiple blockchains, including Ethereum and Binance Smart Chain, enhances its utility across various decentralized finance (DeFi) platforms. This multi-chain support allows me to use BUSD for a range of DeFi activities, from yield farming to liquidity provision, while maintaining the stability and security that come with a fiat-backed asset.

4. Dai (DAI)

Dai (DAI) is a decentralized stablecoin that operates differently from its centralized counterparts. Instead of being backed by fiat reserves, DAI is collateralized by a mix of cryptocurrencies like Ethereum (ETH) and is maintained by smart contracts within the MakerDAO system. Launched in 2017, DAI has become a staple in the DeFi ecosystem, offering a decentralized alternative to traditional stablecoins. Its value is pegged to the U.S. dollar, but what makes DAI unique is its decentralized nature—there’s no single entity controlling it, and its stability is maintained through a system of smart contracts that automatically adjust the supply based on market conditions.

As someone who values decentralization, DAI has been a crucial part of my trading strategy, especially during the DeFi boom in 2020. DAI allows me to engage in lending, borrowing, and other DeFi activities without relying on a centralized issuer. This not only gives me more control over my assets but also reduces the risk of censorship or centralized failure. However, DAI’s reliance on crypto collateral means that its stability can be affected by significant fluctuations in the underlying assets. Despite this, DAI’s role as a decentralized, stable asset makes it an essential tool for those looking to maintain stability while fully embracing the potential of decentralized finance.

5. Pax Dollar (USDP)

Pax Dollar (USDP), formerly known as Paxos Standard, is another key player in the stablecoin market, known for its strong focus on regulatory compliance and transparency. Launched by Paxos in 2018, USDP is fully backed by U.S. dollars held in FDIC-insured banks and is regularly audited to ensure that each token is indeed backed by a real-world asset. This makes USDP one of the most secure and trusted stablecoins, especially for traders and institutions that require a high level of confidence in the assets they are using. For me, USDP has been particularly useful in scenarios where regulatory compliance is crucial, such as when dealing with large transactions or when working with institutions that require a high level of security and transparency.

USDP is not as widely adopted as USDT or USDC, but it has carved out a niche for itself among users who prioritize security and regulatory oversight. Its integration with various financial platforms and its backing by Paxos—a company known for its commitment to compliance—make USDP a reliable choice for those looking to engage with the crypto market in a secure and transparent manner. Whether I’m moving large sums of money or simply need a stable asset with guaranteed backing, USDP provides the peace of mind that comes with knowing my assets are fully protected and compliant with the highest standards of the financial industry.

Types of Stablecoins

Fiat Collateralized Stablecoins

Fiat-backed stablecoins like USD Coin (USDC) are the most common. These stablecoins are pegged to the U.S. dollar or other fiat currencies, ensuring a stable value. Fiat collateralized stablecoins are backed by reserves of fiat currency, typically held by a financial institution or stablecoin issuer.

Crypto-Backed Stablecoins

Crypto-backed stablecoins are another variant where the stable value is achieved by using other crypto assets as collateral. These stablecoins rely on crypto-collateralized mechanisms to maintain their peg to fiat currencies or other assets.

Algorithmic Stablecoins

Algorithmic stablecoins represent a more complex type. These digital assets aren’t backed by any real assets but instead, use smart contracts to maintain their value. The smart contract algorithms adjust the supply of the stablecoin to keep it close to a target price.

Importance of Stablecoins in the Crypto World

Stablecoins have emerged as a vital component, primarily due to their ability to counteract the notorious price volatility that we see with assets like Bitcoin and Ethereum. As someone who’s been trading for years, I can tell you that this stability is a game-changer. Stablecoins provide a stable digital asset that allows traders like me to engage in the crypto market without the anxiety that comes from the wild price swings of more volatile assets.

For instance, when I was heavily trading during the Bitcoin surge in 2017, I knew that holding everything in Bitcoin was risky. The market was too unpredictable. So, I would often move a portion of my holdings into stablecoins like USDT or USDC. This not only helped me preserve my profits but also kept me ready to jump back into the market when the conditions were right.

Stablecoins are particularly appealing to those of us who want to enjoy the advantages of digital assets while avoiding the rollercoaster that is the crypto market. They provide a balance that’s crucial for long-term investments, remittances, or even just as a medium of exchange for everyday transactions. I’ve used stablecoins to send money across borders quickly and without the fear of losing value during the transfer—a common issue with more volatile cryptocurrencies.

Their role in minimizing price fluctuations makes the crypto landscape more accessible and reliable, not just for seasoned traders like myself but also for newcomers who might be hesitant to jump into a market known for its volatility. In many ways, stablecoins are making the digital economy more inclusive by offering a safer entry point.

Stablecoins and the Regulatory Landscape

Now, as stablecoins gain traction, they’re naturally drawing the attention of regulators. And this is something I’ve watched closely because it directly impacts how I use these assets. The regulatory landscape around stablecoins is evolving, with entities like the New York Attorney General leading the charge in examining how these digital currencies can be integrated into the existing financial framework.

For traders like me, the push for regulation is a double-edged sword. On one hand, it could bring about greater transparency and security, which is always a good thing. I remember the uncertainty around Tether (USDT) a few years back when there were concerns about whether it was fully backed by reserves. Regulatory oversight could help avoid such situations, ensuring that stablecoins are as secure and reliable as they claim to be.

On the other hand, there’s the concern that over-regulation could stifle innovation. The beauty of cryptocurrencies lies in their decentralization and the freedom they offer from traditional financial systems. As regulations come into play, there’s always the risk that this freedom could be curtailed. But I’m optimistic that a balanced approach can be found—one that protects consumers without sacrificing the innovative potential of stablecoins.

As stablecoins become more embedded in everyday financial transactions, the urgency to develop a comprehensive regulatory framework is only going to increase. We’re likely to see regulations that ensure stablecoins are backed by real-world assets, that the issuers are operating with integrity, and that they integrate smoothly with the broader financial system. For those of us in the trading world, this could mean a more secure environment for using stablecoins, which in turn could lead to their even wider adoption.

The fact that stablecoins are under such intense scrutiny is actually a testament to their significance. They’re no longer just a niche tool for crypto enthusiasts; they’re becoming a permanent fixture in the financial landscape. And as someone who’s been in the trading game for a long time, I can tell you that this is a development worth watching closely.

Conclusion

In conclusion, stablecoins have become indispensable tools for traders and investors navigating the often volatile and unpredictable world of cryptocurrencies. Their ability to provide a stable value amidst the wild swings of the market makes them not only a safe haven but also a strategic asset in both crypto and traditional financial portfolios. Whether it’s hedging against market volatility, facilitating quick and secure transactions, or serving as a stable store of value, stablecoins like USDT, USDC, BUSD, DAI, and USDP offer a balance of stability and utility that is crucial for anyone serious about trading.

As the role of stablecoins continues to grow, so too will the regulatory landscape surrounding them. This evolving framework will likely bring about greater transparency and security, ensuring that stablecoins can be trusted as a reliable form of digital currency. However, it will be important to strike a balance that preserves the innovative spirit of cryptocurrencies while providing the safeguards needed to protect consumers. For traders like myself, staying informed about these developments and understanding how to leverage stablecoins effectively will be key to thriving in the fast-paced world of forex and crypto trading.

Also Read: Top 5 Best Decentralized Exchanges in 2024