Position in Rating | Overall Rating | Trading Terminals |

121st  | 3.1 Overall Rating |  |

Weltrade Review

Choosing the right Forex broker is crucial for anyone interested in trading currencies. Forex brokers act as intermediaries between traders and the Forex market, providing the platforms, tools, and access needed to execute trades. The right broker can enhance your trading experience with reliable execution, competitive spreads, and robust security measures.

Weltrade is an online Forex and CFD broker with over 13 years of experience in the financial markets. Headquartered in St. Vincent & the Grenadines, Weltrade operates globally, offering a variety of account types and trading platforms, including MetaTrader 4 and MetaTrader 5.

In this comprehensive review, I aim to provide an exhaustive evaluation of Weltrade, emphasizing its unique selling propositions and potential drawbacks. My objective is to supply you with essential insights about the broker, such as the various account options available, deposit and withdrawal processes, commission structures, and other crucial details. My balanced perspective combines expert analysis and actual trader experiences to equip you with the necessary information to make an informed decision about considering Weltrade as your preferred brokerage service provider.

What is Weltrade?

Weltrade is an online Forex and CFD broker with over 13 years of experience in the financial markets. The broker operates globally, providing traders access to a variety of financial instruments including Forex pairs, cryptocurrencies, commodities, and indices. Headquartered in St. Vincent & the Grenadines, Weltrade has a presence in multiple countries, reflecting its wide-reaching influence in the trading community.

One of the standout features of Weltrade is its fast withdrawal process, which allows traders to access their funds within 30 minutes, even on weekends. This quick withdrawal capability, combined with 24/7 customer support, ensures that traders can manage their accounts and resolve issues promptly, enhancing the overall trading experience.

Benefits of Trading with Weltrade

Trading with Weltrade has several benefits that enhance the overall trading experience. One of the standout features is their quick withdrawal process, which allows you to access your funds within 30 minutes. This efficiency is crucial for managing liquidity and ensuring that you can utilize your funds when needed.

Another benefit is the 24/7 customer support, which ensures that help is available at any time. This continuous support is particularly useful for traders who operate across different time zones or encounter issues outside regular business hours. The multilingual support team further enhances accessibility, making it easier to communicate and resolve issues effectively.

Weltrade also offers competitive spreads and a variety of account types to cater to different trading needs. Whether you’re a beginner or an experienced trader, there are account options that provide favorable trading conditions and leverage options. The platform’s flexibility and the availability of both MetaTrader 4 and MetaTrader 5 ensure that you have access to powerful trading tools.

Weltrade Regulation and Safety

Weltrade operates under the name Systemgates Ltd and is registered in St. Vincent & the Grenadines, with a regulated subsidiary in South Africa under the Financial Sector Conduct Authority (FSCA). This mixed regulatory environment provides some oversight and accountability, although the offshore locations do not offer the same level of client protection as more stringent regulators. Despite this, Weltrade has a solid operational record over 16 years, serving over 600,000 traders globally.

Weltrade employs safety measures such as negative balance protection and SSL encryption on its platforms to safeguard client funds and data. Negative balance protection ensures that traders cannot lose more than their deposited funds, a crucial safeguard against volatile market conditions. While the broker’s operational history and security protocols provide a relatively safe trading environment, it is essential to understand the implications of trading with an offshore broker and perform thorough research.

Weltrade Pros and Cons

Pros

- Fast withdrawals

- Low minimum deposit

- High leverage options

- Diverse asset selection

- 24/7 customer support

- Negative balance protection

Cons

- No top-tier regulation

- Potential higher risk

- Limited educational resources

- Mixed user reviews

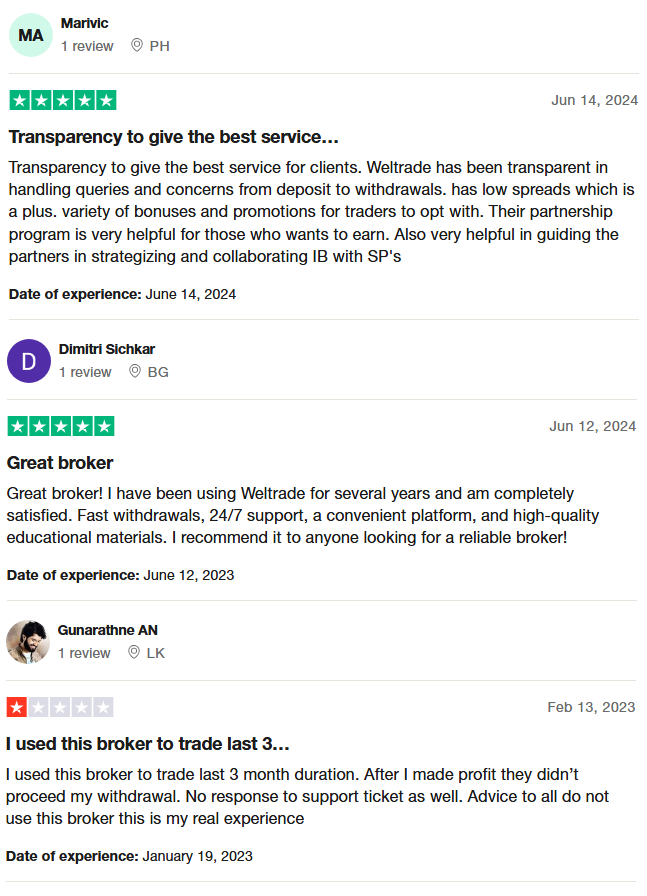

Weltrade Customer Reviews

Customer reviews of Weltrade are mixed, highlighting both strengths and areas of concern. Many users appreciate the broker’s transparency in handling queries and the variety of bonuses and promotions available. Positive feedback often mentions fast withdrawals, 24/7 support, and a convenient trading platform. However, there are some negative experiences, such as instances where withdrawal requests were not processed and support tickets went unanswered. Overall, while Weltrade is praised for its low spreads and partnership programs, potential users should be aware of the mixed reviews and consider their risk tolerance before trading.

Weltrade Spreads, Fees, and Commissions

When trading with Weltrade, I found their spreads, fees, and commissions to be quite competitive. The spreads start from 0.5 pips on major currency pairs like EUR/USD, especially in their Pro account, which makes trading cost-effective. For most account types, including Micro and Premium, there are no commissions on trades, which significantly lowers overall trading costs. This structure benefits traders who prefer to avoid additional fees eating into their profits.

Weltrade’s commission-free trading applies to the majority of its accounts, which is a great advantage. However, the ZuluTrade account does charge a commission of $1.50 per side per lot, adding to the total cost per round lot. Despite this, the spreads on ZuluTrade accounts start from 2.9 pips, which might still be reasonable for traders using this specific service. Additionally, Weltrade offers various incentives and cashback rewards that can further reduce trading costs for active traders.

Another aspect to consider is the swap fees on overnight positions. Depending on the trading strategy, these can add up, so it’s important to check these rates in the trading platform. Weltrade also offers positive swap rates on qualifying short positions, meaning traders can actually earn money for holding certain trades overnight. This feature can be a significant advantage for those who utilize long-term trading strategies.

Account Types

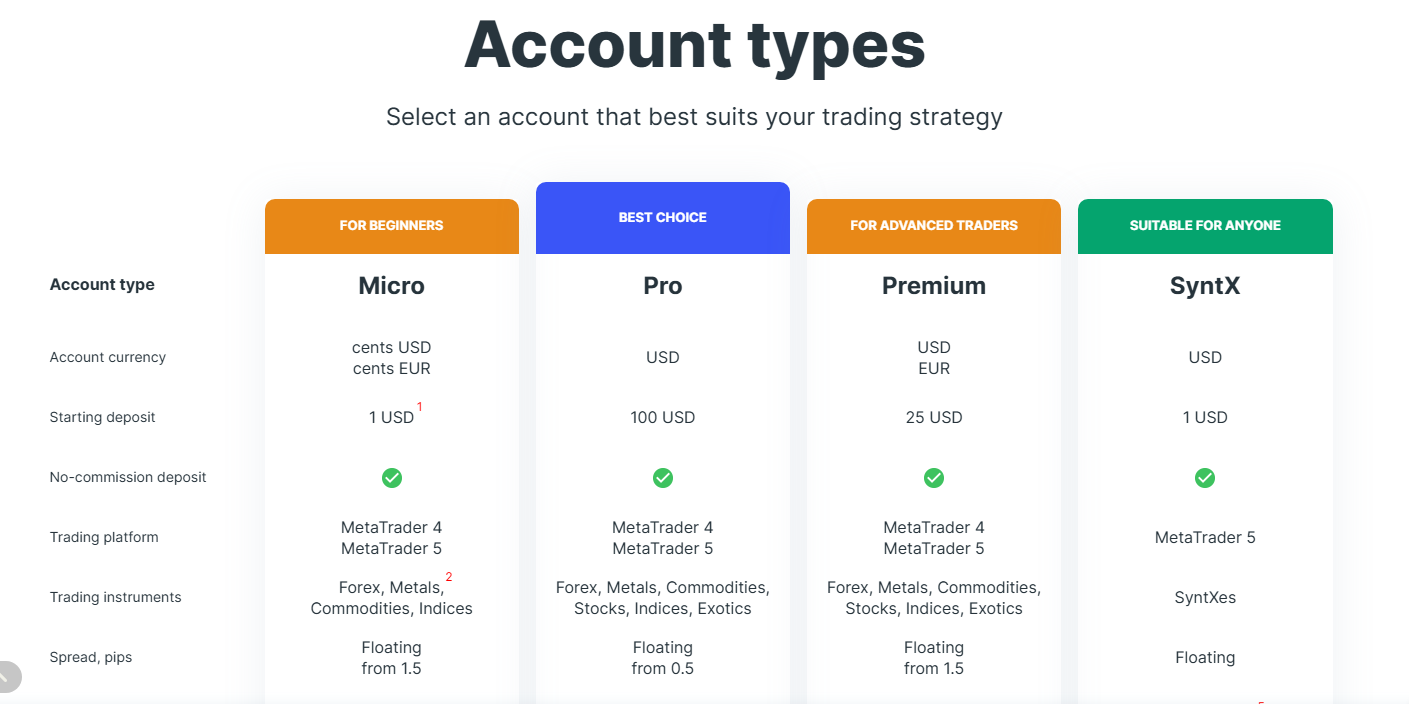

Micro Account

- Starting Deposit: 1 USD

- Spreads: Floating from 1.5 pips

- Leverage: Up to 1:1000

- Platforms: MetaTrader 4, MetaTrader 5

- Features: No commissions, market execution, suitable for beginners

Premium Account

- Starting Deposit: 25 USD

- Spreads: Floating from 1.5 pips

- Leverage: Up to 1:1000

- Platforms: MetaTrader 4, MetaTrader 5

- Features: No commissions, market execution, higher equity limits

Pro Account

- Starting Deposit: 100 USD

- Spreads: Floating from 0.5 pips

- Leverage: Up to 1:1000

- Platforms: MetaTrader 4, MetaTrader 5

- Features: No commissions, market execution, designed for advanced traders

SyntX Account

- Starting Deposit: 1 USD

- Spreads: Floating

- Leverage: Up to 1:10000

- Platform: MetaTrader 5

- Features: Market execution, suitable for various trading styles

ZuluTrade Account

- Starting Deposit: 200 USD

- Spreads: Floating from 2.9 pips

- Leverage: Up to 1:500

- Platform: MetaTrader 4

- Features: 1.5 points commission, designed for copy trading

How to Open Your Account

- Go to the Weltrade website and click the “Registration” button on the homepage.

- Fill in your email, country of residence, and partner code (optional).

- Enter the 4-digit code sent to your email to verify your account.

- Log in to the system using your registered email and the password provided.

- Complete the personal data section by providing additional required information.

- Verify your identity by uploading the necessary documents such as ID and proof of residence.

- Complete the short quiz to confirm your trading experience and knowledge.

- Once your account is verified, deposit funds to start trading.

Weltrade Trading Platforms

Weltrade offers two main trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). MT4 is widely popular for its user-friendly interface and comprehensive charting tools, making it suitable for both beginners and experienced traders. It supports automated trading through Expert Advisors (EAs), which can be a significant advantage for those who prefer automated strategies.

On the other hand, MT5 is an advanced platform with more features and tools compared to MT4. It includes additional timeframes, an economic calendar, and improved charting capabilities. MT5 also supports hedging and offers more order types, making it ideal for traders who need more sophisticated trading tools.

Both platforms are available on desktop, web, and mobile, ensuring you can trade wherever you are. The mobile apps for MT4 and MT5 are particularly useful for monitoring the markets and managing trades on the go. I found the platforms to be reliable and efficient, providing a seamless trading experience across all devices.

What Can You Trade on Weltrade

At Weltrade, you can trade a wide variety of Forex pairs, including major, minor, and exotic currencies. This allows for extensive trading opportunities across different market conditions. I found the spreads to be competitive, making it cost-effective to trade various currency pairs.

In addition to Forex, Weltrade offers precious metals like gold and silver. These instruments are great for those looking to diversify their portfolio. Trading commodities such as oil is also available, providing exposure to energy markets.

For those interested in stock markets, Weltrade provides Index CFDs, which include popular indices from around the world. This gives traders the ability to speculate on the performance of global markets. Furthermore, you can trade cryptocurrencies like Bitcoin, Ethereum, and others, offering access to the rapidly growing digital asset market.

Weltrade Customer Support

Weltrade offers 24/7 customer support, which is a significant advantage for traders needing assistance at any time. The support team is available through live chat, email, and phone, ensuring that help is always accessible. In my experience, the live chat feature is particularly useful for quick queries and immediate assistance.

I also appreciate the multilingual support provided by Weltrade, catering to a global clientele. This ensures that language barriers do not hinder the ability to get help. Additionally, the comprehensive FAQ section on their website addresses many common questions, making it easier to find answers without needing to contact support.

Advantages and Disadvantages of Weltrade Customer Support

Withdrawal Options and Fees

Weltrade offers a variety of withdrawal options to ensure that traders can access their funds easily. These options include bank transfers, credit/debit cards, and popular e-wallets like Skrill and Neteller. Additionally, you can withdraw funds using cryptocurrencies, which provides added flexibility for those who prefer digital currencies.

The withdrawal process is generally quick, with most requests processed within 30 minutes. This efficiency is a significant advantage for traders who need timely access to their funds. However, it’s essential to note that the speed of withdrawal can also depend on the method chosen and the processing times of your bank or payment provider.

Regarding withdrawal fees, Weltrade charges vary depending on the method used. For instance, bank transfers typically incur higher fees compared to e-wallets or cryptocurrency withdrawals. It’s crucial to review the fee structure on Weltrade’s website to understand the costs associated with each withdrawal method and choose the most cost-effective option.

Weltrade Vs Other Brokers

#1. Weltrade vs AvaTrade

Weltrade and AvaTrade both offer extensive trading options, but they differ in several key areas. Weltrade is known for its quick withdrawal processes and 24/7 customer support, making it highly accessible for traders. AvaTrade, on the other hand, boasts over 300,000 registered customers globally and offers more than 1,250 financial instruments. AvaTrade is heavily regulated with multiple global jurisdictions, which enhances its credibility. While Weltrade focuses on efficient trading with competitive spreads, AvaTrade provides a comprehensive trading experience with advanced tools and educational resources.

Verdict: AvaTrade is generally better for those looking for a heavily regulated and globally recognized broker with extensive trading instruments. However, Weltrade may be preferable for traders prioritizing quick withdrawals and constant customer support.

#2. Weltrade vs RoboForex

Weltrade and RoboForex cater to different types of traders with their unique features. Weltrade offers simplicity with a range of account types and quick withdrawal options, making it ideal for traders who value accessibility and efficiency. RoboForex, regulated by the FSC, offers a broader range of trading options with over 12,000 instruments and advanced platforms like MetaTrader, cTrader, and RTrader. Additionally, RoboForex’s ContestFX offers unique trading competitions on demo accounts, which can be appealing for traders looking to test their strategies in a competitive environment.

Verdict: RoboForex stands out for its extensive trading options and advanced platform choices, making it better suited for experienced traders seeking variety and advanced tools. Weltrade, however, is a solid choice for those who prioritize straightforward trading conditions and quick access to funds.

#3. Weltrade vs Exness

Weltrade and Exness both provide solid trading environments, but their offerings cater to different needs. Weltrade is known for its competitive spreads and efficient withdrawal processes, which are crucial for active traders. Exness offers over 120 currency pairs and CFDs, including cryptocurrencies, with features like infinite leverage and immediate order execution. Exness’s platform is designed for traders who need flexible leverage options and a wide range of instruments. Additionally, Exness provides a demo account for both new and experienced traders to practice their strategies.

Verdict: Exness is generally better for traders who require high leverage options and a wide variety of trading instruments. Weltrade, with its focus on efficient service and competitive spreads, is a better choice for those who need quick and reliable access to their funds.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: Weltrade Review

Weltrade offers a reliable trading environment with quick withdrawals and 24/7 customer support, making it highly accessible for traders. Their competitive spreads and diverse account types cater to various trading needs, from beginners to experienced traders. The broker’s efficiency and variety of withdrawal options are significant advantages.

However, Weltrade is not without its drawbacks. It lacks top-tier regulatory oversight, which can be a concern for some traders. Additionally, while their platform is efficient, it might not offer the extensive range of tools and educational resources found in more established brokers like AvaTrade or RoboForex. Potential users should weigh these factors carefully before deciding if Weltrade aligns with their trading goals.

Also Read: ModMount Review 2024 – Expert Trader Insights

Weltrade Review: FAQs

What are the withdrawal options available on Weltrade?

Weltrade offers a variety of withdrawal options including bank transfers, credit/debit cards, e-wallets like Skrill and Neteller, and cryptocurrencies. Most withdrawals are processed within 30 minutes.

Does Weltrade charge any fees for withdrawals?

Yes, Weltrade charges withdrawal fees which vary depending on the method used. Bank transfers typically have higher fees compared to e-wallets or cryptocurrency withdrawals.

Is Weltrade a regulated broker?

Weltrade is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa but lacks top-tier regulatory oversight. This may be a consideration for traders looking for brokers with more stringent regulatory environments.

OPEN AN ACCOUNT NOW WITH WELTRADE AND GET YOUR BONUS