Slow Start Due to Holidays

The week begins slowly as US and UK markets are closed on Monday for Memorial Day and a bank holiday, respectively. These holidays in major financial hubs mean lower trading volume, possibly leading to sluggish price action. However, thin liquidity can sometimes amplify price movements if unexpected news arises, with fewer traders around to absorb buy and sell orders. Caution is advised for those who choose to trade on Monday.

As the week progresses, we anticipate a relatively calm period with few high-impact events likely to spark significant volatility. The landscape could change on Friday with the release of critical economic indicators. On one side of the Atlantic, Eurozone May CPI figures will be released. On the other side, the US core personal consumption expenditure (PCE) data, the Federal Reserve’s most closely watched inflation gauge, will be published.

Eurozone Economic Outlook

The European Central Bank (ECB) is likely to reduce borrowing costs from a record high of 4% at its upcoming June meeting. The extent of further rate cuts will depend on the inflation outlook. The May Flash CPI report will be crucial, providing insights into recent price trends within the regional economy, and influencing the monetary policy trajectory.

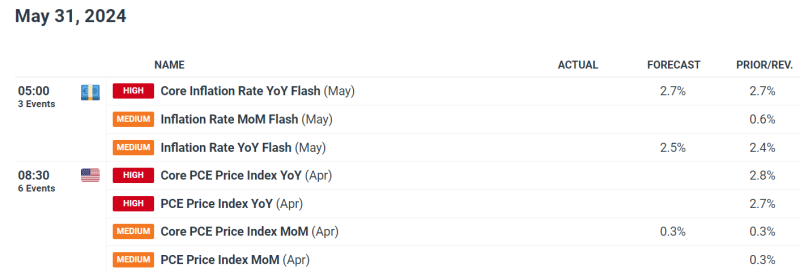

Analysts expect Eurozone inflation to rise to 2.5% YoY this month from 2.4% in April, with the core gauge anticipated to remain steady at 2.7%. A slight uptick in the headline metric may not deter the ECB from acting next month, but an upside surprise could prompt a more cautious approach to future easing. This could lead to heightened volatility in euro FX pairs heading into the weekend.

US Economic Outlook

The core PCE deflator data will also be released on Friday. Consensus estimates suggest a 0.3% increase in April, with the annual rate cooling to 2.7% from 2.8%, marking a small but favorable directional move. A downward surprise could reignite optimism that the disinflationary trend, which began in late 2023 but stalled earlier this year, is back on track, strengthening the case for the FOMC to pivot to a looser stance in the fall. This should be bearish for the US dollar but positive for stocks and gold.

Conversely, if inflation numbers exceed forecasts, interest rate expectations could shift in a hawkish direction, delaying the Fed’s timeline for initiating rate cuts. In this scenario, November or December could become the new baseline for a potential move by the US central bank. Such a development could propel bond yields and the greenback higher, creating a more challenging environment for equities and precious metals.