Position in Rating | Overall Rating | Trading Terminals |

172nd  | 2.9 Overall Rating |  |

W7 Broker Review

In the fast-paced world of Forex trading, choosing the right Forex broker is crucial to navigating the markets effectively. Forex brokers serve as the gateway to global currency markets, offering platforms where traders can buy and sell foreign currencies. The importance of selecting a reliable broker cannot be overstated, as they not only provide the tools necessary for trading but also significantly impact your trading success through their services, security, and cost structures.

W7 Broker and Trading (W7BT), established in 2019, stands out as an ECN broker. This means they provide direct access to other participants in the currency markets through electronic communications networks. What makes W7 Broker particularly appealing is its broad range of tradable assets, which includes cryptocurrencies and indices, catering to a diverse portfolio of traders.

This review aims to delve deeply into W7 Broker, highlighting what sets it apart while also noting any potential shortcomings. From various account options to straightforward deposit and withdrawal processes, and competitive commission structures, we cover all the angles. Combining expert analysis with real trader feedback, we provide a balanced view that equips you with all the information needed to decide if W7 Broker is the best choice for your trading needs.

What is W7 Broker?

W7 Broker is a distinguished ECN broker that has been operational since 2019. As an ECN broker, W7 Broker facilitates direct access between participants in the Forex markets, which can lead to tighter spreads and more competitive trading conditions. They offer trading opportunities in six different asset classes, including modern options like cryptocurrencies and traditional assets like indices.

Located in Kingstown, Saint Vincent and the Grenadines, W7 Broker operates from an offshore economic zone. This location allows them to benefit from the regulatory framework specific to offshore financial centers. W7 Broker prioritizes regulatory compliance and works in tandem with the legal departments of its clients to ensure adherence to all local financial regulations, enhancing the security and reliability of its trading services.

Benefits of Trading with W7 Broker

Trading with W7 Broker has offered me several significant benefits that have enhanced my trading experience. One of the most valuable aspects is their ECN trading model, which ensures that my trades are executed directly in the market, providing transparency and faster execution speeds. This model has minimized slippages and improved the overall accuracy of my trades.

The range of assets available for trading is another major advantage. With access to over six asset classes, including popular markets like forex, cryptocurrencies, and indices, I have been able to diversify my portfolio and spread risk across different instruments. This variety not only broadens my trading opportunities but also helps in managing investment risks more effectively.

Furthermore, the broker’s technological infrastructure is robust, featuring advanced trading platforms such as MetaTrader 5. This platform has equipped me with powerful analytical tools, automated trading capabilities, and real-time data, all of which are crucial for making informed trading decisions quickly and efficiently. The combination of these features within W7 Broker’s service offering has significantly contributed to the positive outcomes of my trading activities.

W7 Broker Regulation and Safety

W7 Broker operates under the regulatory framework of the offshore economic zone in Kingstown, Saint Vincent and the Grenadines, where it is officially registered as W7 Limited, with the registration number 25512 BC 2019. This setup highlights the importance of understanding the specific regulatory conditions that apply to brokers in offshore zones, which can differ significantly from those in more traditional financial centers.

For traders, knowing about the broker’s regulatory compliance and safety measures is crucial. W7 Broker enhances trader security by maintaining client funds in accounts separate from the company’s own finances. This separation is key to protecting client assets in case of financial discrepancies. Additionally, they provide negative balance protection, which is automated and ensures that clients cannot lose more money than they have in their accounts, thereby mitigating potential financial risks.

From a support perspective, W7 Broker offers accessible and responsive technical support available at any time. This ensures that traders can receive help quickly whenever they encounter issues with financial instruments or trading platforms. The information about W7 Broker’s regulation and safety was gathered through direct trading experiences, offering firsthand insight into its operational standards and the protections it offers to its clients.

W7 Broker Pros and Cons

Pros

- Guaranteed negative balance protection

- Quick order execution

- No dealing desk

- User-friendly trading experience

- Competitive spreads

- Multi-Account Manager (MAM) accounts

- Commitment to transparency

Cons

- Limited deposit options

- Mandatory user verification

- No micro (cent) accounts available

W7 Broker Customer Reviews

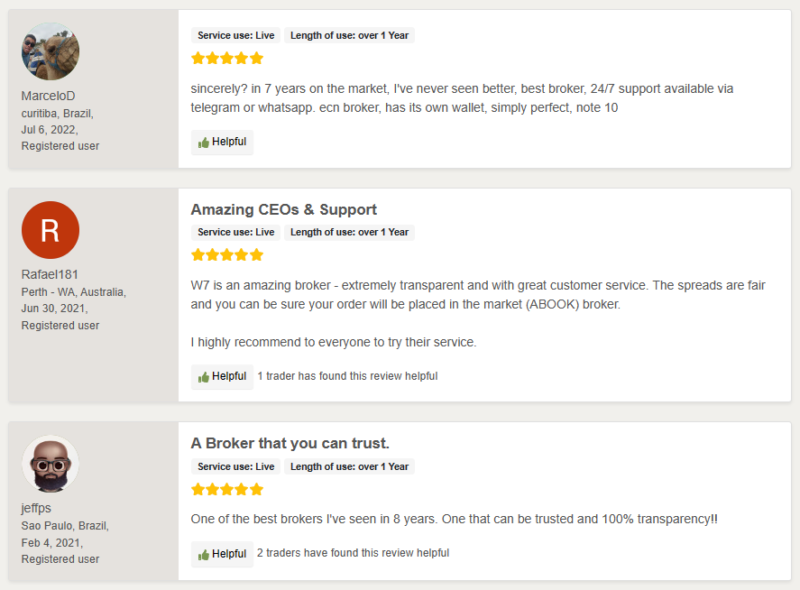

Customer reviews consistently praise W7 Broker for its excellent service and market transparency. Many users, with years of trading experience, regard W7 as one of the best brokers they have encountered, citing its reliable 24/7 support through channels like Telegram and WhatsApp. Clients appreciate the ECN model that ensures direct market access, along with fair spreads and the assurance that orders will be executed as intended. The inclusion of unique features like a proprietary wallet and the broker’s clear commitment to transparency have significantly enhanced user satisfaction, solidifying W7 Broker’s reputation as a trustworthy and efficient trading partner.

W7 Broker Spreads, Fees, and Commissions

As a trader using W7 Broker, I’ve found that their spreads, fees, and commissions are straightforward and competitive. In a Standard account, there’s a charge of $7.5 per lot traded, which applies to all types of assets. For those with Professional and Privilege accounts, the fees are even more favorable, set at $6 and $5 per lot, respectively. This tiered fee structure benefits more active and professional traders by reducing costs as their trading volume increases.

Another financial benefit is that deposits are made without any fees, which is a relief as it allows for moving funds without extra charges. However, it’s important to be aware that swaps are charged, which can affect the cost of holding positions overnight. Overall, these details are crucial for potential traders to consider when evaluating W7 Broker as their trading platform choice.

Account Types

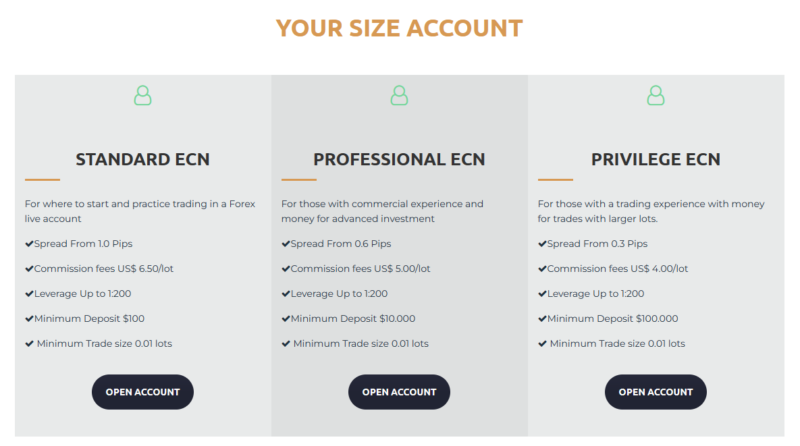

In choosing W7 Broker, I’ve explored their diverse account types, each tailored to different levels of trading experience and investment capacity. Here’s a breakdown:

Standard ECN Account

- Spread: From 1.5 pips

- Fee: $7.5 per lot

- Leverage: Up to 1:200

- Minimum Deposit: $100

- Minimum Trade Size: 0.01 lots

- This account is ideal for traders who are new to the ECN environment, offering manageable entry requirements and reasonable costs.

Professional ECN Account

- Spread: From 1 pip

- Fee: $6 per lot

- Leverage: Up to 1:200

- Minimum Deposit: $10,000

- Minimum Trade Size: 0.01 lots

- Designed for more experienced traders, this account provides tighter spreads and lower fees, rewarding higher volume trading with cost efficiency.

Privilege ECN Account

- Spread: Starts from 0.7 pips

- Fee: $5 per lot

- Leverage: Up to 1:200

- Minimum Deposit: $100,000

- Minimum Trade Size: 0.01 lots

- Aimed at high-net-worth individuals or institutional traders, this account offers the best terms for spreads and fees, reflecting the significant investment required.

These options reflect W7 Broker’s commitment to providing flexible trading solutions suited to a variety of trading strategies and capital sizes.

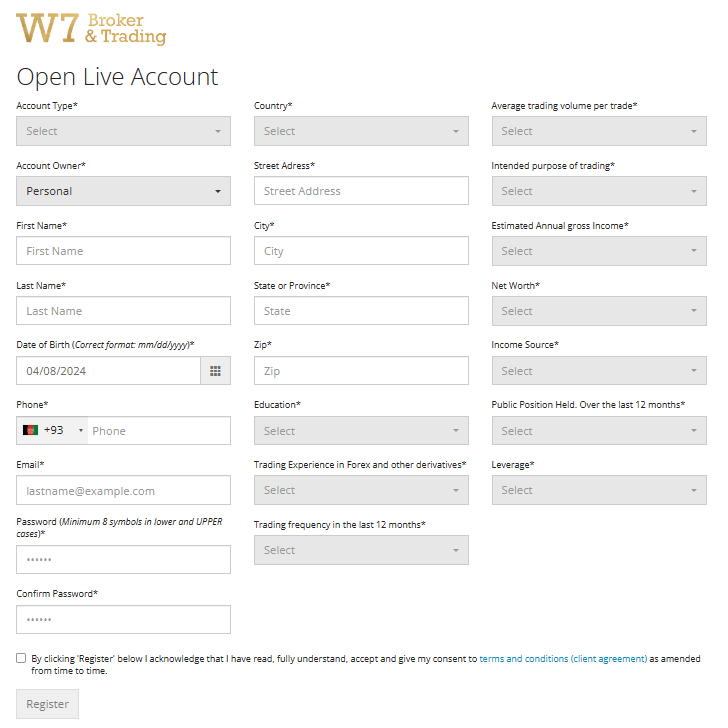

How to Open Your Account

- Visit the W7 Broker & Trading website to start the account opening process.

- Select your desired account type directly from the homepage.

- Look for a confirmation email after creating your account.

- Use your email and password to log into your new account.

- Fill out your profile including contact information, trading experience, and initial investment.

- Set up Google Authenticator with your account to enhance security.

- Initiate the verification process by going to the Personal Info section.

- Submit scanned copies of required documents for account verification and wait for approval before you can begin trading.

W7 Broker Trading Platforms

In my experience with W7 Broker, I’ve found that they offer access to MetaTrader 5 (MT5), a highly respected trading platform known for its robust functionality. MT5 is well-suited for traders of all levels due to its user-friendly interface and comprehensive analytical tools. This platform supports trading in multiple asset classes, which greatly benefits my trading strategy by allowing seamless transitions between forex, stocks, and other markets. Additionally, the ability to use automated trading systems through Expert Advisors (EAs) on MT5 has significantly enhanced my trading efficiency.

What Can You Trade on W7 Broker

Based on my experience with W7 Broker, I have accessed a diverse range of trading instruments that cater to different trading preferences and strategies. They offer a wide selection of currency pairs, with 67 options available, which is ideal for those who specialize in Forex trading. This extensive variety allows for significant flexibility in pursuing both major and exotic currency trades.

In addition to Forex, W7 Broker provides the opportunity to trade CFDs on stocks, indices, metals, energies, and cryptocurrencies. Specifically, they offer 20 stock CFDs, 13 indices, 7 types of metals, 4 energy commodities, and a robust selection of cryptocurrencies. This assortment enables traders like me to diversify their portfolios beyond traditional Forex markets, exploring opportunities in commodities, stock indices, and the thriving crypto market.

Each category of assets has been carefully curated to include highly sought-after and strategically important instruments, enhancing the trading experience by providing multiple avenues for investment and risk management. This comprehensive approach supports traders in optimizing their strategies across various market conditions.

W7 Broker Customer Support

In my dealings with W7 Broker, I’ve found their customer support to be both accessible and helpful. They offer several ways to contact their technical support team, including email, live chat from the user account, and a Telegram channel. This variety ensures that you can choose the most convenient method for your needs, whether you prefer the immediacy of live chat or the asynchronous nature of email.

The availability of support through Telegram is particularly notable, as it allows for quick and informal communication, which I have found to be efficient for resolving minor issues or getting quick answers. Moreover, every trader, regardless of their account type or trading volume, has access to these support services. This universal accessibility has significantly enhanced my trading experience, as I feel supported and confident that help is readily available whenever I need it.

Advantages and Disadvantages of W7 Broker Customer Support

Withdrawal Options and Fees

In my experience with W7 Broker, I’ve found their withdrawal process to be quite efficient. The company typically accepts withdrawal applications within 48 hours, but I’ve often seen them processed within 24 hours, which is convenient for quick access to funds. The verification step is mandatory for both depositing and withdrawing funds; this can be completed easily through the user account.

Regarding withdrawal methods, W7 Broker offers several options including bank cards, cryptocurrency transactions, and SEPA transfers. However, it’s important to note that standard bank transfers are not available. The withdrawal fees vary depending on the method or payment system chosen, which is something to consider when planning your withdrawals to minimize costs.

These features reflect W7 Broker’s commitment to providing flexible and efficient financial transactions, although the absence of standard bank transfers might be a limitation for some traders. Overall, the multiple withdrawal options and the straightforward verification process enhance the trading experience by making fund management both flexible and secure.

W7 Broker Vs Other Brokers

#1. W7 Broker vs AvaTrade

W7 Broker, an ECN broker, offers direct access to the markets with competitive fees and a focus on a broad range of trading assets including cryptocurrencies. Established in 2019, it operates mainly from an offshore zone in Saint Vincent and the Grenadines. AvaTrade, on the other hand, has been a stalwart in the Forex and CFD trading arena since 2006. With a heavy regulation and a strong presence in several international jurisdictions, AvaTrade offers over 1,250 financial instruments and prides itself on high levels of customer retention and service.

Verdict: AvaTrade might be a better choice for traders looking for a highly regulated environment and a more extensive range of financial instruments. However, W7 Broker could be more suitable for those prioritizing direct market access through an ECN broker and an interest in cryptocurrency trading.

#2. W7 Broker vs RoboForex

RoboForex, established in 2009, offers a vast array of trading options with over 12,000 available and is known for using cutting-edge technology to enhance trading conditions. Like W7 Broker, it serves a global audience but with a different regulatory background, being regulated by the FSC with a specific license. W7 Broker’s ECN model ensures fast and transparent trade execution, which is appealing to traders needing direct market access.

Verdict: RoboForex may be more appealing for traders who value technology and a vast selection of trading instruments. However, W7 Broker is potentially more favorable for those who prefer an ECN model that can provide quicker, more direct market access and an efficient trading experience in terms of costs and execution speeds.

#3. W7 Broker vs Exness

Exness, a broker established in 2008, boasts a strong presence with high forex ratings and a considerable monthly trading volume. It offers a wide range of CFDs and over 120 currency pairs. Exness is known for its low commissions, instant order executions, and the unique feature of unlimited leverage. W7 Broker, while newer and smaller in scale, provides ECN access and has a straightforward, perhaps less diverse, service offering focused on essential trading needs.

Verdict: For traders requiring extensive currency pair options and the flexibility of conditions like unlimited leverage, Exness could be the better choice. W7 Broker, however, might be preferable for those who prioritize the benefits of trading with an ECN broker for better speed and transparency in execution.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH W7 BROKER

Conclusion: W7 Broker Review

In conclusion, W7 Broker emerges as a competitive choice in the Forex and CFD trading landscape, especially noted for its ECN brokerage model that facilitates direct market access, quick trade executions, and transparent trading environments. The broker’s ability to offer a variety of tradable assets, including cryptocurrencies, appeals to traders seeking diverse investment opportunities. Furthermore, the flexible account types and competitive fee structures cater to both new and experienced traders, enhancing its attractiveness.

However, potential clients should consider that W7 Broker operates from an offshore location, which might present regulatory differences compared to brokers based in more tightly regulated jurisdictions. While the company takes measures to ensure compliance with local regulations and offers robust customer support, the language limitations and absence of more traditional communication methods, such as phone support, could be restrictive for some traders.

Also Read: Dizicx Group Review 2024 – Expert Trader Insights

W7 Broker Review: FAQs

What types of accounts does W7 Broker offer?

W7 Broker provides three main account types: Standard ECN Account, Professional ECN Account, and Privilege ECN Account. These accounts vary in terms of spreads, fees, and minimum deposit requirements, catering to different levels of traders from beginners to experienced professionals.

Can I trade cryptocurrencies with W7 Broker?

Yes, W7 Broker allows trading in cryptocurrencies along with other asset classes such as currency pairs, indices, metals, and energies, making it a versatile platform for traders interested in diversifying their portfolios.

Is W7 Broker regulated?

Yes, W7 Broker is regulated by the financial authorities of Saint Vincent and the Grenadines, operating under the regulations applicable to its offshore economic zone. This provides a level of oversight, although it’s different from the regulatory environments of more traditional financial centers.

OPEN AN ACCOUNT NOW WITH W7 BROKER AND GET YOUR BONUS