Position in Rating | Overall Rating | Trading Terminals |

19th  | 4.4 Overall Rating |  |

VT Markets Review

VT Markets is a global financial markets broker that provides access to a wide variety of financial trading instrument, such as forex, indices, commodities, precious metals, shares, and ETFs.

VT Markets is known for its user-friendly trading platform interface, VT Markets supports MetaTrader 4, MetaTrader 5, WebTrader, and its proprietary VT Markets App. This range of platforms allows both beginner traders and experienced traders to analyze and trade conveniently, either on desktop or mobile.

With over 1,000 tradable instruments, VT Markets offers competitive spreads starting at 0.0 pips on its Raw ECN account and access to high leverage up to 1:500, depending on regulatory jurisdiction.

The broker provides two primary account types: Standard STP, with no commissions and spreads from 1.2 pips, and Raw ECN, designed for tight spreads with a small commission fee. Both accounts offer negative balance protection and support for algorithmic trading features on MetaTrader platforms.

What is VT Markets?

VT Markets is a global broker that offers a wide range of financial instruments. It provides multiple trading platforms such as MetaTrader 4, MetaTrader 5, WebTrader, and a proprietary mobile app, allowing traders to operate from both desktop and mobile devices. Known for its user-friendly approach and competitive trading conditions, VT Markets supports both beginners and experienced traders seeking flexible options.

Regulated by ASIC in Australia and FSCA in South Africa, VT Markets offers key features like high leverage up to 1:500, negative balance protection, and tight spreads starting from 0.0 pips. The VT Markets broker also provides a demo account for practice trading and a Swap-Free (Islamic) account for clients following Sharia principles.

VT Markets Regulation and Safety

VT Markets is a regulated broker as it operates under the regulation of the Australian Securities and Investments Commission (ASIC) and the Financial Sector Conduct Authority (FSCA) in South Africa, ensuring compliance with strict financial standards.

These regulatory bodies enforce guidelines that promote transparency, client fund protection, and fair-trading practices. VT Markets’ regulation under ASIC and FSCA provides traders with additional confidence in the platform’s adherence to established financial regulations.

For added security, VT Markets offers negative balance protection on all accounts, which prevents users from losing more than their deposited funds during volatile market conditions. This feature is crucial for those using high leverage, as it limits their risk exposure. The broker also uses segregated accounts to store client funds separately from its operating funds, ensuring further protection and compliance with industry standards.

Additionally, VT Markets supports two-factor authentication for account access and uses advanced encryption technology to secure user data. These measures enhance the safety of trading on VT Markets, making it a reliable choice for traders looking for a secure and well-regulated platform.

VT Markets Pros and Cons

Pros:

- Regulated by ASIC and FSCA

- High leverage options

- Multiple platforms (MT4/MT5)

- Negative balance protection

Cons:

- Limited asset range outside CFDs

- Withdrawal fees

- No 24/7 support

- High leverage risks

Benefits of Trading with VT Markets

VT Markets offers a range of benefits for traders looking for flexibility and reliability. Regulated by ASIC and FSCA, the platform provides strong security features, including negative balance protection, which ensures that users cannot lose more than their deposited funds. This security measure, along with the use of segregated client accounts, provides peace of mind for traders, especially in volatile markets.

Another key benefit is the platform’s access to high leverage up to 1:500, enabling traders to control larger positions with a smaller capital base. While leverage can increase profit potential, it’s important to manage it carefully, as it also raises the risk of losses. VT Markets offers high leverage primarily for experienced traders looking to capitalize on market fluctuations.

VT Markets also supports multiple trading platforms, including MetaTrader 4, MetaTrader 5, and its mobile app, making it easy to trade on both desktop and mobile. These platforms offer tools for technical analysis, automated trading, and real-time market data, catering to both beginner and advanced traders. Additionally, with competitive spreads starting from 0.0 pips on certain accounts, VT Markets provides a cost-effective trading environment.

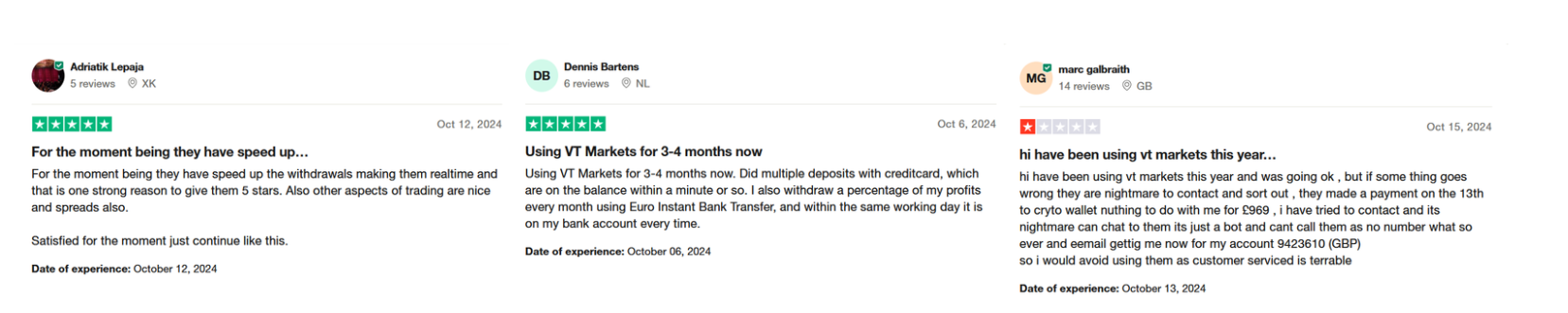

VT Markets Customer Reviews

Recent reviews of VT Markets show mixed experiences among users. Some traders praised the platform for speeding up withdrawals, reporting quick deposit and withdrawal times, which have been reliable for them. Additionally, they found other trading aspects, like spreads, satisfactory and have had positive interactions with the platform.

However, other users experienced significant issues, particularly with customer support and account management. One user reported difficulties contacting support, describing it as a “nightmare” and noting issues with unexpected transactions and limited communication channels. This indicates that while some users have a smooth experience, others encounter challenges with support responsiveness.

VT Markets Spreads, Fees, and Commision

For those traders who wants no commission charges and has a featured spread that starts from 1.2 pips, Standard STP account may be ideal for their forex trading.

On the other hand, the Raw ECN account is suited for more experienced traders, with spreads starting from 0.0 pips but a commission of $3 per side per lot on forex trades, ensuring low-cost trading for high-volume investors.

VT Markets doesn’t impose inactivity fees, which can be beneficial for long-term traders who may not trade frequently. Withdrawals are free for amounts over $100, but smaller withdrawals or specific methods may incur a $20 trading fees. Additionally, currency conversion fees may apply if trading in a currency different from the account’s base currency.

Account Types

VT Markets offers a range of account types designed to meet the needs of all traders, from beginners to experienced professionals. With different options, VT Markets provides flexible choices to accommodate different trading goals and preferences.

Standard STP Account

The Standard STP Account is designed for beginner and intermediate traders, offering no commission fees and spreads starting from 1.2 pips. This account provides easy access to markets with a low-cost structure, suitable for those seeking a straightforward trading experience. It includes essential features like negative balance protection and supports all VT Markets trading platforms.

Raw ECN Account

The Raw ECN Account is tailored for more experienced traders who prioritize low spreads, starting from 0.0 pips. This account has a commission of $3 per side per lot, providing tighter spreads for high-frequency traders. It’s ideal for those looking for cost-efficiency and fast market access with precise execution.

Cent Account

The Cent Account is designed for beginners who want to trade in smaller increments and build their skills with minimal risk. This account type operates with smaller units, allowing traders to trade cents instead of dollars, making it ideal for testing strategies with lower exposure. It helps new traders gain market experience with manageable amounts.

Swap-Free (Islamic) Account

The Swap-Free Account, also called the Islamic account, is designed for traders who follow Sharia principles. This account type excludes overnight interest (swap) fees while maintaining all the features of other accounts. It is a compliant option for Muslim traders seeking a trading experience aligned with their beliefs.

VT Markets also offers a demo accounts which is suitable for new and experienced traders looking to practice and try trading platforms with risk-free trading strategies. Demo account replicates to the real conditions of markets which allows users to experiment with virtual funds.

How to Open Your Account

It’s easy and quick to start trading with VT Markets. This guide will walk you through the simple steps of creating an account, from initial registration to setting it up, so you can be trading in no time.

Step 1: Registration

Go to the official VT Markets website and click on the “Register now” button to start the registration process. Fill in basic personal information such as your name, email, and phone number. After submitting these details, you’ll receive a confirmation email to verify your account.

Step 2: Identity Verification

Once registered, you’ll need to complete identity verification by uploading a copy of your ID (such as a passport or driver’s license) and proof of address (like a utility bill or bank statement). This step is required to comply with financial regulations and ensures the security of your account. Verification typically takes a short time, depending on the quality of submitted documents.

Step 3: Choose Account Type

After verifying your identity, select the type of account you want to open, such as Standard STP, Raw ECN, or Cent Account, based on your trading preferences. Each account type has specific features, so make sure to review them before finalizing your choice. This selection will determine the trading conditions you’ll work with.

Step 4: Fund Your Account

Once your account type is set, go to the deposit section and choose a preferred payment method to fund your account. VT Markets offers various options, including bank transfers, credit/debit cards, and e-wallets. Minimum deposit requirements may vary depending on the account type.

Step 5: Start Trading

With your account funded, you can now access VT Markets’ trading platforms, such as MetaTrader 4, MetaTrader 5, or the mobile app. Start by exploring the platform’s features, accessing market data, and placing your first trades. You are now ready to trade with VT Markets.

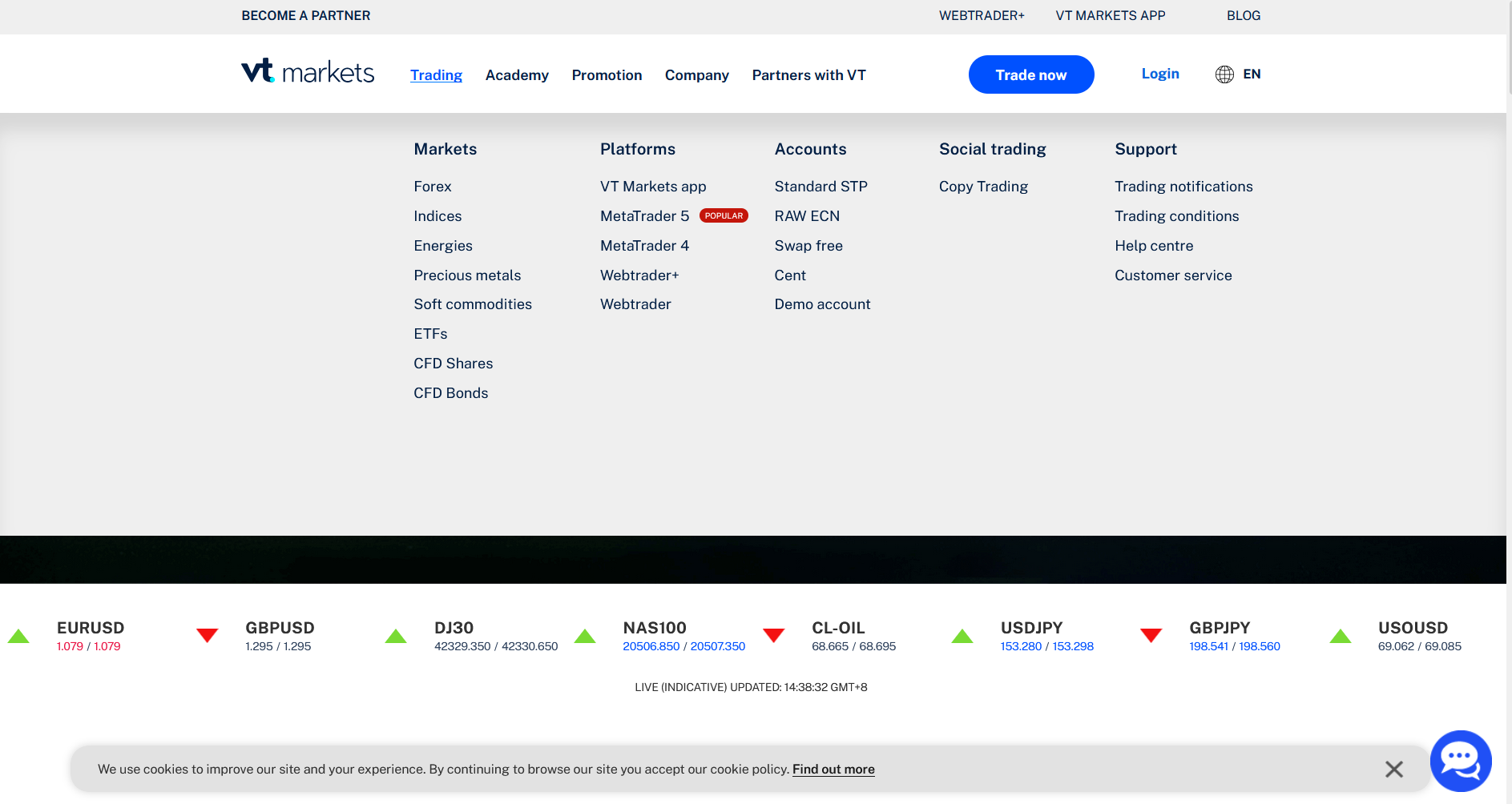

VT Markets Trading Platforms

VT Markets provides a range of trading platforms to suit different trading styles. These include MetaTrader 4 (MT4) for forex and CFD trading, which is user-friendly and supports automated trading tools, and MetaTrader 5 (MT5), which offers more advanced features for professional traders, like an integrated economic calendar and a broader range of assets.

VT Markets also supports WebTrader and a Mobile App for convenient, on-the-go trading. WebTrader allows access to trading through any browser without requiring downloads, while the mobile app, compatible with iOS and Android, enables users to trade, monitor markets, and manage accounts from anywhere. This flexibility in platform choices makes VT Markets accessible for traders who want to stay connected to the market at all times.

What Can You Trade on VT Markets

VT Markets provides access to a wide variety of assets, all within a single trading platform. This overview will introduce you to the main asset classes available, each offering distinct characteristics to suit different trading approaches and preferences.

Forex

VT Markets provides access to over 40 currency pairs, including major, minor, and exotic pairs. Traders can take advantage of high liquidity and competitive spreads, making forex trading suitable for short-term and high-frequency strategies. This market is available 24/5, offering flexibility across global trading sessions.

Indices

The platform offers popular global indices such as the S&P 500, NASDAQ, and FTSE 100, allowing traders to speculate on the performance of major stock markets. Indices trading provides an opportunity to diversify, with each index representing a collection of top companies within a particular country or sector. This asset class is ideal for those interested in tracking economic trends.

Commodities

VT Markets enables trading in commodities like oil, natural gas, and agricultural products. Commodities provide traders with a way to diversify their portfolios, often acting as a hedge against inflation. This market includes both hard commodities (like metals) and soft commodities (like wheat and coffee).

Precious Metals

Traders can access gold and silver markets on VT Markets, which are commonly used as safe-haven assets during economic uncertainty. Precious metals trading offers a way to manage risk, as these assets tend to retain value when currency markets are volatile. They are popular choices for long-term investments and portfolio diversification.

Shares

VT Markets provides CFD trading on a range of individual company shares from markets like the U.S., UK, and Australia. This allows traders to take positions on company performance without owning actual shares. Share CFDs provide leverage, allowing traders to amplify returns with smaller capital outlays.

ETFs (Exchange-Traded Funds)

With access to ETFs, traders can diversify by investing in baskets of assets that track sectors, commodities, or indexes. ETFs offer flexibility and lower costs compared to individual stock trading, making them appealing for long-term investors. This option suits traders looking for broad exposure with a single transaction.

VT Markets Customer Support

VT Markets provides multiple customer support options to assist traders throughout their trading experience. Users can reach out to the support team via live chat, phone, or email, which are available during regular business hours. Live chat is typically responsive and is ideal for quick inquiries, providing users with instant support for basic account or platform-related issues.

For more complex issues, email support is available, with response times generally within one to three business days, ensuring detailed responses when needed. Phone support is also offered, though it may require scheduling a callback depending on availability, which could be inconvenient for some users.

Advantages and Disadvantages of VT Markets Customer Support

Withdrawal Options and Fees

VT Markets understands that getting your money out easily and conveniently is important. They offer a variety of withdrawal methods, each with its own requirements and fees, so you can select the best one for your needs. Here’s a summary of the withdrawal options available and what they will cost you.

Bank Transfer

Withdrawals via bank transfer are available for most VT Markets users. This method may incur fees depending on the bank’s location and policies, with some banks charging an international transfer fee. Processing times typically take 1-3 business days, making it a reliable option for traders who prefer direct transfers to their bank accounts.

Credit/Debit Card

VT Markets supports credit and debit card withdrawals for added convenience, especially for users who initially funded their accounts with a card. Withdrawals to a card are often quicker than bank transfers, though they may take 1-5 business days depending on the card provider. Card withdrawals are usually fee-free but may be subject to limitations based on the card issuer’s policies.

E-Wallets (Skrill, Neteller)

For users who prefer faster transactions, VT Markets offers e-wallet withdrawals via options like Skrill and Neteller. E-wallet withdrawals are typically processed within 24 hours, providing a quick way to access funds. Some e-wallet providers may charge a small transaction fee, but the speed makes this a popular choice for traders needing fast access.

Cryptocurrency Withdrawals

VT Markets allows cryptocurrency withdrawals, making it a convenient option for users who prefer digital assets. Processing times are usually within a few hours, but blockchain network congestion may cause slight delays. Cryptocurrency withdrawals often come with network fees, which vary depending on the chosen digital currency.

VT Markets Vs Other Brokers

#1 VT Markets vs AvaTrade

VT Markets and AvaTrade both provide comprehensive trading options, but they cater to different types of traders. VT Markets offers a wide range of instruments, including forex, indices, commodities, and cryptocurrencies, with high leverage up to 1:500, appealing to traders who prioritize flexibility and leverage. It supports MetaTrader 4, MetaTrader 5, and its proprietary mobile app, offering both a straightforward interface and advanced trading tools. AvaTrade, on the other hand, provides a broader selection of asset classes, including CFDs on stocks, bonds, and ETFs, and it has additional platform options such as AvaOptions and the AvaTradeGO mobile app, which are well-suited for traders interested in options and risk management tools. AvaTrade also has regulatory coverage in multiple jurisdictions, adding a layer of credibility and security for traders focused on compliance and safety.

Verdict: VT Markets is ideal for traders seeking high leverage and focused on forex and crypto markets, while AvaTrade is more suited for those looking to diversify across asset classes, including options. AvaTrade’s extensive regulatory oversight also makes it a strong choice for security-conscious investors.

#2 VT Markets vs RoboForex

VT Markets and RoboForex offer different features and benefits, each catering to unique trading needs. VT Markets provides a straightforward, highly regulated platform, with oversight from ASIC and FSCA, offering forex, commodities, indices, and CFDs on stocks. Its maximum leverage is capped at 1:500, making it a suitable option for traders prioritizing regulated and controlled trading environments. RoboForex, regulated by IFSC in Belize, allows access to a broader range of assets, including cryptocurrencies, ETFs, and metals, with leverage reaching up to 1:2000. RoboForex also stands out with its proprietary R StocksTrader platform, which appeals to traders interested in stock and ETF CFDs, along with support for MetaTrader 4 and 5.

Verdict: VT Markets is ideal for traders looking for strong regulatory oversight and a more controlled leverage environment. In contrast, RoboForex is better suited for those seeking higher leverage and a broader asset selection, including cryptocurrencies and unique tools like the R StocksTrader platform.

#3 VT Markets vs Exness

VT Markets and Exness offer competitive features, but they cater to different trading needs. VT Markets is regulated by ASIC and FSCA, providing a secure trading environment with leverage up to 1:500. It supports MetaTrader 4, MetaTrader 5, and offers social trading through its proprietary app, making it appealing to traders interested in forex, commodities, and indices with moderate leverage. Exness, regulated by top-tier authorities like FCA and CySEC, goes further by offering unlimited leverage on certain accounts and includes unique tools such as its Exness Trader app and VPS hosting, appealing to high-risk traders and professionals looking for enhanced flexibility.

Verdict: VT Markets is suitable for traders seeking a well-regulated platform with accessible leverage and social trading options. Exness, with its higher leverage and extensive regulatory oversight, is better suited for experienced traders who need advanced tools and flexibility across a broader asset range.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH VT MARKETS

Conclusion: VT Markets Review

VT Markets is a versatile broker that offers a solid range of trading options, including forex, indices, commodities, and cryptocurrencies, catering to both beginner and experienced traders. The platform’s support for MetaTrader 4 and MetaTrader 5, along with social trading through its app, makes it user-friendly and adaptable to different trading styles. With leverage up to 1:500 and oversight from reputable regulators like ASIC and FSCA, VT Markets provides a secure environment with sufficient flexibility.

While VT Markets provides helpful educational resources and accessible customer support, its lack of 24/7 support and limited account variety may be a drawback for some. Overall, VT Markets is a reliable option for traders looking for strong regulatory security, flexible leverage, and a diverse asset selection across an intuitive trading platform.

VT Markets Review: FAQs

Is VT Markets regulated?

Yes, VT Markets is regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Sector Conduct Authority (FSCA) in South Africa. These regulatory bodies ensure that VT Markets adheres to strict financial standards for client protection and operational transparency.

What trading platforms does VT Markets offer?

VT Markets supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which are widely used for their robust analysis tools and automated trading capabilities. The broker also offers a proprietary mobile app for convenient trading on the go.

What types of accounts are available on VT Markets?

VT Markets provides two primary account types: the Standard STP Account and the Raw ECN Account. The Standard account has no commission fees, while the Raw ECN account offers tighter spreads starting from 0.0 pips with a small commission fee, catering to different trading needs.

OPEN AN ACCOUNT NOW WITH VT MARKETS AND GET YOUR BONUS