VPFX Review

VPFX is a reputable forex broker that has established itself as a trusted provider of trading services to individuals and institutions in the global financial markets. With a strong focus on transparency, reliability, and customer satisfaction, VPFX has garnered recognition and trust from traders worldwide.

In this comprehensive review, we will delve into the various aspects of VPFX, offering an unbiased evaluation of its features, offerings, advantages, disadvantages, and comparisons to other renowned brokers. Additionally, we will thoroughly analyze the security protocols and safeguards implemented by VPFX to protect the funds and personal data of its clients.

By conducting a detailed examination of VPFX, traders can make informed decisions about whether the broker aligns with their specific trading needs and preferences. It is advisable to consider multiple sources of information and stay updated with the latest developments and reviews to ensure well-informed choices when selecting a forex broker.

What is VPFX?

VPFX is a well-established broker since 2020, with headquarters located in Malaysia, St. Vincent & Grenadines, United Arab Emirates, and Australia. With a customer base of over 4 million clients, VPFX offers Forex/CFD trading services. The broker is regulated by multiple reputable bodies, including FSA (Labuan) LL16224, FSA (St. Vincent & Grenadines) 26406, Department of Economic Development (Dubai) 960254, and ASIC ACN 641 553 933.

The VPFX group consists of three related companies: VPFX AU, regulated by the Australian Securities and Investments Commission (ASIC); VPFX UAE, regulated by the Dubai Economic Department (DED); and VPFX MY, regulated by the Labuan Financial Services Authority (LFSA).

Clients from around the world, excluding the USA, EEA countries, Afghanistan, Cuba, Cote d'Ivoire, Iran, Libya, Myanmar, North Korea, Sudan, Puerto Rico, Syria, and Yemen, can access VPFX's services. The broker stands out with its multiple licenses and supervision by reputable statutory bodies.

Traders benefit from web access to an economic calendar, live charts, and live prices. VPFX offers a diverse range of trading instruments, including 30+ currency pairs, 7 indices CFDs, 2 metal CFDs (Gold and Silver), 3 energy CFDs (Crude Oil and Natural Gas), and 100+ stock CFDs based on shares of US, UK, German, and French companies.

Advantages and Disadvantages of Trading with VPFX?

Trading with VPFX presents a variety of advantages and disadvantages that traders should consider when selecting a forex broker. These factors contribute to the overall trading experience, and understanding them can help traders align their choice with their trading goals and preferences.

Benefits of Trading with VPFX

Indeed, before diving into the benefits of trading with VPFX, it's important to understand that the choice of a broker can significantly impact your trading journey. The right broker not only provides a platform for executing trades but also offers the tools, resources, and services to facilitate successful trading outcomes.

As a well-established and respected broker, VPFX brings numerous advantages to the table that can enhance your trading experience. Here, we delve into the key benefits of choosing VPFX as your trading partner.

Regulated Broker

VPFX is regulated by reputable financial authorities such as FSA (Labuan), FSA (St. Vincent & Grenadines), the Department of Economic Development (Dubai), and ASIC. This regulatory oversight provides traders with confidence and reassurance that the broker operates in accordance with established standards and guidelines.

Wide Range of Trading Instruments

VPFX provides a diverse selection of trading instruments, including currency pairs, stock CFDs, indexes, and precious metals. This allows traders to access multiple markets and diversify their trading strategies based on their preferences and market opportunities.

Advanced Trading Platforms

VPFX offers access to industry-leading trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are renowned for their user-friendly interfaces, comprehensive charting tools, customizable indicators, and automated trading capabilities. Traders can benefit from the advanced features and flexibility provided by these platforms.

Competitive Trading Conditions

VPFX strives to offer competitive trading conditions, including tight spreads, fast execution, and low slippage. These factors can enhance the trading experience and potentially improve overall profitability.

High Leverage Options

VPFX provides high-leverage options, enabling traders to amplify their trading positions. Higher leverage allows for greater exposure to the market with smaller capital investment. However, it's important to exercise caution and use leverage responsibly, as it also increases the potential risk.

Educational Resources

VPFX offers educational resources such as webinars, tutorials, and market analysis to support traders in enhancing their trading knowledge and skills. These resources can be valuable for both beginner and experienced traders looking to expand their understanding of the financial markets.

Customer Support

VPFX provides customer support through various channels, including email, phone, and live chat. Traders can reach out to the support team for assistance with inquiries, account-related matters, technical issues, and more. Responsive customer support ensures that traders receive timely and efficient assistance when needed.

VPFX Pros and Cons

When choosing a forex broker, understanding the pros and cons can provide a balanced perspective to aid decision-making. Here are some key advantages and disadvantages associated with VPFX:

Pros

- Fast Execution Speed

- User-Friendly Interface

- Security Measures

- Accessibility

- Functionality

Cons

- Loose regulation

- Demo spreads are not that good

VPFX Customer Reviews

Based on customer reviews, VPFX has received positive feedback from traders. One trader mentioned their satisfaction with the standard account, praising the excellent spreads, order execution, and customer support.

They also expressed that their account balance has remained stable, and they have seen a doubling of their initial investment. Overall, the trader highly recommends VPFX as a trustworthy platform.

Keep in mind that reviews can be subjective and are often based on personal experiences, so it's wise to look for patterns and consistent feedback among multiple reviews. Remember, while user reviews can be helpful, they should not be the only factor considered when choosing a forex broker.

VPFX Spreads, Fees, and Commissions

Choosing a broker with competitive spreads, fees, and commissions is a key factor in maximizing your trading profits. It's not just about the trading platform's capabilities or the variety of markets available to trade.

VPFX is a reputable broker known for its competitive trading conditions and commitment to client satisfaction. With a focus on providing tight spreads and low-cost trading, VPFX aims to offer traders a cost-effective and efficient trading experience.

One of the standout features of VPFX is its tight spreads on major instruments. Traders can enjoy spreads as low as 0.0 pips on popular currency pairs like EUR/USD. This can significantly reduce trading costs and potentially enhance profitability, making VPFX an attractive choice for traders who value competitive pricing.

In addition to favorable spreads, VPFX distinguishes itself by offering zero deposit fees and no transaction fees or minimum commissions for funding trading accounts. This means that traders can deposit funds into their accounts without incurring additional charges, allowing them to fully utilize their investment capital for trading purposes.

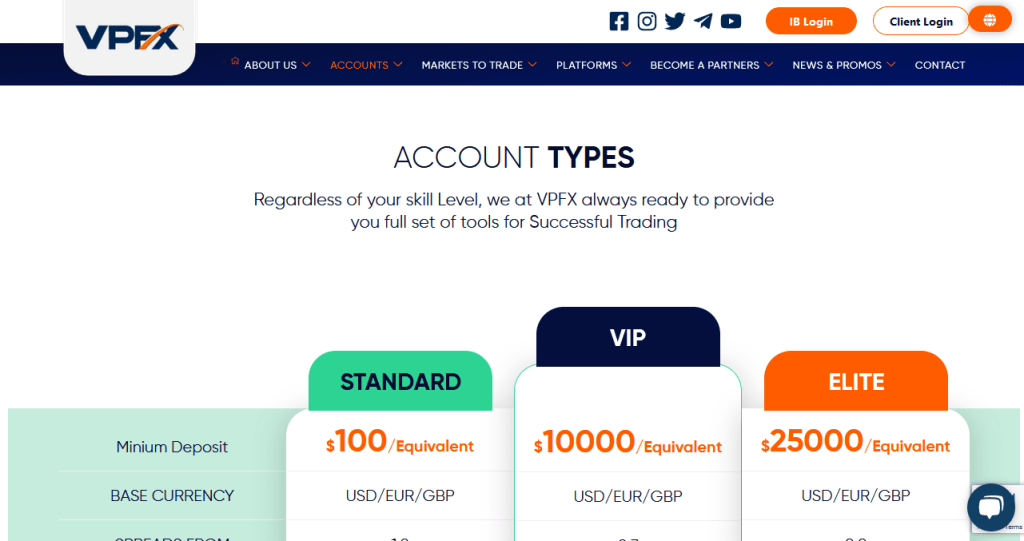

Account Types

VPFX offers a range of live account choices for traders. These include the Essential Account, Original Account, and Signature Account. Additionally, an Islamic Account version is available for all these account types. Traders can also access a demo account upon registration to practice and familiarize themselves with the platform. Here's an overview:

Elite Account

The Elite account is likely the highest-tier account offered by VPFX. It may require a significant initial deposit, making it suitable for experienced or high-net-worth traders. This account type often provides premium features and benefits, such as lower spreads, dedicated account managers, priority customer support, and exclusive research or analysis.

VIP Account

The VIP account is designed for traders who seek additional perks and preferential treatment. It may require a relatively large initial deposit. Traders with VIP accounts typically enjoy advantages such as lower spreads, reduced trading costs, faster execution, and access to exclusive resources or trading tools. VIP account holders may also receive personalized support and tailored services.

Standard Account

The Standard account is likely the entry-level or basic account offered by VPFX. It typically has a lower minimum deposit requirement, making it accessible to a wide range of traders, including beginners. The Standard account may offer competitive spreads and basic trading features, providing traders with a solid foundation to start their trading journey.

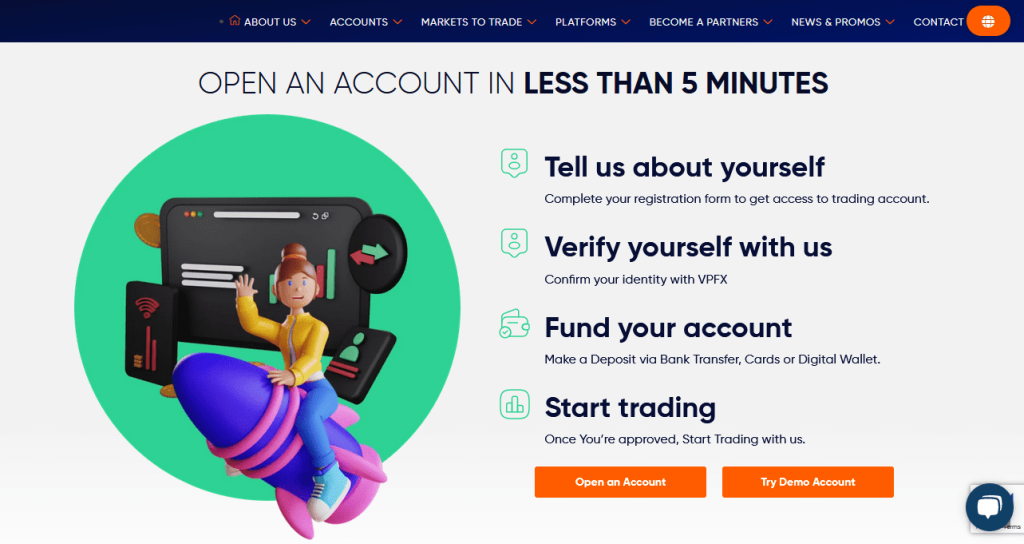

How To Open Your Account?

Opening an account with VPFX is a straightforward process. Here's a step-by-step guide. Be sure to check VPFX's official website for any changes to this process.

Visit the VPFX website: Start by going to the VPFX official website.

Sign Up: Click on the “Register” or “Open Live Account” button, usually located at the top right of the website.

Complete the Registration Form: You'll be asked to fill out a form with personal details, including your name, email address, phone number, and country of residence.

Choose an Account Type: Select the account type that best fits your trading needs and deposit requirements – Elite, VIP, and Standard account.

Verify Your Identity: To comply with financial regulations, VPFX will require proof of identity and proof of residence. This can usually be completed by uploading a scanned copy of a valid passport or ID for proof of identity, and a utility bill or bank statement for proof of residence.

Fund Your Account: Once your account is verified, you can deposit funds. VPFX offers several funding options, including bank transfers, credit/debit cards, and various online wallets. Select the method that suits you best and follow the instructions to complete the deposit.

Start Trading: After your deposit has been processed, you can start trading. Download the trading platform, log in with your account details, and begin your trading journey.

What Can You Trade on VPFX?

VPFX provides a diverse range of financial instruments for trading, allowing traders to access multiple markets from a single platform. While specific offerings may evolve over time, here are some of the common instruments you can trade on VPFX:

Forex: VPFX offers a wide range of currency pairs for trading. This includes major currency pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic currency pairs.

Gold & Silver: Traders can also participate in the trading of precious metals such as gold and silver. These commodities provide opportunities for traders to speculate on price movements and hedge against inflation or market volatility.

Stocks: VPFX enables trading in the stocks of various companies. Traders can access shares of well-known companies listed in the US, UK, Germany, and France. This allows traders to potentially profit from the performance of individual stocks.

Indices: VPFX provides trading opportunities in stock market indices. Traders can speculate on the performance of major global indices, including the German DAX, the Dow Jones Index, and the NASDAQ 100 index. Index trading allows traders to take a broader market perspective.

Trading hours, spreads, and commissions vary depending on the specific instrument and market. Traders should refer to the platform or contact VPFX for accurate and up-to-date information regarding trading hours as well as the associated spreads and commissions for each product.

VPFX Customer Support

VPFX offers several customer support channels, including email, call, and chat support, to assist traders with their inquiries and concerns. Traders can communicate with the support team through email, enabling them to send detailed messages and receive responses at their convenience.

Call support provides a direct line of communication for immediate assistance and verbal interaction. The live chat support feature allows traders to engage in real-time conversations with a support representative for instant responses to their queries.

However, it's important to note that VPFX does not offer office support. This means that traders may not have the option to visit a physical office location for in-person assistance. While the available customer support channels aim to provide efficient and timely help, the absence of office support might limit certain aspects of face-to-face communication or direct interaction with the support team.

Traders should consider this limitation when assessing their preferred method of support and ensure that the available channels adequately address their needs and concerns. Despite the absence of office support, VPFX strives to provide responsive assistance through their available customer support channels to cater to the trading requirements of their clients.

Advantages and Disadvantages of VPFX Customer Support

When considering the customer support provided by VPFX, it's important to assess both the advantages and disadvantages to gain a comprehensive understanding. Here are some potential advantages and disadvantages of VPFX' customer support:

Security for Investors

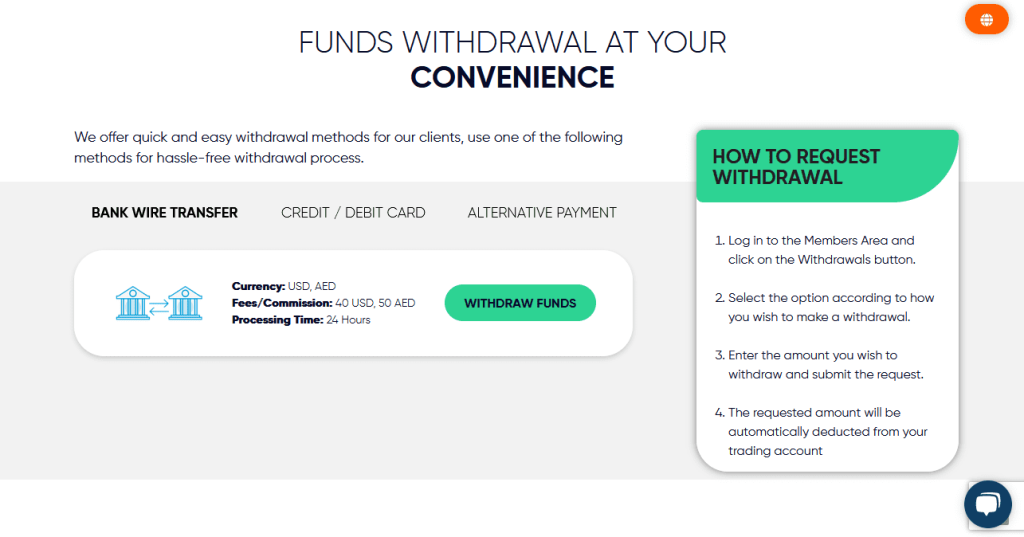

Withdrawal Options and Fees

VPFX provides a wide range of deposit and withdrawal options for its clients. The broker offers flexibility in choosing the most convenient method for funding and withdrawing funds from trading accounts.

Withdrawal Options

- Skrill: Fast, easy, and secure online payment service option for funding trading accounts with payment cards, bank wire transfers, or Skrill e-wallet accounts.

- Wire transfer: Traditional and widely used method for secure bank transfers, suitable for traders who prefer avoiding third-party payments or lack credit cards.

- Neteller: Popular online payment service similar to PayPal, widely accepted by forex brokers for fund deposits and withdrawals, particularly favored in Europe.

- FasaPay: E-payment system known for its competitive edge with low fees and instant processing, preferred by retail forex traders.

- Credit/Debit cards: VPFX also provides payment options through credit/debit cards, offering a convenient and widely used method for funding trading accounts.

VPFX provides withdrawal options in USD and AED currencies, offering flexibility for traders. The withdrawal fee/commission for withdrawals in USD currency is 40 USD, while for withdrawals in AED currency, the fee is 50 AED.

It's important to note that these fees are subject to change, and traders should refer to the official VPFX website or contact customer support for the most up-to-date information.

The processing time for withdrawals is typically 24 hours, indicating that VPFX aims to process withdrawal requests in a timely manner. However, it's important to consider that processing times may vary depending on various factors, such as the payment method and the verification process.

VPFX Vs Other Brokers

When comparing VPFX to other brokers, it's essential to consider various factors that can impact the trading experience. Here, we'll explore the comparisons between VPFX and AvaTrade, RoboForex, and Alpari to help you make an informed decision.

#1. VPFX Vs AvaTrade

One significant difference is their regulatory status. VPFX is regulated by multiple authorities, including FSA (Labuan), FSA (St. Vincent & Grenadines), Department of Economic Development (Dubai), and ASIC.

On the other hand, AvaTrade is regulated by well-known regulatory bodies such as the Central Bank of Ireland, ASIC, and FSCA. Traders who prioritize a higher number of regulatory licenses may lean towards VPFX.

In terms of trading platforms, VPFX offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are well-known for their robust features and user-friendly interfaces. AvaTrade, on the other hand, provides its proprietary platform called AvaTradeGO, as well as the option to trade on MT4. Traders who prefer a wider range of platform choices may find VPFX more appealing.

Regarding trading conditions, both brokers offer competitive spreads, but specific details may vary. Traders should review the available instruments, leverage options, and account types to determine which aligns better with their trading preferences and strategies.

In terms of customer support, both brokers offer multiple channels such as email, phone, and live chat. However, VPFX supports several languages, including English, Indonesian, Malay, Thai, and Chinese, which may be beneficial for traders from those regions.

Verdict:

Ultimately, the choice between VPFX and AvaTrade depends on individual preferences and trading requirements. Traders who prioritize a higher number of regulatory licenses and a wider range of supported languages may lean towards VPFX.

On the other hand, traders who prefer the flexibility of a proprietary trading platform and are comfortable with the available regulatory licenses may opt for AvaTrade.

#2. VPFX Vs RoboForex

VPFX is regulated by multiple authorities, including FSA (Labuan), FSA (St. Vincent & Grenadines), Department of Economic Development (Dubai), and ASIC.

On the other hand, RoboForex is regulated by entities such as the International Financial Services Commission (IFSC) of Belize and the Cyprus Securities and Exchange Commission (CySEC). Traders who prioritize a higher number of regulatory licenses may lean towards VPFX.

In terms of trading platforms, both brokers offer the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are known for their advanced features and user-friendly interfaces. Traders who prefer a wide range of platform choices may find both VPFX and RoboForex appealing.

Trading conditions, including spreads, commissions, and available instruments, may differ between the two brokers. Traders should review and compare the specific details of each broker's offerings to determine which better aligns with their trading preferences and strategies.

When it comes to customer support, both VPFX and RoboForex provide multiple channels such as email, phone, and live chat. Traders should consider factors like responsiveness and availability of support when evaluating their customer service.

Verdict:

Choosing between VPFX and RoboForex depends on individual priorities and trading needs. Traders who prioritize a higher number of regulatory licenses may prefer VPFX, while those seeking a regulated broker with a global presence may opt for RoboForex.

#3. VPFX Vs Alpari

VPFX is regulated by multiple authorities, including FSA (Labuan), FSA (St. Vincent & Grenadines), Department of Economic Development (Dubai), and ASIC.

Alpari, on the other hand, is regulated by various entities, including the Financial Services Authority (FSA) in Saint Vincent and the Grenadines and the Financial Services Commission (FSC) in Mauritius. Traders who prioritize a higher number of regulatory licenses may lean towards VPFX.

Trading platforms also differ between the two brokers. VPFX offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms known for their extensive features and user-friendly interfaces. Alpari provides its proprietary platform called Alpari International, along with the option to trade on MT4 and MT5. Traders who prefer a wider range of platform choices may find VPFX more appealing.

In terms of trading conditions, including spreads, commissions, and available instruments, traders should compare the specifics provided by each broker. The offerings may vary, and traders should consider their preferred trading instruments and strategies when making a decision.

Customer support is an important aspect of any broker. Both VPFX and Alpari offer various support channels, such as email, phone, and live chat. Traders should evaluate the responsiveness and quality of customer support services when assessing their options.

Verdict:

The choice between VPFX and Alpari depends on individual preferences and trading requirements. Traders who prioritize a higher number of regulatory licenses may prefer VPFX, while those seeking a proprietary trading platform and comfortable with the available regulatory licenses may opt for Alpari.

Conclusion: VPFX Review

VPFX (Ventura Prime FX) is a relatively new forex and CFD broker based in Malaysia and regulated in the Labuan offshore zone. The broker offers high leverage and a wide selection of single-stock CFDs, with trading available on MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. It also has entities regulated by the Dubai Economic Department (DED) in Dubai and the Australian Securities and Investments Commission (ASIC) in Australia.

VPFX stands out for its focus on stock CFDs, offering over 100 stocks from well-known companies listed in the US, UK, France, and Germany. However, the broker's offerings lack certain instruments like bonds, cryptocurrencies, and additional commodities, which could enhance its overall range of trading options.

VPFX provides three types of trading accounts: Standard, VIP, and Elite, each with distinct features. The Standard account requires a minimum deposit of USD 100 but has higher spreads starting at 1.2 pips. The VIP and Elite accounts offer lower spreads (starting from 0.7 and 0.2 pips, respectively), but they require substantial deposits of USD 10,000 and USD 20,000, making them less accessible for many retail traders.

Deposits can be made via bank transfer, credit/debit cards, and e-wallets such as Skrill, Neteller, and Fasapay. However, cryptocurrency payments are not currently supported. While funding methods are generally free, some withdrawal methods may have associated fees.

VPFX offers customer support through phone, email, and live chat. The exact working hours of the support team are not explicitly stated on the website, but the broker promises 24/5 support for all account holders.

Overall, VPFX is striving to establish a presence in the forex trading market, particularly in Malaysia. However, the minimum deposit requirements for the most attractive account types may be considered high for ordinary traders, while the basic account remains affordable. Addressing this issue could improve the broker's appeal to a wider range of traders and enhance its competitiveness in the industry.

VPFX Review FAQs

What regulatory authorities oversee VPFX's operations?

VPFX is regulated by multiple authorities, including FSA (Labuan), FSA (St. Vincent & Grenadines), Department of Economic Development (Dubai), and ASIC.

What trading platforms are available on VPFX?

VPFX offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their advanced features and user-friendly interfaces.

What are the available withdrawal options on VPFX?

VPFX provides withdrawal options such as Skrill, wire transfer, Neteller, FasaPay, and credit/debit cards, offering flexibility and convenience for traders.