Vonway Review

A reliable Forex broker plays a crucial role in a trader’s success, ensuring low trading costs, security, and efficient fund management. The ability to execute trades seamlessly with advanced trading tools and favorable spreads significantly impacts a trader’s trading journey. With a diverse range of brokers in the forex market, making an informed decision requires careful evaluation of trading platforms, trading conditions, and customer support.

Vonway Broker distinguishes itself with multiple trading account options, including a standard account and a demo account, catering to both beginners and seasoned traders. Its trading instruments cover a broad spectrum of financial markets, offering opportunities in forex, commodities, and indices. Additionally, Vonway clients benefit from a seamless trading experience, supported by a prompt assistance team and easy processes to withdraw funds.

The broker’s terms feature a transparent commission structure and non-trading fees, ensuring cost-effective trading activities. Vonway also provides educational resources and technical analysis tools to enhance traders’ trading strategies. However, it operates without oversight from major regulatory bodies like the Commodity Futures Trading Commission (CFTC) or the National Futures Association (NFA), which may concern those prioritizing financial authorities’ supervision.

This review will offer comprehensive information on Vonway’s strengths and limitations, covering minimum deposit requirements, minimum withdrawal amount, available deposit bonuses, and overall trading experience. By exploring real trader feedback and expert evaluations, this analysis aims to provide valuable insights into whether Vonway Broker aligns with your trading opportunities and long-term market goals.

What is Vonway?

Vonway is a Forex and CFD broker with over 800 assets, such as currency pairs, stocks, indices, metals, commodities, and cryptocurrencies, offered on the MT4 platform. The two primary account types that the company offers are Standard and Raw Spread accounts, which have a minimum deposit requirement of $50. The spreads offered to traders start at 0 pips and go up to a leverage of 1:2000.

However, Vonway lacks comprehensive oversight in terms of regulations, so this may prove to be an issue for more cautious traders. In addition, the broker lacks the option to receive passive income in the forms of PAMM accounts and copy trading. Even though the Vonway online broker offers all the trading tools and flexible conditions of leverage use, potential customers need to thoroughly evaluate these characteristics before engaging with the broker to perform trading.

Vonway Regulation and Safety

Vonway is not under the supervision of any significant financial authority, which could cause worries for traders looking for a regulated trading environment. By working without supervision from established regulatory agencies, Vonway fails to provide the investor safeguards usually linked to regulated brokers.

To improve client security, Vonway adopts strategies like verifying accounts via personal identification and address confirmation. They additionally implement secure withdrawal protocols, mandating email confirmations and verifying payment information to deter unauthorized access.

Moreover, Vonway has implemented an Anti-Money Laundering (AML) policy that forbids and actively hinders activities associated with money laundering and financing terrorism. This policy is relevant to all officers, employees, and designated producers, making certain that they adhere to relevant laws and regulations.

Despite these internal policies, the lack of external regulatory supervision implies that clients cannot utilize investor compensation schemes or established paths for resolving disputes. Traders must thoughtfully assess these factors when determining the safety and security of trading with Vonway.

Vonway Pros and Cons

Pros:

- High Leverage

- Diverse Instruments

- MT4 Platform

- Demo Accounts

Cons:

- Unregulated Broker

- Limited Resources

- Negative Reviews

- Misleading Claims

Benefits of Trading with Vonway

Vonway allows the tightest spreads that begin from 0.0 pips, with leverage of up to 1:2000, helping minimize costs and maximize returns. Access to over 800 trading instruments, ranging from Forex pairs, stocks, and commodities, to cryptocurrencies, diversifies the trading portfolios. The MetaTrader 4 offers a better trading experience using advanced charting tools, automated trading, and user-friendliness.

Vonway allows traders to access multiple accounts with different specifications that cater to varied experiences and trading strategies: Standard, Raw Spread, Micro, etc. Orders are fast to execute, as servers at the Equinix NY4 data center handle them for high-frequency trading purposes. Vonway does not limit trading because no restrictions in any form can be found among scalping, hedging, or algorithmic trading.

Vonway also offers 24/7 customer support, meaning traders will receive assistance whenever needed. Although the platform offers competitive trading conditions, traders should weigh its features against their needs to decide if it is suitable for them.

Vonway Customer Reviews

Traders love the spreads on Vonway, withdrawal fees do not apply, and the speed of the order execution. Flexibility and trading tools on the MT4 platform are in extensive use and are most praised. Most users refer to transparent trading conditions and also to their wide selection of assets. The attraction lies in high leverage up to 1:2000, so traders can control larger positions using smaller capital. The spreads equal those advertised and the execution speed is reliable. Some of the weaknesses include no regulations, no copy trading, and limited cryptocurrency CFDs. Customer support also only extends up to one trading platform. Overall, customers find Vonway suitable for active trading but inadequate in investment.

Vonway Spreads, Charges, and Commissions

Vonway offers competitive spreads, beginning at 0.0 pips on key currency pairs, which is attractive for traders aiming to reduce expenses. The spread fluctuates according to market conditions and liquidity, indicating that traders may face narrower or broader spreads depending on the time of day and market volatility. Narrow spreads can advantage scalpers and high-frequency traders, whereas typical spread conditions suit long-term strategies.

The broker utilizes a market execution model, guaranteeing that trades are executed quickly with little delay. The typical order execution time is approximately 35 milliseconds, enabling traders to swiftly enter and exit trades. This is especially advantageous for traders who depend on quick market fluctuations or utilize automated trading methods.

Vonway does not impose extra commissions on CFD indices, making trading in these markets more affordable for investors. Nonetheless, forex transactions might involve commission charges, depending on the structure of the spread. Some accounts function with no commission and slightly wider spreads, while others offer raw spreads along with a fixed commission for each lot. Traders must examine the fee structure closely to choose the most economical method for their trading preferences.

Account Types

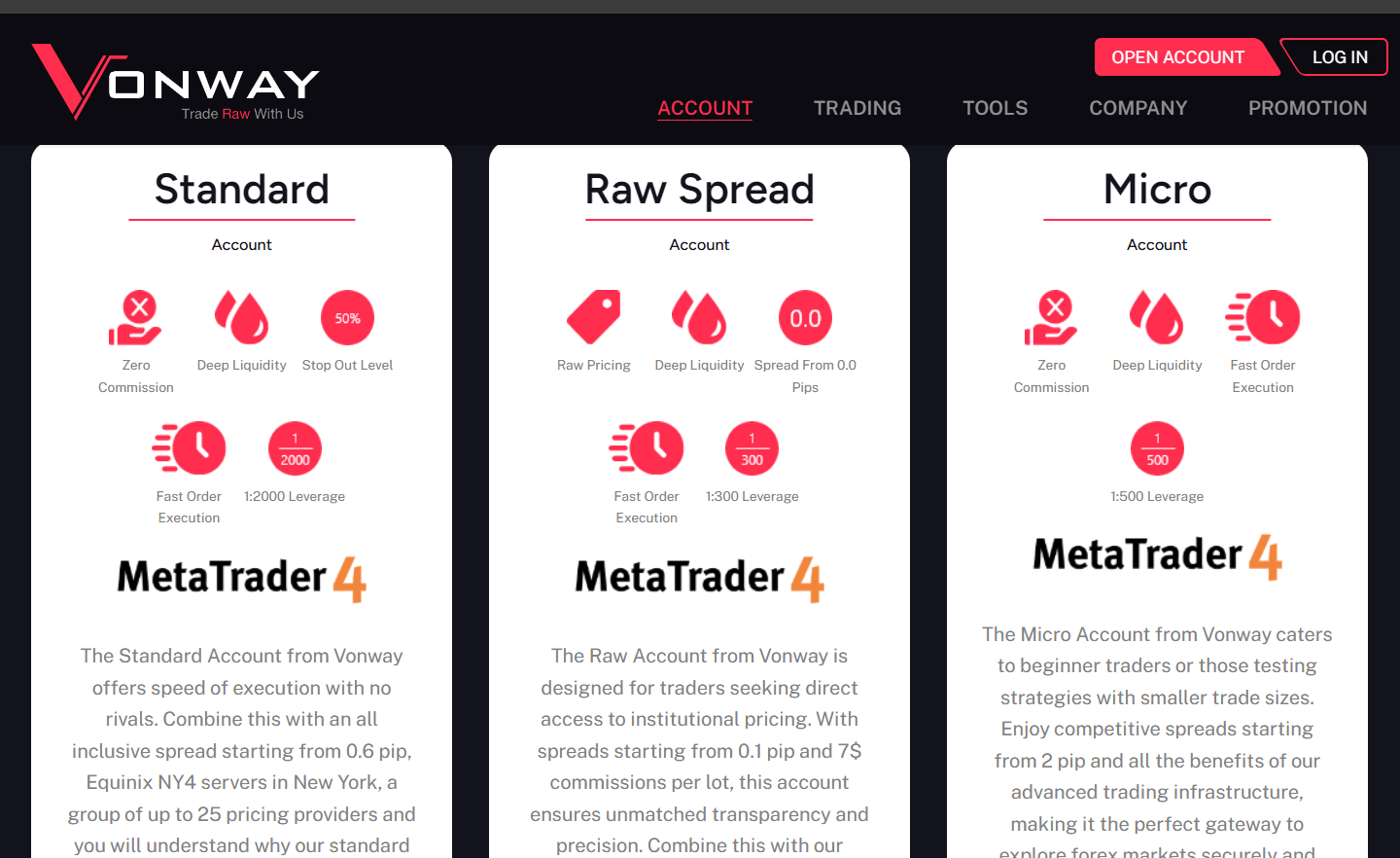

Standard Account

The Standard Account provides fast execution with spreads starting from 0.6 pips and zero commissions. Traders can access deep liquidity and leverage up to 1:2000, making it suitable for those seeking straightforward trading conditions.

Raw Spread Account

Designed for traders seeking direct access to institutional pricing, the Raw Spread Account offers spreads from 0.0 pips with a $7 commission per lot. It features deep liquidity and fast order execution, appealing to day traders and scalpers.

Micro Account

The Micro Account is tailored for beginners or those testing strategies with smaller trade sizes. It offers competitive spreads starting from 2 pips, leverages up to 1:500, and all the benefits of Vonway’s advanced trading infrastructure, providing a secure and efficient gateway into forex markets.

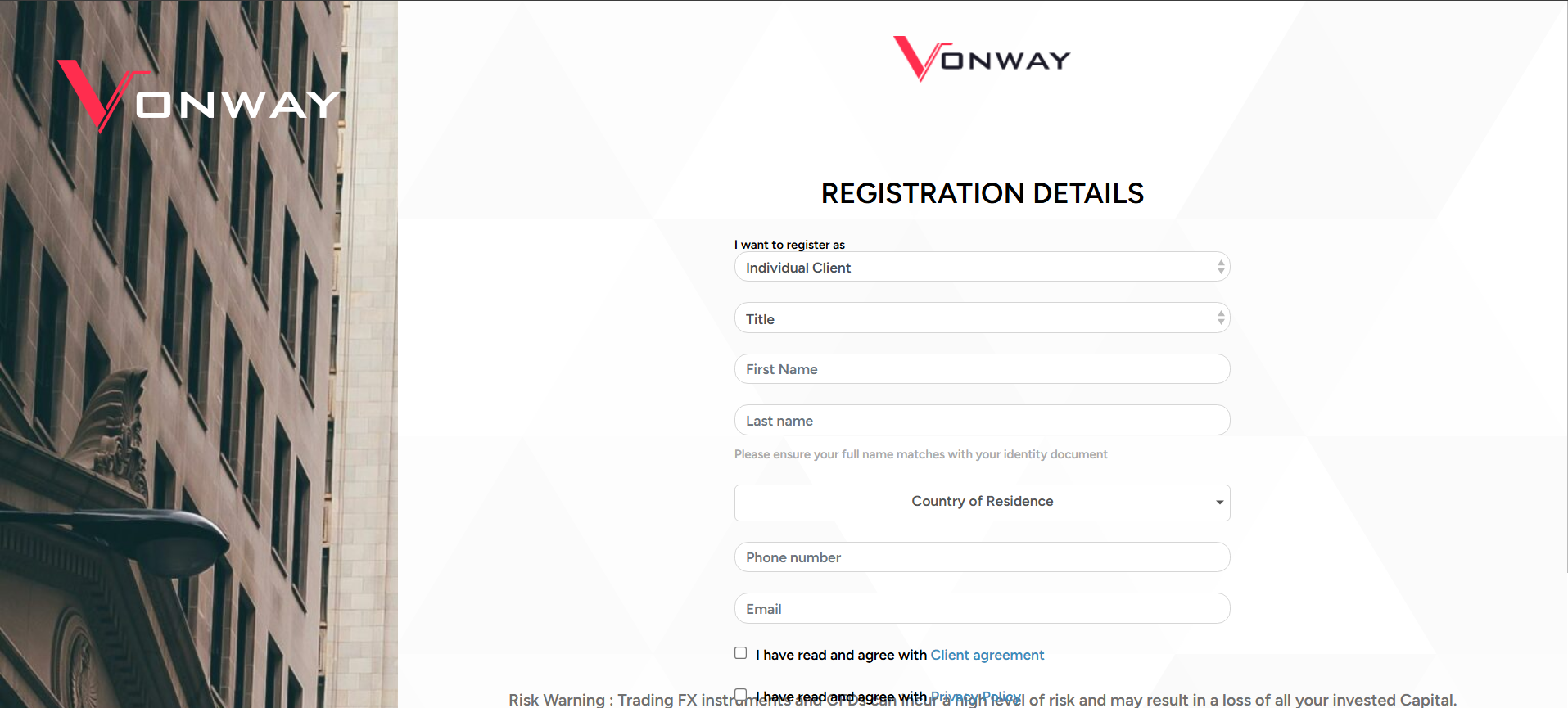

How to Open Your Account

Step 1: Visit Vonway’s Official Website

Go to Vonway’s official website and click on the “Open a Live Account” link to begin the registration process.

Step 2: Complete the Application Form

Fill out the online application form with your personal details. Ensure that all information is accurate to prevent delays in the approval process.

Step 3: Verify Your Identity

Upload a valid government-issued photo ID (passport or driver’s license) and a proof of address document (such as a utility bill or bank statement issued within the last three months). These documents are required to comply with KYC (Know Your Customer) regulations.

Step 4: Receive Your Login Details

Once your application and documents are reviewed and approved by Vonway’s accounts team, you will receive your trading account login details via email.

Step 5: Deposit Funds

Log in to your Client Area and deposit funds using one of Vonway’s 15+ flexible funding options, available in 10 different base currencies. Choose the payment method that best suits your needs.

Step 6: Start Trading

With funds in your account, you can access Vonway’s trading platform and start trading across a wide range of financial instruments. Make sure to explore the platform’s features to optimize your trading experience.

Vonway Trading Platforms

Vonway offers MetaTrader 4 (MT4) trading software, very popular and famous for its dependability and state-of-the-art features. This platform provides real-time data on the markets, technical indicators, and even automated trading systems, making it suitable for novice as well as experienced traders.

MT4 on Vonway provides fast trade execution, which enables traders to capitalize on price movements without delay. Customizable charts, multiple timeframes, and expert advisors are features that enable automated trading, thus making it easier for users to analyze trends and execute trades.

The traders can access the MT4 platform through desktop, web, and mobile. This means that it is easily accessible to manage trades anywhere. The mobile app for iOS and Android features real-time quotes, interactive charts, and full trading functionalities with access to markets that are secure and efficient.

What Can You Trade on Vonway

Forex

Trade major, minor, and exotic currency pairs with competitive spreads and leverage options. Forex trading on Vonway provides access to the global currency market, allowing traders to capitalize on currency fluctuations.

Indices

Engage in trading contracts for difference (CFDs) on major global stock indices. This enables traders to speculate on the performance of a group of stocks representing a specific market segment.

Stock

Access a selection of international company stocks through CFDs. This allows traders to take positions on individual company shares without owning the underlying asset.

Cryptocurrency

Trade popular cryptocurrencies like Bitcoin, Ethereum, and others. Vonway offers cryptocurrency trading through CFDs, enabling traders to speculate on digital currency price movements without holding the actual coins.

Commodities

Diversify your portfolio by trading commodities such as gold, silver, oil, and agricultural products. Commodity trading on Vonway allows exposure to the commodities market through CFDs.

Vonway Customer Support

Vonway offers 24/7 customer support to assist traders with their needs. Traders can reach out via live chat on the Vonway website, ensuring immediate assistance. Additionally, support is available through email at support@vonwayforex.com and by phone at +852 3615 1075. The support team is known for being responsive and professional, addressing issues promptly. Vonway’s commitment to accessible and efficient customer service enhances the overall trading experience.

Advantages and Disadvantages of Vonway Customer Support

Withdrawal Options and Fees

Vonway provides a wide range of withdrawal options to allow clients to easily access their funds. Traders can choose over 15 flexible methods, such as bank wire transfers, credit/debit cards, and many electronic payment systems. Please be aware that some withdrawal methods are restricted according to the client’s country of residence.

The broker cares about prompt processing, indicating the need to approve withdrawal requests within 24 hours. However, the withdrawals are only done during working days, not on weekends. Vonway takes serious anti-money laundering policies, indicating that the withdrawals shall be made through the same method as the deposit. This implies that the funds should be withdrawn from the same bank account, the same credit/debit card, or the digital wallet used in putting down deposits.

When considering fees, Vonway seeks to provide inexpensive transfers. Though a withdrawal fee for the broker has not been identified on the brokerage’s website, clients are referred to view applicable terms that specifically apply to each withdrawal option offered, since such third-party sites may incur fee charges.

Vonway Vs Other Brokers

#1. Vonway vs AvaTrade

Vonway and AvaTrade offer forex and CFD trading but are vastly different in major aspects. Vonway offers very high leverage, which can be up to 1:2000, but AvaTrade does not, only allowing up to 1:400 because it must adhere to the regulation. AvaTrade is also completely regulated through various authorities that allow for greater protection of the funds. Vonway is operating without major regulation. Both brokers offer MetaTrader 4, though AvaTrade has also added support for MetaTrader 5 and AvaOptions for greater flexibility. Vonway has spreads starting from 0.0 pips, but they charge a commission on raw accounts, while AvaTrade has more expensive fixed spreads with no commission. Withdrawal processing at Vonway is usually within 24 hours, but AvaTrade usually takes up to 5 business days depending on the withdrawal method.

Verdict: Vonway offers higher leverage and tighter spreads, which makes it a good choice for aggressive traders, but the lack of regulation does pose risks. AvaTrade offers better security and platform diversity, making it a more reliable choice for traders who prioritize fund protection.

#2. Vonway vs RoboForex

Vonway and RoboForex have similar offerings for trading in forex and CFD but differ on the most significant parameters. Vonway offers up to 1:2000 leverage, whereas RoboForex offers a maximum of 1:3000, thus appealing to those extreme leverage-seeking traders. The IFSC regulates RoboForex, giving more security to its clients, while Vonway is not covered under any significant regulatory oversight. Both brokers offer MetaTrader 4, but RoboForex also includes MetaTrader 5, cTrader, and R StocksTrader, giving users greater flexibility. Vonway’s spreads begin at 0.0 pips for raw accounts, whereas RoboForex provides narrow spreads with fees on ECN accounts. Vonway processes withdrawals more quickly, typically within 24 hours, whereas RoboForex withdrawal times vary by method and can take as long as 3 business days.

Verdict: Vonway provides quicker withdrawals and straightforward trading terms, appealing to traders looking for swift transactions. RoboForex, offering increased leverage and various platform selections, is more suitable for traders seeking a regulatory-compliant broker and a range of tools.

#3. Vonway vs Exness

Both Vonway and Exness provide forex and CFD trading services, but Exness boasts a more robust regulatory framework with CySEC, FCA, and FSCA, whereas Vonway functions without significant regulation. Leverage at Vonway goes up to 1:2000, while Exness offers unlimited leverage for specific account categories. Vonway and Exness both provide MetaTrader 4, while Exness additionally features MetaTrader 5, which includes more sophisticated trading tools. Vonway offers spreads that begin at 0.0 pips on raw accounts, akin to Exness, which similarly provides narrow spreads through commission-based accounts. Vonway processes withdrawals within 24 hours, while Exness provides instant withdrawals for certain methods, enhancing the efficiency of fund access.

Verdict: Vonway offers significant leverage and quick withdrawals, yet it lacks regulatory safeguards, increasing risk. Exness, due to its robust regulation and immediate withdrawal alternatives, is a superior option for traders who value security and easy access to liquidity.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH VONWAY MARKETS

Conclusion: Vonway Review

Vonway provides its clients with an enormous variety of financial instruments covering forex, indices, stocks, cryptocurrencies, and commodities. The broker offers competitive trading conditions, including tight spreads that start from 0.0 pips, as well as up to 1:2000 leverage. The client can select one of the following accounts to prefer trading, enjoying a multiple number of funding options in various base currencies. Additionally, Vonway supports the MetaTrader 4 platform, available across desktop, web, and mobile devices, ensuring flexibility and convenience for traders.

However, it’s worth mentioning that Vonway is not strictly regulated, and some traders might find this situation problematic for their funds’ safety. Even though the broker declares the quick withdrawal processing and has customer support working 24/7, prospective clients should pay much attention to the absence of regulation when they are choosing a trading partner.

Vonway Review: FAQs

Who is Vonway?

Vonway is one of the world’s leading Forex CFD provider. The company was incorporated with the vision of providing fair and transparent Forex trading to active traders. Vonway is dedicated to bringing solutions previously only available to professionals and large global investment banks to retail investors and traders around the world. For additional information about Vonway, please visit the About Us page.

What happens to my funds if the bank which holds my funds goes insolvent?

Vonway holds client money in segregated client trust accounts with a number of AA-rated Australian banks. We diversify the client money in segregated client trust accounts across multiple banks to reduce credit risk and counterparty exposure.

How does Vonway use my personal information?

We only collect personal information that is reasonably necessary to provide you with quality products or services, conduct identification checks to meet our legal regulatory obligations, and combat fraud. We do not sell your personal information to any third party for marketing purposes. Our privacy policy outlines how we handle our customer’s personal information in detail.

OPEN AN ACCOUNT NOW WITH VONWAY AND GET YOUR BONUS