VantageFX Review

Among the types of forex trading companies is the Straight Through Processing (STP). It is a forex brokerage company that serves institutional traders by forex trading and providing forex services wholesale. It facilitates the exchange of world choices – high-quality forex trading institutions and retail customer service. The STP broker provides a full spectrum of professionals that provides under one roof; analysis, investment, communication, and marketing services. One good example of an STP trading company is the Vantage FX.

The Vantage FX (Vantage Markets) is a Straight Through Processing (STP) broker that has been operational since 2009. Forex currency pairs can be found on the Vantage Markets website. A trader can find CFDs on European, American, and Australian indices, stocks, and commodities. The Vantage FX trading company is under the regulation of FCA in the UK, ASIC in Australia, VFSC in Vanuatu, and CIMA in the Cayman Islands. Since its operational commencement, the Vantage FX brokerage company has bagged eleven (11) prestigious awards.

The following article aims to draw a vivid picture of how the brokerage company works. Get to learn more about Vantage Markets, its services, the security features in place, and its customer service in general.

What is VantageFX?

VantageFx is a Standard Through Processing (STP) forex broker. It commenced its operations in 2009. The Vantage Fx Broker operates with different currencies such as CAD, USD, SGD, EUR, and AUD.

VantageFX is a regulated forex company – which means that the investor’s money is safe. It is regulated by several bodies, including they include Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, Vanuatu Financial Services Commission (VFSC) in Vanuatu, and Cayman Island Monetary Authority (CIMA) in the Cayman Islands.

VantageFx offers the client an option of three accounts to choose from. They range from the simplest for newbies to the most complex ones for experienced traders. It offers a practice account called a demo account without any restrictions. The trader can access different trading instruments that include 44 currency pairs, 226 CFDs on stocks, and 19 commodities.

Advantages and Disadvantages of Trading with VantageFX

Benefits of Trading with Vantage FX

There are quite several benefits associated with trading with Vantage Fx. One of these ways includes the provision of passive income. Vantage Markets give traders access to the long-term transaction with CFDs stock investments as well as currency pairs. Vantage Markets has partnered with three independent traders. They include DupliTrade, MyFxBook, and Zulu Trade. Autotrading is ideal for both experienced and novice traders.

VantageFx provides its clients with affiliate programs. It is a way of generating income through referrals to attract new customers. The affiliate program by Vantage Markets sees the member trader earn some dollars by inviting a new person into the site. The country from which the new trader is coming determines the amount of bonus to get paid. The affiliate program income ranges from $100 to a high of $600.

The other benefits of trading with VantageFx include a minimum of $200. The company offers the clients three accounts to choose from depending on the trader’s experience. The newbies who want to learn or are experienced and need to sharpen their skills can use the unrestricted demo account.

Further enough, Vantage Fx has a 24-hour service 5 days a week. this makes it reasonably the best responsive STO account. It has a minimum of $200 and a 1:500 leverage.

Vantage FX Pros and Cons

Pros

- It is regulated by reputable authorities

- Has an affiliate program for members

- Can be reached on different platforms

- Offers clients a variety of accounts to choose from with unrestricted upgrades

Cons

- It is only accessible 5 days a week

- Has limited platforms

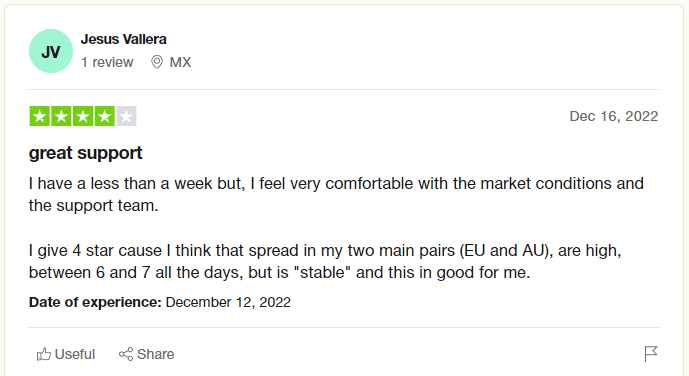

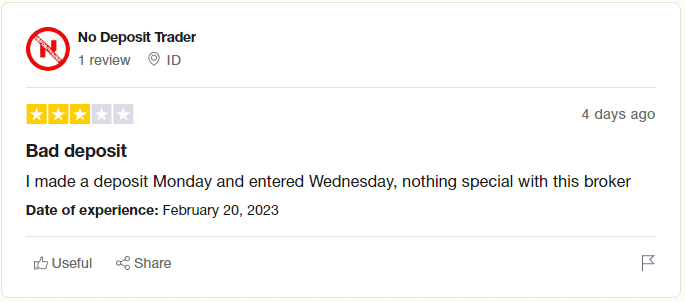

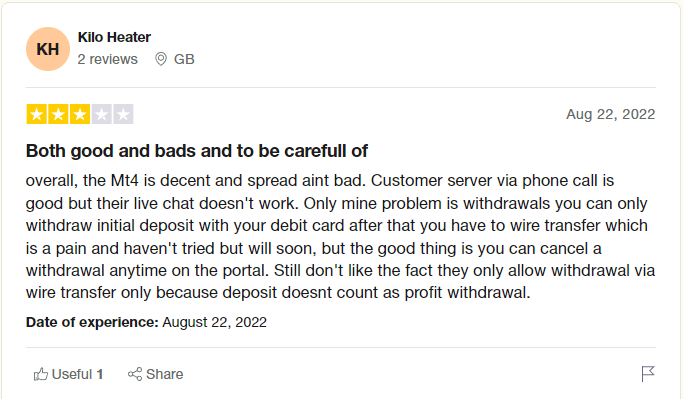

Vantage FX Customer Reviews

Customer reviews give traders an insight on how the broker is performing. From these reviews we can tell how efficient a broker is. Let’s look at the top VantageFx customer reviews:

From the first review the trader has joined the broker in a week and is already pleased with the market conditions and the support team. But, he does not give the broker a five stars cause he believes the spreads are too high in the following currencies; EU and AU. He goes ahead and says the broker is “stable” for him. This is an indication that despite the spreads he is somehow pleased by the broker.

The second broker is not pleased at all in terms of deposits. The trader complains on how he made a deposit only to reflect after two days. He declares that there’s nothing special about Vantage FX.

The last trader says the broker has both the good and bad side. He says that the MT4 platform and the spreads are not bad at all. The customer service is okay via phone calls but the live chat is completely down. The trader has had issues with the withdrawal method. He is not okay that he can only withdrawal his profit using the debit card. He is not okay that withdrawals have to be made through wire transfers. The only thing positive about withdrawals is that you can cancel them ant time.

Overall, in accordance to most customer reviews Vantage fx has both the advantages and disadvantages sides. Some are pleased with their services and others claim they’re not fully satisfied. It is up to you as a trader to try the broker and find out whether it meets your desirable qualities and needs.

Vantage FX Spreads, Fees, and Commissions

A spread is a difference between the Ask price and the bid price of a certain currency pair. Forex brokers vary in spreads offered. VantageFX offers very competitive spreads for certain currency pairs. For instance, while trading with XAU/USD trading pair, a trader enjoys spreads of 0.7 pips. In addition to it, it further gives a commission per lot. This makes it even more competitive in the trading market.

Fees are applied by the brokerage company as compensation for helping you facilitate trade on the platform. The trading fees are applied when you want to sell or buy a given investment. VantageFX offers adequate fees making the trade profitable for the trader.

From the older reviews, it is evident that traders are loving the VantageFX commissions. They offer the client a minimum commission of $5. The slow transfer rate is disappointing but the commission earned seems to leave clients feeling compensated. The commission is earned even from trading in currency pairs. This can be termed as a very encouraging part of trading with VantageFX.

Account Types

Vantage FX has several accounts for the trader to choose the most appropriate one for them. They have accounts that support newbies in trading to one that is suitable for experienced traders. All traders have access to the Trading platforms regardless of their account types. The different account types also offer the same leverage. Here is a list of the trading accounts available at Vantage FX where you can execute forex and cfd trading.

The Standard STP Account

This type of account is suitable for novice traders to trade forex who are looking for a simple with direct market access. It allows a minimum deposit of $200. It operates under mt4 and mt5 Other include WebTrader and Mobile app. This allows the forex trader to choose the suitable trading platform to use. The commission is charged in form of a spread, and the spread size starts at 1.4 pips when trading forex It has a wide variety of trading instruments that include 44 currency pairs, 16 Indices, 19 commodities, and 226 share CFDs.

Raw ECN account

Raw ECN account is a forex account that is ideal for experienced forex – traders looking for high liquidity and razor-sharp spreads. Raw ECN allows a min. deposit of $500. Raw ECN operates under mt4 and mt5. Other include WebTrader and Mobile app. This allows the forex trader to choose the suitable trading platform to use. There is a commission when trading forex Raw ECN has a wide variety of trading instruments that include 44 currency pairs, 16 Indices, 19 commodities, and 226 share CFDs.

Pro ECN account

The Pro ECN account is a forex account for professional traders. Traders with money managers are seeking high-volume trade. It allows a min. deposit of $20,000. It operates under MetaTrade 4 and MetaTrade 5. Other include WebTrader and Mobile app. Active traders on this account have access to pro trader tools. This allows the forex trader to choose the suitable trading platform to use. There is a commission when trading forex. It has a wide variety of trading instruments that include 44 currency pairs, 16 Indices, 19 commodities, and 226 share CFD trading.

VantageFX has a free demo account that is used by willing to learn the forex trading strategy. It can also help enhance a person’s trading experience.

How To Open Your Account?

Vantage FX has proven to be among the best STP trading company. The benefits offered are impressive. To be able to easily trade with them you required a account. Here are the steps to follow to get your Vantage FX account up and running.

The first step, visit their website and click on the live account tab that’s located at the top of the website’s main page.

Secondly, fill out the details as required by the form that appears there. The needed personal details include your name, your surname, the country you’re residing in, your phone number, your email address, and the account type – this can either be individual or company.

The next step is to provide the broker with some additional information about yourself. They include your date of birth and the type of identity card you possess. There will be several documents that you will be expected to upload for verification.

The broker will ask you to fill out your residential details. Here, one needs to specify their resident address, region, city, and postal code.

The broker asks about your financial status. Under this section, you need to indicate your employment status, your size of investment and savings, and your income margin.

The last part of your registration is setting up your trading account. Here you need to select a Trading terminal, account type, and currency base. The next step is to seek verification by uploading your Identification card and proof of residence. The last step is to learn and use trading tools such as Pro Trader Tools, Trading signals, and video guides to facilitate seamless trading.

What Can You Trade on VantageFX

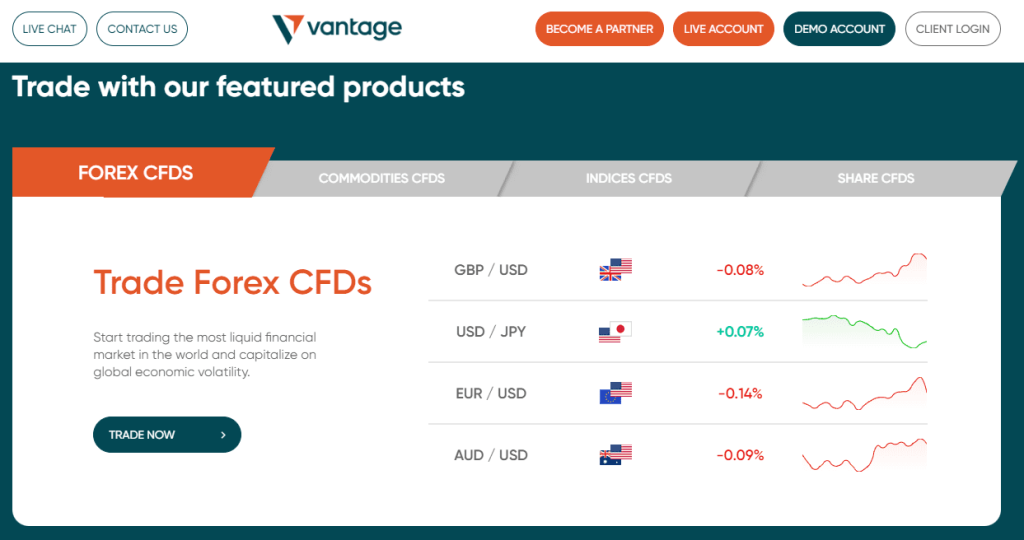

Vantage FX offers clients a broad range of trading instruments that include 44 currency pairs, 226 CFDs on stocks, and 19 commodities. Here is a brief breakdown of these trading instruments by Vantage FX.

Forex

Forex trading entails the exchange of international currencies. It is traded in pairs for instance EUR/USD. VantageFX offers their clients over 44 trading currency pairs.

Metals

Metals are a form of commodities trading that involves an exchange of metals. It is among the 19 commodities trading instruments provided by VantageFX for its clients.

CFDs

A contract for differences (CFDs) is very common in forex and commodities trading. It is a financial contract that pays the difference between the opening and the closing price after settlement. Vantage FX offers CDFs in its forex and commodities trading.

Indexes

When a trader trades a group of stocks that make an index, that is called index trading. It’s derived from the index, which means the value of a section of a stock market. This is among the Trading instruments in Vantage FX.

Stocks

Stock trading can also be referred to as equity or share trading. It allows the buyer owns a stake in a business by buying stocks, shares, or equity.

VantageFX Customer Support

Customer support is the basic unit when it comes to running a successful business. It acts as the link between the customers and the company. It allows the customers to reach out to the company if they have a challenge or need some calcifications done. Vantage FX has provided its clients with elaborate client support services.

A customer can reach Vantage FX by visiting their offices on the 4th Floor of The Harbor Center, 42 N Church St, George Town, Cayman Islands. Alternatively, a customer may reach out via the contact me page on their website.

They also have an email address that customers can write to them and raise their concerns. For instant one-on-one communication, a client can reach them via phone call and have them speak to a representative. Their customer service is available 24 hours on the 5 days working days.

Advantages and Disadvantages of Vantage FX Customer Support

Security for Investors

Vantage FX is regulated by different regulating bodies from different governments. They include FCA from the UK under license number 590299, ASIC from Australia under license number 428901, CIMA from the Cayman islands under license number 1384981, and VFSC from Vanuatu under license number 700291. Here are some advantages and disadvantages of Security for Investors

Withdrawal Options and Fees

The Vantage FX trading company allows withdrawals to be made through bank transfer and MasterCard or Visa cards. It takes 3 to 5 working days for funds to reflect on the bank account after withdrawing through a bank card transfer.

Withdrawals through bank transfers are processed the same day. The request must be done between Monday to Friday. It must also be filled between 0900hrs and 1900hrs AEST. Requesting that time frame pushes the order to the next day.

One thing to note, making a bank card withdrawal requires one to be the holder of the card. It can’t be transferred to a different card owner.

Vantage FX Vs Other Brokers

#1. VantageFX vs Avatrade

VantageFX supports trading platforms such as MT4, MT5, WebTrader, and Mobile Apps. Avatrade on the other hand supports some extra trading platforms such as Zulu Trader, Mirror Trader, AvaTrader, and AVA Options. It does not support the basic MT5 trading platform.

It has a minimum deposit of $200 which is higher compared to the $100 for Avatrade. It has a leveraged margin of between 1:1 and 1:500 while Avatrade has between 1:200 and 1:400. Its order execution is by market execution while Avatrade uses instant execution.

Similar to Avatrade, Vantage FX does not offer trust management nor does it do monthly interest payments.

#2. VantageFX vs Roboforex

VantageFX supports trading platforms such as MT4, MT5, WebTrader, and Mobile Apps. This is quite little compared to Roboforex which supports trading platforms such as MT5, MT4, cTrader, R StocksTrader, R MobileTrader, and R WebTrader.

It has a minimum deposit of $200 which is higher compared to Roboforex which has a minimum deposit of $10. It has a leveraged margin of between 1:1 and 1:500 while Roboforex has between 1:1 to 1:2000.

Its order execution is by market execution making it inferior compared to Roboforex which has both Market Execution and Instant Execution. They both do not offer trust management nor does it do monthly interest payments.

#3. VantageFX vs Alpari

Vantage FX supports trading platforms such as MT4, MT5, WebTrader, and Mobile Apps. Alpari on the other hand only supports the basic MT4 and MT5. It has a minimum deposit of $200 while the Alpari has one of $1.

It has a leveraged margin of between 1:1 and 1:500 while Alpari has between 1:1 and 1:3000. Its order execution is by market execution, unlike Alpari which uses both 5Market Execution, and Instant Execution.

A common similarity is that both do not offer trust management nor does it do monthly interest payments.

Conclusion: Vantage FX Review

VantageFX is an STP trading company that has over 10 years of experience after having been in the trading industry for over a decade. It offers clients a variety of trading instruments that include forex, stocks, commodities, indices, and CFDs just to mention a few.

VantageFX has different accounts that customers can choose from. They were made to suit the needs of different people with different needs in trading. It supports the basic trading platforms, the MT4, and MT5 making it ideal for all types of traders.

VantageFX Review FAQs

Is VantageFX legit?

Yes, VantageFX is legit. It is registered and regulated by reputable authorities in four different countries. The investor’s money under the company is kept in an AA-rated Australian bank.

What is VantageFX minimum deposit?

The minimum deposit for VantageFX is capped at an average of $200. It may vary depending on the account the customers choose. The ECN account has a minimum of $500 and a maximum of $20,000.

How long does VantageFX withdrawal take?

The bank transfer is instant – meaning it reflects on the same day. The bank card transfer takes a minimum of 3 working days and a maximum of 5 working days.