Valutrades Review

With an extensive reach that spans six continents and over 120 countries, Valutrades has emerged as a reliable provider of online trading in Forex, Commodities, and Index CFDs. Since its inception, this established firm has demonstrated a consistent commitment to offering high-quality services in the trading industry.

This comprehensive review delves deep into the strengths, weaknesses, and everything in between regarding Valutrades. By examining its feature set, commission structure, account types, transaction procedures, and beyond, we provide a holistic perspective, integrating expert evaluations and real trader experiences to aid in your decision-making process.

What is Valutrades?

Operating out of London, UK, Valutrades is a leading Forex and CFD trading provider, catering to a diverse clientele, from beginners to seasoned traders. With a spectrum of over 80 major, minor, and exotic Forex currency pairs, along with CFDs on Equity Index, Indices, and Commodities, Valutrades presents a plethora of trading options.

Powered by advanced ECN execution, the firm ensures swift, transparent trading. Furthermore, Valutrades provides fair trading conditions, encompassing free VPS, spreads from 0.0 pips, and negative balance protection, among other benefits. In addition to serving retail clients, the firm also fosters partnerships via affiliate programs, thereby providing lucrative opportunities for fund managers via the MAM program and more.

Advantages and Disadvantages of Trading with Valutrades?

Benefits of Trading with Valutrades

There are a multitude of advantages associated with trading through Valutrades that make it an appealing choice for traders of varying degrees of experience. A concise exploration of these benefits can offer a deeper understanding of Valutrades’ value proposition.

- Commendably Low Fees: One of the most significant advantages of trading with Valutrades is the broker’s exceptionally low commissions, beginning from zero. This potentially leads to maximized profit margins for traders and minimize losing money rapidly for beginners.

- Instantaneous Execution: Valutrades boasts of quick execution times. Thanks to their robust connection to data centers processing a vast amount of liquidity from prominent banks, trades are executed almost instantaneously. This ensures that you can make the most of market fluctuations and opportunities as they emerge.

- Variety in Deposit/Withdrawal Methods: Valutrades goes to great lengths to provide a broad array of deposit and withdrawal methods. This variety provides flexibility to traders worldwide, catering to their preferred modes of transaction. This ultimately results in a smooth and convenient funding process for trading accounts.

- Dependable Regulatory Framework: Valutrades is regulated by the Financial Conduct Authority (FCA) and Financial Services Authority Seychelles (FSAS). In addition to this, the firm offers insurance for clients’ funds and extends negative balance protection to all users. This provides an additional safety net to protect traders’ investments.

- Access to MetaTrader 4 and MetaTrader 5: Valutrades users can choose to trade via the desktop, online, or mobile versions of MetaTrader 4 and MetaTrader 5. These are some of the most popular, user-friendly, and algorithmic trading platforms globally, boasting extensive features, analytics tools, and the flexibility to accommodate any trading style.

- No Minimum Deposit Requirement: Valutrades stands out in its inclusivity and accessibility. The broker imposes no minimum deposit requirement, allowing traders to begin trading with just USD 1 in their account. This encourages individuals with diverse financial backgrounds to kickstart their trading journey without significant upfront investment.

Valutrades Pros and Cons

Pros:

- Valutrades features an economical fee structure that minimizes trading costs.

- The broker ensures prompt order fulfillment, providing quick execution of trades.

- Valutrades operates under robust regulatory compliance, overseen by the Financial Conduct Authority (FCA) and Financial Services Authority Seychelles (FSAS).

- Funds are protected by Financial Services Compensation Scheme and guaranteed negative balance protection.

- It offers aggressive trading costs and spreads, increasing the potential profitability for traders.

Cons:

- The broker provides a somewhat restricted range of trading instruments such as Forex trading, which may limit diversification options for traders.

- The lack of Percentage Allocation Management Module (PAMM) services might be a drawback for some traders seeking advanced portfolio management options.

- Valutrades does not offer 24/7 customer support, potentially leading to delayed resolution of queries during non-working hours.

- Some traders have reported challenges in obtaining expert support assistance, indicating room for improvement in customer service.

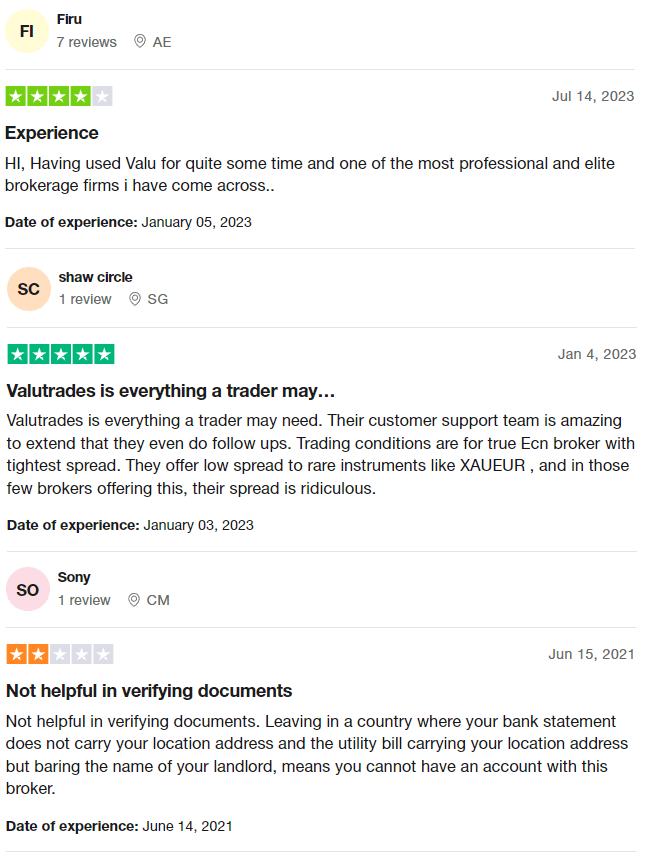

Valutrades Customer Reviews

Customers have lauded Valutrades for its professional conduct and elite status among brokerage firms. The firm’s customer support, offering regular follow-ups and catering to the needs of traders, has been highly praised. Its trading conditions, characterized by a true ECN broker with tight spreads, have been deemed exemplary by customers. However, some clients have expressed dissatisfaction with the document verification process, which has been seen as inconvenient for those who cannot provide certain kinds of proof of residence.

Valutrades Spreads, Fees, and Commissions

The fee structure at Valutrades is integrated into the spreads and commissions for the ECN account. Traders must be mindful of swap or rollover fees, which are applied when a position is open for more than a day. The firm boasts some of the industry’s tightest spreads, beginning as low as 0 pips, with the average spread for the major EUR-USD pair being a mere 0.1 pips.

The commission per lot begins at $3.0, dependent on the asset traded. There are no charges on deposits, and the full deposit amount is credited directly to the client’s trading account. Additionally, clients can enjoy three fee-free withdrawals each month, with subsequent withdrawals subjected to a 5% fee. However, retail investor accounts may face additional fees, depending on their selected payment system.

Account Types

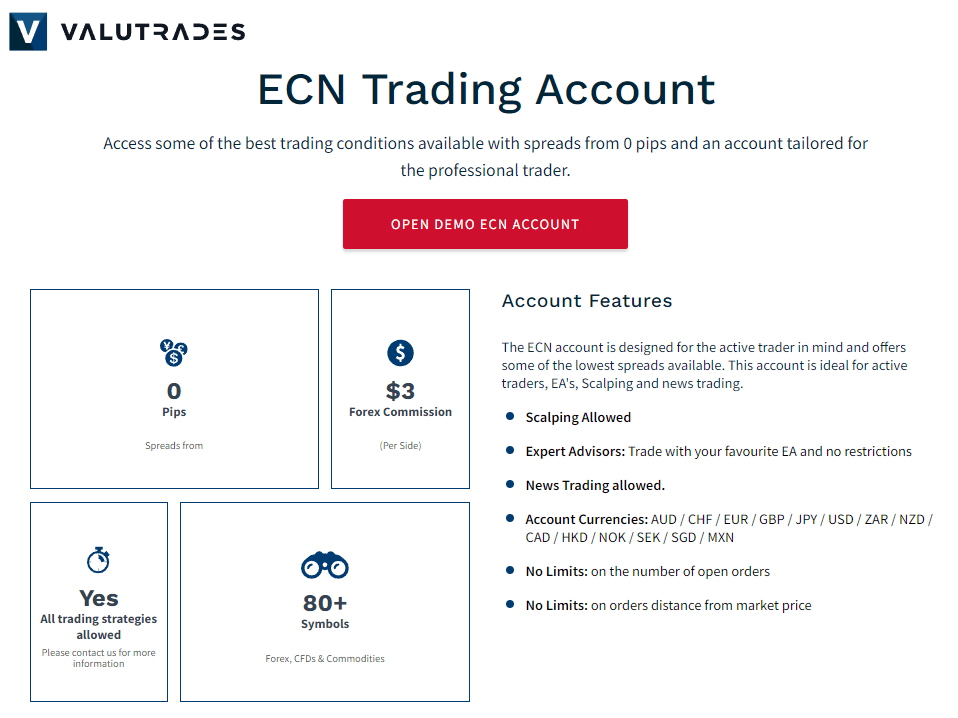

ECN Account

Valutrades’ primary offering is an ECN trading account, specially designed to deliver competitive spreads and commissions. This platform is attractive to both novice traders and experienced individuals, with a free Demo ECN Account allowing them to evaluate Valutrades’ platform without financial risks.

This account provides flexibility to cater to active traders and offers some of the market’s tightest spreads, making it an ideal choice for advisors, scalpers, and news traders. With no restrictions on the number of orders or the order price’s distance from the market price, traders are given complete flexibility.

Active traders executing large volumes can take advantage of free VPS, ensuring minimal trading latency. The maximum leverage for retail clients is 1:30, while professional traders can leverage up to 1:500.

How to Open Your Account

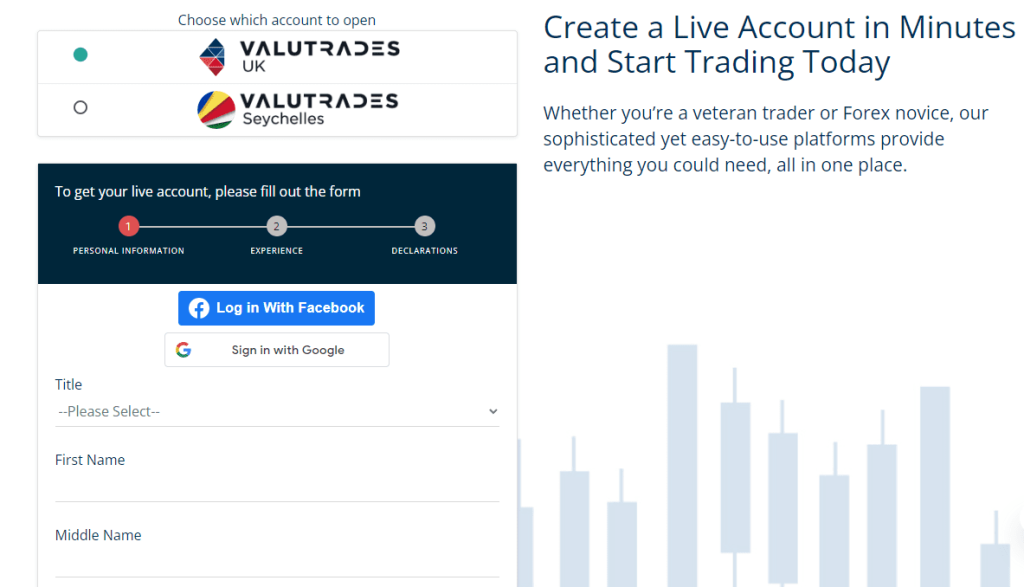

Opening an account with Valutrades is quite simple. Start by visiting the account opening or sign-in page on their website. Here are the steps:

- Click on the “Open Live Account” option.

- Fill in the required personal data such as name, email, phone number, and more.

- Verify your personal data by uploading relevant documents. These include proof of residence and a valid identification document.

- After activating your account and verifying your identity, deposit funds into your account to complete the setup process. Now, you are all set to begin trading.

What Can You Trade on Valutrades

Valutrades boasts an expansive selection of over 100 tradable instruments. This wide range cuts across various asset classes, including Forex, Commodities, and Contract for Difference (CFD). Whether a trader is interested in the volatility of forex markets, the stability of commodities, or the variety offered by CFDs, Valutrades has them covered. This broad selection enables traders to tailor their investment and trading strategies according to their risk appetite, market understanding, and investment goals. The broker’s extensive offering thus presents an opportunity for traders to diversify their portfolios effectively.

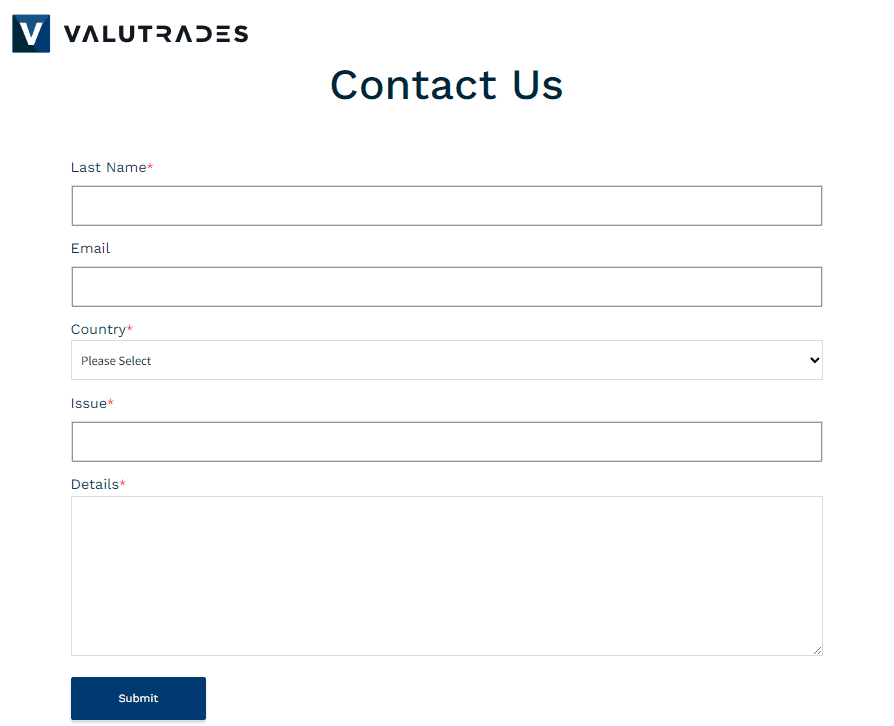

Valutrades Customer Support

Valutrades prioritizes exceptional customer support, offering services five days a week, 24 hours a day. The firm ensures prompt and convenient customer service through various channels like Live Chat and WhatsApp.

Other modes of communication include phone, email, and an online chat facility accessible on the website and within the Personal Account. There’s also a feedback form available for clients to share their experiences or any encountered issues. Remarkably, even prospective clients without an active Personal Account can access this support, emphasizing Valutrades’ commitment to transparency, accessibility, and customer satisfaction.

Advantages and Disadvantages of Valutrades Customer Support

Security for Investors

Withdrawal Options and Fees

The withdrawal procedures at Valutrades are designed to be as smooth and efficient as possible.

- All withdrawal applications are processed within a 24-hour window during the working week. The broker adds value to its services by offering three fee-free withdrawals each month. This feature significantly reduces the cost for active traders who may need to withdraw their earnings frequently.

- However, any subsequent withdrawals after the initial three in a month are subject to a 5% fee. This fee serves as an important consideration for those planning their trading and withdrawal strategy.

- In terms of the withdrawal method, Valutrades requires clients to use the same method for withdrawals as was used for deposits. If a particular method used for depositing funds is no longer available, clients must get in touch with the customer support team to resolve the issue.

- Before being able to deposit money into their account, traders must complete the verification process to ensure compliance with regulatory requirements. This helps maintain the integrity and security of the trading platform and protects all parties involved.

- It’s worth noting that while Valutrades does not enforce a minimum deposit limit, traders should be aware that certain payment providers may impose their own deposit requirements. Traders should check these details with their preferred payment provider to ensure a seamless trading experience.

Valutrades Vs Other Brokers

#1. Valutrades vs AvaTrade

Valutrades and AvaTrade both cater to a global clientele and offer a wide range of trading instruments. Valutrades boasts over 100 tradable symbols, while AvaTrade executes roughly two million transactions monthly across more than 1,250 financial instruments. AvaTrade surpasses Valutrades in terms of geographic reach, with presence in over 150 countries and four global locations.

In terms of regulation, both firms are heavily regulated to ensure client security, with Valutrades regulated by the FCA and AvaTrade being registered with multiple global jurisdictions. This offers a high level of trust and security for traders.

One key difference lies in the platforms they use; while Valutrades focuses on the MetaTrader platform (both MT4 and MT5), AvaTrade provides multiple platforms, including their own proprietary one, AvaTradeGo, along with MetaTrader 4 and 5.

Verdict: Given the larger range of financial instruments, more extensive geographic reach, and the provision of a proprietary platform, AvaTrade might have a slight edge over Valutrades for many traders.

#2. Valutrades vs RoboForex

RoboForex, like Valutrades, offers a wide selection of trading instruments. However, RoboForex provides over 12,000 trading options across eight asset classes, significantly more than Valutrades. Both brokers use the MetaTrader platform, but RoboForex also offers the cTrader and RTrader platforms, giving traders more options.

RoboForex also sets itself apart with its unique feature, ContestFX, where traders can compete in contests on demo accounts with winnings paid into real trading accounts. This feature can be particularly attractive to new traders looking to gain experience and potentially earn real money.

Verdict: RoboForex appears to have an advantage with its wider range of trading platforms, extensive trading options, and the unique ContestFX feature. These factors may make RoboForex a more attractive option for a large number of traders.

#3. Valutrades vs Exness

Exness, like Valutrades, offers trading in Forex, commodities, and CFDs. However, Exness provides a broader range of instruments, including CFDs for stocks, energy, metals, cryptocurrencies, and more than 120 currency pairings.

Exness also offers the possibility of earnings on small deposits due to its offering of unlimited leverage, a feature not found at Valutrades. Additionally, Exness offers a demo account that serves both as a training tool for new traders and a platform for experienced traders to test their strategies.

Verdict: For traders looking for a wider variety of trading instruments, the possibility of trading on small deposits with unlimited leverage, and a robust demo account, Exness may be the better choice.

Also Read: The 10 Best Forex Brokers in 2023 – By Asia Forex Mentor

Conclusion: Valutrades Review

In conclusion, Valutrades offers a secure and user-friendly trading platform for both beginner and experienced CFDs and Forex traders. With its low commission structure and spreads starting from zero, clients can maximize their profits. The quick execution of trades is facilitated by connections to data centers processing large flows of liquidity. Valutrades also offers a wide variety of deposit and withdrawal methods, with a reliable regulatory framework provided by the FCA. Furthermore, there is no requirement for a minimum deposit, which makes it easy for all levels of traders to have direct market access via their platform. However, it’s important to note the limitations such as the lack of 24/7 customer support and difficulty in getting qualified help from the support team.

Valutrades Review: FAQs

How diverse are the trading instruments available on Valutrades?

Valutrades provides over 100 tradable symbols across Forex, Commodities, and CFDs. This extensive range offers a comprehensive suite for traders to diversify their portfolio.

What is the minimum deposit required to start trading with Valutrades?

Valutrades does not stipulate a minimum deposit, making it accessible for all levels of traders. You can start trading with as little as USD 1 on your account. However, individual payment providers may have their own requirements.

How does Valutrades handle withdrawals and what are the associated fees?

Valutrades processes withdrawal applications within 24 hours of working time. Clients are entitled to three zero-fee withdrawals per month, and subsequent withdrawals are subject to a 5% fee. Withdrawals must be made using the same method as deposits. If that method is no longer available, clients must contact customer support.