US Dollar Struggles After Bullish Start

After a strong beginning to the week, the US Dollar Index reversed course on Thursday, wiping out its recent gains. Early Friday, the index continues its slide, moving closer to 101.00. Today, the focus shifts to Eurostat’s Industrial Production data for July and the US releases of the Export Price Index, Import Price Index, and the University of Michigan’s Consumer Sentiment Survey for September.

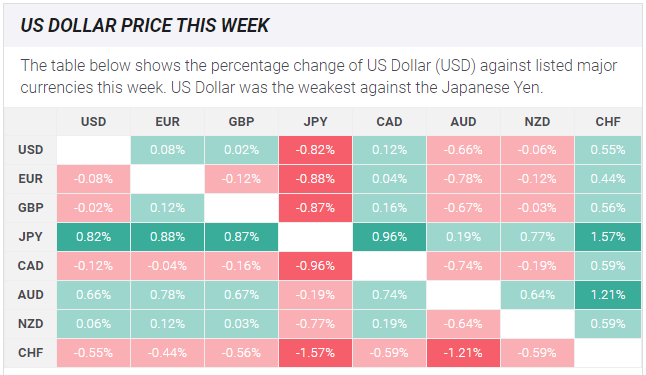

The table below highlights the percentage change of the US Dollar against major currencies this week. The USD has been weakest against the Japanese Yen.

Thursday’s Producer Price Index (PPI) data fell below expectations, with August’s 1.7% increase undershooting July’s 2.1% figure. This soft inflation data has increased market bets for a large rate cut by the Federal Reserve in the upcoming policy meeting. The weaker PPI, alongside improved risk sentiment, is pressuring the USD further. Early Friday, US stock futures remain flat while the 10-year Treasury yield holds at 3.65%.

Euro Boosted by ECB Rate Decision

GBP/USD capitalized on the weakening USD and risk-on sentiment, gaining over 0.6% on Thursday. The pair remains steady above 1.3100 during Friday’s European session. Fitch Ratings forecast the Bank of Japan will raise rates to 0.5% by 2024, 0.75% by 2025, and 1% by 2026. Following this report, USD/JPY dropped 0.5%, trading around 141.10.

The European Central Bank (ECB) cut its deposit facility rate by 25 basis points to 3.5% as expected. Despite refraining from indicating further policy easing, EUR/USD gained momentum and rebounded by more than 0.5%, snapping a four-day losing streak.

Gold surged on Thursday, reaching a new record high of $2,570 during Friday’s Asian session. Despite a slight retreat, XAU/USD continues to hold above $2,560, eyeing strong weekly gains.