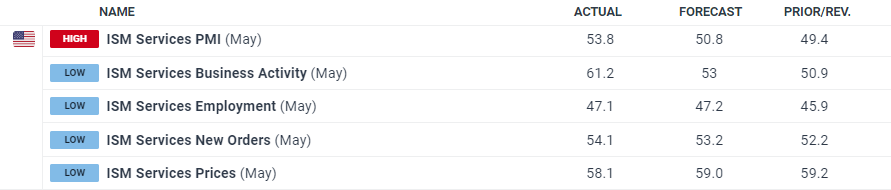

The latest ISM services report highlights a robust state of US business activity, surpassing both forecasts and the previous month’s readings.

Anthony Nieves, Chair of the Institute for Supply Management (ISM), notes, “May’s composite index rise was driven by notably higher business activity, accelerated orders, and slower supplier deliveries, despite ongoing employment contraction. Respondents reported increasing overall business, with growth varying across companies and industries. Challenges in employment persist, mainly due to difficulties in filling positions and managing labor costs. The majority cited inflation and current interest rates as barriers to improved business conditions.”

Following the ISM report, the US dollar witnessed a slight uptick, curbing recent losses. The dollar index had retreated after reaching a two-week high last Thursday, influenced by marginally better-than-expected US inflation figures and disappointing Chicago PMI and employment data earlier this week.

Tuesday, June 4

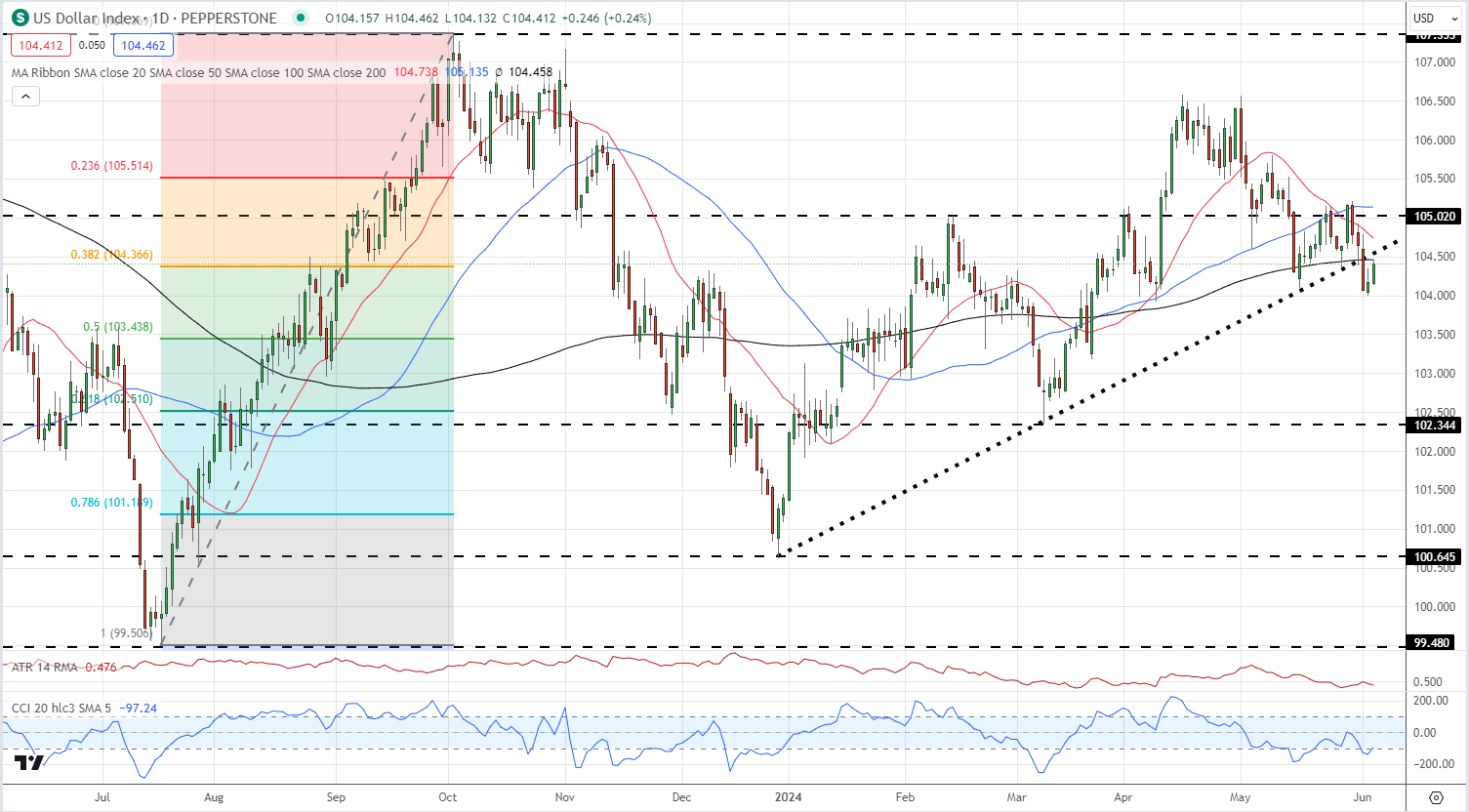

US Dollar Index Daily Chart

The sell-off nudged the US dollar index below its three simple moving averages, disrupting a multi-month pattern of higher lows. Currently, the 200-day SMA, recent uptrend, and the 38.2% Fibonacci retracement level pose near-term resistance.

This Friday’s US Jobs Report (NFP) now stands as a critical indicator, with potential weaknesses in the job market likely to press the dollar lower. Dollar traders should also pay attention to tomorrow’s ECB policy decision, where President Lagarde is anticipated to announce a 25 basis point cut.

Any indication of a further rate cut in July could weaken the Euro, consequently bolstering the dollar index, which heavily weights the Euro at 58%.