Oil Prices Retrace Gains

Crude oil prices dipped slightly in Europe on Thursday, giving back some gains made earlier in the week. These gains were driven by hopes that OPEC and its allies will maintain current, voluntary production cuts at their policy meeting on Sunday. The impending start of the US summer driving season has also boosted expectations for increased gasoline demand.

Figures from the American Petroleum Institute showed that crude stockpiles were down by 6.59 million barrels in the week ending May 24. The market’s focus now shifts to the Energy Information Administration’s inventory snapshot, due later on Thursday.

Middle East Tensions and Oil Prices

Israel’s strikes on the Palestinian city of Rafah have kept Middle East conflict in the spotlight, with the US West Texas Intermediate oil benchmark and the global Brent market both up by more than 1% this week.

Despite solid fundamental support, the energy market remains uncertain about when US interest rates might start to fall and how many cuts could follow. While economic resilience keeping rates high isn’t necessarily bad for oil demand, oil bulls prefer when central banks are in stimulus mode.

Futures markets currently predict that US interest rates will start falling in September, with European rates potentially coming down sooner. However, these forecasts depend heavily on inflation data, making upcoming numbers critical for all markets. The next major release is the US Personal Income and Expenditure series on Friday. After that, all eyes will turn to OPEC.

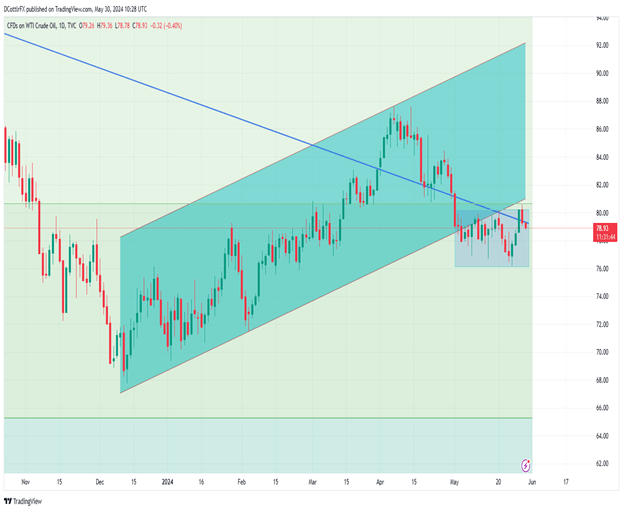

Price Movements and Trading Range

After breaking below their uptrend channel from mid-December at the start of May, oil prices have largely traded sideways within a narrow range of $80.18 to $76.23 per barrel, with the latter marking a two-month low. These levels have been tested infrequently, and the usual trading range has been even narrower.

This week, bulls tried to push past the range top on Tuesday but failed. The month is likely to close with the established band still in place, reflecting the fundamental uncertainty over demand and monetary prospects.

The market is now hovering around support from its long-term downtrend line from June 22, which is at $79.35, with resistance at the retracement level of $80.68.