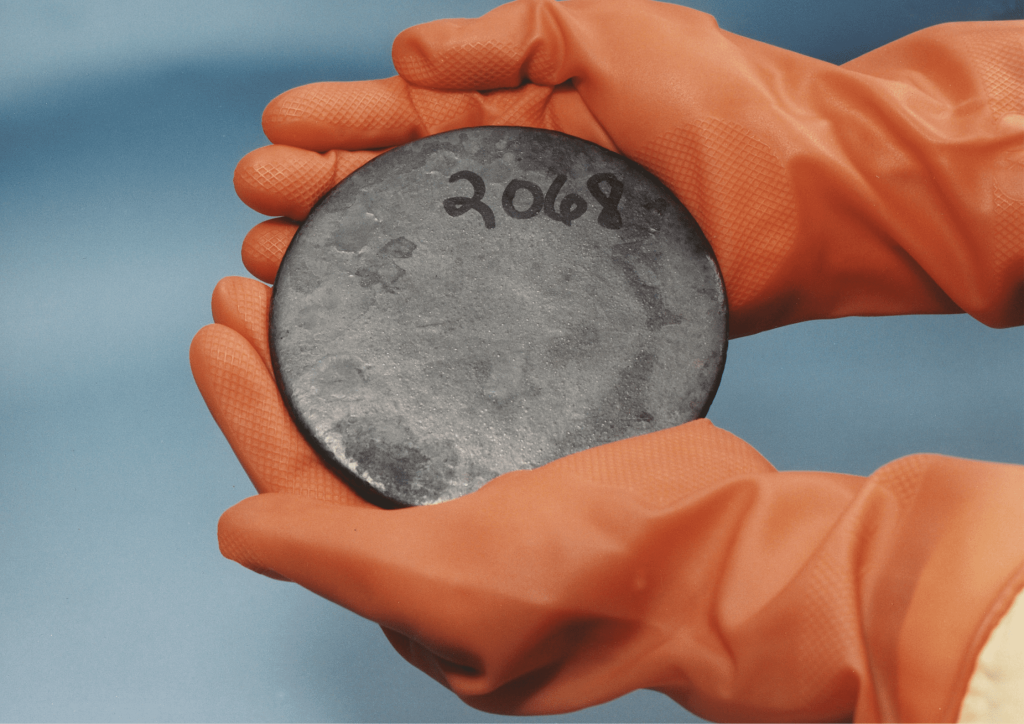

This guide will dive deep into the complexities of the uranium industry, discussing everything from uranium mining to energy fuels and prices, and how you can take advantage of the surging uranium market. Uranium, a heavy metal that is denser than lead, is a critical component in nuclear energy production. The uranium industry encompasses an extensive network of operations, including exploration, mining, milling, refining, conversion, and fabrication of fuel for nuclear reactors. Understanding the uranium industry begins with the exploration and mining process. The discovery of uranium deposits is a costly and time-consuming process, requiring significant investments in geophysical surveys and exploratory drilling. Once a deposit is found and deemed commercially viable, mining begins. Uranium is extracted through traditional mining techniques or through in-situ leaching, where a chemical solution is used to dissolve and extract the uranium directly from the ground. After the uranium is mined, it goes through a series of processing steps to produce nuclear fuel. First, it is milled and refined to extract uranium oxide, commonly referred to as yellowcake. The yellowcake then undergoes conversion into uranium hexafluoride, which is enriched to increase the concentration of the uranium-235 isotope. This enriched uranium is then fabricated into fuel assemblies, which are used in nuclear reactors. As a potential investor, it's essential to understand the complexities and the capital-intensive nature of the uranium industry. It's also crucial to be aware of the industry's regulatory environment, as uranium is a sensitive material with potential nuclear weapon applications. Uranium companies often face stringent regulations that can impact operations and costs. Uranium plays a pivotal role in the global energy sector as the primary fuel for nuclear power plants. These power plants currently generate approximately 10% of the world's electricity, making uranium a critical commodity. Nuclear power offers several advantages over other energy sources. Firstly, it's capable of producing a large amount of electricity from a small amount of uranium. This makes nuclear power a reliable and space-efficient energy source, capable of providing baseload power. Secondly, nuclear power is a low-carbon energy source. Unlike fossil fuels, nuclear power does not produce greenhouse gases during operation, making it a cleaner alternative. Given the increasing focus on climate change and the transition towards sustainable energy, nuclear power – and by extension, uranium – will likely play a crucial role in the future energy mix. As an investor, the role of uranium in the energy sector offers both opportunities and challenges. The demand for nuclear power and uranium can fluctuate based on global energy policies, technological advancements in renewable energy, and public opinion regarding nuclear safety. Also Read: Best Renewable Energy Stock Investing in uranium stocks offers exposure to the uranium industry and the broader energy sector. Investors can choose to invest in companies at various stages of the uranium supply chain, including exploration companies, mining companies, and those involved in refining and conversion. When selecting a uranium stock, it's important to evaluate the company's financial health, production capabilities, and growth prospects. Also, consider the company's mining operations, the quality of its uranium reserves, and its cost of production. A company with high-quality reserves and low production costs will be better positioned to profit from increasing uranium prices. An alternative or complement to investing in individual uranium stocks is investing in uranium ETFs, such as the Global X Uranium ETF. ETFs offer several advantages for investors, including diversification, liquidity, and simplicity. A uranium ETF holds a basket of uranium-related stocks, providing exposure to the entire uranium industry rather than a single company. Investing in a uranium ETF can mitigate some of the risks associated with individual stocks, such as company-specific risks or the volatility of uranium prices. Additionally, ETFs are traded on exchanges like regular stocks, offering liquidity and ease of access for investors. Also Read: What Are Space Stocks? Dividends represent the portion of a company's earnings that are distributed back to shareholders. The dividend yield is a financial ratio that indicates the percentage of a company's market price returned to shareholders in the form of annual dividends. It is calculated by dividing the annual dividends per share by the company's price per share. Investing in uranium stocks that provide dividends can be a viable strategy for generating income, especially during market downturns. However, it's essential to remember that not all companies in the uranium industry pay dividends. Many might choose to reinvest their earnings back into the business for research, exploration, and the expansion of mining operations. A high dividend yield can be attractive, but it's important to dig deeper. A high yield could be the result of a significantly reduced stock price due to the company's financial difficulties. Therefore, it's critical to investigate the company's financial health, payout ratio (the percentage of earnings paid out as dividends), and the consistency of its dividend payments over the years. Investing in uranium stocks requires careful consideration of several factors. Here are some of the key points to consider before you decide to buy: 1. Demand and Supply of Uranium: The global demand for uranium largely depends on the number of operational nuclear reactors and the pace of new constructions. On the supply side, the volume of uranium production and the size of global uranium reserves can affect prices. An increase in demand or a decrease in supply can result in higher uranium prices, positively impacting uranium stocks. 2. Uranium Prices: Uranium prices can be quite volatile, influenced by changes in supply and demand, global energy policies, and geopolitical events. Monitoring uranium price trends can provide insights into potential future price movements. 3. Geopolitical Risks: Geopolitical risks can significantly impact uranium companies. For example, regulatory changes, trade restrictions, or political instability in countries that are major uranium producers or consumers can influence the uranium market. 4. Company Fundamentals: Before investing in a specific uranium company, review the company's financials, operations, management, and growth strategy. A company with strong fundamentals is more likely to withstand market volatility and generate long-term returns. When assessing uranium companies and stocks, you need to examine both macro and micro-level factors. On the macro level, consider the overall state of the uranium industry and the global economic environment. A positive industry outlook, coupled with stable economic conditions, is generally favorable for uranium companies. Additionally, consider the role of global politics and how it might affect uranium supply and demand. On the micro level, evaluate the specific uranium company you are considering. Examine the company's financial health, using indicators such as debt levels, cash flow, and profitability. A company with a strong financial position is better equipped to navigate industry challenges and take advantage of growth opportunities. Also, consider the company's operations. Look at the quality and size of their uranium reserves, the efficiency of their production processes, and their compliance with environmental and safety regulations. A company with large, high-quality reserves and efficient operations is typically a safer bet. Finally, assess the company's management team and its strategy. Good management can make a significant difference in a company's success, and a clear, realistic strategy can provide a roadmap for future growth. The uranium market is inherently global, given the widespread use of nuclear energy and the diverse locations of uranium deposits. As a result, global politics significantly impact the uranium market, shaping both demand and supply dynamics. On the demand side, countries' energy policies are a key determinant. Government decisions to build new nuclear power plants or phase out existing ones directly affect the need for uranium. For instance, a commitment to nuclear energy, as we've seen in countries like China and India, can stimulate the uranium market. Conversely, decisions to move away from nuclear power, such as Germany's post-Fukushima policy, can depress demand. Supply-side dynamics are also subject to political influence. Uranium mining and production are often subject to regulatory oversight and environmental guidelines, which can vary greatly from one jurisdiction to another. Regulatory changes can alter the pace and cost of uranium extraction, thus impacting supply. Moreover, geopolitical tensions can affect uranium exports and imports, and in extreme cases, may even lead to trade restrictions or sanctions, disrupting the global supply chain. Therefore, an understanding of global politics is vital for anyone investing in the uranium market. It's important to monitor international relations, energy policies, and political stability in key uranium-producing and consuming countries. Investing in uranium stocks is not without its risks, some of which are unique to the uranium industry. Here are some key risks to consider: 1. Price Volatility: The uranium market is known for its price volatility. Fluctuations in uranium prices can dramatically affect the profitability of uranium companies and, subsequently, the value of their stocks. This volatility can be driven by changes in supply and demand, global energy policies, and other macroeconomic factors. 2. Regulatory Risks: As a critical component in nuclear energy and potential nuclear weaponry, the uranium industry is heavily regulated. Changes in regulations or policy shifts can impact uranium companies' operations, costs, and market access. 3. Environmental Risks: Uranium mining and processing have environmental implications, including potential radiation exposure and the generation of radioactive waste. Stricter environmental regulations or a significant environmental incident could increase costs for uranium companies or even halt operations. 4. Geopolitical Risks: Geopolitical issues, such as political instability in uranium-producing countries or trade restrictions, can disrupt the uranium supply chain and impact uranium prices. Given these risks, potential investors should carefully consider their risk tolerance and investment goals. It's also important to diversify investments to mitigate these risks. The future of the uranium industry is closely tied to the future of nuclear energy. As the world grapples with the dual challenges of meeting growing energy demands and reducing carbon emissions, nuclear energy stands as a potential solution, given its high energy density and low carbon footprint. Several factors suggest a positive outlook for the uranium industry. Many countries, particularly in Asia, are expanding their nuclear energy capabilities to meet rising electricity demand and climate goals. This expansion is likely to drive demand for uranium. Furthermore, the advent of small modular reactors (SMRs) and advanced reactor designs could broaden the applications of nuclear energy, potentially boosting uranium consumption. However, there are also challenges ahead. Public opinion on nuclear energy is mixed, with concerns about nuclear safety and the disposal of radioactive waste. The growth of renewable energy technologies, such as solar and wind, also presents competition. Investors in the uranium industry should keep a close eye on these trends, as they will shape the industry's future landscape. A prudent investment strategy would take into account both the potential opportunities and challenges in this dynamic sector. Also Read: Best Commodity ETF Investing in uranium stocks offers an intriguing proposition, particularly given the increasing global demand for cleaner, sustainable energy sources. With nuclear power standing as a significant player in this area, the demand for uranium, the fuel for nuclear energy, is set to rise. However, navigating the uranium market requires a deep understanding of the dynamics at play, from uranium mining and production to the role of nuclear energy and the factors that drive uranium prices. It's also important to evaluate uranium companies thoroughly, understand the impact of global politics on the uranium market, and be aware of the associated risks. While the potential for higher returns is undeniable, it's crucial to remember that the uranium market, like all investments, can be volatile and unpredictable. Therefore, potential investors should consider consulting with a financial advisor or conducting thorough research before venturing into uranium stocks. Yes, investing in uranium stocks can be an effective way to diversify your portfolio, especially if you're interested in gaining exposure to the energy sector. Uranium stocks often perform differently than stocks in other sectors, which can help to balance out portfolio performance. However, like all investments, uranium stocks come with their own set of risks, including price volatility, regulatory changes, and geopolitical issues. It's always recommended to conduct thorough research before making an investment and to diversify your holdings across different sectors and asset classes. Uranium prices can be tracked through various financial news platforms and commodity market websites, which provide updates on uranium prices along with relevant market news. It's important to note that uranium is not traded on a traditional commodity exchange but instead is sold through long-term contracts between producers and utilities, as well as on the spot market. The Ux Consulting Company (UxC) and TradeTech are two widely referenced sources of uranium price information. Uranium, as the primary fuel for nuclear power, plays a significant role in clean energy production. Nuclear power is a low-carbon energy source, capable of generating substantial amounts of electricity without releasing greenhouse gases. By investing in uranium, you're supporting the companies that produce the fuel for nuclear power. However, it's also worth considering the environmental impacts of uranium mining and the challenge of nuclear waste disposal. It's essential to invest in responsible companies that adhere to high environmental and safety standards.What You Need to Know in the Uranium Industry

The Role of Uranium in the Energy Sector

Why Invest in Uranium Stocks and ETFs?

Dividend Yield and Uranium Stocks

Buying Uranium Stocks: Key Factors to Consider

Evaluate Uranium Companies and Stocks First

The Role of Global Politics in the Uranium Market

The Risks of Investing in Uranium Stocks

The Future of the Uranium Industry

Conclusion

FAQs

Is investing in uranium stocks a good way to diversify my portfolio?

How can I track uranium prices?

Can investing in uranium help support clean energy?

This is Why the Real Move Begins After Bitcoin Clears 120K

Bitcoin just went over $120,000, and it didn’t even blink. After Bitcoin traded sideways near $100K for months, the original cryptocurrency finally got rid of the rust and ran away. This rally isn’t just a normal hype-fueled pump; it’s clean, consistent, and remarkably mature. What’s changed? From “Is It Dead?”