Position in Rating | Overall Rating | Trading Terminals |

36th  | 4.3 Overall Rating |

Ultima Markets Review

Choosing the right Forex broker is crucial for any trader, whether you’re a beginner or an experienced professional. Forex brokers act as intermediaries, facilitating trades between buyers and sellers in the currency market. The right broker can provide you with essential tools, resources, and security to succeed in the volatile world of Forex trading.

Ultima Markets stands out in the crowded Forex brokerage market with its commitment to providing a seamless trading experience. They offer a range of account options and user-friendly platforms, making it easier for traders to find the best fit for their needs. Ultima Markets also prides itself on excellent customer support and a transparent fee structure, ensuring traders can focus on their strategies without worrying about hidden costs.

In this detailed review, I aim to provide an exhaustive evaluation of Ultima Markets, emphasizing its unique selling propositions and potential drawbacks. My objective is to supply you with essential insights about the broker, such as the various account options available, deposit and withdrawal processes, commission structures, and other crucial details. My balanced perspective combines expert analysis and actual trader experiences to equip you with the necessary information to make an informed decision about considering Ultima Markets as your preferred brokerage service provider.

What is Ultima Markets?

Ultima Markets is a reputable CFD broker that offers a diverse range of trading options across various asset classes. They provide access to over 75 forex currency pairs, commodities, stocks, indices, and cryptocurrencies through the popular MetaTrader 4 platform, available on PC, web, and mobile versions. Established in 2016 and regulated by the Financial Services Commission (FSC) in Mauritius, Ultima Markets ensures a secure trading environment by keeping client funds in segregated bank accounts, enhancing the safety of your investments.

Trading with Ultima Markets offers several advantages, including high leverage of up to 1:2000, which allows traders to control larger positions with a smaller amount of capital. The broker provides a variety of account types to cater to different trading needs, such as Standard, ECN, and Cent accounts, each designed to suit different levels of trading experience and strategies. Additionally, the minimum deposit requirements are low, starting at just $20 for a Cent account, making it accessible for beginners.

Benefits of Trading with Ultima Markets

Trading with Ultima Markets has provided me with several key benefits that enhance my overall trading experience. One of the main advantages is the high leverage of up to 1:2000, which allows me to control larger positions with a smaller amount of capital. This flexibility can significantly amplify potential profits, although it’s important to manage the risks associated with high leverage.

The variety of trading instruments available is another benefit I’ve experienced with Ultima Markets. They offer a wide range of assets including forex, commodities, indices, shares CFDs, and cryptocurrencies. This diversity enables me to diversify my trading portfolio and take advantage of different market opportunities, which is crucial for a balanced trading strategy.

Additionally, Ultima Markets provides a user-friendly trading environment with the MetaTrader 4 platform and a dedicated mobile app. These platforms offer robust features, including advanced charting tools and automated trading capabilities, which help me execute trades efficiently and effectively. The seamless integration of these platforms ensures that I can trade from anywhere, whether I’m at home or on the go.

Ultima Markets Regulation and Safety

Trading with Ultima Markets has given me firsthand experience with their regulatory and safety measures, which are crucial for any trader to understand. Ultima Markets is regulated by the Financial Services Commission (FSC) of Mauritius, which offers a reasonable level of oversight, though it’s not as stringent as some other regulators. However, being regulated means that Ultima Markets adheres to certain standards that help protect traders’ interests.

One of the key safety measures Ultima Markets implements is the segregation of client funds. This means that the money you deposit is kept separate from the broker’s operating funds, reducing the risk of your money being used for the broker’s expenses. Additionally, Ultima Markets is a member of the Financial Commission, which provides a compensation fund of up to €20,000 per client in case of disputes, adding another layer of security for traders.

Furthermore, Ultima Markets has partnered with Willis Towers Watson (WTW), offering comprehensive insurance coverage up to $1,000,000 per account. This insurance is automatically applied to all accounts at no extra cost, ensuring that your funds are protected if the broker faces financial difficulties. Understanding these safety features is essential because it allows you to trade with confidence, knowing that your investments are safeguarded against various risks.

Ultima Markets Pros and Cons

Pros

- High leverage options

- Multiple account types

- Low minimum deposit

- Commission-free trading

- Robust trading platforms

- Diverse asset offerings

Cons

- High commission fees

- Not regulated by top-tier authorities

- Slow withdrawal times

- Limited educational resources

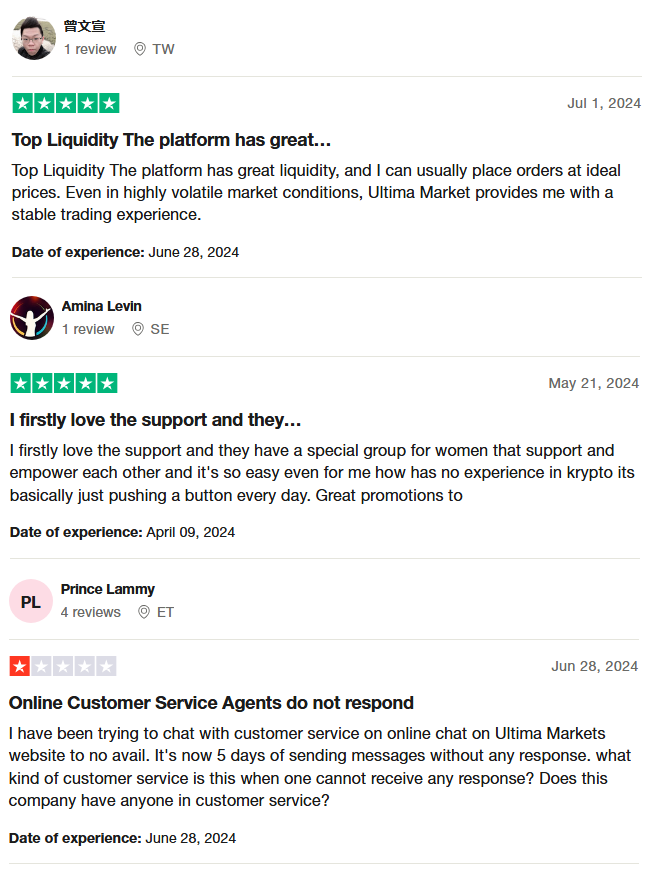

Ultima Markets Customer Reviews

Customers have mixed reviews about Ultima Markets. Many users praise the platform for its top liquidity and stable trading experience even in volatile market conditions. Additionally, the broker’s support for women traders and great promotions has garnered positive feedback. However, there are complaints about poor customer service, with some users reporting delays in responses from the online chat support. This balance of strengths and weaknesses highlights the varied experiences of traders with Ultima Markets.

Ultima Markets Spreads, Fees, and Commissions

Trading with Ultima Markets has provided me with clear insights into their spreads, fees, and commissions, which are essential factors for any trader. On a Standard account, spreads start from 1 pip, and there are no additional commissions, making it a cost-effective option for those who prefer a straightforward fee structure. This can be advantageous for traders who do not engage in high-frequency trading and appreciate a transparent fee system.

For those using the ECN account, Ultima Markets charges a $5 commission per lot with spreads starting from 0 pips. This setup benefits active traders, including scalpers and high-frequency traders, who need tight spreads and can manage the commission costs effectively. The Pro ECN account offers even more competitive conditions with zero spread markups and a $3 commission per lot, but it requires a significant initial deposit of $20,000, making it suitable for professional traders.

In addition to trading costs, it’s noteworthy that Ultima Markets does not charge inactivity fees or withdrawal fees, which adds to its appeal by reducing non-trading costs. This is particularly beneficial for traders who may not trade frequently but still want to maintain their accounts without incurring extra charges.

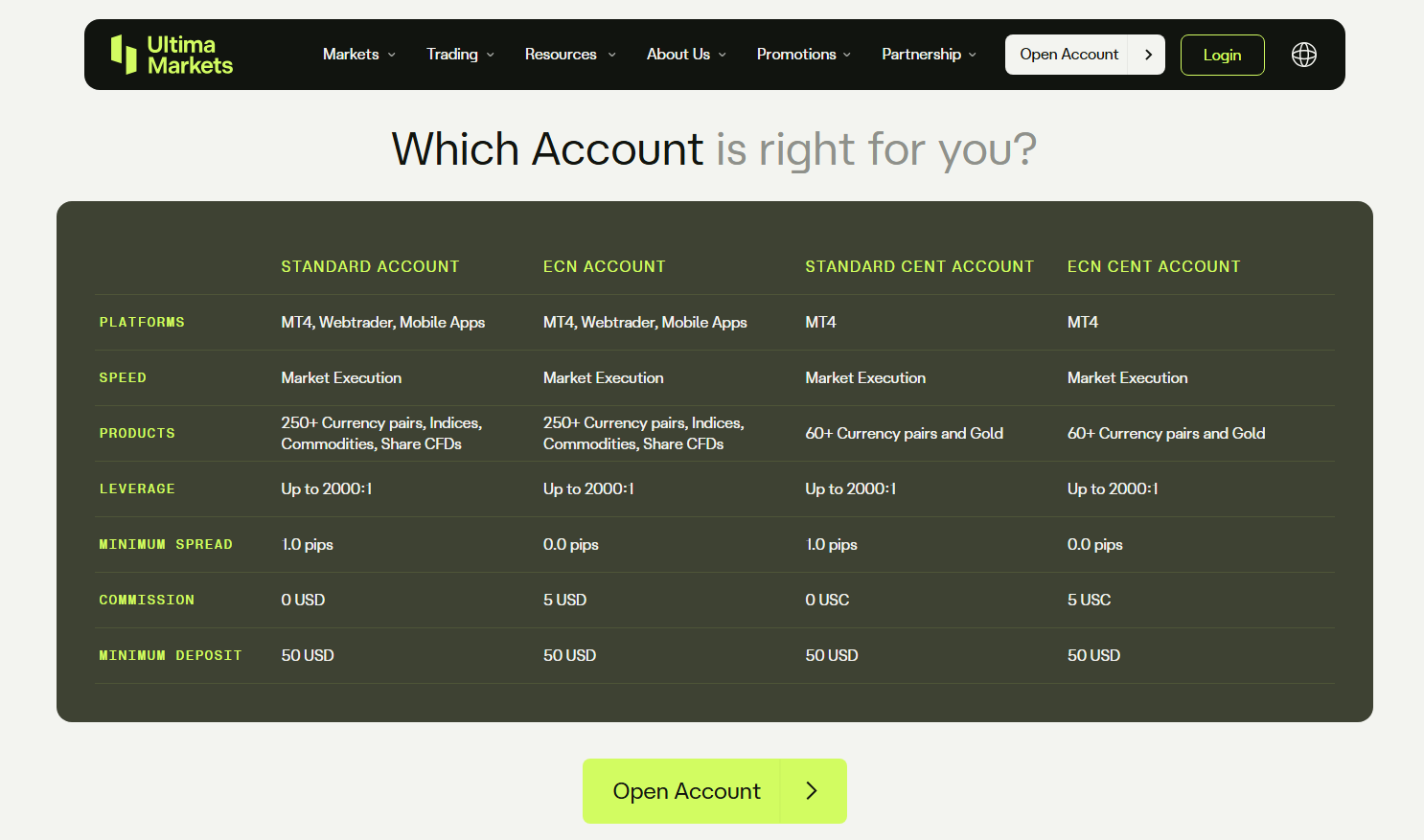

Account Types

When trading with Ultima Markets, I found that they offer a variety of account types to suit different trading needs. Here’s a breakdown of the available accounts:

Standard Account

- Platforms: MT4, Webtrader, Mobile Apps

- Products: 250+ Currency pairs, Indices, Commodities, Share CFDs

- Leverage: Up to 2000:1

- Minimum Spread: 1.0 pips

- Commission: 0 USD

- Minimum Deposit: 50 USD

ECN Account

- Platforms: MT4, Webtrader, Mobile Apps

- Products: 250+ Currency pairs, Indices, Commodities, Share CFDs

- Leverage: Up to 2000:1

- Minimum Spread: 0.0 pips

- Commission: 5 USD

- Minimum Deposit: 50 USD

Standard Cent Account

- Platforms: MT4

- Products: 60+ Currency pairs and Gold

- Leverage: Up to 2000:1

- Minimum Spread: 1.0 pips

- Commission: 0 USC

- Minimum Deposit: 50 USD

ECN Cent Account

- Platforms: MT4

- Products: 60+ Currency pairs and Gold

- Leverage: Up to 2000:1

- Minimum Spread: 0.0 pips

- Commission: 5 USC

- Minimum Deposit: 50 USD

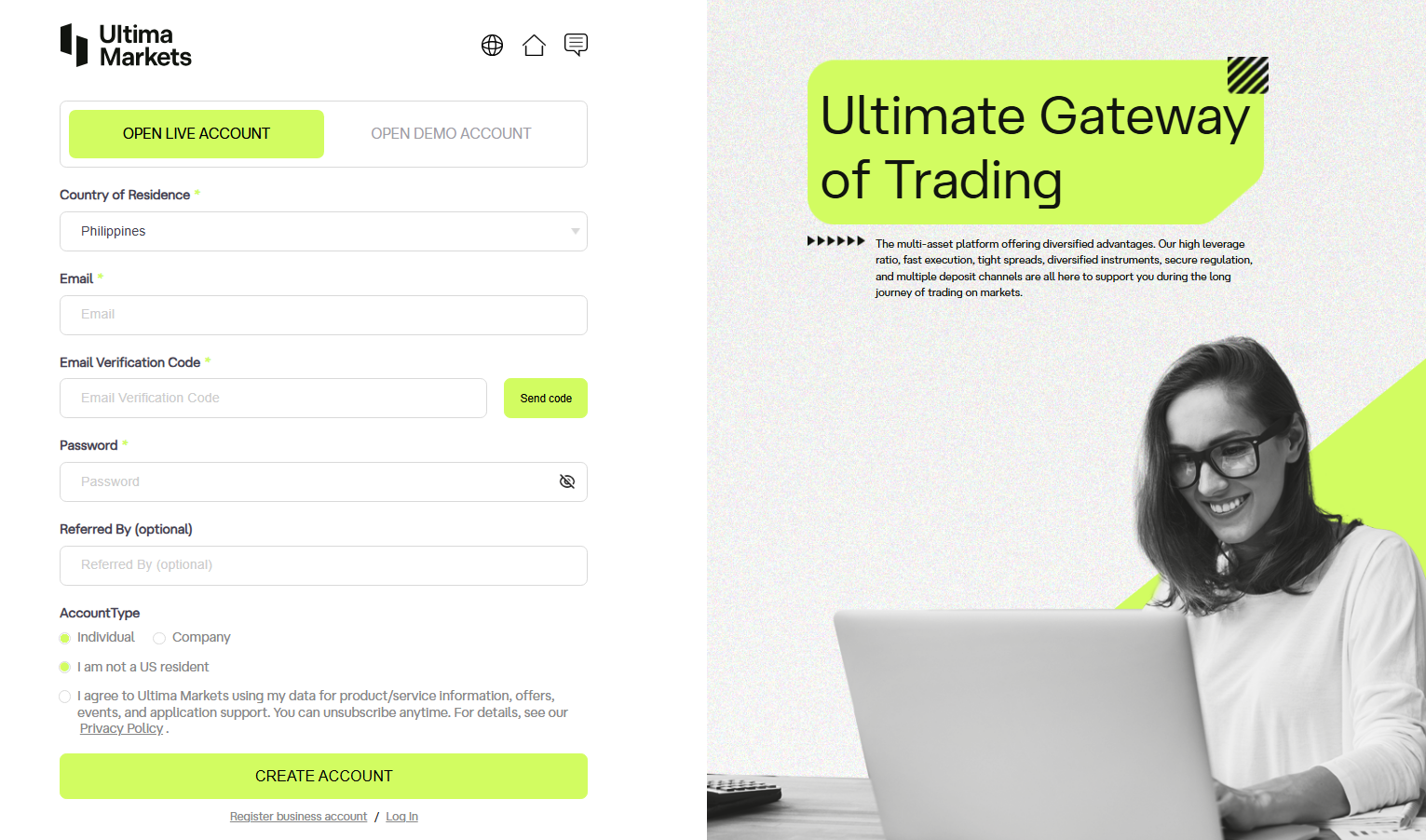

How to Open Your Account

- Visit the Ultima Markets website and choose your preferred language from the top of the screen.

- In the upper right corner, click the “Open Account” button to begin the registration process.

- Enter your first and last name, select your country of residence, provide your phone number and email address, and choose the account type — individual or corporate. Click “Open a user account”.

- For the initial registration, input additional details such as your salutation, birthdate, birthplace, and nationality. Choose a document for identity verification and enter its number. If you have dual citizenship, mark the appropriate checkbox. Click “Next”.

- Specify your residence and complete address, and check the option if you are a U.S. citizen. Click “Next”.

- Answer questions about your financial capabilities and trading experience. These are required for statistical purposes and will not affect your account status. Click “Next”.

- Select the trading platform (MT4) and account type — standard or ECN. Specify the account currency from options like USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, and JPY. Agree to the terms of cooperation and click “Next”.

- Upload scans or photos of documents confirming your identity and residency. Follow the provided comments and click “Next”.

- Wait for the verification process to complete. Once your documents are verified, you will receive an email notification and can access all platform functions.

- Click “Deposit funds now”, choose your deposit method, and follow the on-screen instructions. Visit the “Downloads” section to download the trading platform and the broker’s mobile application. Launch the platform, input your registration details, and start trading.

Ultima Markets Trading Platforms

Based on my experience, Ultima Markets offers several trading platforms that cater to different needs and preferences.

MetaTrader 4 (MT4) is one of the primary platforms available, known for its user-friendly interface and robust features. It supports desktop, web, and mobile versions, making it convenient to trade from any device. The platform offers excellent charting and analysis tools, 30+ integrated indicators, and support for automated trading through Expert Advisors (EAs). This flexibility and range of tools make MT4 a reliable choice for traders of all levels.

The Ultima Markets App is another significant offering, providing a comprehensive mobile trading experience. Available for both iOS and Android, the app is designed to be intuitive and user-friendly, allowing you to manage your account, analyze price movements, and execute trades on the go. With features like real-time updates and dynamic charting, the app ensures that you can keep track of the market and make informed decisions wherever you are.

Lastly, Ultima Markets also supports WebTrader, which allows you to access your account from any web browser without needing to download any software. This platform offers the same advanced trading tools and features as the desktop version of MT4, ensuring a seamless transition between devices. WebTrader is particularly useful for those who prefer trading directly from their browser without the hassle of installations.

What Can You Trade on Ultima Markets

When trading with Ultima Markets, I’ve found that they offer a broad spectrum of trading instruments, providing flexibility and diversity for traders.

Forex trading at Ultima Markets is extensive, allowing you to trade in the largest and most liquid market. They offer over 250 currency pairs with high leverage up to 1:2000 and competitive spreads starting from 0.0 pips, making it ideal for both novice and experienced traders.

Metals and Commodities are also available, giving traders the ability to speculate on price movements in hard commodities like gold and oil, as well as soft commodities such as coffee and wheat. The platform ensures fast execution and no hidden fees, which is crucial for effective trading in these volatile markets.

Indices trading at Ultima Markets includes key global indices like the Dow Jones, S&P 500, and FTSE 100. This allows traders to participate in the global equities market with low fees and high leverage up to 1:500, providing ample opportunities for diversified trading strategies.

For those interested in Shares CFDs, Ultima Markets offers access to popular stocks like Apple, Amazon, and Tesla. Trading these share CFDs allows you to benefit from price movements without owning the actual shares, with features like low fees and deep liquidity ensuring a smooth trading experience.

Finally, Cryptocurrencies are also available, enabling trading in digital assets such as Bitcoin and Ethereum. The platform offers fast execution and no requotes, making it a robust option for trading in the highly dynamic crypto market.

Ultima Markets Customer Support

Based on my experience, Ultima Markets offers a robust customer support system that is available 24/5. You can reach out to them through multiple channels including live chat, email, and phone support. This flexibility ensures that you can get assistance quickly, regardless of your preferred method of communication.

The support team is highly responsive and knowledgeable, helping with everything from technical issues to account-related queries. They also provide dedicated support through social media platforms, making it easy to get help no matter where you are. This comprehensive support structure enhances the overall trading experience and ensures that help is always just a click or call away.

Advantages and Disadvantages of Ultima Markets Customer Support

Withdrawal Options and Fees

Based on my experience with Ultima Markets, the broker offers a variety of withdrawal options to ensure flexibility and convenience for traders. You can withdraw funds using major credit and debit cards, bank transfers, e-wallets, and cryptocurrencies. This variety makes it easy to choose a method that suits your needs and preferences.

One of the standout features is that Ultima Markets does not charge any fees for withdrawals, which is a significant advantage. However, it’s important to note that intermediary banks may impose their own fees, especially for international transfers. This means while Ultima Markets keeps costs low on their end, you should check with your bank to understand any additional charges you might incur.

Withdrawal processing times are generally quick, with e-wallets and cryptocurrencies being processed within 0-2 working days, and credit/debit cards and bank transfers taking about 2-5 working days. The minimum withdrawal amount is relatively low, set at $40, making it accessible for traders who might need to make smaller withdrawals.

Ultima Markets Vs Other Brokers

#1. Ultima Markets vs AvaTrade

Ultima Markets offers high leverage up to 1:2000, diverse trading instruments including forex, commodities, indices, shares, and cryptocurrencies, and supports MetaTrader 4 and mobile trading platforms. AvaTrade, on the other hand, provides a slightly lower maximum leverage of 1:400 but offers a broader range of trading platforms including MetaTrader 4, MetaTrader 5, AvaTradeGO, and WebTrader. AvaTrade is also known for its strong regulatory framework, being regulated in several jurisdictions including Europe, Australia, Japan, and South Africa, whereas Ultima Markets operates under an offshore regulatory license, which might be perceived as less stringent.

Verdict: AvaTrade is the better option due to its robust regulatory environment and wider range of trading platforms, offering a higher degree of security and versatility for traders.

#2. Ultima Markets vs RoboForex

Ultima Markets provides extensive leverage options up to 1:2000 and a diverse range of tradable assets. It primarily uses MetaTrader 4 for its trading platform. RoboForex offers a competitive leverage of up to 1:2000 as well, but it also supports multiple platforms including MetaTrader 4, MetaTrader 5, cTrader, and R Trader. RoboForex is regulated by the International Financial Services Commission (IFSC), offering a slightly better regulatory standing than Ultima Markets. Additionally, RoboForex provides a broader range of account types and additional trading tools such as copy trading and PAMM accounts.

Verdict: RoboForex stands out due to its better regulatory status and wider range of trading platforms and tools, making it a more versatile and potentially safer choice for traders.

#3. Ultima Markets vs Exness

Ultima Markets offers a maximum leverage of 1:2000, multiple trading instruments, and uses MetaTrader 4. Exness, however, offers even higher leverage options, including unlimited leverage for some account types, which can be particularly appealing for experienced traders. Exness also supports MetaTrader 4 and MetaTrader 5, and it has a strong regulatory framework, being regulated by CySEC, FCA, and FSA. Moreover, Exness is known for its low spreads and transparent fee structures, which can be advantageous for cost-conscious traders.

Verdict: Exness is the superior choice due to its higher leverage options, strong regulatory framework, and lower trading costs, offering a safer and more flexible trading environment for various trader needs.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH ULTIMA MARKETS

Conclusion: Ultima Markets Review

Ultima Markets offers a range of trading instruments, high leverage options up to 1:2000, and supports popular trading platforms like MetaTrader 4 and a mobile app. They cater to various trading needs with multiple account types and competitive trading conditions, making it appealing for both novice and experienced traders. The broker also provides multiple withdrawal options without charging fees, enhancing the overall trading experience.

However, Ultima Markets operates under an offshore regulatory license, which might not provide the same level of security as top-tier regulators. Customer support is available 24/5 through multiple channels, but there are occasional delays during peak times and no support on weekends. Additionally, while the broker offers several advantages, such as high leverage and diverse trading instruments, it’s essential for traders to consider the potential risks associated with lower regulatory oversight.

Also Read: Cabana Capitals Review 2024 – Expert Trader Insights

Ultima Markets Review: FAQs

What types of trading instruments does Ultima Markets offer?

Ultima Markets provides a variety of trading instruments including forex, commodities, indices, shares CFDs, and cryptocurrencies.

What is the maximum leverage available at Ultima Markets?

The maximum leverage offered by Ultima Markets is up to 1:2000, allowing traders to control larger positions with smaller capital.

Is Ultima Markets regulated?

Ultima Markets is regulated by the Financial Services Commission (FSC) of Mauritius, which may be perceived as less stringent compared to top-tier regulators like the FCA or ASIC.

OPEN AN ACCOUNT NOW WITH ULTIMA MARKETS AND GET YOUR BONUS