Shares of Taiwan Semiconductor Manufacturing Co. (TSMC) soared to a new all-time high on Friday after the chipmaker reported earnings that surpassed market expectations, reflecting the company’s resilience amid a global slowdown in the semiconductor industry. The upbeat results have fueled investor optimism about TSMC’s ability to navigate challenges in the tech sector, driving its stock price higher.

Shares of Taiwan Semiconductor Manufacturing Co. (TSMC) soared to a new all-time high on Friday after the chipmaker reported earnings that surpassed market expectations, reflecting the company’s resilience amid a global slowdown in the semiconductor industry. The upbeat results have fueled investor optimism about TSMC’s ability to navigate challenges in the tech sector, driving its stock price higher.

TSMC reported a better-than-expected quarterly profit, boosted by strong demand for its advanced chips used in smartphones and high-performance computing. The company’s net income came in at $9.5 billion, beating analyst estimates and underscoring its dominant position in the global semiconductor supply chain. This robust performance helped push TSMC’s stock to a record level, rising 3% in early trading.

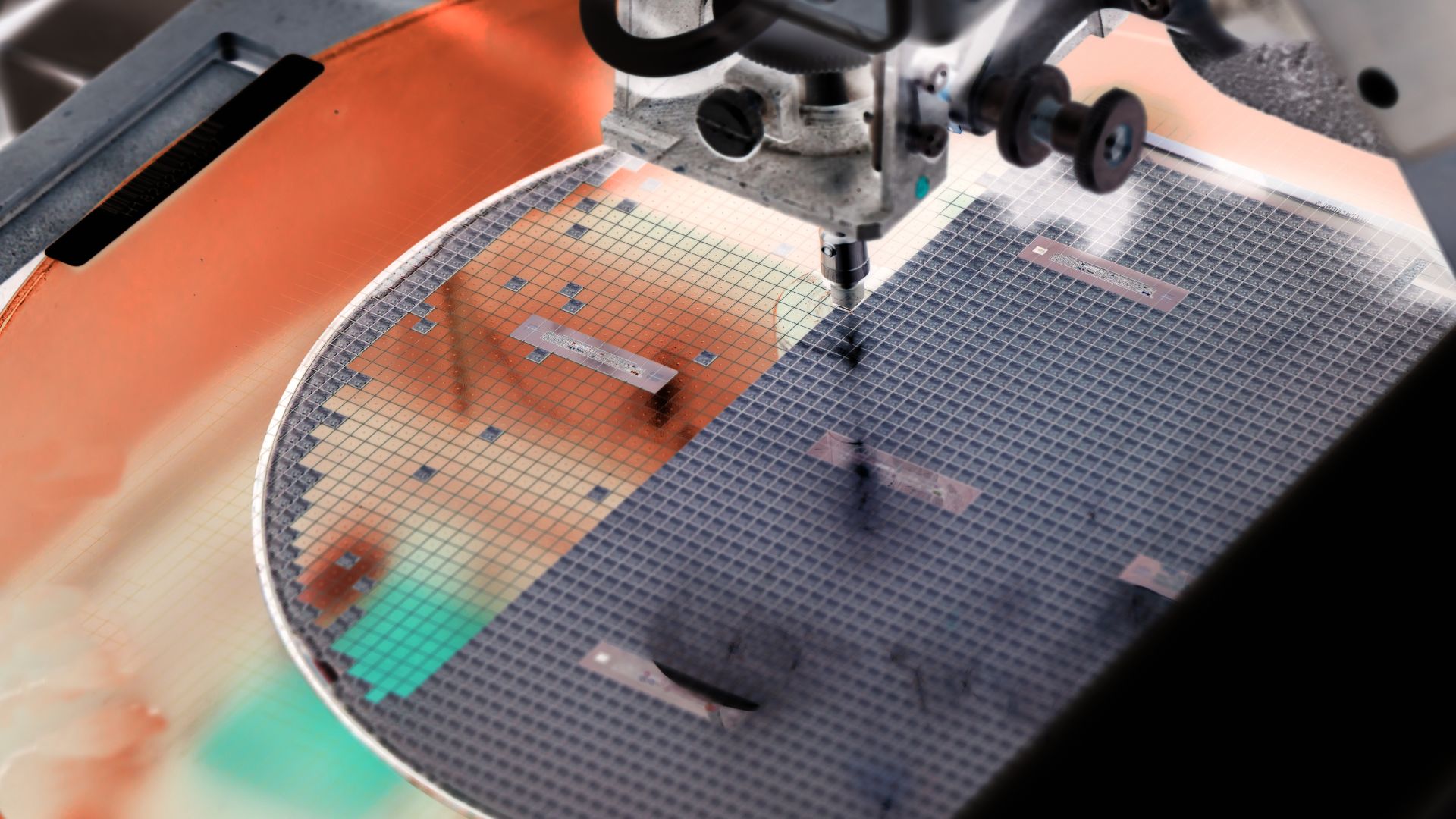

The chipmaker’s strong results come at a time when the broader semiconductor industry has faced headwinds from weaker demand and inventory adjustments. However, TSMC’s strategic focus on cutting-edge technologies, particularly in the production of 3-nanometer chips, has allowed it to maintain steady growth and profitability.

“TSMC continues to outperform despite the cyclical downturn affecting much of the industry,” said Jason Lee, an analyst at ABC Capital. “Its leading position in advanced chip manufacturing has insulated it from some of the demand softness we’re seeing elsewhere.”

Looking forward, TSMC raised its revenue outlook for the rest of the year, driven by expectations of stronger demand for artificial intelligence and 5G applications. The company’s continued investments in expanding capacity for next-generation chips have also positioned it well to capture growth opportunities as demand rebounds.

Investors remain bullish on TSMC’s future, with many seeing the company as a key player in the global tech supply chain, particularly as the world shifts toward more advanced technologies like AI and autonomous systems. For now, the company’s record earnings and optimistic outlook have further cemented its standing as a leader in the semiconductor space.