Position in Rating | Overall Rating | Trading Terminals |

192nd  | 2.7 Overall Rating |  |

Trive Review

Choosing the right Forex broker is crucial for success in the highly volatile Forex market. Forex brokers serve as intermediaries between traders and the currency markets, offering platforms, tools, and resources necessary for trading. The right broker can provide competitive spreads, robust trading platforms, and reliable customer support, making a significant difference in trading outcomes.

Trive stands out in the crowded Forex market due to its competitive pricing, extensive range of trading instruments, and exceptional customer service. Offering over 40 currency pairs, Trive provides traders with deep liquidity, fast execution, and expert support, making it an attractive choice for both novice and experienced traders.

In this comprehensive review, I aim to provide an in-depth evaluation of Trive, highlighting its unique selling points and potential drawbacks. I’ll cover crucial aspects such as account types, deposit and withdrawal processes, commission structures, and other essential details. My goal is to equip you with the necessary insights to make an informed decision about whether Trive is the right brokerage service for you. By combining expert analysis with real trader experiences, this review will help you understand what to expect when trading with Trive.

What is Trive?

Trive is an international Forex and CFD broker that provides access to a wide range of financial instruments, including over 30 Forex currency pairs, stocks, ETFs, cryptocurrencies, and commodities. They offer a variety of trading platforms such as MetaTrader 4, MetaTrader 5, and a proprietary mobile app, making it convenient for traders to execute trades from anywhere.

Trive is known for its competitive spreads and low fees, which can significantly enhance profitability for traders. With maximum leverage up to 1:30, they cater to both beginner and advanced traders, providing the flexibility needed to manage trading strategies effectively.

What sets Trive apart is their commitment to customer service and educational resources. They offer market analysis by experts, free educational material, and responsive support, ensuring that traders have all the tools and information they need to succeed in the financial markets.

Benefits of Trading with Trive

Trading with Trive has been a positive experience due to its competitive spreads and variety of trading instruments, which include Forex, stocks, commodities, and cryptocurrencies. This diversity allows me to diversify my portfolio and manage risk more effectively. The availability of multiple account types ensures that both beginners and experienced traders can find a suitable option.

The trading platforms offered by Trive, such as MT4, MT5, and a user-friendly mobile app, provide flexibility and convenience. These platforms are reliable and come with advanced trading tools, enhancing my trading efficiency. Additionally, Trive’s customer support has proven to be responsive and knowledgeable, helping me resolve issues quickly and continue trading without significant interruptions.

Trive’s transparent fee structure and secure withdrawal processes give me confidence in managing my funds. With no deposit fees and reasonable withdrawal charges, it is easier to plan and execute my trading strategies. Overall, Trive offers a well-rounded trading experience, combining affordability, flexibility, and support.

Trive Regulation and Safety

Trive is a well-regulated broker, operating under the supervision of multiple financial authorities. This regulatory framework includes oversight by the Malta Financial Services Authority (MFSA), among others, ensuring that the broker adheres to strict financial standards. It’s crucial to know this because regulation provides a layer of security for your investments, ensuring that your funds are managed properly and that the broker operates transparently.

Additionally, Trive has established a presence in several regions, being authorized by regulatory bodies in countries like Germany and Spain. This broad regulatory approval means that Trive must comply with diverse and rigorous regulations, enhancing the safety of your trading environment. Knowing that a broker is regulated across multiple jurisdictions provides peace of mind and confirms their commitment to maintaining high operational standards.

Trive Pros and Cons

Pros

- Competitive spreads

- Wide range of trading instruments

- Multiple trading platforms

- Strong regulatory oversight

- Fast execution speeds

- Excellent customer support

Cons

- High minimum deposit for premium accounts

- Limited cryptocurrency options

- Monthly maintenance fee for inactive accounts

- No support for third-party payments

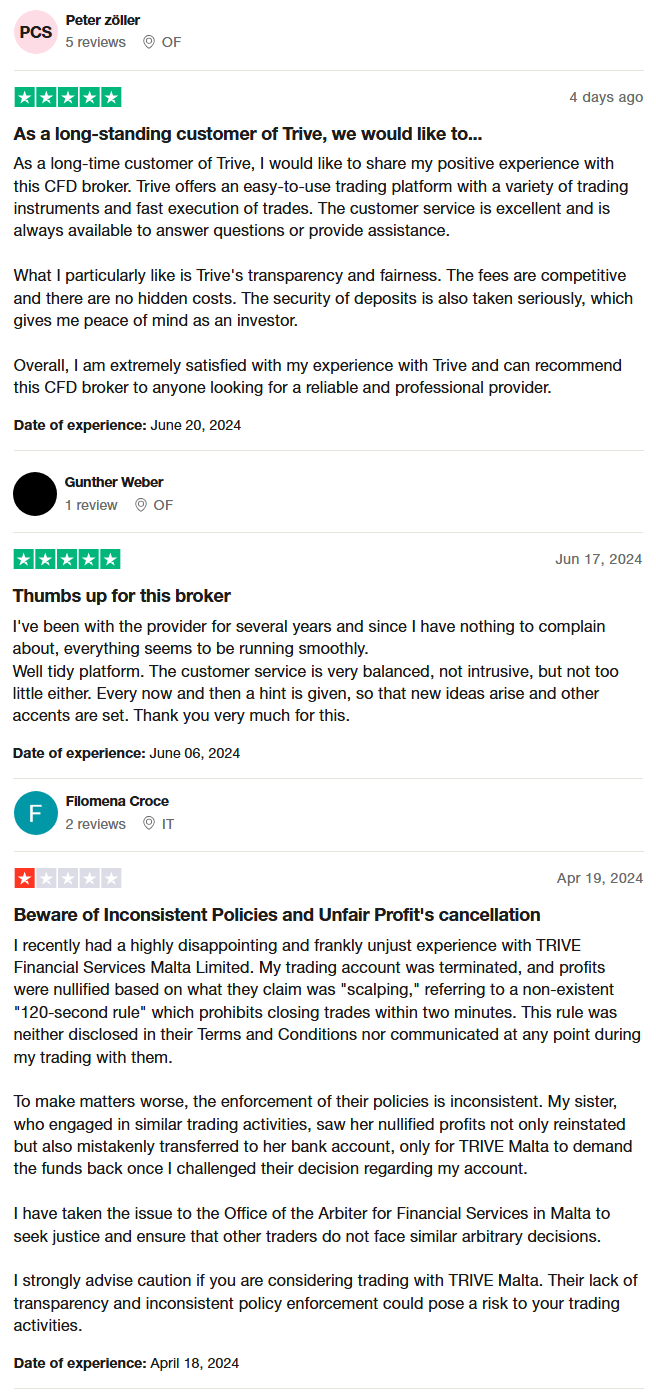

Trive Customer Reviews

Customers of Trive generally have positive experiences with this broker, highlighting the easy-to-use trading platform and the variety of trading instruments available. Many appreciate the fast execution of trades and excellent customer service, which is always available to provide assistance. Users also value the transparency and fairness of Trive, noting that the fees are competitive and there are no hidden costs. However, some users have reported negative experiences, particularly concerning inconsistent policy enforcement and lack of transparency, which have led to disputes over account terminations and profit nullifications. Despite these issues, many traders remain satisfied, citing the security of deposits and the overall reliability of Trive as key benefits.

Trive Spreads, Fees, and Commissions

Trading with Trive, I found their spreads to be very competitive, particularly for major currency pairs. For instance, typical spreads start from as low as 0.5 pips for some pairs, which is ideal for minimizing trading costs. This low spread can significantly enhance profitability, especially for high-frequency traders.

In terms of fees, Trive does not charge any deposit fees, which is a big plus. However, there is a monthly maintenance fee for inactive accounts, which starts after six months of inactivity. This is something to keep in mind to avoid unexpected charges. The overall fee structure is transparent, with no hidden costs, ensuring you know what you are paying for.

Commissions depend on the type of account you choose. The Classic account is commission-free, which can be beneficial for traders looking to avoid additional costs. On the other hand, the Prime Plus account charges a commission of 5 Euros per lot but offers tighter spreads starting from 0.1 pips. This can be a good option for traders who prefer lower spreads and can trade higher volumes.

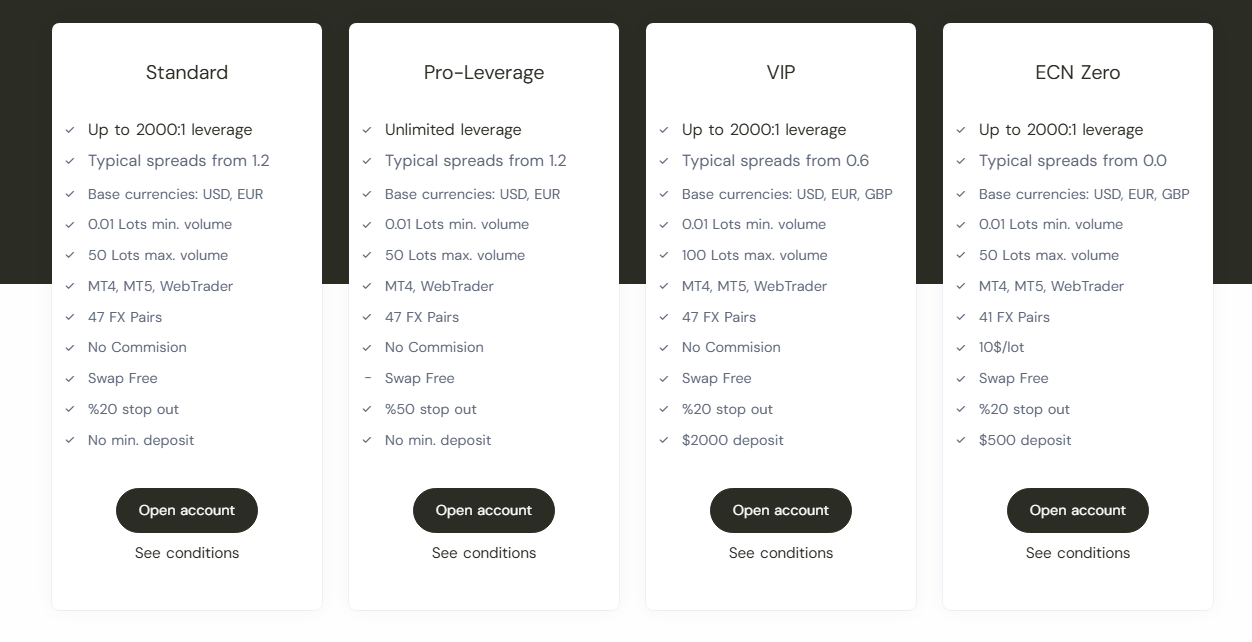

Account Types

Trive offers several account types designed to meet various trading needs. Here’s a quick overview:

Standard Account

- Up to 2000:1 leverage

- Typical spreads from 1.2 pips

- No minimum deposit

- No commission

- Suitable for beginners

Pro-Leverage Account

- Unlimited leverage

- Typical spreads from 1.2 pips

- No minimum deposit

- No commission

- Ideal for experienced traders

VIP Account

- Up to 2000:1 leverage

- Typical spreads from 0.6 pips

- $2000 minimum deposit

- No commission

- Perfect for high-volume traders

ECN Zero Account

- Up to 2000:1 leverage

- Typical spreads from 0.0 pips

- $500 minimum deposit

- $10 per lot commission

- Best for traders seeking the lowest spreads

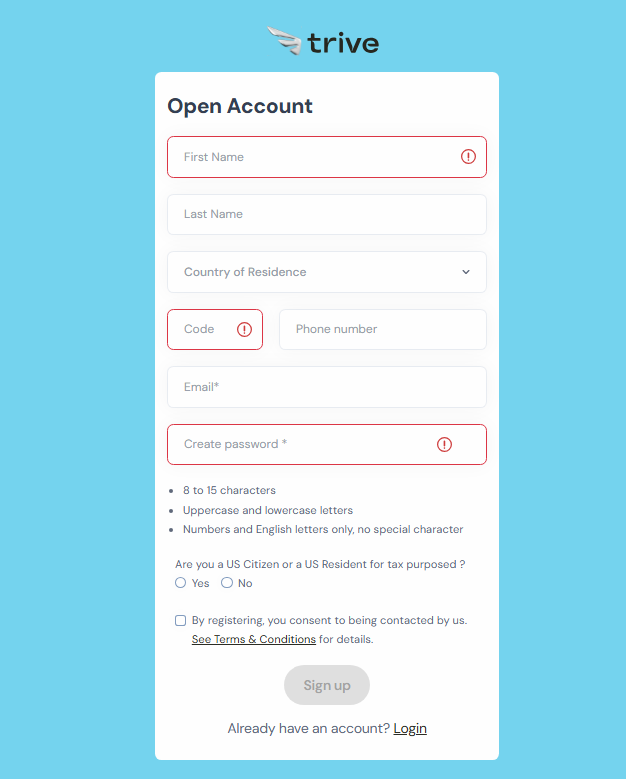

How to Open Your Account

- Go to the Trive website and select your preferred interface language in the upper right corner.

- Click “Open an account” and enter your name, email, and phone number, then agree to the terms and click “Continue”.

- Create a password, confirm you are not a U.S. citizen, and click “Done”.

- Choose the asset group you are interested in, agree to the terms, and click “Next”.

- Fill in your gender, birth details, country of residence, address, nationality, and status, then click “Next”.

- Answer the broker’s questions, clicking “Next” after each section.

- Complete a small trading knowledge test; it doesn’t affect your account status.

- To open a live account, follow on-screen instructions, verify your identity with document scans, choose your account type, trading terminal, leverage, and other settings, then download the trading terminal.

Trive Trading Platforms

Trive offers a range of trading platforms that cater to different trading styles and preferences. MetaTrader 4 (MT4) is one of the platforms available, providing a user-friendly interface and a variety of tools for technical analysis. I found MT4 to be highly reliable, with fast execution speeds and a robust set of features for effective trading.

For those who prefer a more advanced platform, MetaTrader 5 (MT5) is also available. MT5 offers additional functionalities like advanced charting tools, more order types, and the ability to trade multiple asset classes. Using MT5 has enhanced my trading experience, especially with its improved interface and extended capabilities.

Trive also provides a proprietary Mobile Trading App that is perfect for trading on the go. The mobile app is well-designed and easy to use, allowing me to manage my trades and monitor the markets from anywhere. The app’s performance is smooth and reliable, making it a great tool for traders who need flexibility.

What Can You Trade on Trive

Trading with Trive offers a diverse range of financial instruments, providing ample opportunities for portfolio diversification. Forex trading is a major component, with over 40 currency pairs available. This variety allows me to trade major, minor, and exotic pairs, benefiting from the dynamic and liquid Forex market.

In addition to Forex, Trive also offers CFDs on stocks, allowing me to trade shares of leading companies from global markets. This enables exposure to different sectors and economies, enhancing my investment strategy. The availability of ETFs provides an efficient way to invest in baskets of assets, offering both diversification and reduced risk.

Trive’s platform also supports commodity trading, including metals and energy products. This is beneficial for hedging against market volatility and capitalizing on commodity price movements. Lastly, the option to trade cryptocurrencies like Bitcoin and Ethereum offers a chance to participate in the rapidly growing digital asset market.

Trive Customer Support

From my experience, Trive offers excellent customer support that is both responsive and helpful. Whenever I’ve had questions or issues, their team has been readily available through various channels, including email and phone. The support staff is knowledgeable and always willing to assist, ensuring that any problems are resolved quickly and efficiently.

The broker also provides an extensive FAQ section on their website, which is very useful for finding quick answers to common questions. This resource, combined with their dedicated support team, makes managing your account and resolving issues straightforward. The overall experience with Trive’s customer support has been positive, making it a reliable choice for traders seeking dependable assistance.

Advantages and Disadvantages of Trive Customer Support

Withdrawal Options and Fees

When trading on a real account with Trive, you can withdraw your profits at any time using various methods such as bank transfers, bank cards, or e-wallets. The withdrawal request is processed within your user account and typically reviewed by managers within a business day, ensuring a smooth and efficient process.

There are no fees for bank transfers, making it a cost-effective option. However, for withdrawals to a bank card or cryptocurrency wallet, a fee of 1.5% is applied. It’s important to note that third parties, like banks, may impose their own charges, which can affect the total amount received. Withdrawals usually take 2-3 days to complete, providing a reliable timeframe for accessing your funds.

Trive Vs Other Brokers

#1. Trive vs AvaTrade

Trive and AvaTrade both offer a variety of trading instruments, including Forex, stocks, and commodities. Trive stands out with its competitive spreads and a wide range of account types tailored to different trader needs, while AvaTrade is known for its extensive educational resources and multiple regulatory licenses globally. Trive’s trading platforms include MT4, MT5, and a proprietary mobile app, whereas AvaTrade provides MT4, MT5, and the AvaTradeGO app. Both brokers offer excellent customer service, but Trive’s support is praised for its responsiveness and efficiency.

Verdict: Trive is better for those seeking competitive spreads and a responsive customer support team, while AvaTrade excels for traders who prioritize comprehensive educational resources and a strong global regulatory presence.

#2. Trive vs RoboForex

Trive and RoboForex are both reputable brokers offering a wide range of trading instruments and account types. Trive provides MT4, MT5, and a user-friendly mobile app, whereas RoboForex offers a broader selection of trading platforms, including cTrader and R Trader. Trive is known for its competitive spreads and strong customer support, while RoboForex attracts traders with its high leverage options and bonus programs. Additionally, RoboForex has a more extensive range of deposit and withdrawal methods, catering to a global audience.

Verdict: Trive is preferable for traders who value competitive spreads and excellent customer support, while RoboForex is better suited for those seeking high leverage and a wide variety of trading platforms.

#3. Trive vs Exness

Trive and Exness both offer robust trading platforms, including MT4 and MT5. Trive excels with its competitive spreads and responsive customer service, while Exness is known for its high leverage options and no-deposit fee policy. Both brokers provide a good selection of trading instruments, but Exness offers instant withdrawals and a more extensive range of payment methods, making it highly convenient for traders. Trive, however, has a more transparent fee structure and strong regulatory compliance.

Verdict: Trive is the better choice for traders who prioritize transparent fees and responsive customer support, whereas Exness is ideal for those who value high leverage and instant withdrawal options.

Also Read: AvaTrade Review 2024- Expert Trader Insights

Conclusion: Trive Review

In conclusion, Trive presents itself as a strong contender in the Forex and CFD trading space, offering competitive spreads and a variety of trading instruments. Users appreciate its responsive customer support and the robust platforms available, including MT4, MT5, and a proprietary mobile app. These features make Trive a solid choice for both novice and experienced traders.

However, it’s important to be aware of some drawbacks, such as the high minimum deposit for premium accounts and the monthly maintenance fee for inactive accounts. Despite these cons, Trive remains a reliable broker with a transparent fee structure and strong regulatory oversight, making it a trustworthy option for serious traders.

Also Read: EBSI Forex Review 2024 – Expert Trader Insights

Trive Review: FAQs

What trading platforms does Trive offer?

Trive offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and a proprietary mobile trading app, providing flexibility for various trading styles.

Are there any fees for withdrawing funds from Trive?

Trive charges a 1.5% fee for withdrawals to bank cards and cryptocurrency wallets, while bank transfers are free. Third-party banks may impose additional fees.

What types of accounts are available at Trive?

Trive offers several account types, including Standard, Pro-Leverage, VIP, and ECN Zero, each catering to different trading needs and experience levels.

OPEN AN ACCOUNT NOW WITH TRIVE AND GET YOUR BONUS