Triple witching is the third Friday of the last month of each financial quarter when the expiration dates of stock options, stock index futures, and stock index options contracts all coincide. This day has high trading volume, securities’ volatility, and market activity. Market activity becomes especially frenzied during the triple witching hour, 3.00 pm to 4.00 pm EST, the last hour before the close of the trading day.

The terms quadruple witching and triple witching are used interchangeably by some traders. Quadruple witching is the third Friday of the last month of the financial quarter on which stock options, stock index options, stock index futures, and single stock futures (SSFs) all have the same expiration date.

SSFS were banned in the USA in 2020, although they are still sold in India, Spain, South Africa, and the United Kingdom. Thus, in the USA, there are no quad witching days that include SSFs. However, there can be quad witching days on which four types of options and futures contracts have simultaneous expiration dates which fall on the third Friday of the last month of the financial quarter.

Although triple witching days never change, triple witching dates do change from year to year. While the actual triple witching date may change, it is always on the third Friday of March, June, September, and December.

Also Read: Futures Trading Strategies You Can Try

Contents

- What are Options and Futures Contracts?

- The Three Horsemen of Triple Witching Friday

- Triple Witching Day: Increased Trading Volume, Activity, Price Inefficiencies

- Day Traders Beware the Triple Witching

What are Options and Futures Contracts?

Options and futures contracts are derivative contracts. Derivatives contracts are contracts entered into by a buyer and a seller. The rights and obligations of the buyer will vary with the type of derivative.

However, the sellers are always required to deliver the contracted asset to the buyer at the contract price when the contract is closed. If the buyer has the right to exercise the contract but no obligation to do so, then the seller is not obligated to fulfill the contract terms if the buyer does not complete the contract.

Options Contracts

Options contracts give the buyer, also referred to as an owner or holder, the right to exercise the contract, but no obligation to do so. The buyer can let the contract expire without exercising it, sell it, or close it.

Contract Expiration

If the buyer chooses to not exercise the contract by the expiry date, then the buyer will lose the premium paid for the contract (i.e., the purchase price of the options contract).

Selling the Contract

Buyers may choose to sell the contract to someone else. The contract may be sold because the market has moved against the trader or the trader does not want to maintain the contract or let it expire. When the contract is sold to someone else, the initial buyer transfers the contract’s rights to someone else and is removed from the contract. In essence, the buyer may get all or part of the premium as payment for the contract and be legally removed from the contract when the contract rights are transferred to someone else.

Closing the Contract

The buyer may want to immediately close the contract if the market turns against the set contract or there has not been sufficient market movement for the contract to be profitable. The buyer may also close the contract when the exercising it is profitable, Thus, for a number of reasons the buyer may choose to exercise the contract and close it.

There are two types of options, call and put.

Call Options

Call options give the buyer the right, but not the obligation, to buy the asset specified in the contract, at the listed contract price, before or by the expiration date of the contract.

Put Option

Put options give the buyer the right, but not the obligation, to sell the asset specified in the contract, at the listed contract price, before or by the expiration date of the contract.

Futures Contracts

Futures contracts give the buyer the right and obligation to buy the asset specified in the contract, at the contract price, on the future date listed in the contract. Future contracts are an all or none deal. The buyer correctly speculates what will happen in the future and earns a profit. In the alternative, the buyer doesn’t correctly guess the future performance of the asset and gets nothing on the contract expiration date.

The Three Horsemen of Triple Witching Friday

On triple witching day, the stock options, stock index options, and stock index futures contracts expire on the same day, the third Friday in the last month at the end of each financial quarter.

Stock Options

Stock options give the buyer the right, but not the obligation, to buy the stock specified in the contract on a set future date at the price listed in the contract. The buyer can choose not to exercise the right, sell it, or purchase the stock. If the buyer chooses to exercise the contract, the seller must deliver the stock to the buyer at the contract price when the contract is closed (provided it is closed before the expiration date).

Stock Index Options

Stock index options, also known as index options, track the performance of a large number of many stocks or a specific group of stocks. The indexes get their value from the underlying stocks. The value of the index changes as the value of the underlying assets changes.

Index options speculative investments and used to hedge against potential future losses from existing investments. The diversified portfolio provides protection from losses caused by a few stocks because the other stocks performance will offset the poor performance of a few stocks.

The buyers and sellers enter into a contract that specifies the index, the contract’s expiry date, and the contract price to be collected from the buyer. The buyer has the right, but not the obligation, to purchase the stock index. In this instance, settlement of the contract is done in cash, because no one can physically deliver a stock index. If the buyer exercises the contract, the seller must deliver on it.

Stock Index Futures

A stock index futures contract, also known as equity index futures contract or index futures contract, are contracts entered into for the buy or sell of the value of the underlying asset at a specific price on a set date in the future. The buyer has the right and obligation to purchase the value of the contract’s underlying asset by the contract expiration for the price in the contract.

These contracts are settled on a daily basis in cash. Traders collect the difference in contract value daily.

Index futures are strong indicators of market sentiment. Traders often look at how they are being traded to speculate on the future direction of the market.

Also Read: What are Cotton Futures

Triple Witching Day: Increased Trading Volume, Activity, Price Inefficiencies

Triple witching day occurs four times a year in March, June, September, and December. During the preceding triple witching day, there is increased trading activity by institutional investors that are closing out their trading positions and making trades to avoid trading losses when their contracts expire on triple witching Friday. The most frenzied trading occurs on triple witching day in the final hour, 3.00 pm to 4.00 pm EST.

Increased Trading Activity

The increased trading activity on triple witching day causes a temporary uptrend in securities’ market prices. This uptrend has led some market observers to think that triple witching events are bullish.

The brief increase in asset prices is caused by trade imbalances created by a large amount of assets being quickly traded, especially in the final hour. Notably, in the week following triple witching events, asset market prices fall, which some market observers have labeled a bearish trend.

Overall, there is no evidence of a bullish or bearish trend during or after triple witching events. The rise in prices is due to imbalanced trading, and the decline in prices the week after triple witching Friday is the market correcting itself.

Price Inefficiencies

The price inefficiencies on triple witching Friday are caused by the large orders being processed for institutional investors. Arbitrageurs take advantage of the price inefficiencies to make quick profits from trades lasting only seconds.

Day Traders Beware the Triple Witching

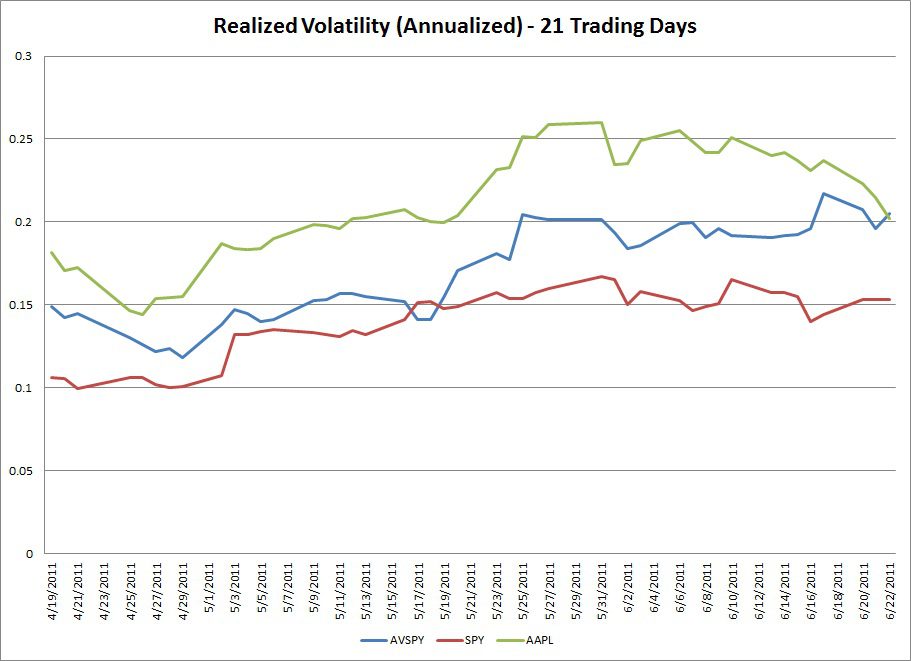

Day traders may want to avoid the market on triple witching days. The increased market activity, higher trading volume, and increased price volatility make this a challenging trading day for day traders looking to make quick profits when the market fluctuates more than usual. In addition, the traders may only have seconds to complete a series of trades in order to make the trading profitable.

Since retail traders are not moving the market, they must follow it or quickly identify the trends being created by the market makers, the big institutional investors trading large lots. Consequently, this is not an ideal trading environment for inexperienced day traders, arbitrageurs, or derivatives traders. So, on triple witching Friday, observe the markets, look for opportunities, and try to identify the trends.

Your content is very interesting. I am very impressed with your post. I hope to receive more great posts.The Warriors Leather Vest

I have invested with some scam brokers in the past, and the story is as horrific as the ones i have read because i went through the ordeal myself. I lost almost $80,000 USD to this unfortunate brokers, a friend referred me to Mr Christopher Emmanuel that got me 80% of my money back, plus my accrued bonuses. Please stay clear of these scammers and if you have lost money you can still get your money back if you really want to, you can reach out to Christopher Emmanuel at: {christoperemmaunel842@gmail.com}. he will definitely help you in getting back your lost funds to any broker….. as mine was recovered too.

I have invested with some scam brokers in the past, and the story is as horrific as the ones i have read because i went through the ordeal myself. I lost almost $80,000 USD to this unfortunate brokers, a friend referred me to Mr Christopher Emmanuel that got me 80% of my money back, plus my accrued bonuses. Please stay clear of these scammers and if you have lost money you can still get your money back if you really want to, you can reach out to Christopher Emmanuel at: {christoperemmaunel842@gmail.com}. he will definitely help you in getting back your lost funds to any broker….. as mine was recovered too.