Tradiso Review

Forex brokers serve as crucial gateways to the global financial markets, offering platforms where individuals can trade a variety of assets including currencies, commodities, and stocks. Choosing the right Forex broker is vital as it affects not only the quality of your trading experience but also the security of your investments and the efficiency of your trading strategy.

Tradiso distinguishes itself in the competitive Forex broker landscape by offering a broad spectrum of financial assets for trading. This includes currency pairs, cryptocurrencies, and CFDs on indices, stocks, and commodities. Such diversity enables traders like me to explore a wide range of investment opportunities under one roof, catering to various investment preferences and risk tolerances.

In this comprehensive review, I aim to provide a detailed evaluation of Tradiso, highlighting its unique features and potential limitations. My goal is to deliver essential insights about the broker’s various account options, deposit and withdrawal processes, and commission structures. By integrating expert analysis with firsthand trader experiences, this review is designed to arm you with the necessary information to decide whether Tradiso is the right choice for your trading needs.

What is Tradiso?

Tradiso is a broker that provides opportunities for trading a diverse range of financial assets, including currency pairs, cryptocurrencies, and CFDs on indices, stocks, and commodities. Operating out of Kingstown, St. Vincent and the Grenadines, Tradiso offers its services on a global scale, allowing traders from various parts of the world to access international markets through its platform.

It’s important to highlight that Tradiso is not regulated by any financial authorities. This lack of regulation means that while the broker offers a broad array of trading options, it does so without the oversight typically provided by financial regulatory bodies. Potential traders should consider this when evaluating Tradiso as a possible broker, as the absence of regulatory oversight may affect the security and protection of their investments.

Benefits of Trading with Tradiso

Trading with Tradiso has provided me with several benefits, enhancing my overall trading experience. The range of financial instruments available, including forex, cryptocurrencies, and CFDs on various assets, allows for a diversified investment strategy. This diversity enables me to tailor my trading actions according to market conditions and my personal risk tolerance.

Another significant advantage of using Tradiso is the access to the MetaTrader 4 platform, which is well-regarded for its reliability and array of analytical tools. This platform supports my trading decisions with advanced charting capabilities, automated trading through Expert Advisors (EAs), and real-time market data. The user-friendly interface of MT4 makes it easy for beginners and experienced traders alike to navigate and optimize their trading setups effectively.

Moreover, Tradiso’s flexibility in account types, including Standard, Pro, and ECN accounts, caters to various trading preferences and levels of experience. Each account type is designed to meet different trader needs, from those seeking no minimum deposit options to those looking for low spreads and high-volume trading capabilities. This flexibility has allowed me to choose an account that best fits my trading style and financial goals.

Tradiso Regulation and Safety

Based on my trading experience with Tradiso, it’s crucial to be aware that while the broker is registered in St. Vincent and the Grenadines, it is not licensed by any regulatory authority. This means that Tradiso operates without the standard regulatory oversight that you might find with other brokers. Additionally, the absence of accessible legal documents on the company’s website raises concerns about the transparency and security guarantees for client funds.

However, Tradiso does take certain measures to enhance the safety of client assets. Client funds are held in segregated accounts, which means they are kept separate from the broker’s operational funds. This is a critical feature that helps protect client assets from being used by the broker for company expenses or other purposes.

For further security, Tradiso provides the option to enable Two-Factor Authentication (2FA) via SMS or Google Authenticator, which adds an extra layer of security to user accounts. Additionally, there is a feature to help clients recognize phishing emails by generating a special code that confirms the authenticity of communications from the broker. These security measures offer some level of protection, despite the lack of regulatory oversight.

Tradiso Pros and Cons

Pros

- Varied trading conditions across three account types

- Zero pip spreads on ECN accounts, tight on Standard

- Rapid order execution

- Extensive selection of trading instruments

- Availability of a demo account for practice

Cons

- Few payment methods available

- Lack of cent accounts for low-risk trading

- Activities of the company are unregulated

Tradiso Customer Reviews

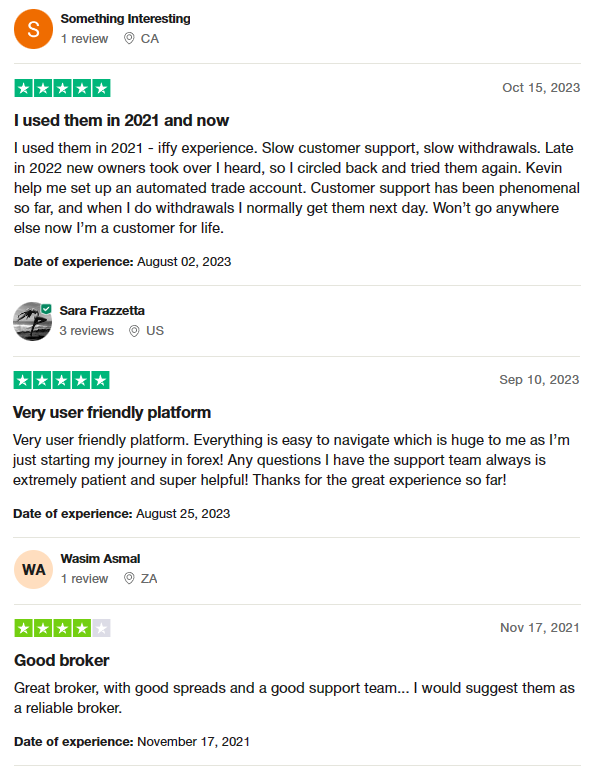

Customer reviews of Tradiso reveal a mixed but overall improving experience with the broker. Initially, users reported issues such as slow customer support and delayed withdrawals. However, following a change in ownership in late 2022, there has been a noticeable improvement in service quality. Users now commend the responsive and helpful customer support, with one particular customer highlighting the assistance received from an employee named Kevin in setting up an automated trading account. This improvement has led to faster withdrawal processes, often completed by the next day, significantly enhancing user satisfaction. New traders particularly appreciate the platform’s user-friendliness and the supportive customer service team, making Tradiso a recommended choice for both novice and experienced traders seeking a reliable broker with competitive spreads and efficient support.

Tradiso Spreads, Fees, and Commissions

Tradiso offers a competitive fee structure that many traders find attractive. In my analysis of their trading and non-trading fees, I’ve noted that there are no deposit or withdrawal fees, which simplifies financial planning for users like myself. However, it’s important for cryptocurrency traders to remember that blockchain fees may still apply, depending on the specific conditions of each blockchain network.

For Forex trading, Tradiso provides several appealing options. The Standard account features spreads starting from 0.6 pips, which suits regular traders looking for consistent and predictable costs. For more advanced traders, the ECN account offers spreads from 0 pips, but there is a $7.5 fee per lot traded. This setup can be particularly beneficial for those who execute large volumes of trades and can offset the commission with tighter spreads.

Moreover, swap fees are incurred for holding positions overnight, a common practice in forex trading. These fees are standard across many trading platforms and are an essential factor to consider when planning long-term trading strategies.

Account Types

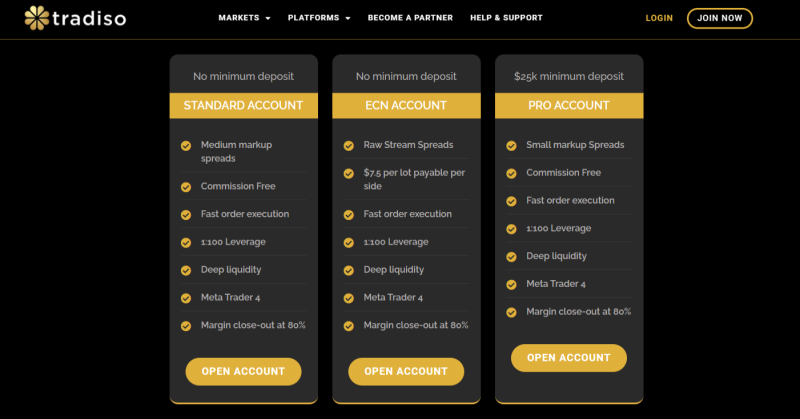

Tradiso offers three distinct account types tailored to accommodate various trading styles and investment levels, ensuring that traders can find a suitable match for their trading needs.

Standard Account

- Spreads: Start from 0.6 pips.

- Minimum Deposit: No minimum deposit required. This account is ideal for new and regular traders seeking low-entry barriers and predictable trading costs.

Pro Account

- Spreads: Fixed at 0.6 pips.

- Minimum Deposit: $25,000 required. The Pro Account is designed for professional traders who can commit to a higher deposit, offering the same competitive spread as the Standard Account but tailored for high-volume trading.

ECN Account

- Spreads: Start from 0 pips.

- Fee: $7.5 per lot traded.

- Minimum Deposit: No minimum deposit required. The ECN Account is perfect for advanced traders who prefer trading at the lowest spreads possible and are comfortable paying a commission on trades. This account is especially advantageous for those dealing in large volumes.

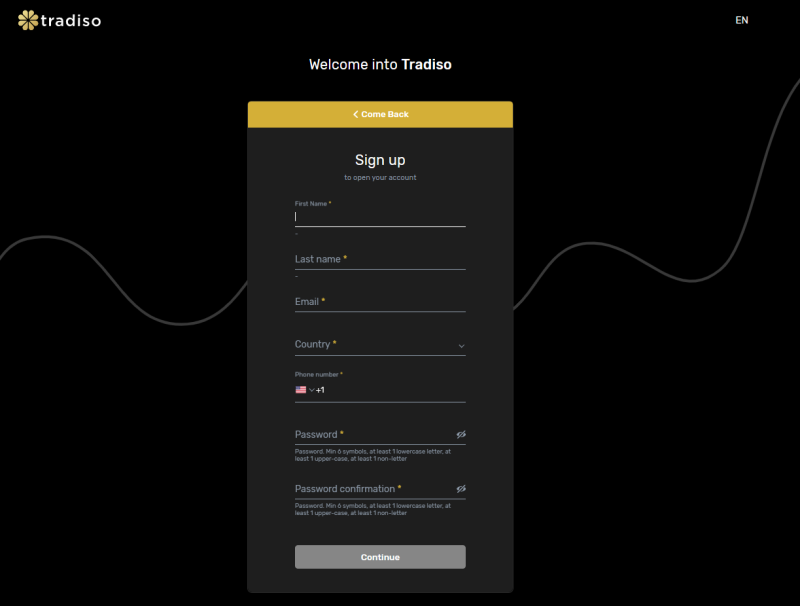

How to Open Your Account

- Visit the Tradiso website and select either “Join Now” or “Create a Live Account.”

- Fill out the registration form by entering your first and last names, email, phone number, and country.

- Choose a password, enter it twice for confirmation, and click “Continue” to move forward.

- Provide additional personal and financial information as required by the registration process.

- Upload the necessary documents to verify your identity and address.

- Allow some time for Tradiso to complete the verification process of your account.

- Once your account is verified, review and select the account type that best aligns with your trading goals.

- Deposit funds into your account using one of the available deposit methods and begin trading on the Tradiso platform.

Tradiso Trading Platforms

Based on my experience trading with Tradiso, the platform offers access to MetaTrader 4 (MT4), which is widely recognized for its robust functionality and versatility. MT4 is highly favored among traders for its advanced charting tools, automated trading capabilities through Expert Advisors (EAs), and comprehensive technical analysis features. This platform provides everything I need to effectively analyze the markets and execute trades, whether I’m looking at forex, CFDs, or other financial instruments.

The user interface of MT4 is intuitively designed, making it accessible for both novice traders and experienced professionals. From my use, I’ve found that the platform supports numerous order types and has a vast array of indicators and customizable options that enhance trading strategies. This accessibility combined with its powerful features makes MT4 an excellent choice for those trading with Tradiso, offering a reliable and efficient trading environment.

What Can You Trade on Tradiso

At Tradiso, I have had the opportunity to trade a diverse range of financial instruments, which has significantly broadened my trading portfolio. The platform offers a variety of currency pairs, including major, minor, and exotic pairs, allowing me to engage in forex trading with flexibility and depth. Additionally, the availability of cryptocurrencies provides a modern approach to trading, tapping into the dynamic and often lucrative crypto markets.

Beyond currencies and crypto, Tradiso also supports trading CFDs on stocks, indices, and commodities. This allows me to speculate on price movements of major stocks, global indices, and commodities like oil and gold without the need to own the underlying assets. Trading CFDs has been particularly beneficial for diversifying my investments and managing risks across different market sectors.

Tradiso Customer Support

When I contacted customer service of Tradiso, I’ve found their contact support to be highly accessible and responsive, which is a vital aspect of their service. The support team can be reached via email and social media, ensuring that I can always get prompt responses to my queries. This multi-channel approach has made it quite convenient to seek assistance whenever needed.

For more in-depth inquiries or to address specific issues, Tradiso encourages clients like me to use its official profiles on major social media platforms, including Facebook, Instagram, X (formerly Twitter), and LinkedIn. Communicating through these platforms is not only direct but also efficient, allowing for quick updates and resolutions concerning my trading account. This level of accessibility has significantly enhanced my overall user experience and satisfaction with Tradiso’s support services.

Advantages and Disadvantages of Tradiso Customer Support

Withdrawal Options and Fees

At Tradiso, before I can make a withdrawal, my account needs to be verified, which is a standard procedure to ensure security and compliance. Once verified, I have found the withdrawal options to be somewhat limited but effective, with crypto wallets and PayPal available for use. It’s important to note that when using crypto wallets, I need to exchange USD for cryptocurrency before submitting my withdrawal request, which adds an extra step to the process.

The platform has a minimum withdrawal amount of either $50 or $100, depending on the withdrawal service used. In terms of processing times, any withdrawal requests I submit before 17:00 are processed on the same day, while requests after 17:00 are processed the next day. This structure helps in planning when I need funds to be available.

Tradiso does not charge any withdrawal fees, which is a significant benefit. However, it’s crucial to remember that when withdrawing via cryptocurrencies, transaction fees may be incurred on the blockchain used, which can vary depending on network congestion and other factors. This is something I always consider when planning my withdrawals to ensure I understand the potential costs involved.

Tradiso Vs Other Brokers

#1. Tradiso vs AvaTrade

Tradiso offers flexibility with its withdrawal options and provides a streamlined user experience through platforms like MetaTrader 4. However, it is less regulated, with registration in St. Vincent and the Grenadines, and lacks the comprehensive global oversight that some traders might prefer. AvaTrade stands out for its heavy regulation and licensing, with operations across multiple global jurisdictions since 2006. It offers a robust online trading experience with a broad array of over 1,250 financial instruments and support for a vast client base from over 150 countries.

Verdict: AvaTrade is the better choice for traders who value security and regulatory compliance over the flexibility of trading terms. Its established global presence and comprehensive regulatory framework provide a safer and more reliable trading environment compared to Tradiso.

#2. Tradiso vs RoboForex

Tradiso provides a basic, yet effective platform for trading a variety of instruments and has flexible account options. However, its regulatory status is minimal, which might be a concern for risk-averse traders. RoboForex, since 2009, offers a significantly richer trading environment with access to more than 12,000 trading options across eight asset classes. It is regulated by the FSC and offers advanced trading platforms like MetaTrader, cTrader, and RTrader, along with innovative contest projects to help new traders gain experience.

Verdict: RoboForex is preferable due to its comprehensive trading offerings, advanced technology platforms, and regulatory status. The broker’s extensive resources and commitment to providing tailored trading conditions make it a more suitable choice for both beginners and experienced traders.

#3. Tradiso vs Exness

Tradiso offers the essentials for trading with a focus on Forex and CFDs on its MetaTrader 4 platform. Its simple approach might appeal to those new to trading or those who prefer a less complex trading environment. Exness excels in providing a high trading volume environment with low commissions and instant execution. Launched in 2008, it offers a wide range of CFDs and over 120 currency pairs, supported by its strong regulatory framework and innovative trading conditions like infinite leverage on small deposits.

Verdict: Exness is superior for traders looking for a dynamic trading environment with excellent trading conditions and rapid execution. Its regulatory compliance and diverse account options provide a more secure and versatile trading platform compared to Tradiso.

Also Read: AvaTrade Review 2024- Expert Trader Insights

Conclusion: Tradiso Review

In conclusion, Tradiso offers a straightforward and accessible trading platform suitable for traders looking to engage with a variety of financial instruments, including forex, cryptocurrencies, and CFDs. The platform’s utilization of MetaTrader 4 appeals to those familiar with this popular trading tool, providing an intuitive and reliable user interface for executing trades.

However, potential users should be cautious of Tradiso’s regulatory status, as the broker is registered in St. Vincent and the Grenadines but lacks more stringent regulatory oversight. This could pose a risk to the security of investments and trader protection which are often more robust in heavily regulated environments. Additionally, while the broker facilitates a range of withdrawal methods and does not charge withdrawal fees, the limited regulatory framework might be a concern for those seeking higher security in their trading operations.

Also Read: InterTrader Review 2024 – Expert Trader Insights

Tradiso Review: FAQs

What trading platforms does Tradiso offer?

Tradiso provides the MetaTrader 4 (MT4) platform, known for its user-friendly interface and powerful trading tools.

Is Tradiso regulated?

No, Tradiso is registered in St. Vincent and the Grenadines but does not hold regulatory status with any major financial regulatory bodies.

What types of trading accounts does Tradiso offer?

Tradiso offers three types of accounts: Standard, Pro, and ECN, each catering to different trading needs and strategies.

OPEN AN ACCOUNT NOW WITH TRADISO AND GET YOUR BONUS