Position in Rating | Overall Rating | Trading Terminals |

243rd  | 2.0 Overall Rating |  |

Tradeview Markets Review

Tradeview Markets is a reputable brokerage that has been delivering advanced trading solutions since 2004. It offers competitive spreads starting at 0 pips, flexible leverage options up to 1:400, and seamless market execution. Traders can also benefit from micro lot trading, dedicated 24/5 account manager support, and straightforward funding methods for their accounts.

The broker guarantees clients safety with regulatory compliance from many jurisdictions and protection of the fund in segregated Tier 1 bank accounts. Tradeview Markets offers trade diversification opportunities, such as the ability to trade precious metals and US/European index CFDs, so that traders can broaden their investment horizons. Considering its reliable services and focus on the trader, this is a good platform both for beginners and experts.

This review highlights Tradeview Markets‘ key offerings: micro lot trading, easy funding methods, and dedicated 24/5 support for traders. It also covers its access to US and European index CFDs, making it a reliable choice for both new and experienced traders.

What is Tradeview Markets?

Tradeview Markets is an ECN and CFD brokerage firm that was established back in 2004. Currently, the company offers services in trading five asset classes. Located in the Cayman Islands, the company has gained quite a strong customer base; it has over 100,000 active users. Furthermore, the company works under the supervision of Cayman Islands Financial Regulator (CIMA) as well as the Malta Financial Services Authority (MFSA), thus providing security to their clients while trading.

The broker provides several trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, CurreneX, and Sterling Trader, accessible on desktop, mobile, and web. These platforms meet the needs of traders, offering advanced tools for both beginners and professionals. Traders can expect an efficient and flexible experience regardless of their device preferences.

Tradeview Markets also offers stock CFD trading through another subsidiary, therefore providing additional options for traders to invest in. With this diverse selection and regulatory support, Tradeview Markets is one of the preferred brokers for traders looking for a reliable and professional brokerage service.

Tradeview Markets Regulation and Safety

Tradeview Markets ensures the safety of its clients by following very strict financial standards in various jurisdictions. The company is licensed and regulated by the Cayman Islands Monetary Authority (CIMA), which monitors its activities as a full securities broker-dealer. Therefore, Tradeview Markets follows the Cayman Islands Securities Investment Business Law (SIBL), giving the clients a secure environment to trade.

Apart from the regulation in the Cayman Islands, Tradeview Markets is also a Class 2 Investment Service Company licensed by the Malta Financial Services Authority (MFSA). Under its EU operations, Tradeview Markets is allowed to provide financial services under the MiFID II framework and thus is able to be compliant with regulations while at the same time being allowed to operate in the whole of the EU/EEA. The MFSA is considered one of the trusted regulatory authorities in the world, with presence within various global financial entities like EBA and ESMA.

To protect clients’ accounts and funds, Tradeview Markets has implemented robust security, from automatic risk management to secure methods for depositing funds and secure protocols for data protection, plus comprehensive back-up plans regarding the safety of client assets. Such safeguards give it the peace of mind that ensures this company is committed to delivering secure and reliable services on trading.

Tradeview Markets Pros and Cons

Pros

- Diverse services offered

- Advanced trading tools

- Multiple platforms available

- Strong regulatory oversight

Cons

- High Minimum deposit

- Limited educational resources

- Inactivity account fees

- Withdrawal fees

Benefits of Trading with Tradeview Markets

Tradeview Markets offers numerous benefits to traders. First of all, it provides secure fund management due to its partnership with Tier 1 banks. Multiple deposit and withdrawal options, including cryptocurrencies and more than 20 international transfer methods, allow for account management simplicity and convenience.

The platform offers advanced trading tools such as CommuniTraders, TradeGATEHub, and Vulkan bridge, which allow traders to access real-time market information and execute trades seamlessly. MultiMAM and cTrader Copy features allow traders and fund managers to manage several accounts efficiently while streamlining trade copying strategies.

Tradeview Markets, as a good broker, also allows informed decision-making with the help of its economic calendar, specialized trading conditions, events, and trading strategies. These tools update traders with the latest market trends and thus improve their strategies. With strong services and advanced tools, Tradeview Markets creates a reliable trading environment for all users.

Tradeview Markets Customer Reviews

Tradeview Markets has received praise for its useful information and high-level trading room, where traders can exchange ideas without any bias. Many customers appreciate the unbiased opinions offered in the trading space, which helps them improve their strategies and decision-making.

On the other side, there are some users claiming a negative experience, specially related to MAM accounts on Tradeview Markets. A reviewer warned not to use them because of the tough conditions to withdraw funds as well as the lack of expertise of money managers. That aside, others have marked that customer service is first-rate and funding options pleasant enough to make Tradeview Markets a pretty favorite among many traders.

Tradeview Markets Spreads, Fees, and Commissions

Tradeview Markets provides competitive spreads to cater to the needs of traders at all levels. Spreads start as low as 0.0 pips, ensuring cost-effective trading opportunities. These low spreads help traders maximize their profits by reducing transaction costs.

In addition to spreads, Tradeview Markets keeps its fee structure transparent and affordable. The platform charges commissions starting at $2.50 per lot, which is suitable for cost-conscious traders. These fees are balanced with reliable trade execution and high leverage options.

With its focus on competitive spreads and reasonable commissions, Tradeview Markets ensures that traders benefit from a low-cost trading environment. This combination of affordability and transparency makes it a preferred choice for traders seeking value.

Account Types

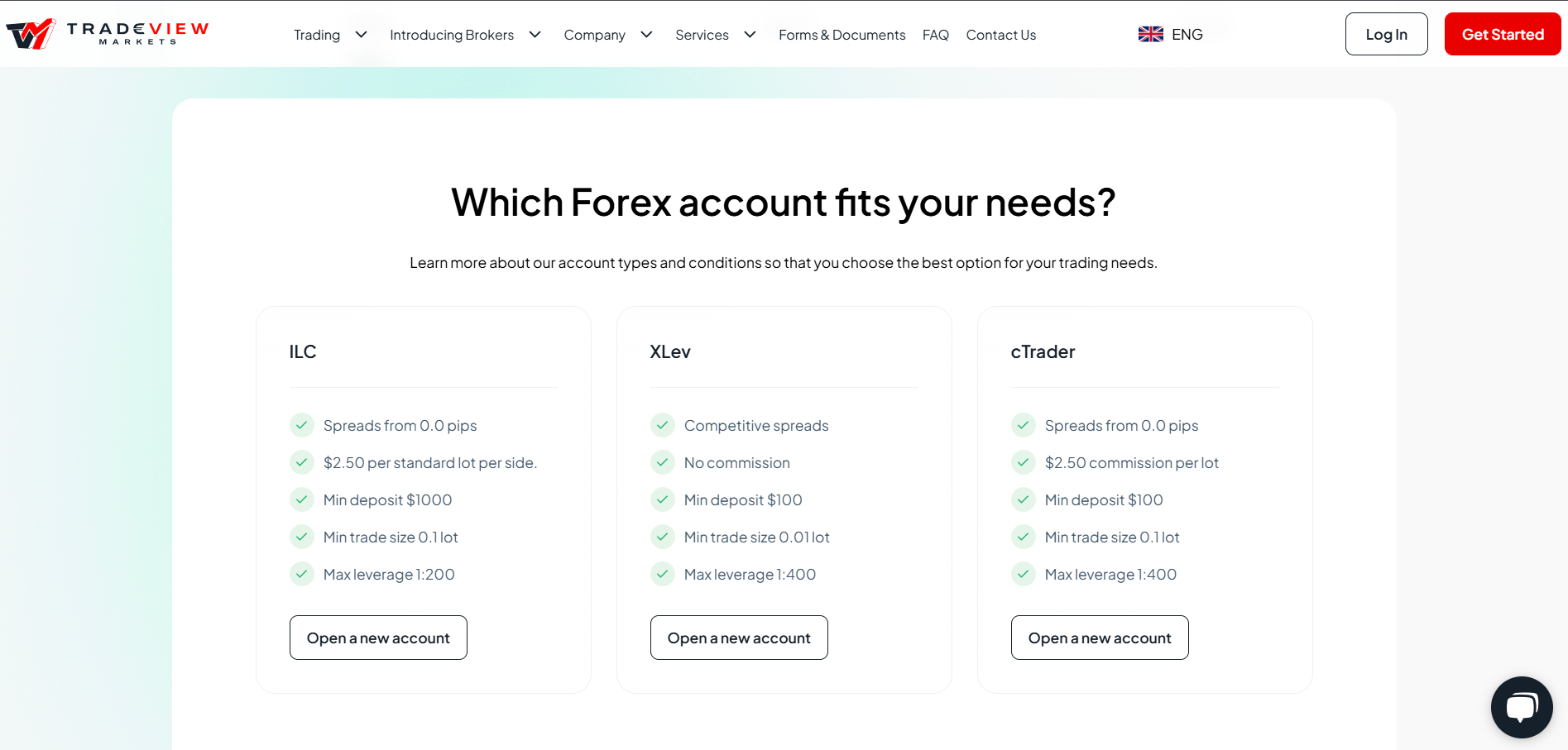

Tradeview Markets offers a variety of account types to suit different forex trading needs. Each account provides specific features for traders based on their experience level and capital requirements, including leverage accounts, ensuring flexibility and accessibility.

ILC Account

The ILC Account is designed for professional traders seeking tight spreads. It offers spreads starting at 0.0 pips with a commission of $2.50 per standard lot per side. The minimum deposit requirement is $1,000, and traders can access a leverage of up to 1:200.

XLev Account

The XLev Account is ideal for beginners or traders with smaller capital. It features competitive spreads with no commission fees, a minimum deposit of $100, and a minimum trade size of 0.01 lot. This account allows traders to leverage up to 1:400.

cTrader Account

The cTrader Account combines tight spreads with affordability. Spreads start from 0.0 pips, with a commission of $2.50 per lot. The minimum deposit is $100, and leverage goes up to 1:400, making it a flexible option for many traders.

How to Open Your Account

Opening an account with Tradeview Markets is a quick and straightforward process, allowing you to start trading forex, CFDs, stocks, and more. By following these simple steps, you can verify your account, fund it, and begin trading with ease.

Step 1: Complete the Application Form

Fill out the account opening application online or download the form and send it via email. Ensure all details are accurate to avoid delays in the process.

Step 2: Verify Your Identity

Submit a valid identification document, such as a passport, driver’s license, or government-issued ID. This is required to comply with regulatory standards and verify your account.

Step 3: Provide Proof of Address

Attach a recent utility bill or bank statement as proof of your address. This step confirms your residential details for account approval.

Step 4: Fund Your Account

Choose your preferred funding method and deposit the required minimum amount. Tradeview Markets supports multiple payment options, including bank transfers, cryptocurrencies, and international transfers.

Step 5: Start Trading

Once your account is verified and funded, you can access Tradeview Markets’ platforms and start trading forex, stocks, CFDs, and more.

Tradeview Markets Trading Platforms

Tradeview Markets offers several powerful trading platforms to suit different trader needs, including MT4 (MetaTrader 4), MT5 (MetaTrader 5), cTrader, CurreneX, and Sterling Trader. These platforms are available on desktop, mobile, and web, providing flexibility and convenience for traders who want to trade on the go or from their desktop. With access to multiple platforms, traders can choose the one that best fits their trading style and preferences.

Each platform has unique features created to make your trading experience much better. MT4 and MT5 are the most popular with advanced charting tools, expert advisors, and automated trading abilities. cTrader is one of the fastest execution systems with an easy-to-use interface and superior charting. CurreneX and Sterling Trader are for professional users, offering high-level customization, advanced features like DMA and sophisticated order types. These are the tools you need, whether you are a beginner or an experienced trader, to be successful in a wide range of markets.

What Can You Trade on Tradeview Markets

Tradeview Markets offers a wide range of trading options, making it easy for traders to diversify their portfolios. You can trade in Forex, stocks, futures, commodities, and indices, providing access to various financial markets worldwide.

Forex

Tradeview Markets provides access to over 50 currency pairs, allowing you to trade major, minor, and exotic currencies. This enables traders to take advantage of the dynamic Forex market and capitalize on currency price fluctuations.

Stocks

With Tradeview Markets, you can trade real US stocks from well-known companies. This gives you the opportunity to invest in top-performing stocks and diversify your portfolio with some of the largest companies in the world.

Futures

Tradeview Markets also offers futures trading, allowing you to speculate on the future price of commodities, stocks, and financial instruments. Futures contracts help traders manage risks and gain from price changes in various markets.

Commodities

Tradeview Markets allows you to trade popular commodities like gold, oil, and agricultural products. Trading commodities offers exposure to essential goods, letting traders capitalize on global supply and demand dynamics.

Indices

On Tradeview Markets, you can trade stock indices such as the S&P 500, which tracks the performance of top companies. This gives you the chance to invest in the overall market, benefiting from market trends rather than individual stock movements.

Tradeview Markets Customer Support

Tradeview Markets provides reliable customer support to assist traders with any issues or inquiries. Their team is available across multiple channels, ensuring you can conveniently reach them for trading-related questions. Support is accessible 24/5, aligning with market hours, so traders get timely assistance when they need it most.

Whether you need help with account setup, trading platforms, or technical issues, Tradeview Markets’ support staff delivers prompt and effective solutions. You can contact them by phone at +1 (345) 945 6271 or via email at support@tvmarkets.com

Additionally, Tradeview Markets offers a comprehensive help center featuring detailed FAQs and guides. This resource helps traders quickly find answers to common questions, reducing the need to contact support for basic issues and ensuring a smooth trading experience.

Advantages and Disadvantages of Tradeview Markets Customer Support

Withdrawal Options and Fees

Tradeview Markets offers several withdrawal options, including bank transfers, bank cards, and electronic payment systems. Bank transfers usually take up to 3 banking days to be completed, while withdrawals through bank cards or electronic payment systems, such as Skrill and Neteller, are processed within 5 minutes. This gives users a choice depending on how quickly they need access to their funds.

The broker allows withdrawals in both fiat currencies and cryptocurrencies, which gives it flexibility to its users. However, one must be aware of the fees that apply to certain methods. Bank transfers incur a fixed commission of $35, while Neteller charges a 1.5% fee and Skrill has a 1% fee. These fees only apply for wire transfers, Neteller, and Skrill withdrawals.

Tradeview Markets requests account verification prior to withdrawal so that users are guaranteed safety. The entire verification process has to be completed during the registration process. Withdrawal methods include Sticpay, UnionPay, Skrill, Uphold, JPay, Interac, Neteller, among others for the user’s convenience in choosing what they need best.

Tradeview Markets Vs Other Brokers

#1. Tradeview Markets vs XM

Tradeview Markets and XM are two well-known brokers offering unique advantages for traders worldwide. Tradeview Markets provides access to over 5,000 U.S. stocks and options alongside Forex, indices, cryptocurrencies, and commodities, while XM supports a broader range of over 1,000 trading instruments, including precious metals and energies. Both brokers offer MetaTrader 4 and 5 platforms, with XM adding its custom XM App for mobile trading. XM offers higher leverage of up to 1:1000 for non-EU clients compared to Tradeview Markets‘ 1:400, and its $5 minimum deposit makes it more accessible than Tradeview Markets’ $100 requirement. While Tradeview Markets charges inactivity fees, XM provides deposit bonuses for non-EU users. Both brokers are regulated—Tradeview Markets by CIMA and MFSA, and XM by ASIC and CySEC with Tradeview Markets excelling in liquidity via over 50 providers and XM prioritizing instant trade execution with 99.35% of orders completed without requotes.

Verdict: Tradeview Markets suits experienced traders with advanced liquidity and extensive stock options, while XM is ideal for beginners seeking low-cost entry, bonuses, and a broader range of instruments. The best choice depends on your priorities, such as leverage, instruments, and account features.

#2. Tradeview Markets vs RoboForex

Tradeview Markets and RoboForex both offer competitive trading conditions for global traders. Tradeview Markets provides access to over 5,000 U.S. stocks and options, along with Forex, indices, and cryptocurrencies, while RoboForex boasts over 12,000 financial instruments, including Forex, stocks, indices, ETFs, and commodities. Both brokers support popular trading platforms like MetaTrader 4 and 5, but RoboForex also includes its own platforms, R StocksTrader and R MobileTrader. In terms of leverage, RoboForex offers up to 1:2000, significantly higher than Tradeview Markets’ maximum of 1:400. While Tradeview Markets’ minimum deposit is $100, RoboForex is more accessible with a $10 minimum. Additionally, Tradeview Markets charges inactivity fees, while RoboForex offers a welcome bonus and an affiliate program with payouts up to 84%.

Verdict: Tradeview Markets is ideal for experienced traders seeking advanced liquidity and more U.S. stocks, while RoboForex is better for beginners with its lower deposit, higher leverage, and diverse instruments. Your choice depends on factors like leverage, instruments, and account accessibility.

#3. Tradeview Markets vs Exness

Tradeview Markets and Exness are both reputable brokers offering a wide range of trading instruments globally. Tradeview Markets provides access to over 5,000 U.S. stocks and options, as well as Forex, indices, and cryptocurrencies, while Exness offers CFDs on forex, stocks, commodities, indices, and cryptocurrencies. Both brokers support popular platforms like MetaTrader 4 and 5, but Exness also features its proprietary Exness Terminal and a mobile app. Exness stands out with its unlimited leverage for retail clients, compared to Tradeview Markets’ maximum leverage of 1:400, and offers a much lower minimum deposit of $10, making it more accessible to new traders. Additionally, Tradeview Markets charges inactivity fees, while Exness offers fast withdrawals, 24/7 support, and competitive spreads starting at 0.1 pips for EUR/USD.

Verdict: Exness is ideal for traders seeking unlimited leverage, lower deposit requirements, and more account options, while Tradeview Markets is better for those wanting advanced liquidity and a broader selection of U.S. stocks. Your choice depends on leverage needs, account preferences, and trading goals.

Also Read: XM Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH TRADEVIEW MARKETS

Conclusion: Tradeview Markets Review

Tradeview Markets is a reliable broker known for its diverse trading platforms, competitive spreads, and multiple account types tailored to different trader needs. The broker supports a wide range of assets, including forex, stocks, and cryptocurrencies, making it suitable for both beginners and experienced traders. Its focus on fast withdrawals and robust customer support adds to its appeal.

While Tradeview Markets offers a comprehensive trading experience, users should consider the fees associated with certain withdrawal methods, such as bank transfers and e-wallets like Skrill and Neteller. Overall, the broker provides a secure and flexible environment for trading, supported by modern tools and transparent policies.

Also Read: Traders Trust Review 2024 – Expert Trader Insights

Tradeview Markets Review: FAQs

What trading platforms are available?

Tradeview Markets offers MetaTrader 4, MetaTrader 5, cTrader, and Currenex for diverse trading needs.

What assets can I trade?

You can trade forex, stocks, indices, commodities, and cryptocurrencies.

Are there withdrawal fees?

Yes, fees apply to some methods: $35 for bank transfers, 1.5% for Neteller, and 1% for Skrill.

Is my account secure?

Yes, Tradeview Markets requires account verification for secure transactions.

OPEN AN ACCOUNT NOW WITH TRADEVIEW MARKETS AND GET YOUR BONUS