Position in Rating | Overall Rating | Trading Terminals |

240th  | 2.0 Overall Rating |  |

TradeUltra Review

A trustworthy Forex broker provides transparency, robust trading platforms, and accessible customer support. They offer competitive fees, secure transaction methods, and a variety of account options tailored to different trader needs. Picking the right broker not only enhances your trading experience but also helps protect your investments.

TradeUltra is identified by its solid user interface and diverse accounts along with flawless transactions. However, competitive pricing and complete transparency about money transfer processes have positioned it as one of the easy ways to transfer money along with generating an income in case a trade is completed, thereby becoming the option for newcomers and professionals.

In this review, we go deep into TradeUltra’s unique features such as account options, deposit and withdrawal methods, commission structure, and much more. Combining expert insights with feedback from real traders, this evaluation will provide you with the knowledge to determine whether TradeUltra meets your trading goals.

What is TradeUltra ?

TradeUltra, which was founded in 2013, is an STP broker that mainly offers CFDs. It is a trading company mainly dealing with CFDs. It offers a wide range of CFDs that include currency pairs, stocks, indices, commodities, and precious metals. The company provides access to over 3,000 financial instruments, including forex, shares, indices, commodities, and digital assets.

TradeUltra is licensed by the Financial Services Commission of Mauritius and Labuan Financial Services Authority in Malaysia. In compliance and transparency, it operates, with Excess of Loss Insurance coverage up to USD 1,000,000.

TradeUltra provides easy-to-use platforms, such as the TradeUltra app and MetaTrader 5, with advanced charting tools and multi-device support. Comprehensive referral programs and institutional services, including white label packages and liquidity provision, are also available to support business growth.

A name associated with excellence, TradeUltra has also received such prestigious awards as Best Multi-Asset Broker 2023 and Most Transparent Broker 2023. The platform keeps innovating and working with great determination to bring clients secure access and innovative solutions in trading.

TradeUltra Regulation and Safety

TradeUltra conducts business under a variety of regulatory frameworks that guarantee the safe trading for its clients. TradeUltra is registered and regulated by Labuan Financial Services Authority (LFSA) in Malaysia. It holds License number MB/20/0059.

In addition, TradeUltra Markets Limited is an International Business Company that is registered in Saint Vincent and the Grenadines. The registration number is 20997 IBC 2013. TradeUltra Limited is also registered in Anguilla under the registration number A000001775.

These regulatory associations represent TradeUltra’s commitment to complying with all the rules, as well as protecting clients through its assurance of international financial standards.

TradeUltra Pros and Cons

Pros

- Low fees

- Multiple platforms

- Asset variety

- Flexible accounts

Cons

- Offshore regulation

- Transparency concerns

- CFD limitation

- Regional restrictions

Benefits of Trading with TradeUltra

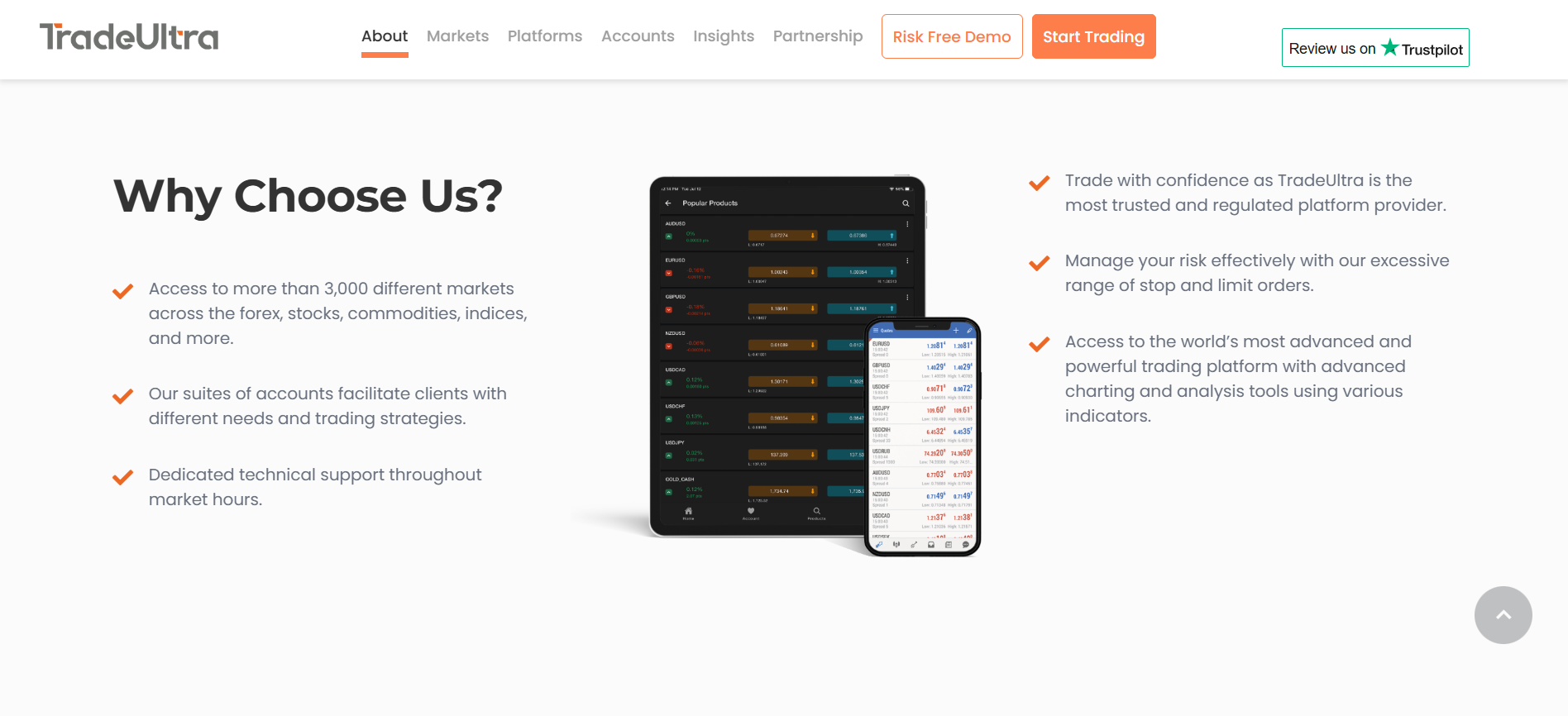

TradeUltra offers accounts of all kinds-from newbies to professionals who do very high-volume trading. They ensure to meet every style of trading by giving several types of accounts, ensuring a highly personal trading experience. With a 24/5 support service, TradeUltra ensures that traders receive the support and guidance they need to address any trading or transaction-related concerns. Their knowledgeable support team helps solve issues promptly, making trading stress-free.

TradeUltra eliminates price manipulation, offering fair and competitive rates to maximize trader profits. Mainly it deals with trading CFDs, offering access to more than 3,000 CFD instruments across different markets, such as currency pairs, stocks, indices, commodities, and precious metals. This means that there is a wide scope for portfolio diversification and capitalization on global opportunities.

TradeUltra operates under the strict regulatory body of the Financial Services Commission (FSC) of Mauritius and Labuan Financial Services Authority (LFSA). This compliance ensures the safe and reliable trading environment. Using robust trading infrastructure, TradeUltra provides low latency, ultra-fast trade executions. In this way, it offers the trader to respond fast on opportunities while offering a security feature at a very high level.

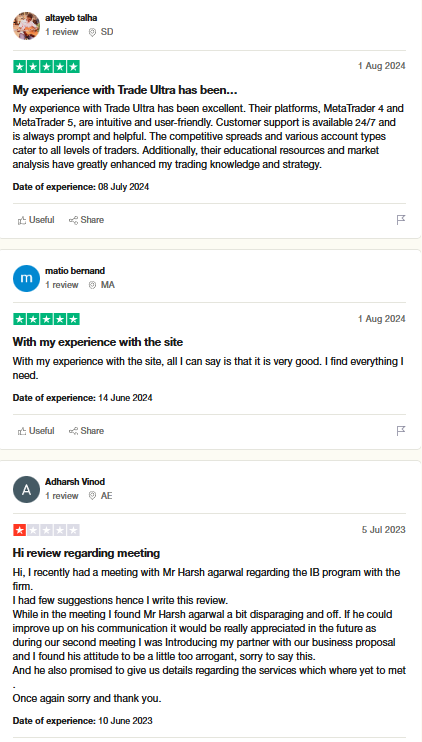

TradeUltra Customer Reviews

TradeUltra has received positive feedback from its customers for providing reliable and user-friendly trading platforms such as MetaTrader 4 and MetaTrader 5. Customers love the platform’s competitive spreads and educational resources, which help traders at all levels. Reviews point out that the 24/7 customer support is prompt and effective in solving issues, making the trading experience smooth. However, there are negative opinions regarding the professionalism of some representatives, such as communication during a meeting about the IB program. Overall, though, the opinion tends to be positive, with a lot of users praising how the platform is able to serve their trading needs efficiently.

TradeUltra Spreads, Fees, and Commissions

TradeUltra brings competitive spreads from 0 pips on the major currency pairs, giving access to the cheaper side of the forex market. This spread structure really tightens up trading, especially for high-frequency traders.

The broker operates on the commission-free model, meaning traders won’t be charged extra fees with every trade. This way costs can be easily calculated with such an approach, thereby providing a benefit for people looking to minimize costs per trade.

TradeUltra maintains transparency by not imposing hidden fees, ensuring that traders have a clear understanding of their trading costs. However, it’s important to note that while trading fees are absent, other non-trading fees, such as withdrawal charges, may apply.

The broker gives access to a universe of 3,000 CFDs across several asset classes, including forex, stocks, indices, commodities, and precious metals. It gives traders an opportunity to diversify their portfolios and explore many markets under one roof.

Account Types

TradeUltra offers three main account to cater to diverse trading needs: Individual, Joint, and Corporate accounts. Each account provides access to over 3,000 financial instruments, competitive spreads, and advanced trading platforms like MT4 and MT5.

Individual Account

This account is designed for solo traders. The Individual Account grants full control over trading activities. Users benefit from advanced charting tools, various order types, and risk management features such as stop-loss and take-profit orders.

Joint Account

Ideal for partners or groups, the Joint Account is a type of account where multiple individuals can share control over a single trading account. This setup makes collaborative trading strategies and shared financial goals possible.

Corporate Account

The Corporate Account is a tailored account for businesses and institutional investors. It provides comprehensive trading solutions with enhanced risk management tools, access to a wide range of trading instruments, and support for implementing diverse trading strategies.

How to Open Your Account

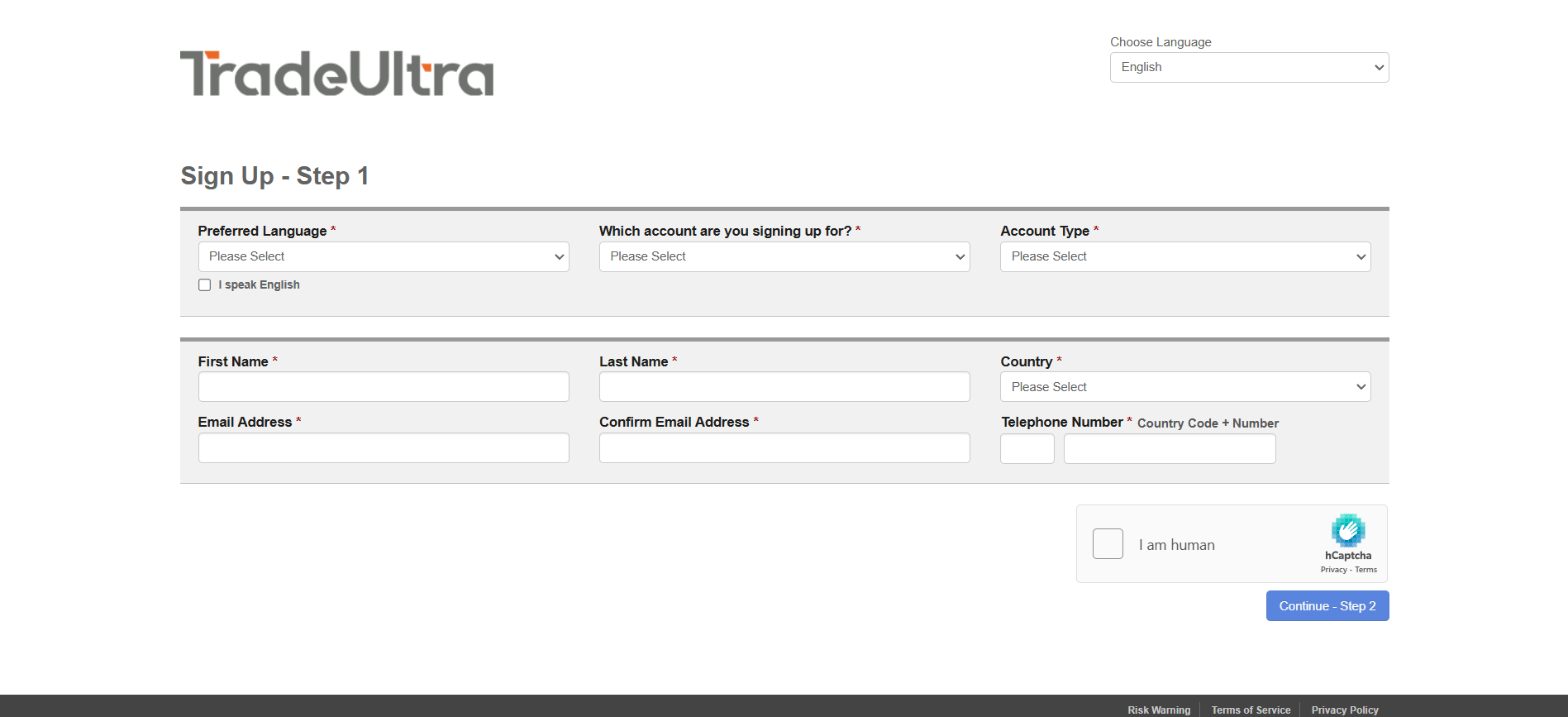

Opening an account with TradeUltra is a simple process designed to get you trading quickly. Here’s how to set up your account:

Step 1: Go to the TradeUltra Website

Go to the TradeUltra accounts page to start the registration process.

Step 2: Click on “Open Live Account”

Find and click on the “Open Live Account” button to open the registration form.

Step 3: Fill out the Registration Form

Fill in your personal information: name, email, phone number, and country of residence. Select the desired account type: Individual, Joint, or Corporate, and set a strong password.

Step 4: Verify Your Identity

Upload necessary identification documents to comply with regulatory requirements. These could be government-issued ID and proof of address.

Step 5: Fund Your Account

After the verification process, deposit money into your account. There are many funding options offered by TradeUltra, including bank transfers and credit/debit cards. The minimum deposit is $100.

Step 6: Trading

Once your account is funded, you can start trading over 3,000 financial instruments through the platforms of TradeUltra, such as MT4 and MT5.

TradeUltra Trading Platforms

TradeUltra provides access to two primary trading platforms-the proprietary TradeUltra App and MetaTrader 5 (MT5), through which it caters for diverse levels of traders and which, in turn, open its doors to over 3,000 financial products covering forex, equities, commodities, and indices.

The TradeUltra App is a multi-asset trading platform which features a customizable dashboard, mobile-friendly tools, and intelligent watchlists. It provides advanced charting tools and detailed product overviews, enabling traders to make informed decisions. The application is accessible across desktop, web, and mobile, ensuring global accessibility and real-time data synchronization.

MetaTrader 5 is one of the most popular platforms among professional traders. It has powerful analytical tools and indicators. The system allows automated trading using Expert Advisors (EAs) and offers an integrated development environment for creating and testing EAs. MT5 is available from desktop, web, and mobile devices, so traders can access their accounts 24/5 from any location on the globe.

Both platforms are built to execute trades with speed, ensuring liquidity and smooth experience during trading. They both facilitate different trading strategies and hedge and scalp, providing good spreads to minimize trading costs.

What Can You Trade on TradeUltra

Forex Trading

Forex trading allows you to trade currency pairs such as EUR/USD, GBP/USD, and more. With TradeUltra, you can access one of the world’s largest financial markets, open 24/5, so you can trade major, minor, and exotic currency pairs. Take advantage of tight spreads, fast execution, and advanced trading tools to maximize your potential.

Shares Trading

TradeUltra provides access to global stocks from top companies like Apple, Amazon, and Tesla. You can speculate on price movements without owning the shares directly. Whether you’re interested in tech giants or other industries, TradeUltra offers opportunities for short- and long-term investments.

Indices Trading

Indices trading allows you to trade on the performance of whole markets, such as the S&P 500, Dow Jones, or FTSE 100. Instead of individual stocks, you are speculating on market trends, which makes it a popular choice for diversified trading. TradeUltra offers competitive spreads and real-time market insights for better decision-making.

Commodities Trading

Commodities offered on TradeUltra include metals such as gold and silver, energy commodities such as oil, and agricultural products. These are considered to be highly volatile markets and diversified ones. Invest in price changes of actual products that have been considered significant in the global economy.

Crude Oil and Energy

Energy market trading is available with TradeUltra. This includes crude oil, natural gas, and other resources. All these are dependent on global demand, geopolitical events, and economic changes, thus providing ample opportunities to trade. Use advanced tools and analysis for confident trading.

Precious Metals Trading

TradeUltra affords access to this marketplace with low spreads as well as flexible trading options; the use of precious metals offers inflation hedging or portfolio diversification.

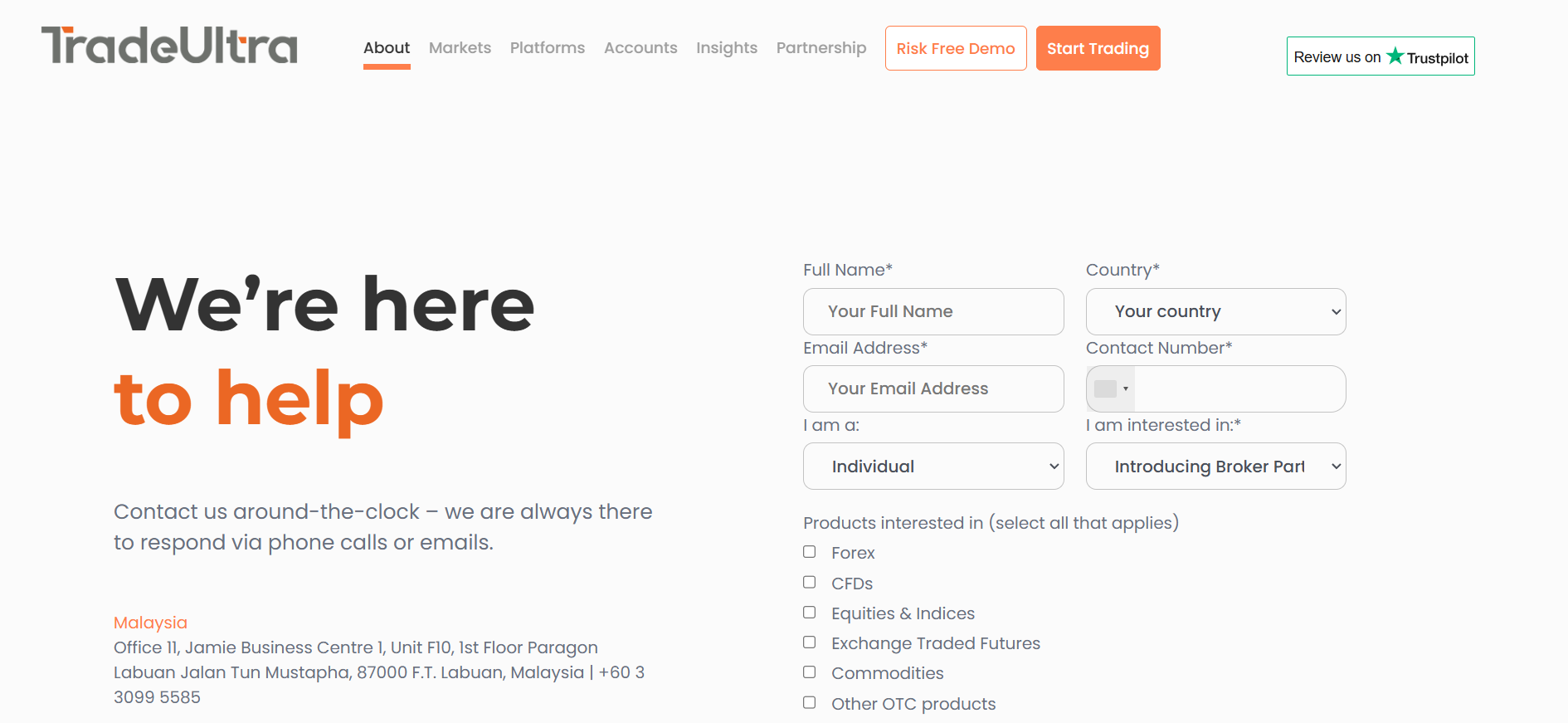

TradeUltra Customer Support

TradeUltra provides strong customer support designed for traders at every level. Their support team operates 24/5, ensuring assistance is available during global market hours. Clients can rely on their multilingual services for seamless communication across different regions.

Quick email contacts are available at info@tradeultra.com for responding to inquiries. Support for immediate concerns is through their phone line at +60 3 3099 5585 with the trained representatives addressing issues that may have arisen concerning account or trading.

Additionally, TradeUltra has a physical office in Labuan, Malaysia at 11 Jamie Business Centre 1, Unit F10, 1st Floor Paragon Labuan, Jalan Tun Mustapha, 87000 F.T. Labuan. This helps ensure accessibility for clients in the region.

For further support or alternative contact details, see their contact page on the TradeUltra website. The user-friendly interface and wealth of information makes it easy to find answers to most frequently asked questions.

Advantages and Disadvantages of TradeUltra Customer Support

Withdrawal Options and Fees

TradeUltra presents a number of withdrawal alternatives to suit their clients’ convenience. Although information on the withdrawal methods and the fees involved is not clearly stated on their website, they declare that they strive to withdraw all funds quickly without hassle.

For specific information on withdrawal options, along with any fees applicable, customers can reach out to TradeUltra’s customer support. This allows customers to have the best and most current information under the most pertinent conditions to their situation.

For a smooth withdrawal, one should first go through TradeUltra’s terms and conditions and then contact the support to get the whole process and related charges. All these steps enable an individual to take better fund management decisions.

TradeUltra Vs Other Brokers

#1. TradeUltra vs XM

TradeUltra and XM cater to different trading preferences.TradeUltra is designed with professional traders in mind, with an emphasis on advanced tools and personalized support, whereas XM focuses on user-friendly platforms and a lower barrier to entry for beginners. TradeUltra provides higher leverage and tighter spreads for high-volume trading, while XM balances competitive spreads with robust educational resources. Both platforms have many supported assets, but XM stands out by having an extensive library of educational resources and providing multilingual support, making it globally inclusive. On the other hand, TradeUltra shines with its premium account options designed for experienced traders who might seek customized features.

Verdict: TradeUltra is well-suited for experienced traders seeking customized tools and advanced features, while XM is better suited for beginners and others who require a wide range of comprehensive educational resources. Each platform caters to individual trader needs, so the choice should be based on experience and trading requirements.

#2. TradeUltra vs RoboForex

TradeUltra and RoboForex both serve traders with all kinds of needs, though they are quite different in what each offers. TradeUltra emphasizes simplicity, with an easy-to-use interface and no commissions on the major asset classes, appealing to the beginners. In contrast, RoboForex provides sophisticated tools, account types, and competitive spreads that suit professional traders. Flexibility in terms of the proprietary platforms and bonuses is also offered by RoboForex, whereas TradeUltra focuses on cost efficiency and straightforward trading. Even though both the brokers offer robust security, the multi-asset coverage and leverage options available with RoboForex are much better than TradeUltra’s streamlined approach.

Verdict: RoboForex suits professional traders looking for different varieties and sophisticated tools, and TradeUltra suits novice traders preferring to be more simplistic, low-costing, based on their preference of experience and need.

#3. TradeUltra vs Exness

TradeUltra and Exness are notable platforms aimed at fulfilling the requirements of diversified traders. TradeUltra focuses more on analytical tools and advanced high-performance charting systems. Thus, it is very apt for professional traders who have the necessity to be elaborately briefed on the markets. On the other hand, Exness is flexible with lower minimum deposits and more varieties of account types that cater to beginning and intermediate traders. Indeed, although TradeUltra specializes in offering a professional environment for trading, Exness offers access and reliability through the user-friendly interface and robust support for its customers.

Verdict: TradeUltra is meant for traders who want really detailed market analysis and professional grade features, while Exness fits those who prioritize affordability and accessibility. The choice then depends on whether advanced tools or entry-level flexibility aligns more with your trading goals.

Also Read: XM Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH TRADEULTRA

Conclusion: TradeUltra Review

TradeUltra is a good brokerage firm that offers a variety of trading instruments, easy interfaces, and strong regulatory support. They have competitive spreads, flexible accounts, and advanced tools, such as MetaTrader 5, which makes them friendly to both beginners and more experienced traders. The primary concerns about offshore regulation should not be a significant worry since the firm is open and secure in transactions.

As TradeUltra offers a robust trading platform for traders who wish to have fast executions as well as a wide selection of assets, it positions itself for the competitive forex and CFD market place while addressing specific trading needs.

Also Read: One Royal Review 2024 – Expert Trader Insights

TradeUltra Review: FAQs

Is TradeUltra a regulated broker?

Yes, TradeUltra is regulated by the Financial Services Commission of Mauritius and the Labuan Financial Services Authority in Malaysia, ensuring compliance with international financial standards.

What trading platforms does TradeUltra offer?

TradeUltra provides the proprietary Trade Ultra App and MetaTrader 5, both designed for seamless and efficient trading across multiple devices.

What is the minimum deposit to start trading with TradeUltra?

The minimum deposit required to open an account with TradeUltra is $100, making it accessible for traders of various levels.

OPEN AN ACCOUNT NOW WITH TRADEULTRA AND GET YOUR BONUS