Tradetime Review

Tradetime is an online trading platform designed for both beginners and seasoned traders, offering a variety of assets like forex, stocks, and commodities. It focuses on a user-friendly experience, with tools to enhance trading efficiency and educational resources to support informed decision-making. Security is also a key feature, with encryption and regulatory compliance safeguarding user data.

Overall, Tradetime provides a comprehensive trading solution, combining diverse assets with robust security and accessible tools. While the wide range of features may feel overwhelming for newcomers, Tradetime positions itself as a suitable choice for those seeking an all-in-one platform for trading.

What is Tradetime?

Tradetime is a forex broker and investment firm specializing in global financial markets, providing access to over 150 assets, including currencies, stocks, indices, and commodities, through a customizable trading platform. The company, operated by SILVER GROUP LTD and based in Macedonia, aims to cater to both beginners and experienced investors with its personalized customer service and trading tools.

However, Tradetime has faced some criticism related to its cost structure and transparency in regulation. Some reviews have highlighted concerns about potential misleading claims regarding regulation and ownership, so prospective users are advised to conduct thorough research before engaging with the platform.

Tradetime Regulation and Safety

Tradetime operates as a forex broker and investment firm, but its regulatory status raises concerns. The company claims to be regulated by the Vanuatu Financial Services Commission (VFSC). However, the VFSC is known for lenient regulatory standards, which may not provide robust investor protection.

Additionally, Tradetime has faced criticism regarding its transparency and legitimacy. Some reviews have labeled it as a potential scam, citing misleading claims about regulation and ownership. Prospective users should exercise caution and conduct thorough research before engaging with the platform not the bonus but the losing funds.

Tradetime Pros and Cons

Pros

- Diverse assets

- MetaTrader 5

- Multiple accounts

- 24/7 support

Cons

- Regulatory concerns

- Withdrawal issues

- High fees

- Limited transparency

Benefits of Trading with Tradetime

Tradetime provides traders with access to over 150 assets, including currencies, stocks, indices, and commodities, allowing for a diversified trading experience. The platform offers various account options, such as ECN accounts with competitive spreads and leverage up to 400:1, which are designed to accommodate both new and seasoned investors.

The platform supports MetaTrader 4, offering features like one-click trading and mobile alerts for a seamless experience. Tradetime also focuses on personalized customer support through multiple channels, aimed at enhancing user satisfaction.

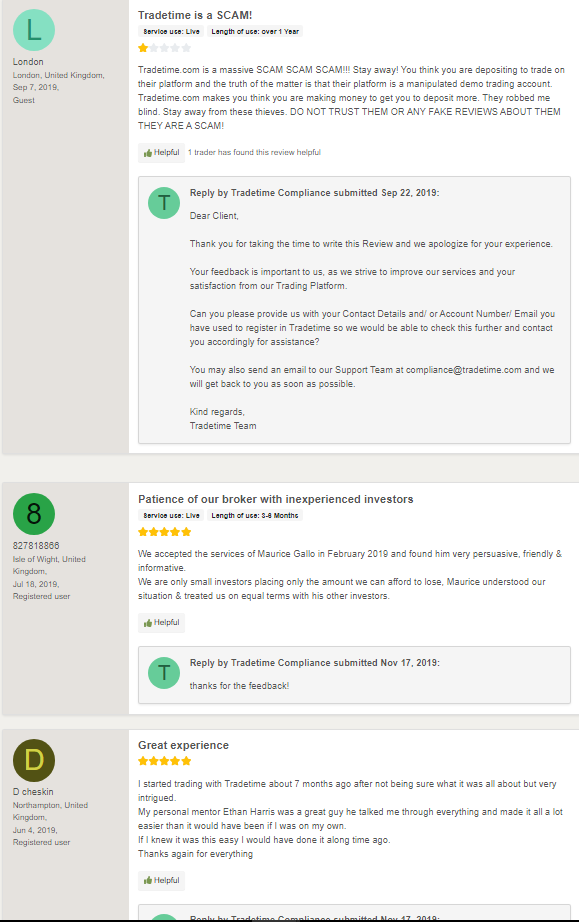

Tradetime Customer Reviews

Tradetime has received mixed feedback from its users. Some traders have reported positive experiences, highlighting the platform’s diverse asset offerings and user-friendly interface. They appreciate the range of trading instruments and the support provided by the customer service team.

However, there are significant concerns regarding Tradetime‘s regulatory status and transparency. Several users have reported issues with fund withdrawals and have questioned the legitimacy of the platform. These concerns suggest that potential investors should exercise caution and conduct thorough research before engaging with Tradetime.

Tradetime Spreads, Fees, and Commissions

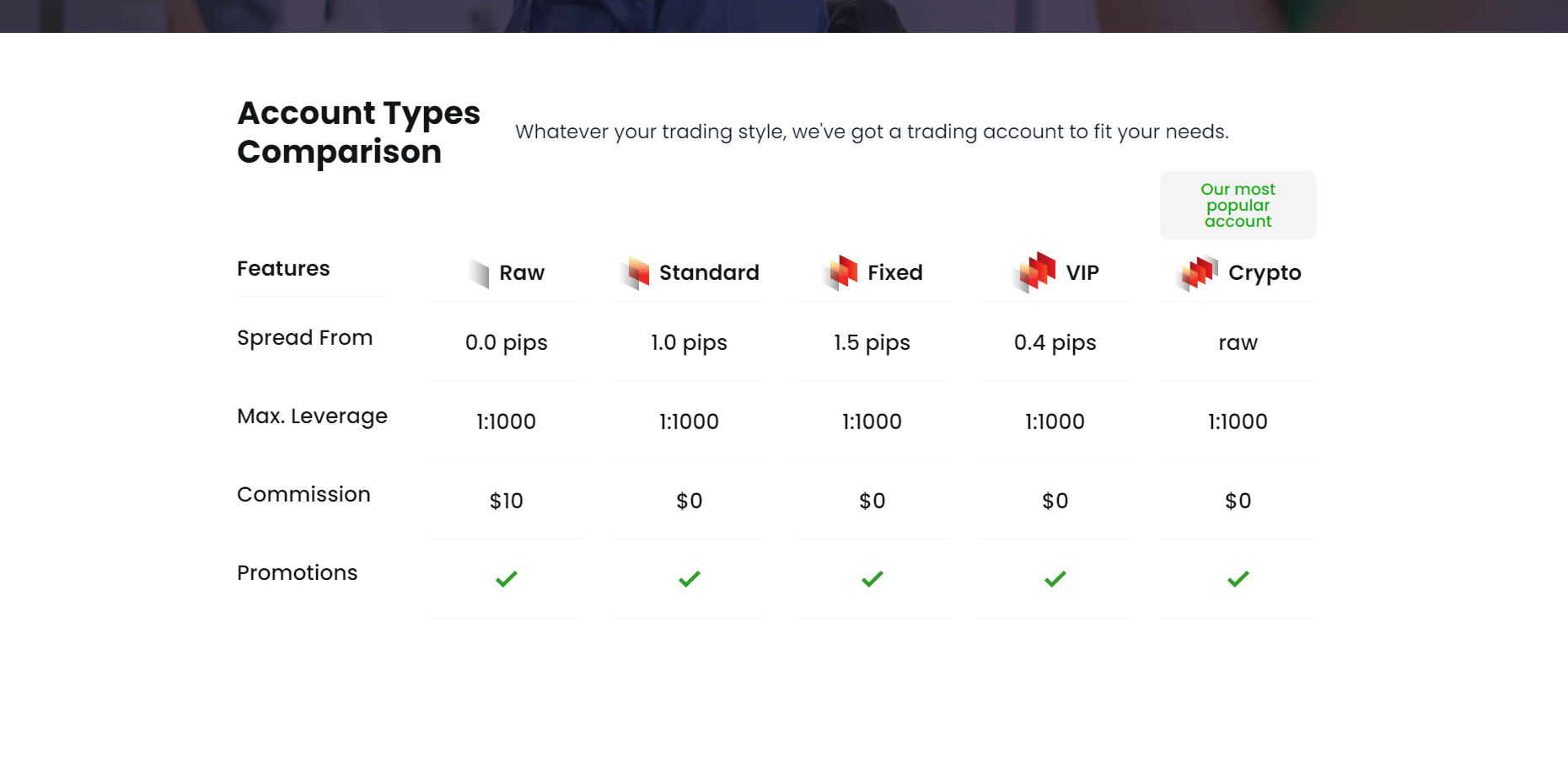

Tradetime offers various account types with differing cost structures to accommodate diverse trading preferences. The Standard account features spreads starting from 1.0 pips with no additional commissions, while the Raw account provides tighter spreads beginning at 0.0 pips, accompanied by a commission of $10 per lot traded. These options allow traders to select a pricing model that aligns with their trading strategies.

In addition to spreads and commissions, Tradetime may impose other fees, such as overnight swap charges for positions held open beyond a trading day. These fees can vary based on the specific instrument and market conditions. It’s essential for traders to review Tradetime‘s detailed fee schedule to fully understand the potential costs associated with their trading activities.

Account Types

Tradetime offers various account types to suit different trading needs and experience levels. Each account type features unique spreads, fees, and trading conditions, allowing traders to select the one that best aligns with their strategies.

Standard Account

The Standard Account is ideal for beginner traders, offering spreads starting from 1.0 pips with no additional commissions. This account provides access to a wide range of assets and basic trading tools, allowing newcomers to enter the market with minimal cost.

Fixed Account

The Fixed Account caters to experienced traders who prefer tighter spreads, beginning at 0.0 pips, with a commission of $10 per lot traded. This account type offers lower trading costs for high-volume traders seeking more competitive pricing.

VIP Account

The VIP Account is designed for professional traders, providing direct market access with extremely tight spreads and a commission structure. This account type is best suited for those who prioritize fast execution and minimal spreads in their trading activities.

How to Open Your Account

Opening an account with Tradetime is a straightforward process designed to get you trading quickly. Follow these steps to set up your account and begin your trading journey.

Step 1: Registration

Visit the Tradetime website and click on the “Register” button. Provide your full name, email address, and phone number to create your account.

Step 2: Verification

After registration, you’ll need to verify your identity. Upload a valid ID or passport to comply with Tradetime‘s security protocols.

Step 3: Account Selection

Choose the account type that best suits your trading needs. Options include Standard, Raw, ECN, and VIP accounts, each with unique features and benefits.

Step 4: Funding

Deposit funds into your account using available methods such as bank transfer, credit/debit card, or online payment systems. Ensure you meet the minimum deposit requirement for your chosen account type.

Step 5: Start Trading

Once your account is funded, access the trading platform to begin trading. Utilize the tools and resources provided by Tradetime to make informed trading decisions.

Tradetime Trading Platforms

Tradetime offers the MetaTrader 5 (MT5) platform, a widely used trading software in the industry. MT5 provides advanced charting tools, technical analysis features, and supports automated trading through Expert Advisors (EAs). This platform is accessible on various devices, including Windows, Mac OS X, and Linux, ensuring flexibility for traders.

In addition to MT5, Tradetime provides a web-based trading platform, allowing users to trade directly from their browsers without the need for software installation. This platform offers real-time market data, a range of order types, and is designed for user-friendly navigation, catering to both novice and experienced traders.

What Can You Trade on Tradetime

Tradetime offers a diverse range of financial instruments, enabling traders to access various global markets. This variety allows for portfolio diversification and the ability to capitalize on multiple trading opportunities.

Forex

Trade over 80 currency pairs, including major, minor, and exotic pairs, with competitive spreads and leverage options. The forex market operates 24 hours a day, five days a week, providing ample trading opportunities.

Indices

Access global equity markets by trading CFDs on major indices such as the S&P 500, NASDAQ-100, and DAX. This allows traders to speculate on the performance of entire market sectors.

Commodities

Engage in trading precious metals like gold and silver, as well as energy products like oil and gas. Commodities trading offers diversification and hedging opportunities against market volatility.

Stocks

Invest in shares of leading companies across various industries without paying commissions. This enables traders to take positions on individual company performances.

Cryptocurrencies

Trade popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin with no need for digital wallets. Benefit from high leverage and the ability to go long or short on crypto assets.

Tradetime Customer Support

Tradetime offers customer support via phone and live chat to assist clients with technical and organizational matters. A dedicated team is available 24/7, providing assistance in over 10 languages to ensure clients are comfortable with the services during their initial trading period. Continued support is available for trading and platform use through a large and highly skilled trading services team. Contact details can be found on the “Contact Us” page of their website.

Customer Support makes the traders trading account and transfer money safe to avoid all the money losing. To avoid the act of lose money, support team treat clients fair within the companies trading.

Advantages and Disadvantages of Tradetime Customer Support

Withdrawal Options and Fees

Tradetime provides several methods for withdrawing funds, each with its own processing times and potential fees. Understanding these options is essential for efficient fund management.

Bank Transfers

Withdrawals can be made directly to your bank account. Processing times typically range from 2 to 5 business days, and fees may apply depending on your bank’s policies.

Credit/Debit Cards

Funds can be returned to the credit or debit card used for deposits. This method usually takes 3 to 5 business days, with potential fees varying by card issuer.

E-Wallets

Options like Skrill and Neteller are available for withdrawals. These transactions are often processed within 24 hours, offering a quicker alternative with minimal fees.

Cryptocurrency

For those trading digital assets, withdrawals can be made in cryptocurrencies. Processing times are generally faster, often within a few hours, though network fees may apply.

Tradetime Vs Other Brokers

#1. Tradetime vs AvaTrade

Tradetime and AvaTrade both provide access to various financial markets, but AvaTrade stands out with its strong regulatory backing from reputable authorities, compared to Tradetime‘s more lenient VFSC regulation. AvaTrade offers multiple trading platforms, including proprietary options, while Tradetime focuses on MetaTrader 5. Additionally, AvaTrade is known for transparent fees and competitive spreads, whereas Tradetime has faced criticism over its fee structure. Customer support at AvaTrade also has a positive reputation, in contrast to Tradetime‘s mixed feedback.

Verdict: AvaTrade emerges as the more reliable and well-rounded choice, especially for those valuing regulation and platform variety. Caution is recommended for those considering Tradetime due to its regulatory and fee concerns.

#2. Tradetime vs RoboForex

Tradetime and RoboForex both offer access to major financial markets, but RoboForex holds stronger regulatory backing from CySEC and IFSC, compared to Tradetime‘s VFSC regulation, which provides less oversight. RoboForex supports multiple platforms, including cTrader and R StocksTrader, while Tradetime focuses on MetaTrader 5. Additionally, RoboForex is praised for transparent fees, whereas Tradetime faces criticism over its cost structure.

Verdict: With stronger regulation and platform variety, RoboForex is the more secure and versatile choice. Caution is advised with Tradetime due to its regulatory and fee concerns.

#3. Tradetime vs Exness

Tradetime and Exness both provide access to key financial markets, but Exness holds stronger regulation through FCA and CySEC, compared to Tradetime‘s VFSC oversight. Exness also supports more platform options, including its proprietary Exness Terminal, whereas Tradetime focuses on MetaTrader 5. Additionally, Exness is known for transparent fees and competitive spreads, while Tradetime has faced criticism over its cost structure.

Verdict: With robust regulation and broader platform options, Exness is a more secure and versatile choice. Users should exercise caution with Tradetime due to its regulatory and fee concerns.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH TRADETIME

Conclusion: Tradetime Review

Tradetime provides a range of trading options with access to various assets, including forex, stocks, and commodities, along with multiple account types and the popular MetaTrader 5 platform. Its flexibility in spreads and account features suits traders of different experience levels, and its support team offers assistance through multiple channels.

However, concerns about Tradetime‘s regulatory transparency and customer complaints regarding withdrawals raise caution. Potential investors should carefully consider these factors and conduct thorough research before committing funds to ensure Tradetime aligns with their trading needs and safety expectations.

Tradetime Review: FAQs

What is Tradetime?

Tradetime is a forex broker offering access to various markets through multiple account types and the MetaTrader 5 platform.

Is Tradetime regulated?

Tradetime is regulated by the VFSC, but this body is known for less stringent investor protections.

What trading platforms does Tradetime offer?

Tradetime provides the MetaTrader 5 (MT5) platform, known for its advanced trading tools and compatibility with multiple devices.

OPEN AN ACCOUNT NOW WITH TRADETIME AND GET YOUR BONUS