TradersWay Review

Forex brokers play a critical role in the world of currency trading, serving as intermediaries between retail traders and the broader financial markets. Choosing the right Forex broker is not just about finding a platform to execute trades; it’s about ensuring security, access to a wide range of markets, and receiving reliable support and tools to enhance your trading experience.

TradersWay (Trader’s Way), established by a team of financial experts, stands out in the crowded marketplace of Forex brokers. Throughout its existence, the broker has focused on continuous improvement of its services and technologies. They’ve consistently added innovative platforms and useful applications, including options for social trading, which allow traders worldwide to maximize their trading potential.

In this comprehensive review, we’ll delve deep into what makes Trader’s Way a unique contender in the Forex market. We aim to provide a thorough evaluation, highlighting both the advantages and potential drawbacks. From varied account options to the specifics of deposit and withdrawal processes, as well as commission structures, this review is designed to give you all the essential details. By combining expert analysis with real trader feedback, we equip you with the knowledge needed to decide if Trader’s Way should be your broker of choice.

What is TradersWay?

TradersWay is a Forex broker that was founded by a group of financial experts and analysts. Their mission is focused on providing trading opportunities to people all over the globe. From its early days, TradersWay has been dedicated to improving the services and technologies it offers to its users.

Over time, TradersWay has significantly expanded its technology offerings. They have integrated new trading platforms and useful applications to enhance the trading experience. Additionally, the introduction of social trading platforms allows users to emulate the strategies of experienced traders, making it easier for both active Forex traders and those who prefer a more passive investment approach to engage with the market.

TradersWay aims to satisfy the diverse trading needs of its clientele by continuously updating and expanding its services. Their goal is to deliver valuable and efficient trading experiences to a wide range of traders and investors, accommodating various levels of involvement and financial capacities. This commitment to growth and adaptation helps maintain their relevance in the competitive Forex trading landscape.

Benefits of Trading with TradersWay

Trading with TradersWay has offered me several notable benefits that have enhanced my trading experience significantly. One of the primary advantages is the competitive spreads that the platform provides, especially on major currency pairs, which can help in reducing trading costs considerably. Additionally, the ability to use hedging, scalping, and algorithmic advisors is a significant plus, as it allows for flexible trading strategies that can be tailored to both conservative and aggressive trading styles.

Another benefit of using TradersWay is the access to multiple social trading platforms. These platforms enable me to follow and copy trades from more experienced traders, which has been invaluable in refining my trading strategies and learning new techniques. This feature is particularly beneficial for newcomers to the forex market or those looking to expand their trading knowledge.

Moreover, TradersWay’s commitment to continuous improvement of services and technologies has kept the platform up-to-date with the latest trading tools and applications. This proactive approach ensures that I have access to state-of-the-art resources that can enhance decision-making and market analysis. Overall, my experience with TradersWay has been positive, offering both robust tools for trading and opportunities for learning and growth within the trading community.

TradersWay Regulation and Safety

TradersWay operates under the umbrella of TW Corp., registered in Dominica in the West Indies. It’s important to recognize that TradersWay is not licensed by any state financial regulators. This detail is crucial for potential traders to consider, as the absence of specific licensing might impact the broker’s oversight and the regulatory protection available to traders.

To enhance security, TradersWay has implemented several protective measures. All new clients are rigorously screened using the World-Check database, which involves checks against sanction lists and searches through various systems, including social media vetting. Additionally, the broker secures personal and transactional information using Secure Sockets Layer (SSL) technology, which helps encrypt and decode data.

Despite these security efforts, TradersWay does have some safety shortcomings that traders should be aware of. The platform does not offer negative balance protection, exposing traders to the risk of losing more funds than they have deposited. Moreover, the absence of segregated accounts means that client funds are not kept separate from the company’s operational funds. Without these segregations and the ability to lodge formal complaints with a financial regulator, there is a lack of formal protection for customer interests and funds. This information has been gathered from direct trading experience with the broker, highlighting areas of potential concern for traders evaluating TradersWay.

TradersWay Pros and Cons

Pros

- Low commissions and tight spreads on ECN accounts

- Permits hedging, scalping, and use of algorithmic advisors

- Access to multiple social trading platforms

Cons

- No availability of cent (micro) accounts

- Lacks PAMM, MAM, and RAMM account options

- Complex verification process with certified translations required

- No proprietary analytics for customers

TradersWay Customer Reviews

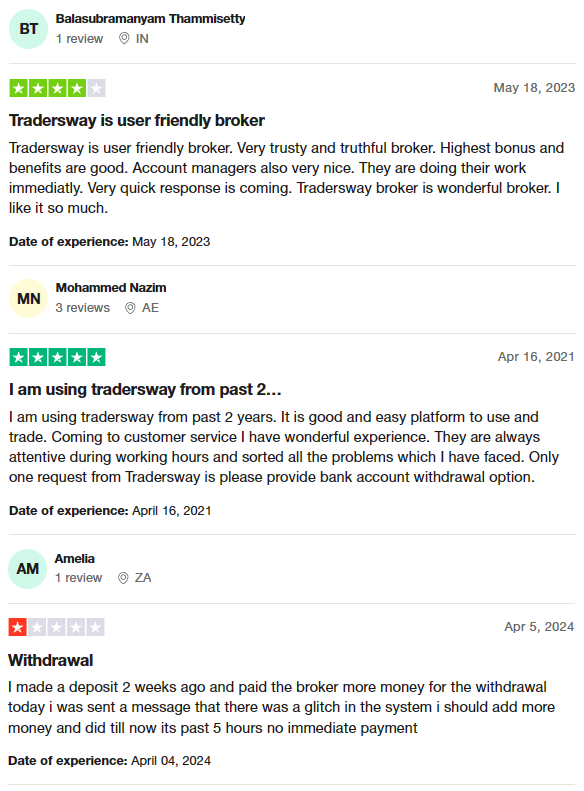

Customer reviews generally portray TradersWay as a user-friendly and trustworthy broker with a responsive and helpful customer service team. Users appreciate the platform’s ease of use and the quick responses from account managers, who are noted for their efficiency in addressing issues. However, there are some concerns about the withdrawal process, as highlighted by a user who experienced delays due to system glitches, suggesting room for improvement in this area. Additionally, there are requests for more withdrawal options, such as direct bank account transfers, indicating a desire for more flexibility in managing funds.

TradersWay Spreads, Fees, and Commissions

TradersWay offers a versatile platform with a range of fees, spreads, and commissions designed to suit diverse trading preferences. I’ve found that they provide competitive spreads on major currency pairs, with EUR/USD at 0.1 pips, GBP/USD at 1.3 pips, USD/CHF at 0.7 pips, and USD/JPY at 0.8 pips. These spreads are dynamic and adjust to market conditions, ensuring tight spreads under typical trading scenarios.

For traders using MT4.VAR accounts, TradersWay simplifies trading costs by incorporating all fees within the spreads, thus eliminating separate commission charges. This makes it easier for traders like me to manage expenses, as there’s no need to calculate additional costs beyond the spread.

On the other hand, ECN accounts at TradersWay offer minimal spreads but include a commission based on the trade volume. The commission calculation involves dividing the deal volume in US dollars by 100,000 and multiplying by the commission rate, details of which are available in the Trading Conditions section on their website.

Additionally, traders should be aware of swap fees, which apply to positions held overnight. These fees, also known as overnight or swap fees, vary depending on the financial instrument and market conditions, and they can add to the cost of maintaining positions for more than a day.

Account Types

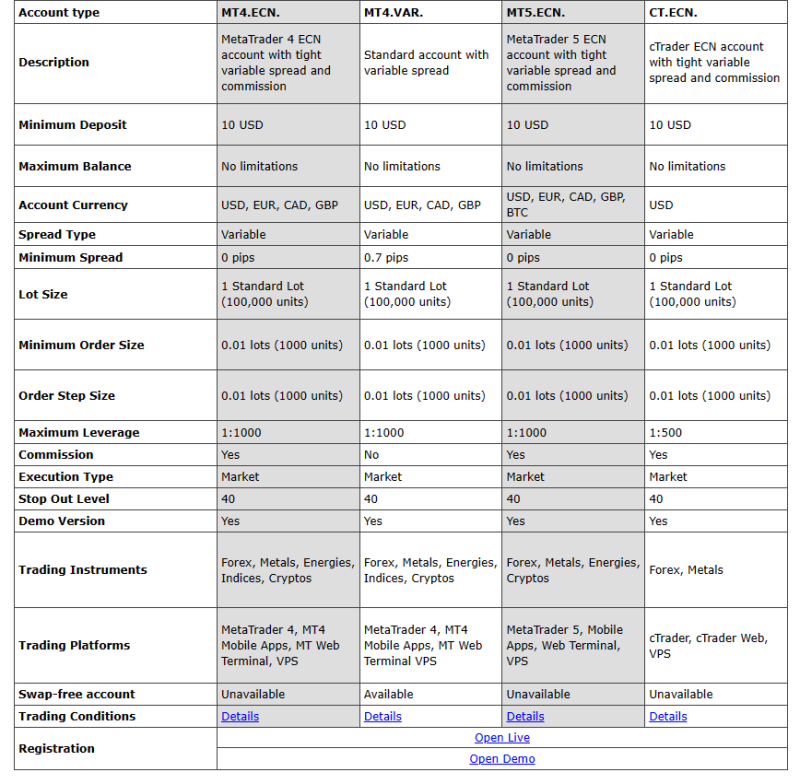

TradersWay offers a variety of account types that cater to different levels of trading expertise and preferences. Each account type is designed to meet specific trading needs, from beginner to professional traders. Here’s a detailed look at each:

MT4.VAR Account

- Type: Standard account with floating spreads.

- Spreads: Starting from 0.7 pips, with an average of 1.4 pips on EUR/USD.

- Leverage: Ranges from 1:100 to 1:1000 for currency instruments, and from 1:25 to 1:250 for metals and energies.

MT4.ECN Account

- Type: Designed for professional trading.

- Spreads: Start from 0.0 pips; EUR/USD spreads begin at 0.5 pips.

- Commission: $2.5 to $3 per lot for Forex trading, varying with trading volume.

MT5.ECN Account

- Type: For experienced traders preferring the MetaTrader 5 platform.

- Spreads: Minimum starts at 0.0 pips, with EUR/USD from 0.5 pips.

- Leverage: 1:100 to 1:1000 on currencies.

- Commission: A flat rate of $3 per lot on Forex instruments.

CT.ECN Account

- Type: Professional account for direct market access via the cTrader platform.

- Spreads: Start at 0.0 pips, with EUR/USD from 0.5 pips.

- Leverage: Maximum of 1:500.

- Commission: $2.5 to $3 per lot on currency pairs.

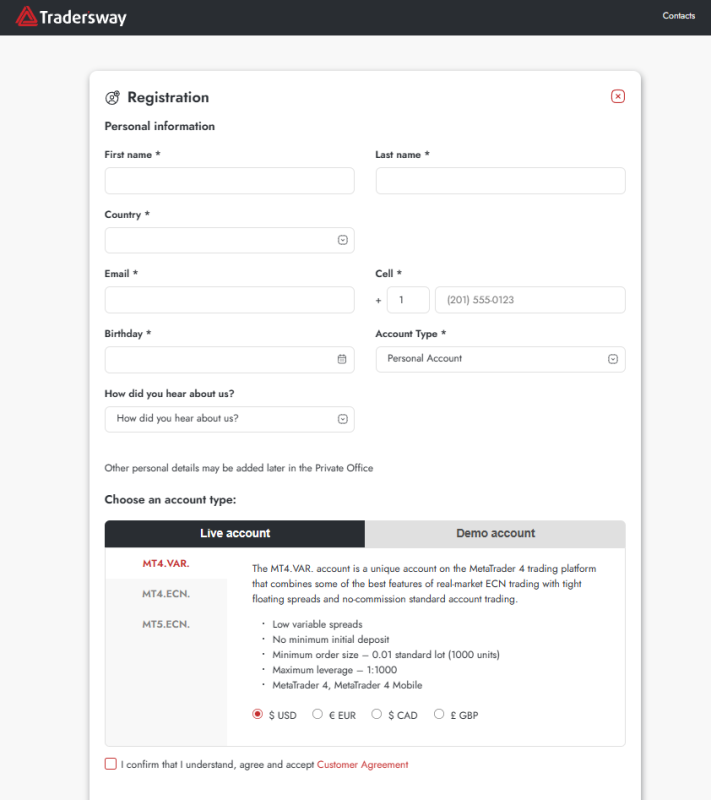

How to Open Your Account

- Navigate to TradersWay‘s official website and select your preferred language.

- Click on ‘Open Live Account’ on any page of the website.

- Fill out the registration form with your first and last name in English, along with your email and phone number.

- Indicate whether the account is for personal or corporate use.

- Enter your date of birth on the form.

- Choose the type of account you wish to open.

- Select your preferred trading currency.

- Go to your Private Office to complete the verification process by submitting your documents in English or provide certified translations that include a seal and the translator’s signature, alongside the original documents.

TradersWay Trading Platforms

Based on my experience, TradersWay offers access to three major trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each platform caters to different trading styles and preferences, providing a comprehensive suite of tools for both novice and experienced traders.

MetaTrader 4 is renowned for its user-friendly interface and robust technical analysis capabilities. It’s particularly favored by beginners and those who rely heavily on automated trading strategies. MT4’s widespread popularity is due to its stability and the vast array of customizable indicators and expert advisors available.

MetaTrader 5 offers more advanced features than MT4, including more technical indicators, graphical objects, and timeframes, making it suitable for traders looking for a more sophisticated trading environment. MT5 also supports trading stocks and commodities, providing a broader market access than MT4.

cTrader, on the other hand, is known for its sleek interface and advanced order capabilities. It’s particularly appreciated by professional traders for its direct market access (DMA) and higher execution speeds. cTrader is ideal for those who prioritize trading execution precision and advanced charting tools.

What Can You Trade on TradersWay

Based on my personal trading experience with TradersWay, the platform offers a wide variety of trading instruments that cater to diverse investment interests and strategies. Forex trading is a major highlight, with access to a vast range of currency pairs. This offers opportunities for both major and exotic pair trading, which can be appealing for those looking to engage in the global currency markets.

TradersWay also provides the option to trade in precious metals such as gold and silver, which are often sought after as safe-haven assets during times of economic uncertainty. The inclusion of these metals allows traders to diversify their portfolios beyond just currency trading.

In addition to Forex and metals, the platform includes energies such as oil and gas. These commodities are essential for traders interested in market sectors that can be influenced by geopolitical and environmental factors. Moreover, cryptocurrencies are available, catering to modern traders interested in the digital currency revolution. Trading in cryptocurrencies through TradersWay allows for exploration into this relatively new and rapidly evolving asset class.

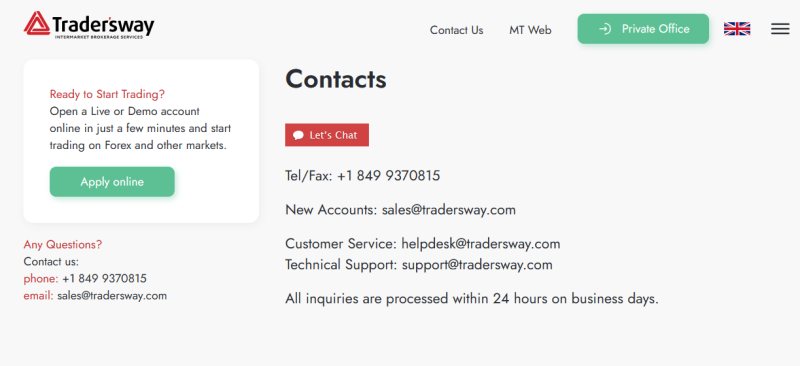

TradersWay Customer Support

TradersWay provides a comprehensive customer support system designed to assist clients efficiently and effectively. Clients can reach out to TradersWay customer support through a variety of channels. These include international phone calls, email inquiries, and an online chat feature available directly on the broker’s website. For those who prefer contemporary communication methods, support is also accessible via messaging apps like Telegram, Facebook, Instagram, and Twitter, which I found to be incredibly convenient.

Support services can be easily accessed either directly on the TradersWay website or from within your Private Office, ensuring that assistance is readily available no matter where you are on the site. This multi-channel approach allows for quick resolutions to any issues or questions, significantly enhancing the overall trading experience at TradersWay. Their readiness to provide help through multiple platforms ensures that traders have a seamless and supportive trading environment.

Advantages and Disadvantages of TradersWay Customer Support

Withdrawal Options and Fees

When I submit a withdrawal request in my personal account (Private Office) at TradersWay, the broker’s financial department processes it within 48 hours. Withdrawals must be carried out through the same system that was used for depositing the funds. It is crucial that the personal data of the recipient matches the first and last name registered in the broker’s database, ensuring the security and proper handling of funds.

TradersWay offers a variety of withdrawal methods including internal transfers, electronic wallets such as Perfect Money, Skrill/Moneybookers, Neteller, Topchange, FasaPay, and cryptocurrency wallets like Bitcoin, Litecoin, and Ether. This range of options provides flexibility for traders to access their funds in a manner that best suits their needs.

In instances where large amounts are being withdrawn, TradersWay may request additional documents to verify the origin of the money. These documents can include annual reports, bank statements, and other relevant paperwork. Importantly, while TradersWay does not impose a brokerage fee for non-trading transactions, the fees charged by payment systems and the transaction periods are not explicitly stated on the broker’s website.

Regarding currency options, deposits and withdrawals can be made in several currencies depending on the account type: МТ4.VAR and МТ4.ECN accounts handle EUR, USD, GBP, and CAD; MT5.ECN accounts are limited to USD and EUR; and CT.ECN accounts operate exclusively in USD. This structured approach to currency management caters to a diverse international clientele.

TradersWay Vs Other Brokers

#1. TradersWay vs AvaTrade

TradersWay offers a flexible trading environment with a focus on providing a range of trading platforms and instruments. It’s less regulated, with registration in Dominica, providing a broader leverage range but potentially higher risk due to less regulatory oversight. AvaTrade, on the other hand, has been in operation since 2006 and is known for its robust regulation and licensing, with offices in several countries including Australia and Ireland. AvaTrade provides a more secure trading environment with access to a wide array of financial instruments and a strong regulatory framework.

Verdict: AvaTrade is generally better for traders who prioritize security and regulatory compliance over higher leverage. Its strong regulatory standing and established market presence offer a more reliable and secure trading experience.

#2. TradersWay vs RoboForex

TradersWay offers a straightforward approach to Forex and CFD trading with multiple account types and the provision for high leverage, suited for traders who are looking for fewer restrictions on their trading strategies. RoboForex, established in 2009, stands out with its extensive range of trading options across eight asset classes and a choice of advanced trading platforms like MetaTrader, cTrader, and RTrader. RoboForex is also known for its innovative ContestFX, which helps new traders gain experience without immediate risk.

Verdict: RoboForex edges out TradersWay due to its variety in trading platforms and the innovative approach to engaging new traders through contests. RoboForex’s comprehensive offerings and technological advancements make it a better choice for traders looking for diversity and cutting-edge tools.

#3. TradersWay vs Exness

TradersWay is appealing for traders who seek flexibility in trading approaches, with its variety of platforms and less stringent regulation. This can be particularly attractive to those who use complex trading strategies that require high leverage. Exness excels in providing high-volume traders with favorable conditions, including low commissions and instant order execution. Its offer of unlimited leverage on small deposits and a wide range of account types makes it exceptionally versatile. Additionally, Exness is well-regulated, with a strong presence in the forex market and a commitment to providing a comfortable trading environment.

Verdict: Exness is likely the better choice for traders looking for a blend of high leverage options and strong regulatory protections. Its provisions for low commissions, instant executions, and a comfortable trading environment make it superior for both new and experienced traders who prioritize a stable and secure trading setup.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH TRADERSWAY

Conclusion: TradersWay Review

In conclusion, TradersWay offers a dynamic trading environment that caters well to traders seeking a range of financial instruments and flexible trading conditions. The platform’s continuous upgrades and additions of new technologies and applications, including social trading options, make it an appealing choice for both new and experienced traders. The diverse account options and competitive spreads further enhance its attractiveness.

However, potential traders should be cautious about the lack of stringent regulatory oversight, as TradersWay is registered in Dominica and does not possess specific licensing from state regulators. This may pose a higher risk compared to more heavily regulated brokers. Additionally, the limitations in withdrawal options and customer support in languages other than English and Russian could be restrictive for a global audience.

Also Read: M4Markets Review 2024 – Expert Trader Insights

TradersWay Review: FAQs

What trading platforms does TradersWay offer?

TradersWay offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader platforms, catering to various trading preferences and strategies.

Are there any safety concerns with trading on TradersWay?

Yes, TradersWay lacks licensing from state financial regulators, which might affect oversight and regulatory protection. Additionally, it does not provide negative balance protection or segregated client accounts, potentially increasing risk for traders.

How can I withdraw funds from TradersWay?

Withdrawals at TradersWay must be made using the same method as deposits, and are processed within 48 hours. The broker offers multiple withdrawal options, including electronic wallets and cryptocurrencies. Ensure that personal data matches the registered name for security.

OPEN AN ACCOUNT NOW WITH TRADERSWAY AND GET YOUR BONUS