Traderseed Review

Prop trading firms have become a key part of the modern financial landscape, offering traders the opportunity to trade with firm capital. In this arena, TraderSeed emerges as a notable entity with its multi-level trading challenge. Established in 2019 and initially partnered with the well-known FTMO, TraderSeed has now carved its independent path. Their mission is to offer a cost-effective alternative in the trading world by providing substantial payouts for just a fraction of the usual subscription fees.

As a Forex expert and seasoned trader, I am well-equipped to provide an in-depth review of TraderSeed. This article will delve into the various aspects of trading with TraderSeed, covering the benefits, available platforms, thorough evaluation process, unique trading features, and other essential details for anyone considering a partnership with this proprietary trading firm. Additionally, it will also shed light on potential drawbacks and limitations, offering a balanced view to help traders and investors make an educated choice in selecting a prop firm that best fits their trading goals and aspirations.

Also Read: Prop Trading: What Is It & How Does It Work?

What is Traderseed?

Traderseed is a proprietary trading firm established in 2019 by an individual named Kieran. The firm’s mission is to offer innovative trading programs designed to help budding traders develop the necessary skills to succeed in proprietary trading. Unique to Traderseed is its fixed-payout model, which allows traders to know their potential earnings from each challenge upfront. These challenges are structured in multiple levels, with each successive level being more demanding but offering larger payouts.

Distinctively, Traderseed positions itself differently from typical proprietary trading firms. While traders utilize the firm’s capital, profits generated don’t translate into a percentage share for the trader. Instead, Traderseed retains all profits, and traders receive predetermined payouts upon reaching specific profit levels. As of now, Traderseed offers three distinct challenge programs. These programs vary in terms of the number of levels (ranging from 4 to 5), profit targets, acceptable levels of drawdown, initial fees, and the scale of payouts.

Benefits of Trading with Traderseed

In my experience with Traderseed, one of its most notable benefits is the fixed-payout model. This model ensures that traders are always aware of what their payout will be for each challenge they undertake. This level of transparency and predictability is a refreshing contrast to traditional proprietary trading firms, where payouts are often uncertain and typically only a small fraction of traders receive significant payouts. As traders progress through higher-level challenges at Traderseed, they are rewarded with bigger payouts, offering a clear path to increased earnings and continual improvement.

Another aspect where Traderseed stands out is in its approach to leverage. The platform has intentionally set its leverage lower than what most prop firms offer. This strategy significantly reduces the risk of traders depleting their accounts with a few unsuccessful trades. By promoting prudent risk management practices, Traderseed assists traders in cultivating the discipline necessary to thrive in the high-stakes world of trading.

Furthermore, despite the relatively low cost of entry into its programs, Traderseed’s challenges are structured to offer substantial payouts to skilled traders. The possibility of earning up to 30 times the amount paid to join a program acts as a strong motivator, encouraging traders to enhance their strategies and strive for success. This potential for high returns, combined with the platform’s supportive structure, makes Traderseed an attractive option for traders seeking both growth and profitability.

Traderseed Pros and Cons

Pros

- Unrestricted use of MetaTrader 4 and all assets

- Choice of three programs with varied plans

- Only initial fee of $75-$250, no monthly or trading fees

- Fixed payouts at each level upon achieving the required profits

- Immediate trading with leverage up to 1:100 without extra checks

- Freedom in trading styles and strategies, mindful of drawdown

- Access to specialized solutions like proprietary copy trading

Cons

- Restarting a challenge after exceeding the drawdown requires paying the initial fee again

- Each level has a strict 30-day time limit for profit targets

Difficulties Met by the Traders Who Participated in the Brokers Challenge

Meeting Strict Profit Targets

Traders participating in the Brokers Challenge often face the pressure of meeting stringent profit targets within a limited timeframe, typically 30 days. This can lead to hasty decisions or overtrading in an attempt to reach these goals quickly.

How to Overcome the Difficulty

The key to overcoming this challenge is to maintain a disciplined trading strategy and not deviate from it under pressure. Setting realistic daily or weekly targets and focusing on consistent, calculated trades rather than trying to achieve the entire profit target in a short span is advisable.

Adhering to Drawdown Limits

A common difficulty in the Brokers Challenge is managing trades within the specified drawdown limits. Exceeding these limits not only disqualifies the current attempt but also requires traders to restart the challenge, often involving additional fees.

How to Overcome the Difficulty

Effective risk management is crucial here. Traders should utilize stop-loss orders judiciously, monitor their trades closely, and avoid high-risk positions that could lead to significant losses. Regularly reviewing and adjusting trading strategies based on performance can also help in staying within drawdown limits.

Adjusting to Fixed Payout Structure

Unlike traditional profit-sharing models, the fixed payout structure in the Brokers Challenge can be a new experience for many traders. This model might not align with the expectations of those used to receiving a percentage of the profits.

How to Overcome the Difficulty

Traders should adjust their mindset to focus on the challenges as stepping stones to improve their trading skills rather than just profit-making ventures. Setting personal performance goals and treating the fixed payouts as rewards for skill development can create a more fulfilling trading experience.

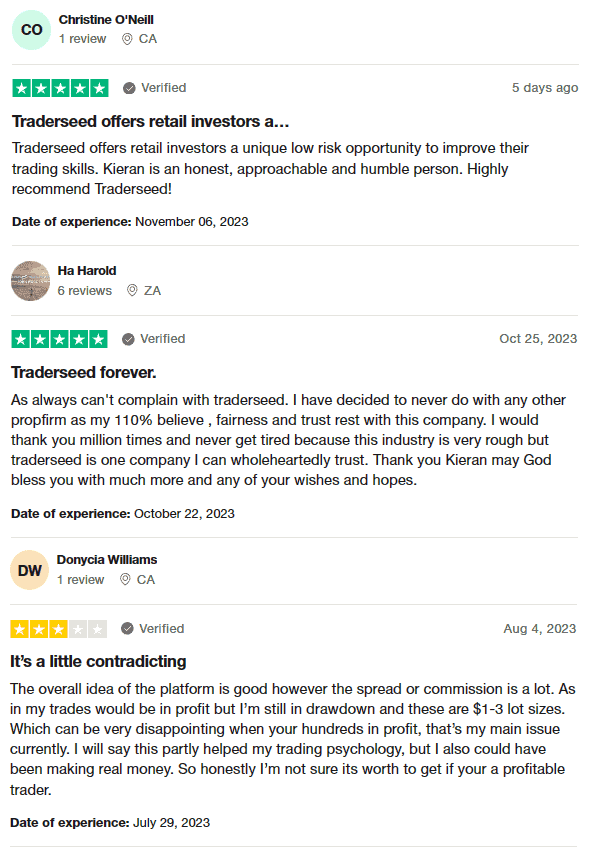

Traderseed Customer Reviews

Traderseed, a proprietary trading firm, currently holds a strong 4.8-star rating on Trustpilot, reflecting a generally positive reception from its clients. Users praise Traderseed for providing a unique, low-risk opportunity for retail investors to enhance their trading skills.

The firm’s founder, Kieran, is often commended for his honesty, approachability, and humility. Many reviewers express a deep sense of trust and fairness in their dealings with Traderseed, with some exclusively choosing it over other prop firms due to this trust.

However, there are notes of concern regarding the spread or commission, as some traders find that these fees impact their profits, particularly when trading with larger lot sizes. This aspect has led to mixed feelings among profitable traders about the platform’s overall value. Despite this, the experience with Traderseed is seen to positively influence trading psychology for many users.

Traderseed Fees and Commissions

In my experience with Traderseed, their fee structure is quite straightforward and differs from the typical model used by many proprietary trading firms and brokers. Proprietary trading firms generally don’t route trades to the market, which means they usually don’t charge trading fees. This is true for Traderseed as well. Additionally, most prop firms don’t apply withdrawal charges, and Traderseed aligns with this practice.

What sets Traderseed apart is its approach to fees and profit sharing. Unlike many prop firms, Traderseed doesn’t charge monthly fees. Instead, traders pay a fixed initial fee and, notably, retain 100% of their profits. This profit arrangement is unique because, instead of sharing a percentage of the profits, traders receive fixed payouts from Traderseed. For traders, this means that the initial fee is essentially the only expense. Even more appealing is that if you need to restart a challenge, doing so is free, which is a significant advantage for traders who are still honing their skills and strategies. This fee structure makes Traderseed an attractive choice for traders looking for a cost-effective way to engage in proprietary trading.

Account Types

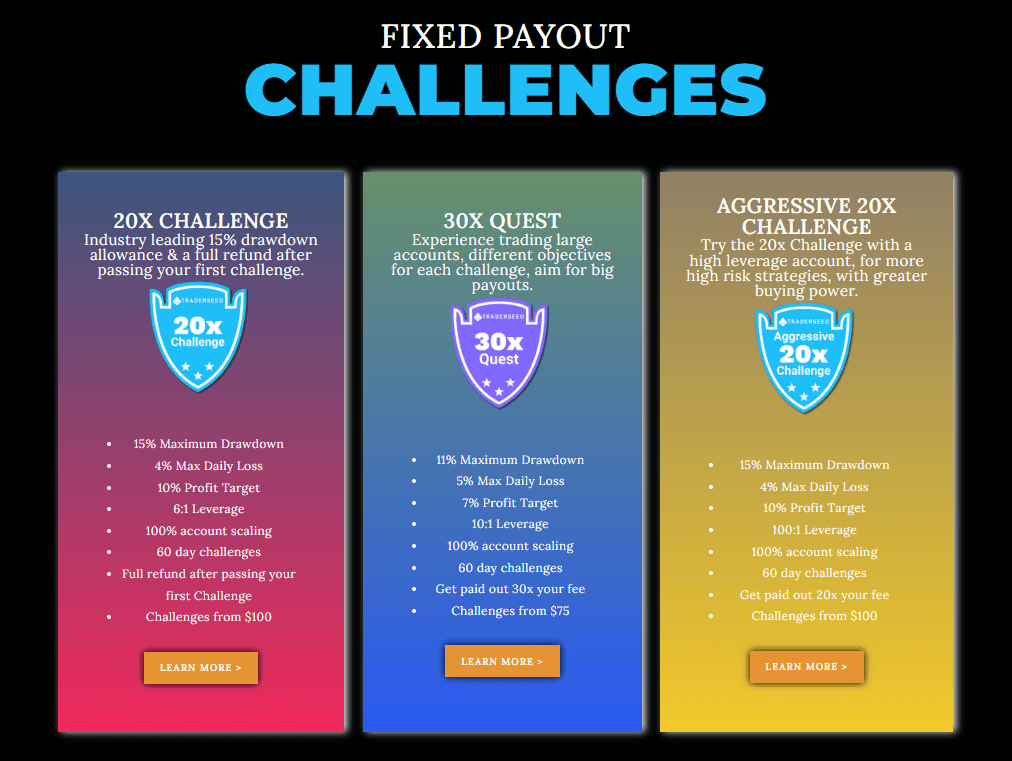

Having tested the account types offered by Traderseed, I can outline their programs clearly. Traderseed provides three distinct programs, each catering to different levels of trading experience and risk appetite.

20х Challenge

- Minimum Initial Fee: $100

- Potential Earnings: $4,000

- Levels: 4

- Balance: $100,000

- Profit Target and Drawdown: Both are set at 10%

This program is well-suited for traders with little to average experience, offering a balanced approach to risk and reward.

Aggressive 20х Challenge

- Minimum Initial Fee: $100

- Potential Earnings: $4,000

- Levels: 5

- Balance: $100,000

- Profit Target and Drawdown: Both are set at 10%

Designed for more active traders, this challenge is a logical choice for those with more experience who are comfortable with a standard risk level.

30х Quest

- Minimum Initial Fee: $75

- Potential Earnings: Up to $7,500

- Levels: 5

- Balance: Ranges from $100,000 to $500,000

- Profit: Up to 11%

- Drawdown: Up to 8%

The 30х Quest is aimed at professional traders, offering the highest potential income but also involving greater risk due to higher leverage.

Each program is structured to accommodate varying trader profiles, from beginners to seasoned professionals, providing a comprehensive range of options to suit different trading strategies and risk tolerances.

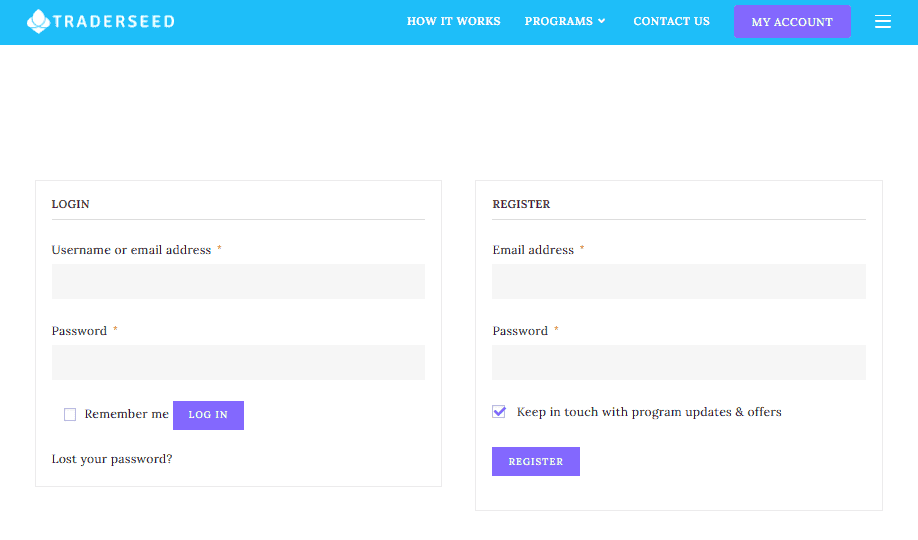

How to Open Your Account

- Visit the Traderseed official website and click on the “My Account” button located in the top right corner.

- Sign in if you already have an account; if not, register by entering your email and creating a password, then click “Register”.

- Once registered, you’ll gain access to your account, but full platform features remain locked until you confirm your email via a link sent to the provided email address.

- In your account menu, select “Payment methods” and click on “Add payment method”, following the instructions that appear on the screen.

- For any difficulties, don’t hesitate to contact technical support for assistance.

- Next, navigate to the “Addresses” section to input your billing and shipping addresses.

- Note that without these address details, you won’t be able to process fund withdrawals.

- After setting up your payment method and addresses, browse the available trading programs.

- Choose the program that aligns with your trading experience and goals.

- Pay the initial fee for your selected program to start your trading journey.

- Once all steps are completed, you’re ready to begin trading with Traderseed.

Traderseed Customer Support

From my personal experience, Traderseed‘s customer support operates primarily through email. For assistance, users can find the support email address in the correspondence section of their website. This method, while perhaps not as immediate as live chat or phone support, ensures that queries are addressed directly and in a documented format.

Additionally, Traderseed maintains an active presence on social media platforms like YouTube, Twitter, and Facebook. These channels not only offer updates and news about the company but also provide an avenue for following their latest developments. Links to Traderseed’s official social media accounts can be easily located in the footer of their website. This multi-channel approach, combining direct email support with social media engagement, facilitates varied ways for users to connect with Traderseed and stay informed.

Advantages and Disadvantages of Traderseed Customer Support

Contact Table

Security for Investors

Withdrawal Options and Fees

In my experience with Traderseed, the withdrawal process and fee structure are straightforward and trader-friendly. Once you choose a program and complete the initial levels of the challenge, you are eligible for your first payout. This happens after either the first or second level, depending on the specific program you’re in.

As you progress through each subsequent level of the challenge, the payouts you receive get larger. This incentivizes continued participation and success in the program. Once you reach the final payout, there’s an option to restart the challenge from the beginning without having to pay the initial fee again. This cyclical structure allows for continuous trading and earning opportunities.

Withdrawal requests at Traderseed are handled individually and can be initiated once you complete at least one challenge level. For withdrawals, you have multiple options, including transferring funds to a bank account, a bank card, a cryptocurrency wallet, or other available methods. This flexibility in withdrawal methods caters to the diverse preferences of traders.

What Makes Glow Node Different from Other Prop Firms

One standout aspect that sets Traderseed apart from other proprietary trading firms is its unique fixed-payout model. Unlike traditional profit-sharing arrangements in most prop firms, Traderseed ensures that traders know exactly what they will earn at each level of their trading challenge. This transparency in payouts provides a clear and predictable income stream for traders, which is particularly appealing to those who value stability in their earnings.

Additionally, Traderseed’s approach to leverage and risk management is distinctively cautious compared to other prop firms. By setting leverage limits lower than industry norms, Traderseed actively mitigates the risk of significant losses. This strategy not only helps protect the trader’s capital but also promotes disciplined and responsible trading practices, which are crucial for long-term success in the trading world.

Finally, the option to restart a challenge without an additional fee upon completing it is an innovative approach by Traderseed. This cyclical challenge system encourages continuous improvement and learning, offering traders an ongoing opportunity to refine their strategies and enhance their trading skills. This focus on skill development and sustainable trading distinguishes Traderseed in the competitive landscape of proprietary trading firms.

How Can Asia Forex Mentor Help You Pass Traderseed’s Evaluation?

Establishing Asia Forex Mentor, I’ve developed a comprehensive approach that can significantly aid traders in passing Traderseed’s evaluation process. Since starting Asia Forex Mentor back in 2008 in Singapore, I’ve evolved from teaching a small group of friends to managing a burgeoning community of traders. This growth led me to conduct live lessons and collaborate with trading companies and banks.

The crux of my teaching is encapsulated in the AFM Proprietary One Core Program. This program is designed to help students build robust trading systems, perform precise forex market analysis, and manage their trading accounts effectively. It’s particularly beneficial for traders preparing for evaluations like those at Traderseed, providing them with a deep understanding of various trading aspects.

The course includes 26 comprehensive lessons covering more than 60 subtopics, each accompanied by high-quality internet videos. I’ve made sure to incorporate my personal examples and insights into every lecture, ensuring that complex trading concepts are easily understandable. This program is ideal for beginners and those looking for a low-risk entry into forex trading. It equips learners with the knowledge and skills needed to excel in proprietary trading evaluations and beyond.

Our Journey at Asia Forex Mentor

Throughout my journey at Asia Forex Mentor, I’ve had the unique opportunity to guide and shape the careers of a diverse array of traders. This journey has seen individuals evolve from retail and bank traders to professionals at major trading institutions and investment firms. Many who began as novices under my tutelage have now become full-time forex traders, and some have risen to esteemed positions like fund managers.

In our One Core Program, I’ve distilled the core of my experience and insights into a comprehensive approach to trading. The latter part of the program particularly focuses on the intricacies of bar-by-bar backtesting and the psychological aspects of trading. I share my personal methods for maintaining trading diaries and outline the critical steps necessary for success in forex trading. The program introduces unique strategies like ‘set-and-forget’, features an exclusive auto stop-loss tool, and delves into the nuances of our free trade concept, including a detailed explanation of the differences between large and small stop loss levels.

For those looking to embark on this enriching educational journey, the One Core Program is available with a seven-day free trial. Priced at a one-time fee of $997, the program is also directly available for $940, an option for those ready to bypass the trial and dive straight into deepening their trading knowledge and skills.

Conclusion: Traderseed Review

In conclusion, my review of Traderseed reveals it as a unique player in the world of proprietary trading firms. Its distinguishing feature is the fixed-payout model, which provides a clear and predictable income for traders at each challenge level. This model, along with the absence of monthly fees and the opportunity to restart challenges without additional costs, positions Traderseed as an attractive option for traders seeking a straightforward and transparent trading journey.

However, it’s important for potential traders to be aware of the drawbacks. The lack of profit-sharing, as Traderseed retains all profits, may not align with the expectations of those accustomed to traditional prop firm models. Additionally, the strict time limit for each challenge level and the necessity to pay the initial fee again if a trader exceeds the specified drawdown are factors that could add pressure and impact the trading experience.

Also Read: Earn2Trade Review 2024

Traderseed Review FAQs

What makes Traderseed unique among prop firms?

Traderseed’s fixed-payout model and no monthly fees make it unique.

Do traders share in the profits they make with Traderseed?

No, Traderseed retains all profits, providing fixed payouts instead.

Can traders restart challenges in Traderseed?

Yes, traders can restart challenges without additional fees.