Traders4Traders Review

Financial trading is a popular means of earning a significant amounts of money, however, this cannot be done without the support of a competent broker, effective trading skills, and massive funds. As most the traders do not have access to such funds, a reliable proprietary firm is a way to go. Therefore, Traders4Traders is one such prop firm that provides financial training and funded trading account at the same time.

Traders4Traders is the right choice for those traders who are looking for a prop firm with a wide range of trading options, multiple types of trading accounts, and most importantly a realistic evaluation process. However, those traders who are looking for high leverage and a faster evaluation process to get the funded account can look for other options.

This Traders4Traders review is written with the purpose of providing the most relevant information that traders require in order to make an informed decision about choosing the firm as a trading partner. Therefore, all the benefits, and perks one may get from Traders4Traders are discussed here as well as the flaws to evaluate the firm evenly. Moreover, the evaluation criteria and trading rules are also discussed so that traders can decide whether or not they can pass this challenge.

What is Traders4Traders Funding?

Traders4Traders is a Porperitary trading firm that provides funds to potential traders who pass their evaluation process. Traders4Traders is not only a prop firm, but it is also a complete online training platform that provides forex trading courses to traders worldwide. Hence, traders who get affiliated with Traders4Traders have the advantage of first learning to trade proficiently and then getting hands on a funded account to earn significant profits.

Traders4Traders has been operating as a complete online forex trading platform since 2009, giving them the experience of more than a decade in the financial market. As a prop firm, Traders4Traders allows traders to earn up to $1000,000 through a practical assessment forex trading demo account. Users need to pay a one-time subscription fee to register themselves and get hold of this demo account.

There are multiple account types on the Trader4Traders platform, which are designed to cater to the different trading needs and the trading skill levels of traders. Therefore, we can say that all types of traders, are they inexperienced or professional traders can take advantage of this platform.

However, on the downside, Trader4Traders has a comparatively slow evaluation process with multiple levels and very low leverage. Therefore, traders looking for quick access to a funded account might find this platform less facilitating.

Advantages and Disadvantages of Trading with Traders4Traders Funding

Benefits of Trading with Traders4Traders Funding

Traders4Traders provides many benefits to the affiliated client. For one, it provides opportunities for a successful trading career by providing resources for trading education as well as a funded trading account. New traders can opt for forex trading courses on the Traders4Traders trading education programs for exceptional trading performance, and then they can apply for a funded account on T4T capital.

Another advantage of T4T capital is that the practical assessment has a laid-back approach where traders are not time-bound to achieve their trading targets. Most of the other prop trading firms have difficult and sometimes unrealistic trading challenges in their evaluation period however, T4T capital does not pressurize the traders to achieve their profit target within the timeline. Traders have unlimited time to reach their goal for a live trading account.

In addition, T4T capital has a fast scaling program. This feature ensures that professional traders do not have to dwell longer on the first level and can quickly scale up to their next account size up. Moreover, the different account sizes offered by this prop firm allows new traders to start low as well as encourages experienced traders to for larger trading amount.

Traders4Traders Funding Pros and Cons

Pros

- One Phase Practical assessment

- Fast scaling Program

- Educational resources

- EAs and automated trading allowed

Cons

- No private broker allowed

- Poor customer support

Difficulties Met By The Traders Who Participated in The Brokers Challenge

#1. 5% trailing Drawdown Limit

The practical assessment phase in the T4T capital demo account has the rule of maintaining a 5% drawdown limit. This means that the initial account balance of the trader should not drop more than 5%. For instance, if the starting balance of the account is $1000,000 then it should not minimize more than $95,000.

How To Overcome This Difficulty

The first step towards minimizing the losses in trading is through the control of emotions. When traders make irrational decisions that are when the downfall in trading occurs, it is important to understand that drawdowns are inevitable in trading. However, one should always keep risk low. Lastly, since T4T capital does not have a time limit, traders can cap their drawdown by not trading for the time being and waiting for the right opportunity.

#2. Maximum Open Risk Limits

This rule denotes that the first trader should not have an exceeded risk limit of 2% and in other trades, this limit cannot surpass the 3% limit. The reason behind this rule is to minimize the risk exposures by traders so that the traders can come up with strategies to contain the potential risks.

How to Overcome This Difficulty

The best approach to overcome the difficulty of maximum open risk limit is through diversification of the portfolio. Traders who will trade on one asset with big amounts are bound to suffer big losses and will have a higher risk. Therefore, to avoid losses and overcome this difficulty, it is essential to trade with multiple assets with smaller trades with consistency.

Traders4Traders Funding Customer Reviews

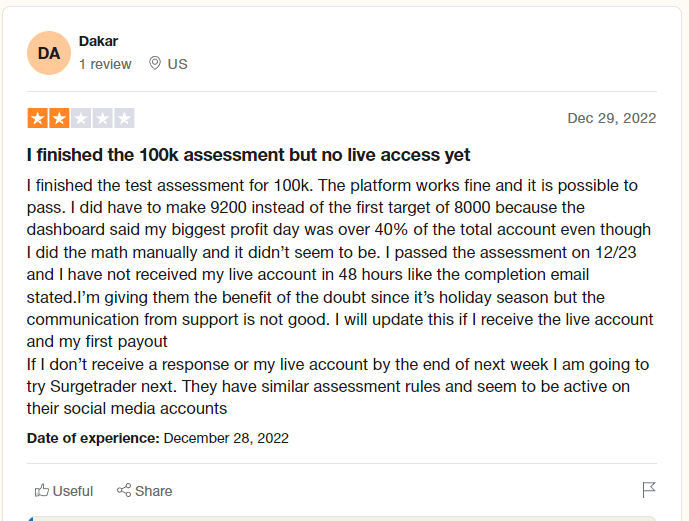

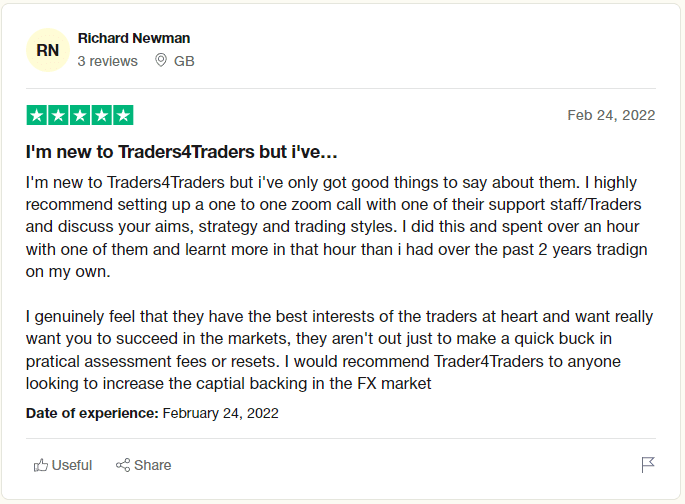

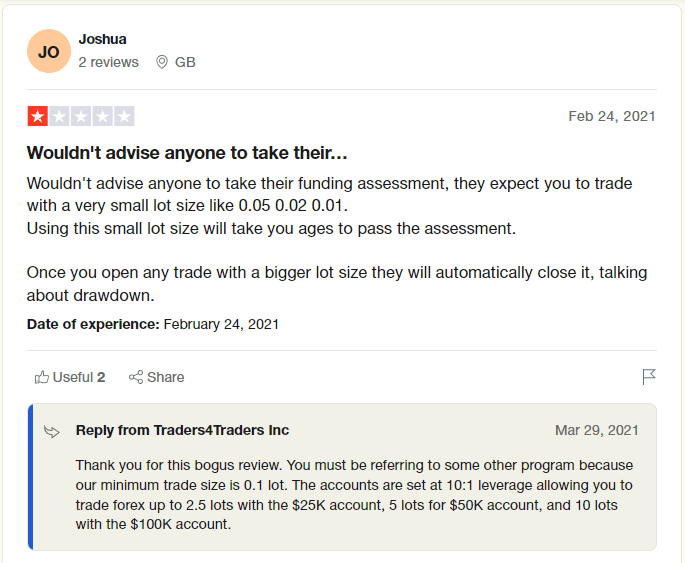

The customer reviews of T4T capital are not so supportive. Most of the customers had bad experiences with the customer support team where either their queries were not answered or were ignored completely. Moreover, some of the customers complained about trading with small lot size, which slow downs the practical assessment process.

On the positive side, there were customers who seemed satisfied with T4T capital and specifically mentioned their good learning experiences through the Traders4Traders trading education platform. Moreover, some clients also praised the platform and said they completed the practical assessment quite easily.

Traders4Traders Funding Fees and Commissions

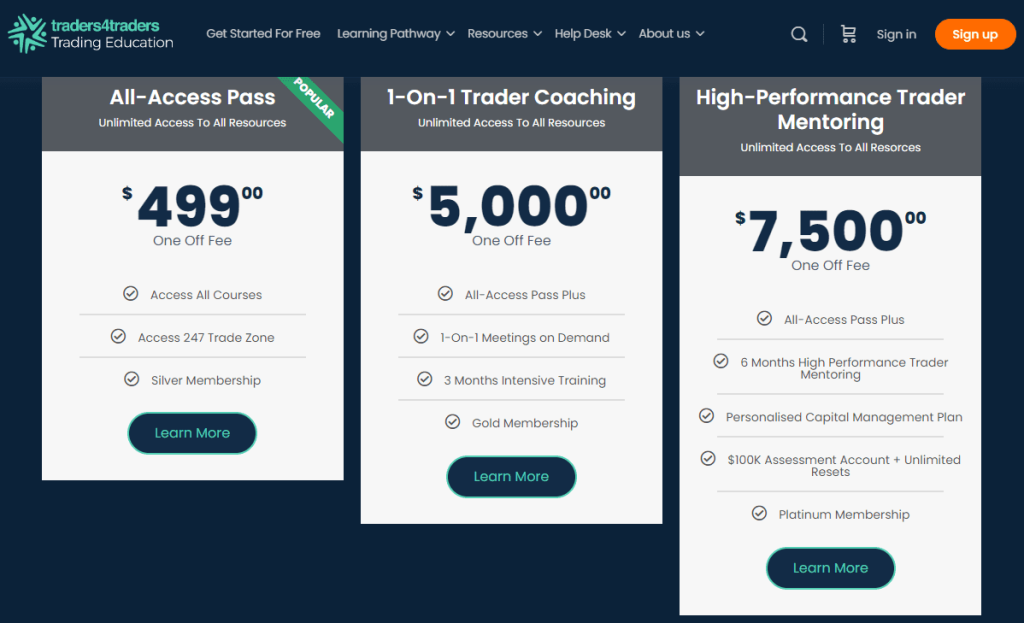

There is a subscription fee at T4T capital for each demo account of practical assessment. The fee ranges from $199 for a $25,000 MT 4 practical assessment to $5000 for a $1000,000 MT5 practical assessment.

There is no trading commission at T4T, however, the firm earns through the profit split that is made with the trader who trades on the live account. The conditions of profit split are that in the first withdrawal, the trader will get 100% profit and from the second withdrawal the profits will be divided into 80/20 where T4T capital will retain 20% of profits.

There are no withdrawal fees or deposit fees at T4T capital; however; there is an account reset fee. If a trader exceeds the maximum daily drawdown limit then the trader’s practical assessment account will be frozen until the account is reset and a fresh account is made. Similarly, traders who wish to reset their accounts can also do so after paying the reset fee. The account reset fee ranges from $100 to $3000, depending on the account type.

Account Types

There are 7 levels of practical assessment available at T4T capital. Moreover, there is no rules related to opening a trading assessment account from level 1 only. Traders have the flexibility and freedom to choose the account level which would suit their trading needs. Therefore, new traders can start from level 1 and professional traders can also go for level 7 if they desire.

The level 1 practical assessment starts with virtual funds of $25,000, and the subscription fee is $125. The level comes with the option of two trading platforms, MT4 and MT5; the fee is the same for both platforms. At Level 2, the initial capital is $50,000 with a subscription fee of $250. This level also has the MT4 and MT5 options.

Levels 3, 4 5, 6, and 7 open with virtual capital of $100,000, $250, 000, $500, 000, $750,000, and $1000,000 respectively. The subscription fee for these levels is $500, $1000, $1250, $2500, $3750 and $5000.

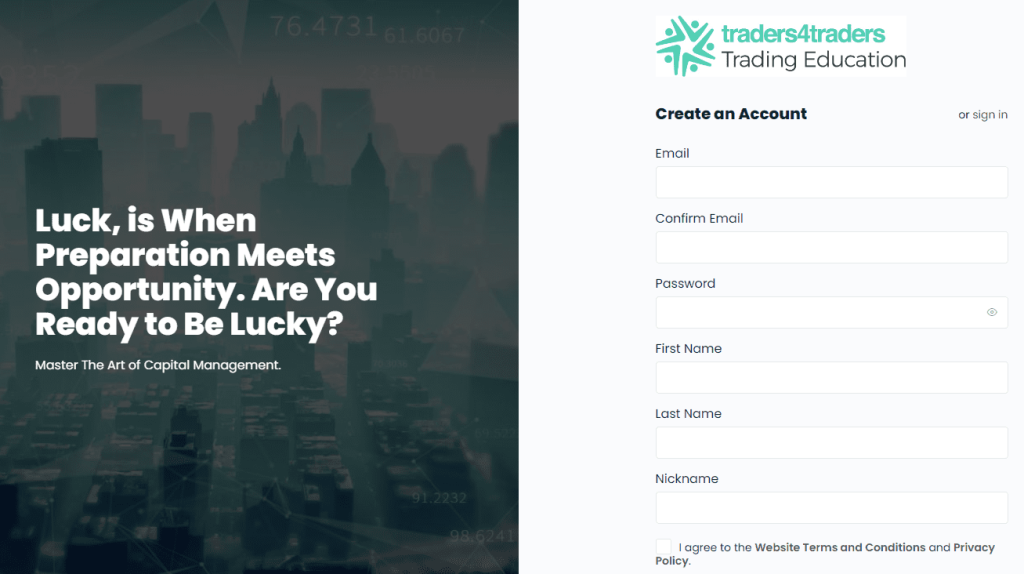

How To Open Your Account?

Opening a demo account for practical assessment on the T4T capital platform is pretty easy. The first step is to go to the website and click on the button “Buy,” which is located at the top corner of the site. After clicking on this button, the website will redirect the user to the “choose your plan” page.

On this page, the users have all the options that are available for the different levels of practical assessment along with their subscription fee. Here the user can choose the plan of their choice and click on the tab of their preference.

Next, there will be a payment page where the users will be asked to make an online payment for their chosen practical assessment trading plan. After making this payment, the user will have their log in details mailed to their given email address. Using the account details, traders can start trading on their demo practical assessment accounts and start their trading journey.

What Can You Trade on Traders4Traders Funding

At T4T capital, there are numerous trading instruments available for the traders to pick and choose from. The asset classes range from Forex trading to indices, commodities, shares, and cryptocurrencies. So we can say that T4T capital is a platform that provides the opportunity for traders to diversify their portfolios.

In trading forex, traders can choose from major, minor and exotic currency pairs. The typical spreads and trade size in these pairs vary from one to another. Hence, in the forex market, T4T capital fulfills the dream of every forex trader to have a funded account. In commodities, traders can choose from crude oil to precious metals such as gold, silver, platinum, etc. The trading features such as spreads, profit margin, and leverage limit differ according to the type of the commodity.

In cryptocurrencies, T4T capital fund management offers a range of more than 200 cryptos, covering high cap, middle cap, low cap, and cap crosses, and indexes. Moreover, traders are also given a choice to select their preferred trading platform from MT4 or MT5.

Another asset class are shares which have options for trading in the US, UK, and EU financial markets. An added benefit is that traders can trade shares without any commission fees on the T4T capital trading platform.

Traders4Traders Funding Customer Support

The customer support of Traders4Traders has faced a lot of criticism from customer reviews. Even though the firm has a live chat box option to provide prompt responses to its clients, there have been complaints about negligence and slow response.

Other than this, there are also limited methods of communication provided by the firm, including a live chat box and online messaging service. There are no toll-free numbers, email address,es or other ways of getting in touch with the firm. However, s some customers d confirm that they can have a zoom live meeting with the staff upon request.

The official website itself claims that the support team is not available 24/7 and so users can leave, and message, and a team member will respond soon. This affirms that there is no way through which traders who are looking for quick responses or immediate answers can contact the customer support team for assistance.

Advantages and Disadvantages of Traders4Traders Funding Customer Support

Security for Investors

Withdrawal Options and Fees

There are multiple withdrawal and deposit methods that are offered by T4T capital. This includes wire transfers, credit/debit cards, and online payment systems like PayPal, Google Pay, Netterl, Skrill, etc.,. All these payment options do not have any commission fee from the Prop firm’s end; however, as the transactions are done through the broker, where additional charges may apply.

These withdrawal methods mostly make transactions instantly, however, bank transfers take 2 to 4 working days, and third-party charges will apply. Moreover, the money that is withdrawn from the profits will be 100% given to the trader on the first transaction however, from the second trade, there will be an 80% to 20% profit split ratio.

What makes Traders4Traders Funding different from other prop firms

There are many qualities and adversities which make Traders4Traders capital fund management a different pro firm from others. The very first advantage of T4T capital which makes it stand out from other prop firms, is the sister website Traders4Traders trader education program. There are multiple courses available on this platform which enables potential traders to learn not just about complete online forex trading but also provides support through forums where traders can share their trade ideas and experiences.

Other than a great source of trade learning, T4T capital is also a better option than other prop firms due to its easy one-phase practical assessment. When other prop firms have two to three phases of trading evaluation, with the latter more difficult than the former, T4T capital has a one-step assessment with straightforward rules.

Moreover, most prop firms have the strict rule of minimum trading days in their evaluation challenge, whereas T4T capital provides unlimited time to the traders to achieve their target and prove their worth. Similarly, a wide range of account levels also gives the freedom of choice to traders to show their skills with ease.

In opposition to this, T4T capital also has the poorest customer service among all prop firms. This is the reason that the firm has earned a bad reputation for itself. T4T capital surely needs to work on its customer support team to win back the trust of traders.

Conclusion: Traders4Traders Funding Review

Traders4Traders capital is a proprietary firm that aims at providing trading opportunities to capable traders through funded trading accounts. The firm has been providing fund management services in the financial market for a long time and claims to have a diverse pool of skilled traders.

The major strength of T4T capital lies in its provision of trading education. Under the same name of Traders4traders, the firm also has an online educational platform where a wide range of forex trading courses and another high level of trading education is given through multiple sources. Hence, through Traders4traders trader education, T4T capital has gained an extra credential in terms of providing trading assistance and support to traders.

In addition to this, T4T capital itself is also providing financial assistance to potential, consistent and successful traders. Similarly, new traders can learn about trading through the courses offered and can then prove their skills on the T4T capital practical assessment process. Since a forex-funded account is offered to those who are good at trading, T4T ensures a successful trading career for all.

Apart from this, the rules of practical assessment at T4T capital are also realistic and can be achieved if the right strategies are applied and if the trader is hard-working and consistent. Moreover, the unlimited time duration to achieve the trading target makes trading less stressful for traders. All in all, traders looking for an opportunity to get up to $1000,000 fast scaling funded accounts can go for T4T capital.

Even when the firm seems just right with all its attractions, it is important to consider that from the customer’s perspective, T4T capital does not own a very good reputation. The poor customer support services and implicit trading rules are common complaints of some of the customers of this firm.

Traders4Traders Review FAQs

Is T4T regulated?

No, Prop trading firms do not utilize the funds of their clients in the trading activity and use their own funds. Therefore, T4T is bound to be regulated as a prop trading firm.

What does Maximum Position Risk mean?

Maximum position risk is one of the rules in the practical assessment procedure. This rule states that the traders have to remain below the maximum limit of risk, which is 5% of their initial capital. Any trader who exceeded more than 5%, their accounts will be deactivated and will be needed to reset after paying a reset fee.

Is T4T legit?

T4T capital is a legit firm claiming to provide funded accounts however, it does to own a good reptationin terms of its customer service and implicit trading rules.