Position in Rating | Overall Rating | Trading Terminals |

244th  | 2.0 Overall Rating |   |

Traders Trust Review

Traders Trust was founded by Nicola Berardi, a Swiss financial expert with over 30 years of experience in the financial services industry. His extensive knowledge and Swiss heritage serve as the foundation for Traders Trust‘s commitment to trust, precision, and reliability, making it a reputable and trusted choice for forex traders worldwide.

Traders Trust ensures the highest level of security for client funds by keeping them separate from operational funds. Client funds are securely stored in reputable banks and are easily accessible at any time. This policy provides peace of mind to traders, knowing their funds are safeguarded in liquid accounts.

Traders Trust provides negative balance protection, ensuring that clients never lose more than their account balance, even during volatile market conditions. This added protection enhances security and allows traders to trade with confidence, knowing their risk is limited.

This review emphasizes that Traders Trust is interested in its clients’ security, providing support to the clients and following trader-friendly policies. The company highlights fund security, starting from a transparent handling of clients’ funds to negative balance protection for all its clients.

What is Traders Trust?

Founded in 2009, Traders Trust is an active brokerage firm with services toward active trading and passive investment. Registered in Bermuda, it has full compliance and regulation from FATCA, providing complete safety of international rules and regulations regarding finance standards.

Traders Trust offers direct access to interbank liquidity providers, allowing its traders to enjoy competitive pricing and fast execution. Its commitment to full transparency in the operations helps build trust among clients and supports informed decisions in trading.

Traders Trust is an institute that caters to both beginner traders and experienced traders, with special focus on compliance and on building client trust. By combining robust regulatory practices and market access, it becomes an excellent choice for anyone requiring a reliable broker for any trading or investing purposes.

Traders Trust Regulation and Safety

Traders Trust operates under multiple regulatory authorities, offering traders a blend of trust and reliability. It is regulated by the Cyprus Securities and Exchange Commission (CySEC), a Tier-1 regulator, which provides strong oversight and investor protection up to €20,000. Additionally, Traders Trust is licensed by the Financial Services Authority (FSA) of Seychelles and the Bermuda Monetary Authority (BMA), both Tier-3 regulators, ensuring it meets international compliance standards.

Safety measures such as negative balance protection are also a bright spot for Traders Trust, preventing the clients from losing more than their account balance during the volatility in the market. The broker also makes strict Know Your Customer verification, which is essential to maintaining its commitment to compliance and safe client onboarding. However, these requirements and paperwork may be challenging for some users when setting up an account.

Having been around for over 8 years, Traders Trust has established a strong track record for reliability. Lacking the investor protection funds under FSA and BMA regulations, the Tier-1 CySEC license and transparent practice make it a competitive choice for traders who prioritize safety and regulatory oversight.

Traders Trust Pros and Cons

Pros

- Zero deposit/withdrawal fees

- Negative balance protection

- Low $50 minimum deposit

- Advanced trading tools

Cons

- Strict account requirements

- Limited investor protection

- 24/5 customer support

- High leverage risks

Benefits of Trading with Traders Trust

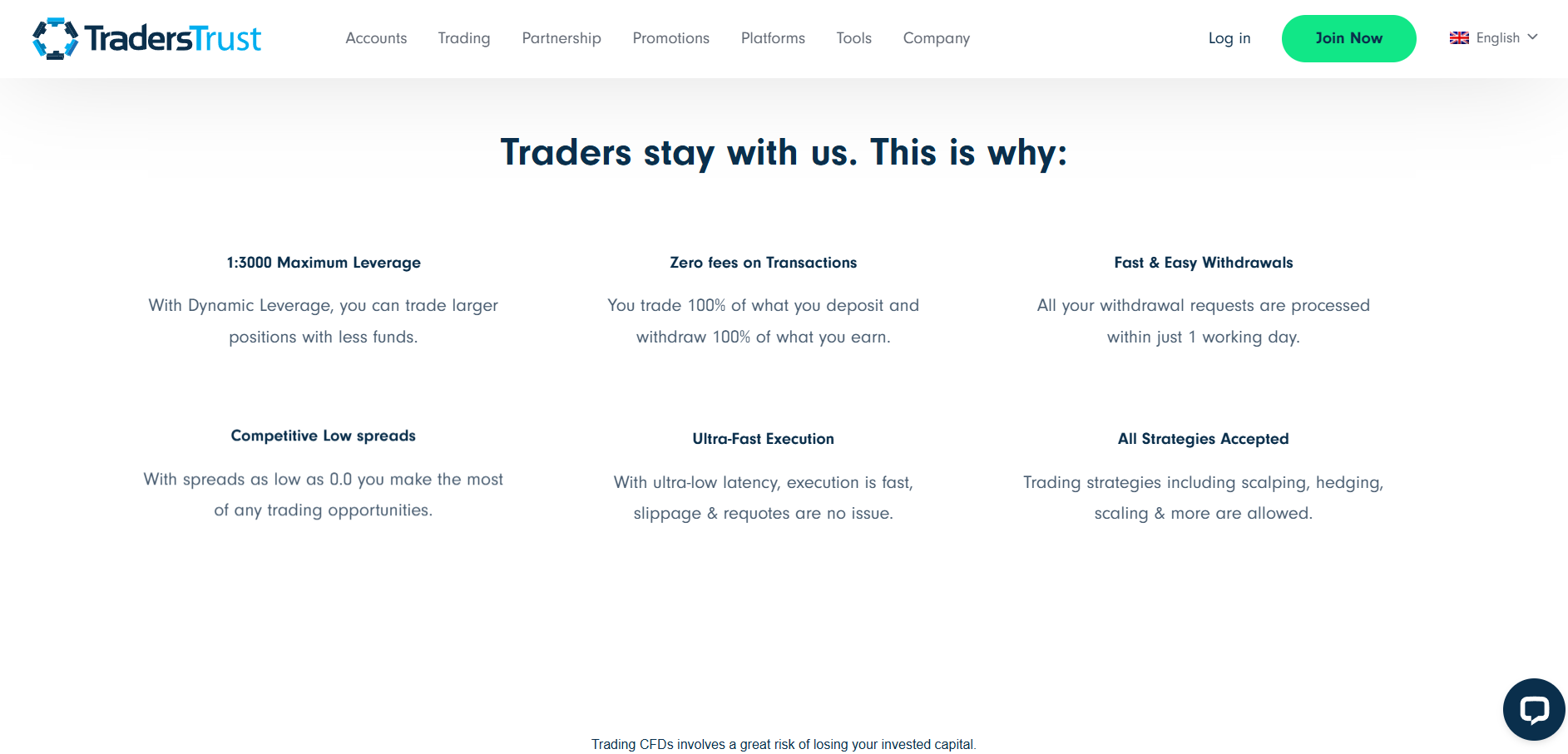

Competitive trading conditions catering to a wide variety of traders are offered by Traders Trust. With dynamic leverage as high as 1:3000 and spreads as low as 0.0 pips, it offers flexibility and cost-effective trading. Moreover, with the minimum deposit being only $50, it is within reach for those with limited funds.

Traders Trust has core features such as transparency and security. The broker provides negative balance protection, meaning that the trader cannot lose more than the account balance. Funds are kept separate from company accounts, which provides added security and peace of mind for the clients.

The sophisticated resources and tools that further advance trading efficiency include an economic calendar to monitor events happening within the market, calculators designed for precise planning during trades, and historical data access that aids in developing strategy. For uninterrupted trading, irrespective of where the trader resides, VPS services guarantee stability and speed.

Another important benefit of the flexibility offered by Traders Trust is that all trading strategies are allowed, such as scalping and hedging, which gives freedom to the traders to execute the preferred methods. The broker, designed to meet the needs of traders at all levels, has zero fees on deposits and withdrawals and offers customer support 24/5.

Traders Trust Customer Reviews

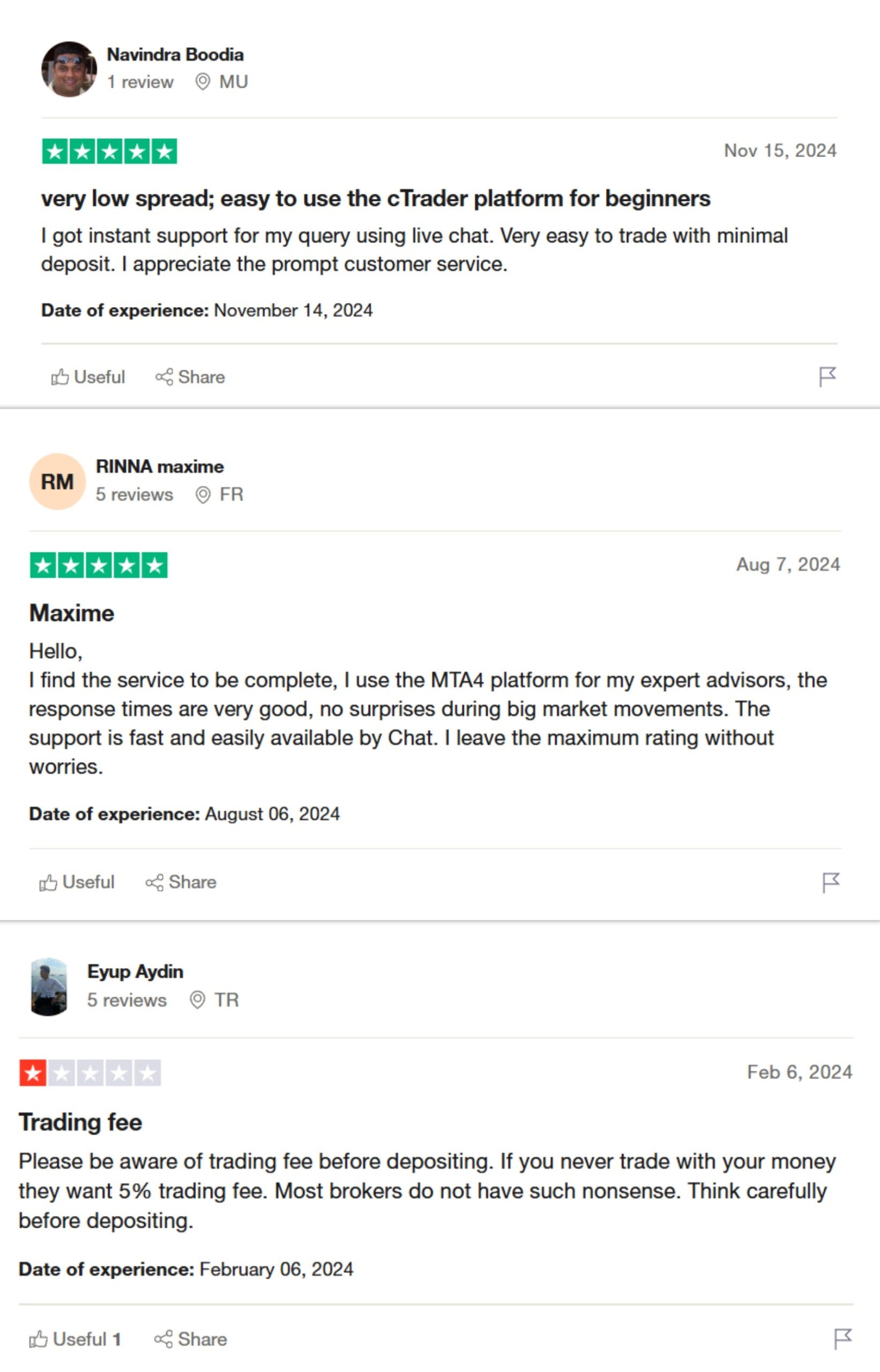

Traders Trust receives positive feedback from many users, particularly for its low spreads and easy-to-use platforms. Customers appreciate the simple cTrader interface, which is ideal for beginners, and the ability to start trading with a minimal deposit. The prompt customer support through live chat is another standout feature, making it easy for traders to get assistance when needed.

However, some users have raised concerns about the broker’s trading fees. One reviewer warned about a 5% fee charged if no trading activity is done after depositing funds, which is not a common practice with other brokers. While this may not affect all traders, it’s important to be aware of this policy before depositing. Despite this, many users still rate Traders Trust highly for its overall service and reliable customer support.

Traders Trust Spreads, Fees, and Commissions

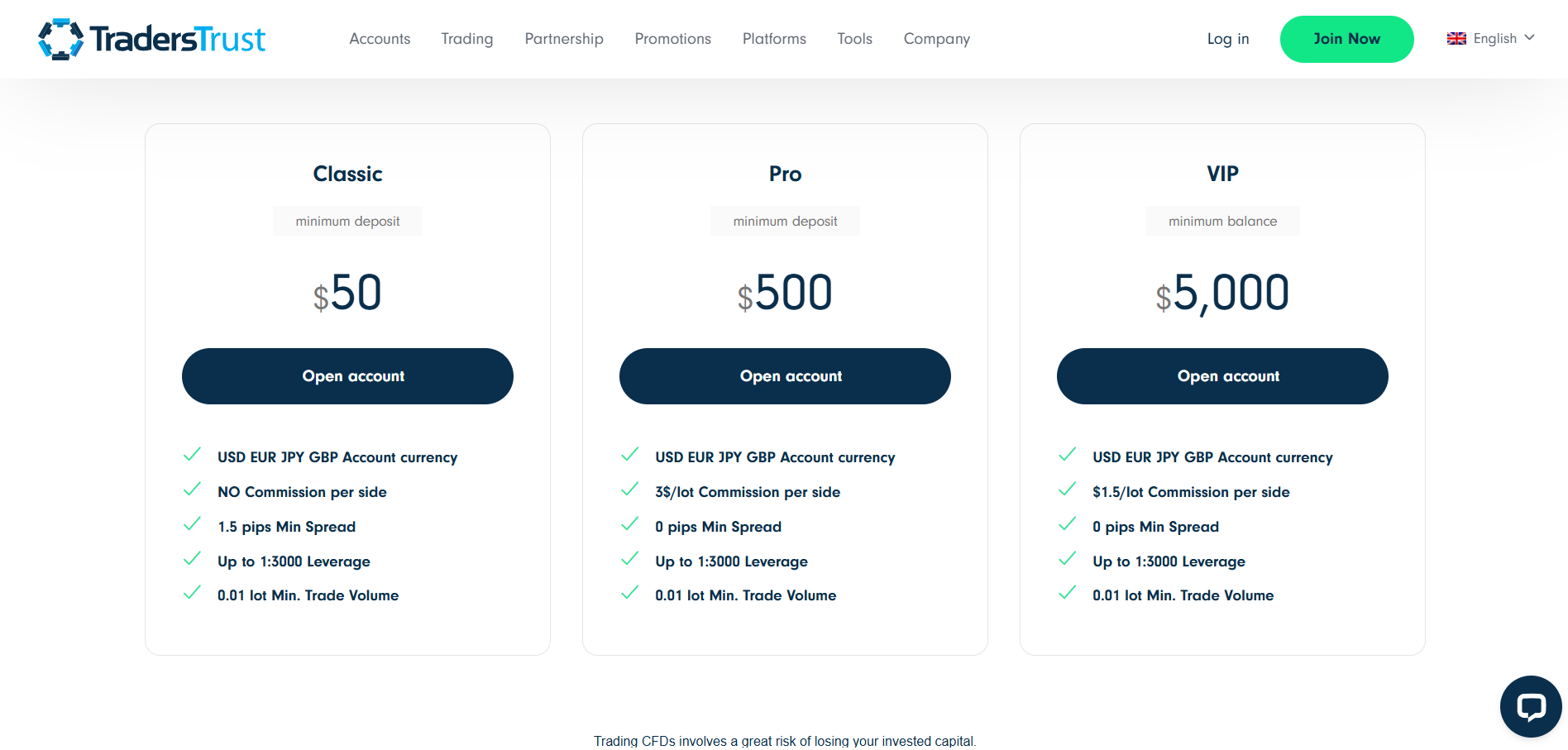

Traders Trust offers various account types with their own spread and commission structures. The Classic account features no commission and a minimum spread of 1.5 pips, so it is a more budget-friendly option for traders who would like simpler trading conditions. It also offers leverage of up to 1:3000 and a minimum trade volume of 0.01 lots.

For traders who want tighter spreads, the Pro account offers a minimum spread of 0 pips but charges a $3 commission per lot on each trade. This account is best for those who want the lowest possible spreads but are comfortable with a commission-based fee structure. It also offers leverage up to 1:3000 and a minimum trade volume of 0.01 lots.

The VIP account provides close conditions to the Pro account but with a minimum spread of 0 pips, at $1.50 per lot commission. This is made for more experienced traders looking for top-tier conditions while willing to pay a bit of commission for tight spreads and high leverage.

Account Types

Traders Trust offers three distinct account types, each catering to different trading needs with varying spreads and commission structures. These account types include Classic, Pro, and VIP, allowing traders to choose based on their trading style and preference for cost efficiency or tighter spreads.

Classic Account

The Classic account is designed for beginners and those who prefer a simpler structure. It has no commission and a minimum spread of 1.5 pips. This account also offers leverage up to 1:3000, with a minimum trade volume of 0.01 lots, making it an accessible option for traders starting with small investments.

Pro Account

The Pro account is ideal for traders seeking tighter spreads. It features a minimum spread of 0 pips but charges a $3 commission per lot. With leverage of up to 1:3000 and a minimum trade volume of 0.01 lots, this account offers more precise trading conditions for experienced traders who are comfortable with commissions.

VIP Account

The VIP account offers premium conditions for seasoned traders. With a minimum spread of 0 pips and a commission of $1.50 per lot, it provides tighter spreads at a slightly lower commission than the Pro account. Like the other account types, it offers leverage up to 1:3000 and a minimum trade volume of 0.01 lots.

How to Open Your Account

Opening an account at Traders Trust is a straightforward process that allows you to start trading in just a few simple steps. Here’s how you can open your account and begin trading:

Step 1: Register for an Account

Begin by filling out the registration form on the Traders Trust website. You’ll need to provide basic personal details such as your name, email, and phone number to create your account.

Step 2: Verify Your Account

After registration, you must verify your account. This involves submitting identification documents as part of the KYC (Know Your Customer) process, which ensures the safety and security of your trading account.

Step 3: Deposit Funds

Once your account is verified, deposit funds into your account using one of the multiple payment methods offered by Traders Trust. Choose from options like bank transfers, credit cards, or other online payment solutions.

Step 4: Choose Your Trading Instruments

Explore the available markets and choose from six asset classes, including forex, commodities, stocks, and more. Study the market trends and select the instruments you wish to trade.

Step 5: Choose Your Trading Instruments

With your account funded and instruments chosen, you’re ready to start trading. Use the trading platform to place orders, monitor market movements, and execute your trades.

Traders Trust Trading Platforms

Traders Trust offers two popular trading platforms: MetaTrader 4 (MT4) and cTrader. MT4 is widely known for its user-friendly interface and powerful charting tools, making it a top choice for forex traders. cTrader, on the other hand, is favored by traders seeking advanced features, fast execution, and a modern interface. Both platforms are accessible on desktop and mobile devices, allowing traders to trade anytime, anywhere.

Both MT4 and cTrader provide a range of tools to enhance the trading experience. They offer features like automated trading, multiple chart types, and a variety of order execution options. Whether you’re a beginner or an experienced trader, Traders Trust provides platforms that cater to your specific trading needs.

What Can You Trade on Traders Trust

Traders Trust offers a wide range of trading options, allowing you to diversify your portfolio across multiple asset classes. Whether you’re looking to trade global indices, popular cryptocurrencies, metals, oil, or stocks, Traders Trust provides access to top markets with competitive conditions.

Indices

With Traders Trust, you can gain instant exposure to a variety of global shares by trading indices. These indices represent the performance of multiple stocks in major markets, offering a convenient way to trade a broad spectrum of companies with a single position.

Crypto

Traders Trust also gives you the opportunity to trade cryptocurrencies, including the most popular digital assets in the market. You can easily trade Bitcoin, Ethereum, and other major cryptos, benefiting from the volatility and potential returns these markets offer.

Metals

Diversify your investment strategy by trading precious metals like gold, silver, and other commodities. Traders Trust allows you to access these safe-haven assets, which can be a valuable hedge against market instability.

Oil

For those interested in energy markets, Traders Trust offers trading on both WTI and Brent crude oil. These oil benchmarks give you exposure to global energy prices, making it easy to speculate on the price movements in the oil industry.

Stocks

Traders Trust provides the opportunity to trade stocks from popular global companies. Whether you’re interested in big tech stocks or established multinational corporations, you can trade shares from major markets directly on the platform.

Traders Trust Customer Support

Traders Trust offers reliable customer support with multiple contact options to ensure assistance is available when needed. Their live chat service is available 24/5, allowing traders to get quick answers to their questions during trading hours. This feature is ideal for resolving issues in real-time.

If you prefer to reach out via email, you can contact Traders Trust at support@ttcm.com. The support team is responsive and aims to resolve inquiries efficiently. This option is perfect for those who require more detailed assistance or have less urgent concerns.

For personalized help, you can also reach Traders Trust by phone at 0044 203 1295899. Additionally, Traders Trust offers multilingual support, ensuring that traders from different regions can receive assistance in their preferred language.

Advantages and Disadvantages of Traders Trust Customer Support

Advantages

- 24/5 Live Chat

- Multilingual Support:

- Multiple Contact Channels

- Email Support

Disadvantages

- Limited Availability

- No 24/7 Support

- Slow Email Responses

- International Phone Charges

Withdrawal Options and Fees

Traders Trust offers multiple withdrawal options with zero fees, allowing you to access your funds quickly and easily. Whether you prefer bank transfer, credit/debit cards, Bitcoin, USDT, Skrill, or Neteller, you can withdraw your funds efficiently.

Bank Transfer

Withdrawals via bank transfer are processed within one business day. With no fees, you can withdraw the full amount in your Traders Trust account directly to your bank.

Credit/Debit Card

Withdraw funds using your credit or debit card with ease. Traders Trust does not charge any fees for card withdrawals, ensuring you can access your funds quickly and without deductions.

Bitcoin

Opt for a Bitcoin withdrawal for fast and secure access to your funds. Traders Trust charges no fees, allowing you to withdraw the full amount in your Bitcoin wallet.

USDT

You can also withdraw via USDT (Tether), another popular cryptocurrency option. Like other withdrawal methods, USDT withdrawals incur no fees, providing a convenient and quick way to access your funds.

Skrill

Skrill withdrawals are processed within one business day and are completely free of charge. You can transfer your funds directly to your Skrill account without any fees from Traders Trust.

Neteller

With Neteller withdrawals, you can easily access your funds without fees. Just like the other withdrawal options, there are no additional charges, ensuring you get the full amount.

Traders Trust ensures fast, fee-free withdrawals through multiple methods. Whether you’re using bank transfer, credit cards, or cryptocurrencies, you can trust that your funds will be available without hidden charges.

Traders Trust Vs Other Brokers

#1. Traders Trust vs XM

Traders Trust and XM are both well-established brokers offering a wide range of trading instruments. Traders Trust provides access to Forex pairs, commodities, stocks, and cryptocurrencies, while XM offers over 1,000 instruments, including stocks, indices, energies, and more. XM operates in nearly 190 countries with a strong regulatory framework, including licenses from ASIC and CySEC, ensuring a secure trading environment. In terms of platforms, Traders Trust supports MetaTrader 4 (MT4) and focuses on cTrader for beginners, while XM offers both MetaTrader 4 and 5 (MT4, MT5), popular among experienced traders, along with the XM mobile app. Both brokers offer competitive spreads, with XM starting from 0.6 pips and offering higher leverage of up to 1:1000 for non-EU countries.

Verdict: Traders Trust suits beginners with its simple platform and low deposit, while XM offers more instruments and platforms. The right broker depends on your preferences and needs.

#2. Traders Trust vs RoboForex

Traders Trust and RoboForex are two well-established brokers offering diverse trading opportunities. Traders Trust provides access to Forex pairs, commodities, stocks, and cryptocurrencies with competitive spreads and platforms like MetaTrader 4 and cTrader. In contrast, RoboForex offers over 12,000 instruments, including currency pairs, CFDs, stocks, and indices, with leverage up to 1:2000 and platforms like MT4, MT5, and R StocksTrader. While both brokers have low minimum deposit requirements and multiple account types, RoboForex stands out with a broader selection of instruments and higher leverage options, making it ideal for active traders. Traders Trust is more suitable for beginners with its simpler platform and strong multilingual support. Both brokers offer fast order execution and various deposit and withdrawal methods with no fees on transactions.

Verdict: Traders Trust is better suited for beginners, while RoboForex offers a more extensive range of instruments and higher leverage, appealing to experienced traders.

#3. Traders Trust vs Exness

Traders Trust and Exness are reputable brokers offering a wide range of trading options. Traders Trust provides access to Forex pairs, commodities, stocks, and cryptocurrencies with competitive spreads and platforms like MetaTrader 4 and cTrader, making it ideal for beginners with its simple platform and multilingual support. Exness specializes in currency pairs and CFDs on stocks, commodities, indices, and cryptocurrencies, offering a broader selection of instruments, higher leverage, and advanced tools for experienced traders. Exness also stands out with faster withdrawals, 24/7 support, multiple regulatory licenses, and more flexible leverage options, while both brokers feature low minimum deposit requirements and various payment methods.

Verdict: Traders Trust is better for beginners, while Exness is more suited for active traders seeking higher leverage and a wider range of instruments. Choose based on your experience level and trading needs.

Also Read: XM Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH TRADERS TRUST

Conclusion: Traders Trust Review

Traders Trust is a reputable broker that offers a broad range of trading instruments, including Forex pairs, commodities, stocks, and cryptocurrencies. The broker is equipped with platforms like MetaTrader 4 and cTrader, which are suitable for traders at different experience levels. Beginners will especially appreciate the user-friendly interface and the comprehensive multilingual support provided by the platform. With its competitive spreads and efficient trade execution, Traders Trust offers an attractive environment for those new to trading.

Traders Trust also offers low minimum deposit requirements, making it accessible to traders with varying budgets. The broker provides a secure trading environment with transparent pricing and no hidden fees, giving traders peace of mind. Overall, Traders Trust stands out as a solid and reliable choice for those seeking a straightforward and dependable platform to start or grow their trading journey.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Traders Trust Review: FAQs

What instruments can I trade with Traders Trust?

Traders Trust offers Forex pairs, commodities, stocks, and cryptocurrencies, providing a wide range of trading options.

What trading platforms does Traders Trust offer?

Traders Trust provides MetaTrader 4 (MT4) and cTrader, both available on desktop, web, and mobile for convenient trading.

Is Traders Trust suitable for beginners?

Yes, Traders Trust is beginner-friendly with its simple platform, low minimum deposit, and multilingual support.

What is the minimum deposit required to open an account with Traders Trust?

Yes, Traders Trust provides leverage, with specific amounts depending on the asset traded.

OPEN AN ACCOUNT NOW WITH TRADERS TRUST AND GET YOUR BONUS