Tradelocker Review

Tradelocker is designed for day traders seeking a robust platform tailored for quick decisions and short-term trading. Its intuitive interface ensures users can monitor and act on market changes without unnecessary delays. Tools like advanced charting and real-time data cater specifically to the fast-paced needs of day trading.

This platform supports various asset classes, offering flexibility for traders to diversify their portfolios. With reliable execution speeds and a user-friendly experience, Tradelocker aims to simplify complex trading processes for both new and experienced day traders.

What is Tradelocker?

Tradelocker is a specialized platform designed for day traders seeking efficient tools for quick decision-making and execution. As a day trading platform, it prioritizes fast trade execution, intuitive interfaces, and features like real-time market data, ensuring users stay ahead in volatile markets.

Catering to both beginners and experienced traders, Tradelocker provides a user-friendly experience with advanced tools like charting, analysis, and trade management. Its focus on simplicity and performance makes it an ideal choice for those aiming to capitalize on short-term market opportunities.

Tradelocker Regulation and Safety

Tradelocker positions itself as a reliable trading platform by prioritizing user safety and incorporating advanced tools for risk management. It strives to build confidence among traders with features like on-chart trading, stop loss integration, and an intuitive, easy-to-use interface. These elements ensure users can manage their trades effectively while mitigating risks in volatile markets.

For experienced traders and prop firms, Tradelocker offers a next-gen trading platform that supports diverse strategies, trading bots, and key instruments to enhance the trading process. Its ability to execute trades seamlessly, coupled with integration for market analysis and well-informed decisions, ensures a smooth trading experience. The lack of a minimum deposit and access to funded accounts further expands its appeal across various client preferences.

Tradelocker Pros and Cons

Pros

- User-friendly

- Fast execution

- Advanced tools

- Day trading

Cons

- Limited assets

- Delays

- High fees

- Restricted access

Benefits of Trading with Tradelocker

Tradelocker offers a modern trading platform designed to enhance the experience for both new and experienced traders. With an easy-to-use interface, the platform simplifies navigation and execution of trades, enabling users to place market orders or engage in on-chart trading effortlessly. Features like one-click trading and advanced trading bots help users capitalize on market movements efficiently.

The platform supports a diverse range of trading instruments, including stocks, making it versatile for traders with varied preferences. Tools like stop loss and risk management strategies are integrated to help users mitigate risks and maintain better control over their positions. With no minimum deposit requirements for opening a Tradelocker account, traders can explore the platform’s key features without heavy financial commitments.

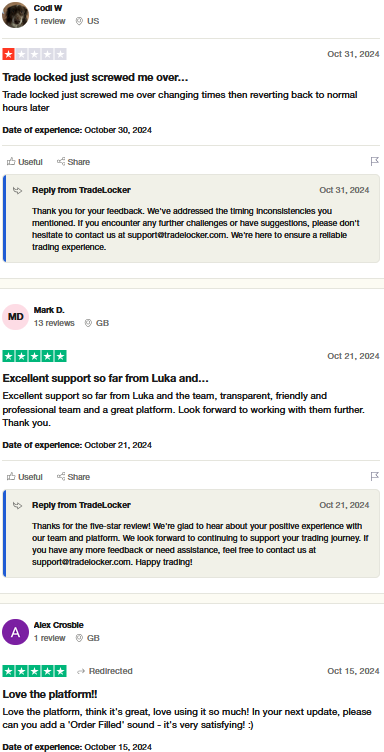

Tradelocker Customer Reviews

Tradelocker has received mixed customer reviews, highlighting its strengths and areas for improvement. Users commend its easy-to-use interface, one-click trading, and tools like on-chart trading and trading bots, which cater to experienced traders and newcomers alike. The platform’s focus on features like stop-loss tools and risk management helps users make well-informed decisions and mitigate risks effectively.

Despite its appeal as a next-gen trading platform, some reviews raise concerns about it being an unregulated broker and challenges with funded accounts. However, Tradelocker supports diverse assets, market orders, and flexible lot sizes, giving traders confidence in their strategies. With no minimum deposit, the platform provides access to a variety of indicators, markets, and instruments, making it a competitive option in the prop firm industry.

Tradelocker Spreads, Fees, and Commissions

Tradelocker offers competitive spreads designed to benefit day traders by minimizing trading costs. The platform provides variable spreads that adjust based on market conditions, ensuring flexibility for different trading strategies.

Fees on Tradelocker are transparent, with no hidden charges that might catch users off guard. While commissions may apply to certain trades, they are clearly outlined, allowing traders to plan their costs effectively. This straightforward approach makes it easier for traders to manage expenses.

Account Types

Tradelocker provides a single, streamlined Brokerage Account designed to cater to all types of traders. This account combines essential features with advanced tools to ensure a seamless trading experience.

Brokerage Account

The Brokerage Account offers access to Tradelocker’s comprehensive trading platform. It includes features such as real-time market data, customizable charting tools, and competitive spreads. With this account, traders can manage multiple asset classes efficiently, making it suitable for both beginners and experienced traders.

Traders need to put funds after creating this account. A new Tradelocker account deposit method is now up and working. With a very easy to use interface, traders can now enjoy their funded account with low risk of losing money. Because of it’s user interface, Trade locker has low negative reviews that’s why they’re adding new features.

How to Open Your Account

Opening a Tradelocker brokerage account is simple and streamlined, perfect for traders looking to start quickly. With just one account type available, Tradelocker ensures an easy and focused onboarding process.

Step 1: Access the Platform

Visit the official Tradelocker website and click on the “Sign Up” option. This will lead you to the registration page for the brokerage account.

Step 2: Enter Your Information

Fill in your personal details, such as your full name, email address, and phone number. Make sure the information is correct to prevent registration errors.

Step 3: Submit Identity Proof

Upload valid documents like a government-issued ID and proof of residence. These are required for Tradelocker to verify and activate your brokerage account.

Step 4: Add Funds to Trade

Select your preferred deposit method and fund your account. Once funded, your Tradelocker brokerage account is ready for trading activities.

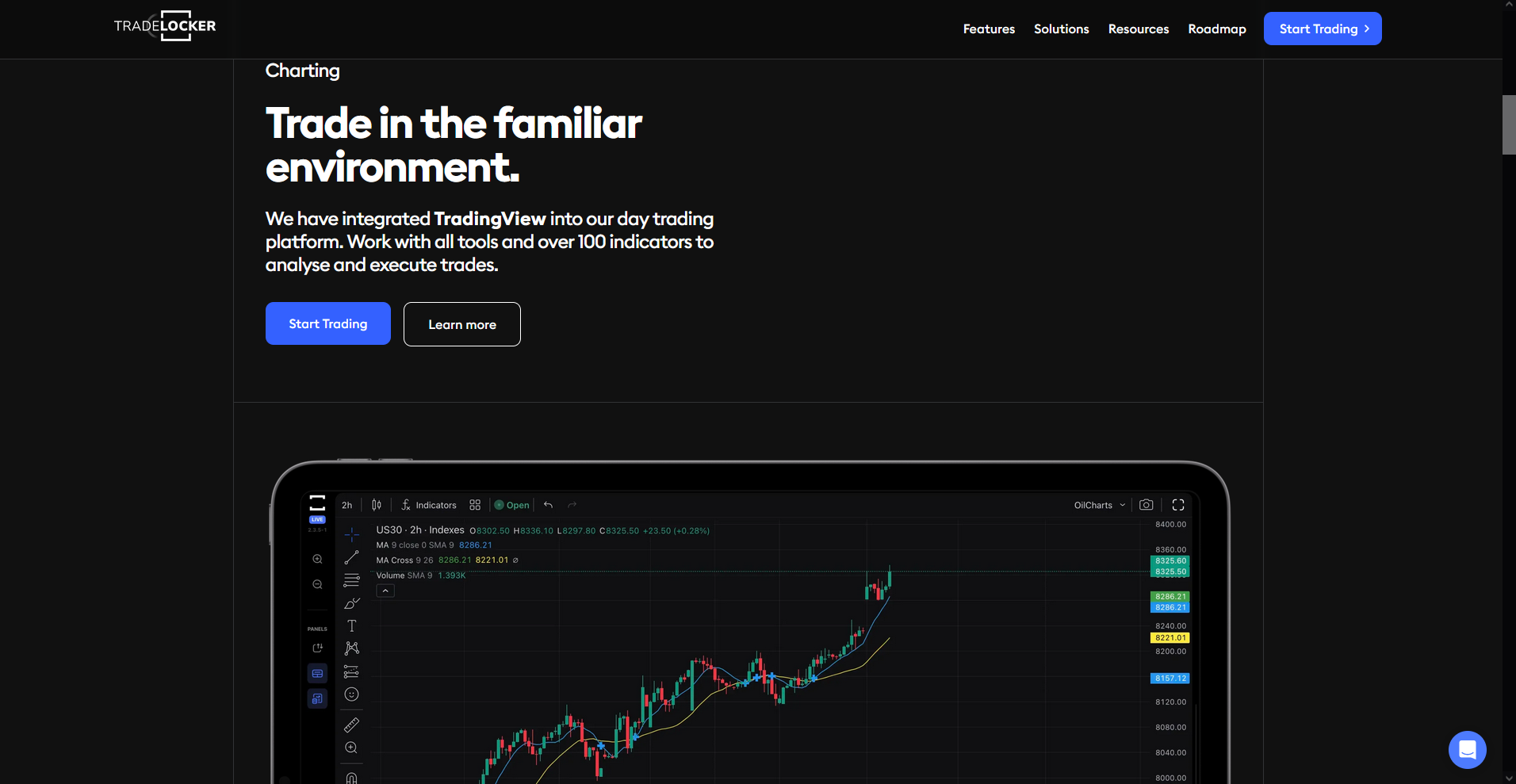

Tradelocker Trading Platforms

Tradelocker offers user-friendly trading platforms designed to meet the needs of day traders. The interface is intuitive, allowing users to navigate efficiently and execute trades quickly. These platforms are equipped with tools for market analysis and strategy development, enhancing the trading experience.

The platform supports multiple devices, ensuring seamless access across desktops, tablets, and smartphones. This flexibility allows traders to monitor the market and manage their positions on the go. Tradelocker ensures that its platforms cater to both beginners and experienced traders with ease and reliability.

What Can You Trade on Tradelocker

Tradelocker provides a diverse range of trading instruments, catering to both beginner and advanced traders. Its platform offers access to global markets, enabling users to trade various asset classes efficiently. Here’s an overview of what you can trade on Tradelocker:

Forex

Tradelocker supports forex trading, offering major, minor, and exotic currency pairs. This allows traders to capitalize on global currency movements with competitive spreads and leverage options.

Stocks

Trade global stocks on Tradelocker, including popular shares from major markets. The platform ensures real-time pricing and user-friendly features for stock market enthusiasts.

Cryptocurrencies

Tradelocker includes a variety of cryptocurrencies like Bitcoin, Ethereum, and more. It provides secure and fast trading options for this high-demand asset class.

Commodities

Access commodities such as gold, silver, and oil through Tradelocker. These options allow traders to hedge against market volatility or diversify their portfolios.

Tradelocker Customer Support

Tradelocker offers responsive customer support to address user concerns effectively. The platform provides multiple support channels, including email and live chat, ensuring traders can quickly access assistance when needed. This accessibility makes it convenient for users to resolve issues or ask questions.

The support team at Tradelocker is trained to handle various inquiries, from technical issues to account management. With prompt and reliable service, the platform ensures traders can focus on their activities without unnecessary disruptions.

Advantages and Disadvantages of Tradelocker Customer Support

Withdrawal Options and Fees

Tradelocker offers multiple withdrawal methods to cater to a wide range of trader preferences. The platform aims to ensure secure and efficient transactions, but fees and processing times vary depending on the chosen method.

Bank Transfers

This option provides direct transfers to your bank account, ensuring high security. However, Tradelocker applies a processing fee and transfers may take 3-5 business days.

Credit/Debit Cards

Withdrawals via credit or debit cards offer convenience and quick access. Tradelocker charges a nominal fee, with processing typically completed within 1-3 business days.

E-Wallets

E-wallet options include PayPal and Skrill, offering faster withdrawals. Tradelocker users benefit from lower fees, with transactions processed within 24 hours.

Cryptocurrencies

Crypto withdrawals are ideal for those seeking privacy and speed. Tradelocker supports major cryptocurrencies with minimal fees and near-instant processing times.

Tradelocker Vs Other Brokers

#1. Tradelocker vs AvaTrade

Tradelocker focuses on day trading with a user-friendly interface, offering fast trade execution and multiple withdrawal options, making it ideal for active traders. In contrast, AvaTrade provides a broader range of trading instruments, including forex, CFDs, and cryptocurrencies, alongside extensive educational resources tailored for beginners. While Tradelocker emphasizes simplicity and speed, AvaTrade delivers a more versatile platform with features like automated trading and regulatory compliance across several jurisdictions.

Verdict: For traders seeking a streamlined platform for quick day trading, Tradelocker stands out. However, AvaTrade is better suited for those requiring a diverse portfolio and comprehensive educational tools.

#2. Tradelocker vs RoboForex

Tradelocker stands out for its user-friendly interface and tailored tools specifically designed for day traders, while RoboForex offers a broader range of account types and trading instruments suitable for various experience levels. RoboForex provides lower minimum deposits and spreads, making it attractive for budget-conscious traders, whereas Tradelocker focuses on robust analytics and a seamless trading experience. Both platforms offer strong customer support, though RoboForex includes multilingual options, which Tradelocker lacks.

Verdict: For day traders seeking simplicity and targeted tools, Tradelocker is a strong choice. However, those looking for diverse account options and lower costs may find RoboForex more suitable.

#3. Tradelocker vs Exness

Tradelocker focuses on day traders, offering a user-friendly platform with quick execution times and tailored tools for short-term trading. In contrast, Exness caters to a broader audience, with a wide range of account types, leverage up to 1:2000, and low spreads suitable for various trading styles. While Tradelocker provides simplified withdrawal options and responsive customer support, Exness excels with a global presence and additional educational resources. However, Exness’s platform may feel overwhelming for beginners, whereas Tradelocker keeps its interface streamlined.

Verdict: For day traders seeking simplicity and speed, Tradelocker is an ideal choice. Exness suits those looking for versatility, higher leverage, and extensive account options.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH TRADELOCKER

Conclusion: Tradelocker Review

Tradelocker stands out as a reliable platform for day traders with its focus on regulation, security, and user-friendly features. It offers a well-rounded trading experience supported by robust safety measures and compliance with industry standards.

For traders seeking a dependable and secure platform, Tradelocker provides the necessary tools and protections to navigate the market confidently. Its emphasis on safety and transparency makes it a solid choice for both new and experienced traders.

Tradelocker Review: FAQs

What assets can I trade on TradeLocker?

TradeLocker provides access to a variety of assets, including forex, stocks, and commodities, along with robust analytical tools for informed decision-making.

Does TradeLocker support automated trading?

TradeLocker does not currently allow the use of Expert Advisors (EAs) or trading bots. However, as the platform continues to evolve, this feature may become available in the future.

How can I contact TradeLocker support?

You can get personalized assistance from the TradeLocker support team from 9 am to 5 pm CET. Additionally, you can explore the help desk and find support wherever you need it, from integration to trading.

OPEN AN ACCOUNT NOW WITH TRADELOCKER AND GET YOUR BONUS