Position in Rating | Overall Rating | Trading Terminals |

183rd  | 2.7 Overall Rating |

TradeLandFX Review

Choosing the right Forex broker is crucial for any trader’s success. The Forex market is vast, with numerous brokers offering various services and trading conditions. As a trader, you need a broker that fits your specific needs, provides a reliable trading platform, and offers good customer support. The importance of selecting a reputable and reliable broker cannot be overstated, as it can significantly impact your trading outcomes and overall experience.

TradeLandFX is a well-regarded Forex broker known for its user-friendly platform and comprehensive range of trading tools. They offer various account types tailored to different trading styles and levels of experience. In my experience, TradeLandFX stands out for its competitive spreads and robust customer support, making it a preferred choice for many traders.

In this detailed review, I aim to provide an exhaustive evaluation of TradeLandFX, emphasizing its unique selling propositions and potential drawbacks. My objective is to supply you with essential insights about the broker, such as the various account options available, deposit and withdrawal processes, commission structures, and other crucial details. This balanced perspective combines expert analysis and actual trader experiences to equip you with the necessary information to make an informed decision about considering TradeLandFX as your preferred brokerage service provider.

What is TradeLandFX?

TradeLandFX is a Forex broker that offers a range of trading services and tools. Established in 2017, TradeLandFX provides access to over 60 currency pairs, as well as commodities, indices, cryptocurrencies, and metals. The broker operates on the MetaTrader 4 platform, known for its user-friendly interface and advanced trading features.

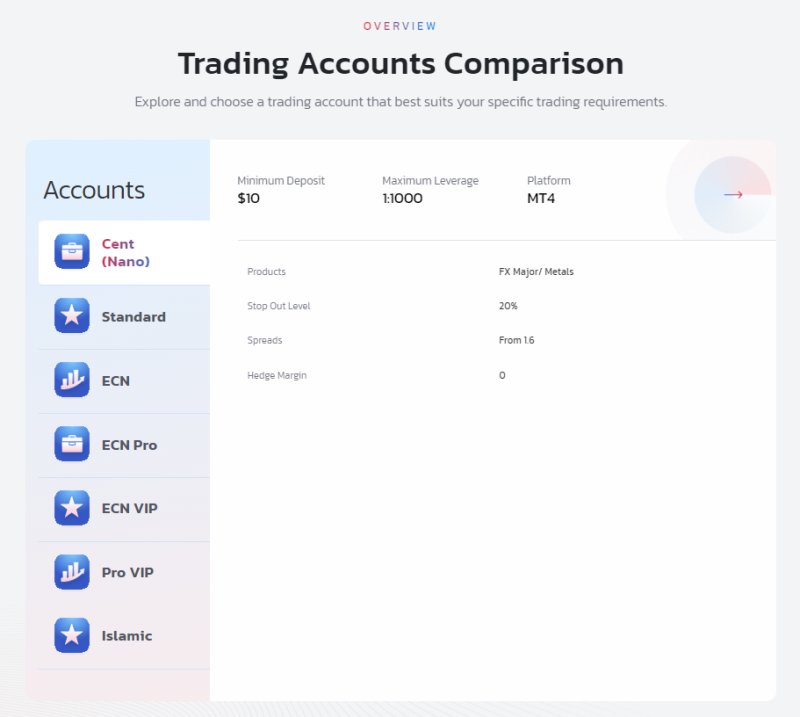

TradeLandFX offers various account types, including Cent (Nano), Standard, ECN, ECN Pro, ECN VIP, and Pro VIP accounts. Each account type is designed to cater to different trading preferences and experience levels. The minimum deposit requirement starts at $10 for the Cent (Nano) account, making it accessible for beginners. The broker also offers competitive spreads starting from 0.2 pips and high leverage up to 1:1000.

One of the standout features of TradeLandFX is its support for copy trading and MAM (Multi-Account Manager) accounts, allowing traders to earn passive income by copying the trades of experienced traders. Additionally, the broker provides a range of educational materials, including guides on fundamental and technical analysis, to help traders improve their skills.

Benefits of Trading with TradeLandFX

After trading with TradeLandFX, I discovered several benefits that make it a standout choice for traders. One of the key advantages is the platform’s user-friendly interface. It is easy to navigate, even for beginners. This makes the trading experience smooth and enjoyable.

Another significant benefit is the wide range of trading instruments available. TradeLandFX offers access to various markets, including forex, commodities, and cryptocurrencies. This diversity allows me to diversify my portfolio effectively.

I also appreciate the broker’s competitive spreads and low fees. Lower trading costs mean I can maximize my profits. The transparency in their fee structure is also reassuring, ensuring there are no hidden charges.

TradeLandFX provides excellent customer support. Their support team is responsive and knowledgeable, which helps resolve issues quickly. This level of service enhances my overall trading experience.

TradeLandFX Regulation and Safety

TradeLandFX is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa. The FSCA is a reputable regulatory body established to enhance the efficiency and integrity of financial markets. Being regulated by the FSCA means that TradeLandFX is required to adhere to strict standards, ensuring that traders receive security guarantees and fair customer treatment.

Knowing the regulatory status of a broker is crucial for traders. This information helps in determining the safety and security of funds invested with the broker. While trading with TradeLandFX, I found it reassuring that they comply with FSCA regulations, which includes maintaining transparency and implementing fair practices. However, it is always advisable to verify such claims directly with the regulatory authority to ensure the broker’s current standing.

TradeLandFX Pros and Cons

Pros

- Variety of account types

- Low minimum deposit

- High leverage options

- Copy trading and MAM accounts

- No trading fees on most accounts

- Wide range of trading instruments

Cons

- Regulation issues

- Limited trading platforms

- Mixed user reviews

- Preference for crypto deposits

TradeLandFX Customer Reviews

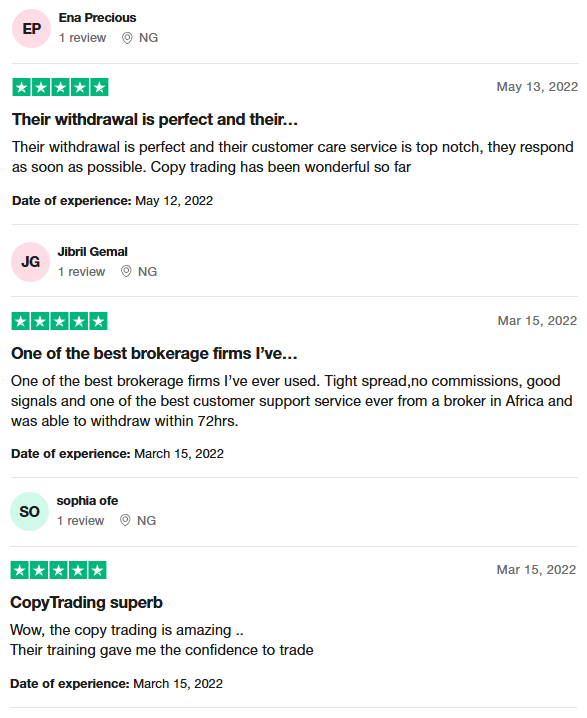

TradeLandFX receives positive feedback from users who praise its excellent withdrawal process and top-notch customer care service. Customers appreciate the tight spreads, no commissions, and good trading signals. The copy trading feature is highlighted as a major benefit, providing a seamless trading experience. Additionally, their training programs are noted for boosting traders’ confidence. Users report that withdrawals are processed swiftly, often within 72 hours, and commend the broker for being one of the best in Africa for its responsive and reliable customer support.

TradeLandFX Spreads, Fees, and Commissions

TradeLandFX offers competitive trading conditions with a focus on low costs and flexibility. The broker provides tight spreads starting from 0.2 pips on certain accounts, making it an attractive choice for traders looking to minimize their trading costs. For instance, their ECN accounts offer some of the lowest spreads, although these come with a small commission per trade.

One of the advantages of TradeLandFX is the lack of trading fees on most accounts, which helps traders maximize their returns. The broker does not charge deposit or withdrawal fees on standard transactions, which adds to the overall cost-effectiveness of trading with them. However, it’s important to note that while the trading fees are generally low, the spread can vary depending on the market conditions and the type of account you choose.

In my experience, the high-leverage options available, up to 1:1000, can be beneficial for experienced traders looking to amplify their positions. However, it also comes with higher risk, which should be managed carefully. Overall, TradeLandFX’s fee structure and trading conditions are designed to be competitive and cater to a wide range of trading strategies.

Account Types

Cent (Nano) Account

- Minimum deposit: $10

- Maximum leverage: 1:1000

- Spreads from 1.6 pips

Standard Account

- Minimum deposit: $100

- Maximum leverage: 1:500

- Spreads from 1.6 pips

ECN Account

- Minimum deposit: $500

- Maximum leverage: 1:500

- Spreads from 1.2 pips

ECN Pro Account

- Minimum deposit: $1,000

- Maximum leverage: 1:200

- Spreads from 0.2 pips + $5 commission

ECN VIP Account

- Minimum deposit: $5,000

- Maximum leverage: 1:200

- Spreads from 0.2 pips + $4 commission

Pro VIP Account

- Minimum deposit: $20,000

- Maximum leverage: 1:200

- Spreads from 0.2 pips, no commission

Islamic Account

- Available on request

- Complies with Sharia law for interest-free trading

How to Open Your Account

- Visit the TradeLandFX official website.

- Choose your preferred interface language from the top-right corner.

- Click “Open Account” or “Try Demo Account.”

- Enter your email, name, country, and phone number, create a password, and agree to the terms of service, then click “Register.”

- Check your email for the verification link and click it to activate your account.

- Log in with your email and password, then click “Login.”

- Select your account type and leverage, then submit and confirm with the code sent to your email.

- Complete your profile and banking information, then deposit funds to start trading.

TradeLandFX Trading Platforms

Based on my experience, TradeLandFX offers traders access to the MetaTrader 4 (MT4) platform. MT4 is renowned for its user-friendly interface and powerful trading tools. This platform supports various order types and provides real-time quotes, making it ideal for both novice and experienced traders.

The charting tools and technical analysis features on MT4 are top-notch. It includes over 30 technical indicators and supports automated trading through Expert Advisors (EAs). The platform is available on desktop, web, and mobile, ensuring you can trade conveniently from anywhere.

Moreover, the platform’s reliability and speed of execution are impressive. I’ve found it easy to manage multiple accounts and use advanced trading strategies seamlessly. Overall, MT4 enhances the trading experience by providing robust tools and flexibility.

What Can You Trade on TradeLandFX

Based on my experience, TradeLandFX offers a wide range of trading instruments, providing ample opportunities for traders to diversify their portfolios. You can trade over 60 currency pairs, including major, minor, and exotic pairs, which allows for extensive market analysis and trading strategies. The platform also supports trading in precious metals like gold and silver, known for their stability and liquidity, making them a great option for hedging.

TradeLandFX also provides access to CFD indices, allowing you to invest in major global indices such as the FTSE 100, Dow Jones, and NASDAQ 100. This broadens your trading options to include market indices with potentially high returns. Additionally, you can trade cryptocurrencies like Bitcoin, Ethereum, and Ripple, taking advantage of the volatility in the crypto market to maximize profits.

Furthermore, the platform supports trading in spot energies such as crude oil and natural gas. These commodities are essential for diversifying your investment and hedging against market volatility. Lastly, TradeLandFX offers CFD shares from major companies like Apple, Tesla, and Facebook, enabling you to partake in the equity markets with low spreads and dynamic leverage options.

TradeLandFX Customer Support

When I traded with them, TradeLandFX offered excellent customer support. Their 24/7 availability ensures that assistance is always at hand whenever you need it. You can reach their support team via email at support@tradelandfx.com or by calling their hotline. The representatives are responsive and knowledgeable, addressing queries and resolving issues promptly.

The accessibility of their customer service is impressive, making it easy for traders to get help anytime. Whether you have questions about account management, trading platforms, or specific transactions, the support team is ready to assist and guide you through any challenges you might face.

Advantages and Disadvantages of TradeLandFX Customer Support

Withdrawal Options and Fees

When trading on TradeLandFX, you can choose from six account types and accumulate your profits in your account. These funds are accessible through MetaTrader 4 or directly via the user account on the broker’s website.

To withdraw your funds, submit a request through the user account, which is processed by technical support. Withdrawal options include bank cards, Perfect Money, PayTrust88, Neteller, and Skrill. You can withdraw in USD or INR, with automatic currency conversion if needed.

Typically, withdrawal requests are processed within 1-2 days. However, delays can occur due to clearing processes.

TradeLandFX Vs Other Brokers

#1. TradeLandFX vs AvaTrade

TradeLandFX offers MetaTrader 4 with tight spreads, high leverage options, and multiple account types. In contrast, AvaTrade provides a more diverse platform range, including MetaTrader 4, MetaTrader 5, and its proprietary AvaTradeGO, along with extensive educational resources. AvaTrade is also heavily regulated across multiple jurisdictions, ensuring a higher level of trust and security for traders.

Verdict: AvaTrade is better due to its broader platform support, comprehensive educational materials, and strong regulatory oversight, which offers enhanced security and reliability for traders.

#2. TradeLandFX vs RoboForex

TradeLandFX focuses on providing high leverage and tight spreads with a straightforward MetaTrader 4 platform. RoboForex, on the other hand, offers a wider variety of platforms, including MetaTrader 4, MetaTrader 5, cTrader, and its proprietary R Trader platform. RoboForex also provides more extensive trading tools and resources, including copy trading and VPS services.

Verdict: RoboForex is better because it offers more platform choices, advanced trading tools, and additional features like VPS and copy trading, which cater to both beginner and advanced traders.

#3. TradeLandFX vs Exness

TradeLandFX provides competitive trading conditions with high leverage and low spreads on MetaTrader 4. Exness also offers MetaTrader 4 and MetaTrader 5 but stands out with its exceptional customer support, ultra-fast order execution, and unlimited leverage for certain accounts. Exness has a strong reputation for reliability and transparency, backed by multiple regulatory bodies.

Verdict: Exness is better due to its superior customer support, faster execution speeds, and the option for unlimited leverage, which provides traders with a more efficient and supportive trading environment.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH TRADELANDFX

Conclusion: TradeLandFX Review

TradeLandFX offers a variety of account types with competitive trading conditions, including high leverage and tight spreads, all accessible through the MetaTrader 4 platform. The broker supports a wide range of trading instruments and provides 24/7 customer support, making it a convenient option for many traders.

While TradeLandFX has many strengths, such as low trading fees and multiple withdrawal options, potential users should carefully consider the regulatory risks. User feedback highlights both the responsive customer service and occasional delays in withdrawal processing.

Also Read: iBroker Review 2024 – Expert Trader Insights

TradeLandFX Review: FAQs

What trading platforms does TradeLandFX offer?

TradeLandFX offers the MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading tools.

What are the withdrawal options available with TradeLandFX?

Withdrawal options include bank cards, Perfect Money, PayTrust88, Neteller, and Skrill, with funds available in USD or INR.

Is TradeLandFX regulated?

TradeLandFX is not regulated by major financial authorities, which raises concerns about the safety and security of funds.

OPEN AN ACCOUNT NOW WITH TRADELANDFX AND GET YOUR BONUS