Trade245 Review

Trade245, a brokerage firm based in Johannesburg, South Africa, was founded in the year 2020. They provide a variety of digital trading options, encompassing a wide array of financial instruments such as Forex, Indices, Stocks, CFDs for Commodities, and Cryptocurrencies.

In this review, we delve deep into an all-encompassing evaluation of Trade245, scrutinizing both its strong points and areas that may require improvements. Our aim is to furnish a comprehensive perspective, meticulously examining various facets like its distinctive features, the pricing scheme in terms of commissions, the diversity of account types offered, and the mechanisms of performing transactions, among other aspects. We endeavor to integrate findings from both industry expert analyses and the experiences shared by actual traders, in order to equip you with insightful information that could prove instrumental in making informed decisions.

What is Trade245?

Trade245, a brokerage firm established in 2020, operates under the governance of the Financial Sector Conduct Authority (FSCA), one of the most respected regulatory bodies in South Africa. The company holds full authorization and stringent regulation by the FSCA, ensuring adherence to the highest standards of financial conduct.

Furthermore, the brokerage extends its international presence, thanks to its licensing by the Financial Services Authority (FSA) of Seychelles. This licensing enables the company to provide services on a global scale, increasing its reach and potential customer base.

The firm boasts an extensive range of assets for its clients to trade, including Forex and Contracts for Difference (CFDs) across several categories such as stocks, metals, commodities, digital currencies, and stock indices. This wide-ranging asset portfolio enables traders to diversify their investments and reduces their risk exposure.

Trade245 offers its clients access to the MetaTrader 4 and 5 platforms, industry-leading tools that facilitate seamless trading experiences. Additionally, they provide an impressively high leverage ratio of 1:500, catering to various trading preferences and risk appetites.

To further reassure its clients, the company adopts stringent financial practices, including the segregation of client funds into separate bank accounts. This ensures client money is distinct from the firm’s operational funds, providing an additional layer of security for its clients’ investments.

Trade245 also ensures efficient liquidity provision, sourcing from top-tier liquidity providers, a practice that ensures efficient and seamless trade execution. Additionally, the firm is committed to reasonably swift order execution, reducing the risk of slippage and providing a more predictable trading environment.

Advantages and Disadvantages of Trading with Trade245

Benefits of Trading with Trade245

Trade245 boasts numerous benefits, making it an attractive platform for traders across a spectrum of experience levels and geographical regions. While there are both pros and cons to consider, let’s delve deeper into the various advantages that this platform presents.

One of the prime attractions of Trade245 is the diverse selection of popular financial instruments that it offers for trading. This includes a variety of asset classes such as Forex, commodities, cryptocurrencies, stocks, and indices. Such a wide range of options offers traders the flexibility to diversify their portfolios, thus minimizing risk while maximizing potential returns.

Moreover, Trade245 prides itself on offering competitive trading solutions. This could involve favorable spreads, efficient trade execution, high leverage ratios, and comprehensive market analysis tools. These features are designed to optimize trading experiences and potentially improve traders’ success rates.

Another significant benefit of trading with Trade245 is the lack of a minimum deposit requirement. This approach provides flexibility to traders of all investment capacities, making it an attractive option for those looking to start small or test the waters before committing more significant sums of money. It removes a significant barrier to entry and opens up the world of trading to a much wider audience.

Trade245 also offers access to the esteemed MetaTrader 4 and 5 trading platforms. These platforms are widely respected for their user-friendly interfaces, advanced technical analysis tools, automated trading capabilities, and real-time market data feeds. Providing these platforms ensures that their traders have the best tools at their disposal for efficient and informed trading.

Moreover, as a South African broker, Trade245 is well-positioned to cater to traders from the African region at large. This includes countries like Namibia, Zambia, and more. Being based in this region, the firm likely understands the specific needs and challenges of African traders, enabling them to provide a more customized and effective trading experience.

Trade245 Pros and Cons

Pros:

- Speedy Execution: Trade245 offers prompt order execution, minimizing the time lag between order placement and fulfillment, thereby reducing the risk of price slippage.

- FSCA Oversight: The firm is under the strict regulation of the Financial Sector Conduct Authority (FSCA), a well-respected regulatory body that ensures compliance with high standards of financial conduct and customer protection.

- Access to MetaTrader Platforms: Traders can use both the MetaTrader 4 and MetaTrader 5 platforms, renowned for their advanced trading tools, user-friendly interfaces, and real-time market data.

- Diverse Trading Currencies: Trade245 supports multiple trading currencies, providing its clients with the flexibility to trade in a currency that suits them best.

- Competitive Pricing: Trade245 offers competitive pricing structures, such as low spreads and commissions, making it an attractive platform for cost-conscious traders.

- Wide Range of Funding Options: The company offers a variety of deposit and withdrawal methods, catering to the diverse financial preferences of its global clientele.

Cons:

- Conditions Subject to Entity: Trading conditions might differ depending on the jurisdictional entity, which might create inconsistency and confusion among traders operating under different entities.

- Limited Product Range: Despite offering a decent array of financial instruments, Trade245 has a more limited product offering compared to some other global brokers.

- Lack of 24/7 Customer Support: Trade245 does not offer round-the-clock customer service, which could potentially inconvenience traders who operate in different time zones or prefer trading during off-peak hours.

- Limited Education and Research Resources: The platform’s educational and research resources may not be comprehensive enough for new traders or those wishing to further deepen their market knowledge and trading skills.

Trade245 Customer Reviews

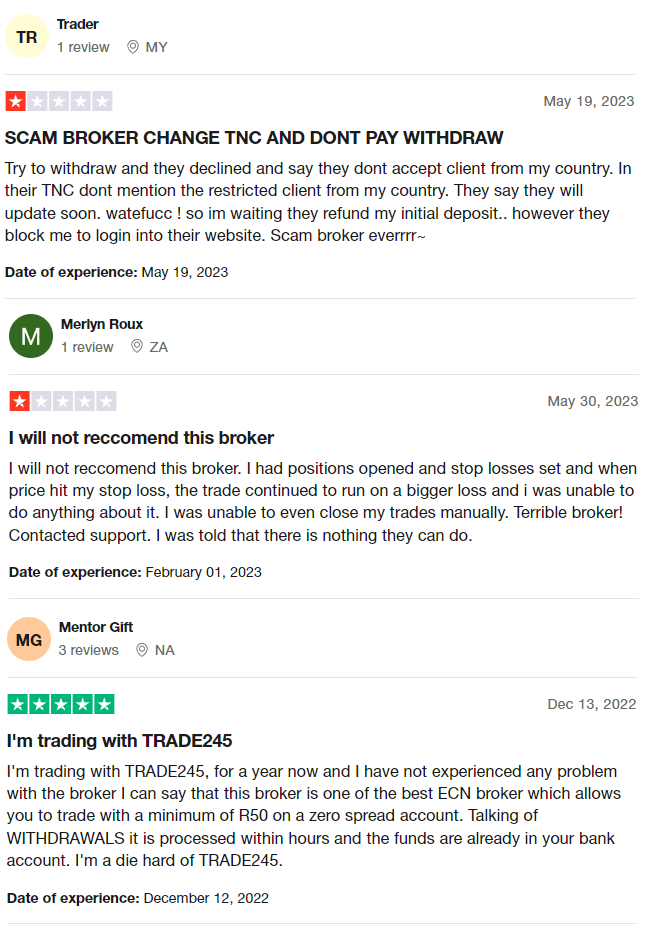

Trade245’s customer reviews reveal a mixed bag of experiences, indicating some inconsistencies in the broker’s service. Some customers have reported significant challenges, such as problems with the withdrawal of funds, unresponsive customer service, and allegations of geographic restrictions not clearly stated in their terms and conditions. These users have reported being blocked from accessing their accounts and trades running past set stop losses, leading to increased losses.

However, others have shared positive experiences with Trade245, lauding its competitive ECN offering with zero spreads and low minimum deposits. These satisfied users highlighted efficient withdrawal processing and overall robust performance. Despite these positive reviews, the number of negative experiences reported suggests that potential clients should approach the platform with caution.

Trade245 Spreads, Fees, and Commissions

Trade245 distinguishes itself by offering competitive and flexible spreads. Specifically, they start from as low as 0 pip, with an average spread of 1 pip noted for the EUR/USD pair, one of the most traded currency pairs in the Forex market. It’s crucial to note, however, that these trading conditions, spreads included, may vary based on the particular entity in question. It is therefore essential for traders to thoroughly understand the spread conditions laid out by the broker and how these might intersect with their personal trading strategies.

In terms of pricing, Trade245’s structure is quite competitive for a majority of its offered services. For certain account types, a commission fee of $10 is charged per lot traded. Also, it’s worth noting that some fees might be associated with depositing or withdrawing funds, with the exact charges depending on the chosen payment method.

Traders should also be mindful of potential additional costs during their trading activities. For instance, swap or rollover fees might be applicable, depending on the nature and duration of their trades. It is thus of utmost importance to review the broker’s fee structure meticulously, alongside their terms and conditions. By doing so, traders can gain an exhaustive understanding of all potential charges and fees, helping them to plan their trading operations more accurately and strategically.

Account Types

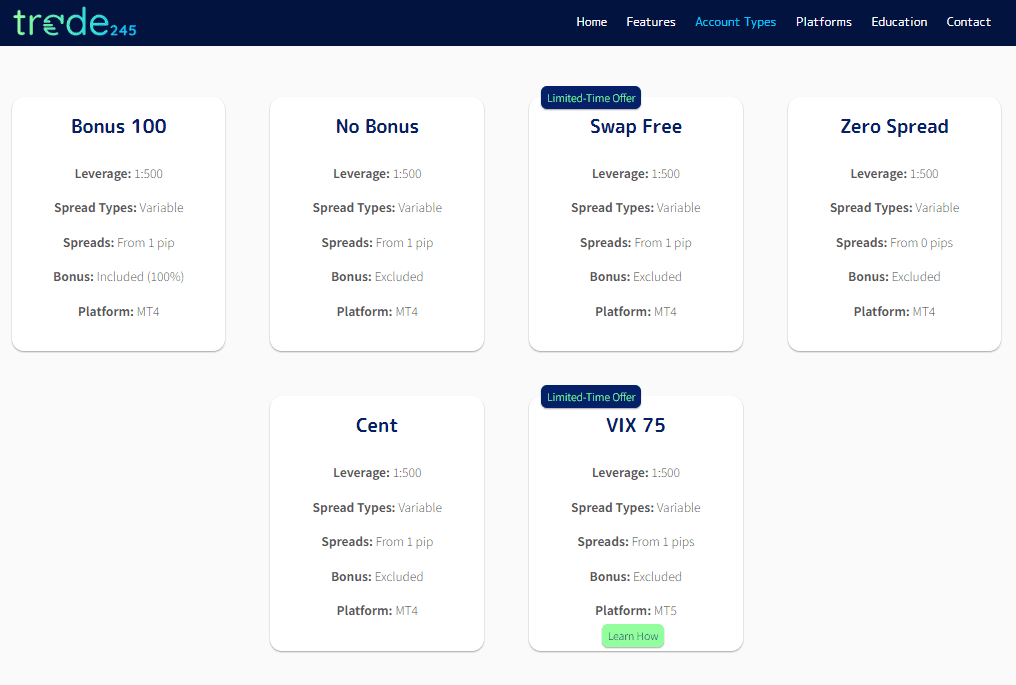

Trade245 offers a wide array of custom-designed account types to cater to a diverse spectrum of trading needs. This extensive selection includes Bonus 100, No Bonus, Swap Free, Zero Spread, Cent, and Weekend Trader account. The offerings are designed to appeal to a broad array of traders, from beginners to advanced, and particularly stand out due to their competitively low spreads.

1. Bonus 100 Account

The Bonus 100 Account provides a generous bonus offer of 100%, in addition to variable spreads starting from 1 pip. It offers a high leverage of 1:500, which could prove attractive for risk-tolerant traders. Trading activities on this account type are conducted on the MT4 platform.

2. No Bonus Account

The No Bonus Account, on the other hand, does not include any bonus offer but compensates with the same high leverage of 1:500 and variable spreads from 1 pip. Like the Bonus 100 Account, this also uses the MT4 platform.

3. Swap Free Account

Similarly, the Swap Free Account is tailored for traders who wish to avoid swap or rollover charges. It features the same high leverage of 1:500, variable spreads starting from 1 pip, and excludes any bonuses. This account also operates on the MT4 platform.

4. Zero Spread Account

The Zero Spread Account stands out by offering spreads from 0 pips, allowing for cost-effective trading. Again, it offers a leverage of 1:500, excludes bonuses, and operates on the MT4 platform.

5. Cent Account

The Cent Account, which is tailored for micro-trading, allows traders to trade in smaller increments and lower risks. It offers variable spreads from 1 pip, a leverage of 1:500, no bonus, and operates on the MT4 platform.

6. Weekend Traders Account

Finally, the Weekend Traders Account is designed for those who prefer to trade during the weekends. It offers variable spreads from 1 pip, high leverage of 1:500, excludes bonuses, and unlike the other accounts, operates on the MT5 platform.

How to Open Your Account

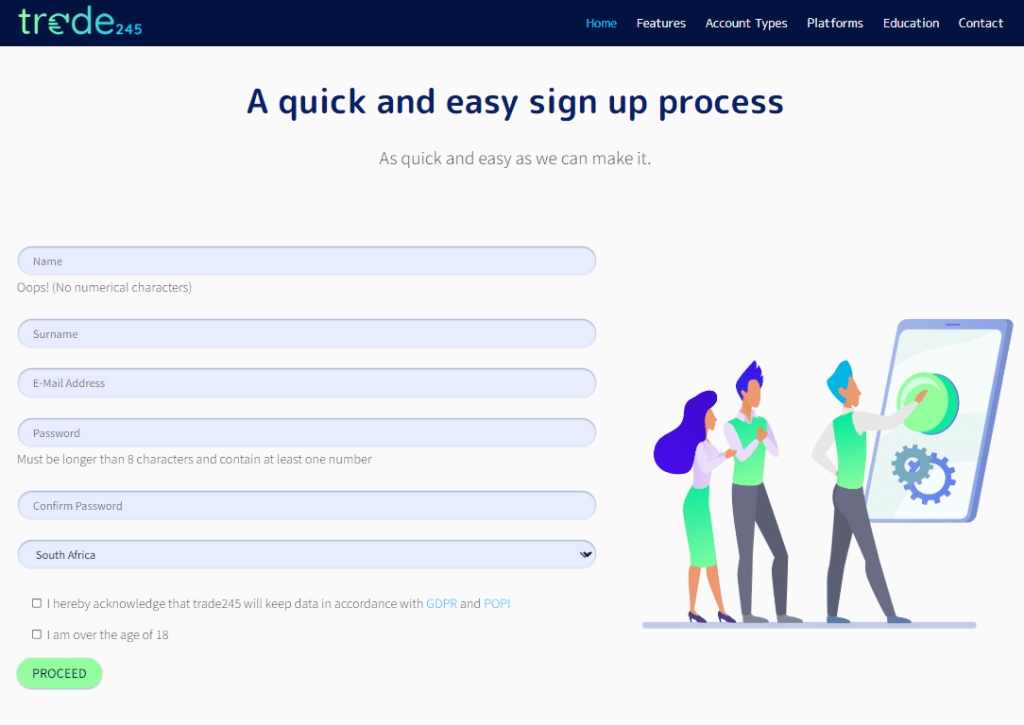

Before one can begin trading with a real account, it’s necessary to complete a registration process with the broker. The steps to sign up with Trade245 are quite straightforward and user-friendly, and they are as follows:

- Start by navigating to the Trade245 website, where you can find the registration portal.

- You’ll then be required to provide personal identification information, including your full name and surname. This is a standard step to verify your identity.

- Next, create and confirm a password. This password will be your key to accessing both your real account and any live trading accounts you may open in the future.

- Following this, you’ll be asked to provide your current place of residence.

- In order to adhere to regulations, you’ll need to confirm that you are at least 18 years old. You’ll also need to read and accept the broker’s data security protocols to ensure you’re aware of how your information will be handled.

- Finally, to complete your registration and set up your real account, click on the “Proceed” button.

What Can You Trade on Trade245

Trade245 offers an expansive selection of trading instruments, catering to a broad spectrum of trader interests and investment strategies. Their offerings include Forex (foreign exchange market), where traders can engage with a multitude of currency pairs. The Indices option allows traders to invest in a basket of stocks representing a particular market or sector.

In addition, Trade245 also provides access to individual Stocks trading, where one can buy or sell shares in specific companies. Their Commodities CFDs (Contracts for Difference) permit traders to speculate on price movements of various physical commodities like gold, oil, or agricultural products without the need to own the underlying assets.

Furthermore, Trade245 caters to the growing demand for Cryptocurrencies, offering traders the opportunity to capitalize on the volatility and potential high returns of this burgeoning market.

However, it’s essential to note that the availability of these instruments can fluctuate depending on the particular entity. This variation could be due to regulatory requirements or specific business decisions made by Trade245.

Trade245 Customer Support

Trade245 ensures its clients receive professional assistance throughout the week by offering customer support from Monday to Friday, around the clock. Traders can reach out via phone or email to a team of knowledgeable experts ready to offer their expertise.

Whether clients require help with technical difficulties while navigating the trading platform, need recommendations for market analysis, have questions about their accounts or services, or encounter operational issues that require immediate attention, the Trade245 support team is on hand to provide guidance and solutions. Their commitment to customer service ensures traders have the necessary support to navigate the complexities of the financial market and the trading platform, thus enhancing the overall trading experience.

Advantages and Disadvantages of Trade245 Customer Support

Security for Investors

Withdrawal Options and Fees

Trade245 promptly processes client withdrawal requests, typically within a matter of hours, ensuring that clients can readily access their funds. Importantly, Trade245 does not impose any fees for either deposits or withdrawals, making financial transactions with the broker cost-efficient for traders.

Clients have the flexibility to withdraw their funds via a variety of methods including bank accounts, e-wallet services, or debit/credit cards. Trade245 also offers the option of cryptocurrency withdrawals, appealing to those engaged in digital asset trading.

In the case of card transactions, Trade245 only transfers back to the card an amount equivalent to what was initially deposited via the card. If the withdrawal amount requested exceeds the initial deposit, the excess amount is transferred to a designated bank account.

If clients opt for bank transfer as their preferred withdrawal method, the timing for funds receipt varies based on the chosen financial institution. For instance, transfers to First National Bank accounts are typically completed within a few hours, while transfers to other banks may take anywhere from 1 to 5 business days.

It is important to note that Trade245 enforces a strict policy of not transferring funds to third-party accounts. This policy is in place to enhance security measures and protect the clients’ financial assets.

Trade245 FX Vs Other Brokers

#1. Trade245 vs AvaTrade

Trade245 and AvaTrade are both reputable brokerage companies, but they cater to different trader needs. Trade245 is known for its range of account types and competitive spreads, with a strong focus on the African market, while AvaTrade is globally recognized and provides a wider range of trading instruments.

Trade245 has its strengths in the number of accounts on offer and its localized approach to servicing the African trading market. In contrast, AvaTrade’s strengths lie in its extensive range of tradable assets, comprehensive educational resources, and a more robust regulatory framework, being regulated in several jurisdictions worldwide.

Verdict: If you’re looking for a more localized broker with a variety of account types, Trade245 could be a better fit. However, if you prioritize a diverse array of tradable assets, superior educational resources, and global recognition, AvaTrade would be the better choice.

#2. Trade245 vs RoboForex

RoboForex and Trade245 are both competitive options in the brokerage market. RoboForex stands out with its comprehensive trading tools and advanced technological approach, providing automated trading opportunities and copy-trading options. On the other hand, Trade245 shines with its high leverage and a variety of account types.

Verdict: If you’re seeking an advanced technological platform with automated trading and a broader array of tools, RoboForex may be your pick. Conversely, if high leverage and a variety of account types are paramount, Trade245 could be the more appealing choice.

#3. Trade245 vs Exness

Trade245 and Exness have distinctive offerings that may appeal to different types of traders. While Trade245 has high leverage and a range of account types, Exness excels with its ultra-low spreads, instant withdrawals, and superior customer service.

Verdict: For traders who value high leverage and account diversity, Trade245 may be the ideal choice. However, if you value low spreads, fast withdrawal processes, and top-tier customer service, then Exness would be a superior choice.

Conclusion: Trade245 Review

In conclusion, Trade245 has demonstrated itself to be a compelling choice in the world of online trading. With its roots in South Africa and regulatory oversight by the reputable FSCA, the broker has built a foundation of trust and transparency. The variety of account types and trading instruments, coupled with competitive pricing and access to popular MT4 and MT5 platforms, makes it a versatile choice catering to a wide range of trading preferences.

Trade245’s commitment to customer support, illustrated by its 24/5 service, further enhances its appeal. However, the broker also has areas for improvement, including expanding its product offerings and introducing round-the-clock customer support. The mixed customer reviews highlight the necessity for potential clients to thoroughly understand the terms, conditions, and potential drawbacks before choosing to trade with Trade245.

In a nutshell, Trade245 is a brokerage that offers solid services that can meet the needs of many traders, yet it should also work on its limitations to improve the overall client experience.

Trade245 Review: FAQs

What types of trading accounts does Trade245 offer?

Trade245 offers a diverse range of account types tailored to various trading needs. These include Bonus 100, No Bonus, Swap Free, Zero Spread, Cent, and Weekend Trader Accounts. Each account type comes with its own set of features, including varying leverage, spread types, and platform availability.

Does Trade245 charge for deposits and withdrawals?

No, Trade245 does not charge any fees for deposits or withdrawals. However, it’s important to review your payment provider’s policies, as they might have separate fees.

How quickly are withdrawal requests processed at Trade245?

Trade245 typically processes withdrawal requests within a few hours. However, the time it takes for funds to reach your account can depend on the withdrawal method and your banking institution. For instance, funds are credited to First National Bank accounts within a few hours, whereas transfers to other banks may take 1-5 business days.