Operational expenses are associated with every aspect of doing business. This situation applies to mutual funds. Understanding the expanses generated with running an investment fund is a prerequisite for investors and fund managers to implement a profitable strategy.

The standard option used by businessman to estimate the cost that goes in operating a mutual fund is a metric called the total expense ratio (TER).

Typically operating expenses consist of various types of fees. Which are associated with legal fees, payment of auditors, trading fees, and any other expanse relating to operational activities.

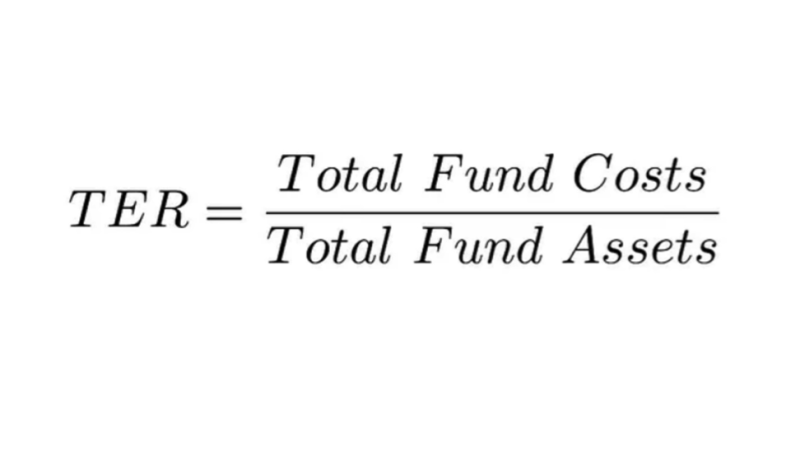

The final cost of the fund is determined by dividing the assets to get a percentage amount that is the TER. The total expense ratio also gets called the reimbursement expense ratio or the net expense ratio.

Also Read: What Is Gearing Ratio?

Contents

- What Is a Mutual Fund?

- Understanding Mutual Funds Expenses

- Elements of TER

- The Mechanism of the Total Expense Ratio

- The Total Expense Ratio (TER) Formula

- What the Expense Ratio Can Tell You

- The Total Expense Ratio vs Gross Expense Ratio

- Limitations of the Total Expense Ratio

- Conclusion

- FAQs

What Is a Mutual Fund?

Pooling capital from several investors to buy securities is the concept behind a mutual fund. It is a professionally managed company that gets frequently classified by the fundamental investments that comprise the portfolio.

The big advantage of mutual funds, when compared with direct investing in assets, is that the funds offer liquidity, scale, diversification, and professional management.

The downside is that mutual funds create extra fees for an investor, that would not have been present or reduced if investing individually.

Government institutions supervise and regulate the activities of mutual funds. The funds are obliged to publish information concerning performance, the assets held in the portfolio, and fees charged.

Understanding Mutual Funds Expenses

Every company or financial entity has operating costs that are necessary for the uninterrupted functioning of the fund that manages total assets.

The financial obligations have to get regularly settled, and they include fees for brokers, salaries for employees, and accountant costs.

Depending on the fund and the type of assets it is focusing on, there can be other costs, such as financial statements, communication among shareholders, custodial services, or archival mechanisms.

It’s also possible for a tiny percentage of the total expense ratio to be used for other expenses connected with the functioning of a mutual fund.

For example, office rental and utilities are expenses that need to be tallied, although frequently this gets perceived as overhead and can incorporate other financial obligations that are not directly connected with the production of a service or products.

Elements of TER

There are several costs in running a mutual fund. But the three biggest expenses get calculated by the TER for mutual funds.

Management Fees

The manager is the decision-maker, and the results of the fund are dependent on the competency of the person leading the organization. Most funds recruit managers with experience and previous positive results in managing similar funds. Because of that managers are paid large fees, which account for a big chunk of the total expense ratio.

Distribution Fees

Few mutual funds also charge fees for distribution mutual fund units. This component gets included in the fund’s TER.

Administrative Costs

The functioning of the mutual fund gets supported by several other services, such as legal, audit, custodian charges, and transfer fees, but also marketing expenses and salaries for other employees, managers are not the only one that works for the mutual fund. Every small cost contributes to the final expanse of running the fund.

The Mechanism of the Total Expense Ratio

Businesses, no matter the format have revenues and expenses, and the difference between the two is the profit. That's why investors perceive the TER as a crucial metric that influences the returns investors can expect from an investment.

We can look at a hypothetical example if a fund produces a return of 12% but at the same time the TER was 8%, then the 12% gain will get reduced to 4%.

This number creates a different picture of the real situation and what investors can expect at the end of the year.

The TER is a mechanism that makes it possible for yearly expenses that are necessary for a successful functioning of a given fund to get covered. The process is not complicated, what is important is to have a piece of accurate information about every cost concerning the operation of the fund, and are generally presented as a single percentage.

Meaning that the amount offered as the total expense ratio gets conditioned on the performance of the given fund.

Funds that are available through the TER, can get implemented to cover legal fees, audit costs, management, and trading. The entire specter of operating expenses.

The TER will typically rise if the fund gets managed actively. Logically it will generate more expenses due to rising transaction and brokerage fees that get a charge every time a trade gets performed.

In contrast, automated funds generate reduced costs of operation, with the final effect being reduced TER.

Also Read: Risk Reward Ratio Ultimate Guide

The Total Expense Ratio (TER) Formula

The total expense ratio gets broadly implemented in the mutual fund industry. The usual psychology among investors concerning the ratio is that a higher ratio will translate into a reduced return.

Most investors believe that increasing operating costs for any business are the product of the reduced performance of that particular business.

To calculate the TER:

The formula gets based on the fund’s total fund's assets that are easily obtainable from financial reports that get distributed via prospectus to investors and analysts.

Expenses concerning distribution, research and administrative expenses need to be considered.

What the Expense Ratio Can Tell You

Operating expenses within a fund stay relatively balanced. Funds that have low expenses will typically keep that trend. Generally, the biggest operating cost is the salary that gets paid to the manager of the mutual fund.

By looking at the TER, investors can get an impression about the daily activities of the fund, but also the total asset value.

In the case of investors that are committed to large capital investments in mutual funds, they can use the metric to distinguish average funds from high-performing mutual funds.

Knowing which option is underperforming will signal to investors what the expected returns will be and if staying with the fund is a wise choice in the long run.

The expense ratios can get adapted in a few ways. It is frequently focused on the complete expenses, yet some investors prefer to know the gross cost compared to net expenses.

The Total Expense Ratio vs Gross Expense Ratio

The total expense ratio (TER) is not the same as the gross expense ratio (GER), although many may think that the only difference is in the terms used to describe the same concept.

The GER estimates the total percentage of the asset of the mutual funds that get used in managing the fund. However, the TER is the estimation of the total expenses related to the functioning of the fund.

Limitations of the Total Expense Ratio

There are several critiques and arguments made that show the total expense ratio in a negative light. The most powerful claim is that TER doesn't include expenses that are paid only once.

The TER gets created to keep track of every cost that comes from the functioning of the fund and provide investors with the necessary information that will make them aware of what they can expect, and the inability to account for every cost is a limitation.

Conclusion

The total expense ratio is a crucial metric for an investor that gives them insight into the cost of investing in a particular fund. And by how much will the returns get reduced. Logically, fewer expenses will mean bigger profits.

Calculating the expense ratios is not complicated, with the appropriate information the formula can get implemented pretty fast.

There have been critics about the concept. Because not every cost gets calculated, but this mostly relates to single payments.

Most financial experts advise investors to use the total expense ratio in combination with other parameters. Include the stability of returns and the fund’s track record. Generally, passively managed funds will have lower TRE when compared with actively managed funds.

However, the total percentage of the TER will give a quality estimate of the returns investors can expect.

FAQs

What Is a Good Total Expense Ratio?

For an actively managed mutual fund, a TER around 0.5% is good, while anything over 1.5% gets perceived as high.

How do You Calculate Total Expense Ratio?

The formula of TER gets based on dividing the total costs during the period with the total fund assets and gets presented as a percentage.

What Is Your Expense Ratio?

The expense ratio is the cost of actively managed funds. It can be seen as the fee that gets paid for the benefit of participating in the investment fund.

What Is Total Expense Ratio ETF?

An expense ratio is a cost, actually the management fees and fees for other services that get charged by the exchange-traded fund (ETF).