TNFX Review

Forex Brokers play a pivotal role in the trading world. They are the gateway to the global currency markets, where trillions are traded daily. Choosing the right Forex broker is crucial. It’s not just about the ease of trading, but also about security, costs, and the overall trading experience.

TNFX stands out in the Forex brokerage landscape. Established in 2019, TNFX has quickly become a notable name. With offices in the Middle East, St. Vincent and the Grenadines, and Seychelles, TNFX offers its services globally. They provide access to trading in currencies, stock indices, stocks, and commodities as CFDs, including options for trading with leverage.

In our upcoming review, we delve deep into TNFX. We’ll highlight what sets TNFX apart, its unique offerings, and areas where it might fall short. From varied account options to the nitty-gritty of deposit and withdrawal processes, we cover it all. Our analysis balances expert insights with real trader experiences, giving you a comprehensive view. This review is designed to empower you with knowledge, ensuring you make an informed decision about choosing TNFX as your Forex broker.

What is TNFX?

TNFX, founded in 2019, positions itself as an ECN (Electronic Communication Network) broker. This type of broker provides direct access to other participants in currency markets. They offer a platform for trading a wide range of financial instruments. This includes currencies, stock indices, stocks, and commodities, all traded as CFDs (Contracts for Difference).

A key feature of TNFX is its extensive range of currency pairs. Traders have access to over 50 pairs, with the option of using leverage up to 1:400. This leverage allows traders to open large positions with a relatively small amount of capital.

In terms of trading software, TNFX relies on the MetaTrader platform. This platform is popular in the market for its user-friendly interface and advanced features. It includes tools like Trading Central charts and AutoChartist, enhancing the trading experience with powerful analytical capabilities.

One of the standout offerings of TNFX is its low spreads, starting from 0 pips. For traders, low spreads mean lower trading costs, which is a significant advantage, especially for those who trade frequently or with large volumes.

Benefits of Trading with TNFX

After trading with TNFX, I can highlight the key benefits of trading with this broker. Firstly, TNFX offers a diverse range of trading instruments, including currencies, options, CFDs, and cryptocurrencies. This variety allows traders to explore different markets and diversify their portfolios.

One standout feature is the low spreads, especially in the VIP accounts, which can contribute to reduced trading costs. Additionally, TNFX provides access to popular trading platforms like MetaTrader 4 and MetaTrader 5, known for their user-friendly interfaces and comprehensive charting tools. These platforms enhance the trading experience and make it suitable for traders at various skill levels.

Furthermore, TNFX offers a range of account types to cater to different trading preferences, from beginners to more experienced traders. This flexibility allows traders to choose an account that aligns with their trading goals and risk tolerance. Overall, my experience with TNFX has highlighted these benefits, making it a competitive option in the Forex brokerage market.

TNFX Regulation and Safety

As a trader, I understand the importance of regulation and safety when choosing a Forex broker. This is why I find TNFX’s regulatory framework reassuring. In Seychelles, TNFX operates under a license from the Financial Services Authority of Seychelles. This authority ensures that the broker adheres to certain financial standards and practices.

In the UAE, TNFX’s operations are regulated by the Dubai Economic Department. This adds an additional layer of oversight, particularly important for traders in the Middle East. Although TNFX has an office in St. Vincent and the Grenadines, it’s worth noting that this country does not issue specific licenses to international companies. Instead, companies like TNFX are registered with a number in the general register.

TNFX’s adherence to regulatory rules is crucial for traders. This compliance ensures that they operate within the bounds of financial legality and standards. Furthermore, TNFX offers negative balance protection. This is a significant safety feature, as it protects traders from losing more money than they have deposited.

Another aspect of TNFX that stands out is the flexibility in using cryptocurrencies and electronic payment systems. Their regulators do not impose restrictions on these methods, which is a big plus for traders who prefer modern payment solutions. This information, gathered after trading with the broker, highlights TNFX’s commitment to providing a secure and versatile trading environment.

TNFX Pros and Cons

Pros

- Wide selection of currency pairs

- Trading on MetaTrader platforms

- Negative balance protection

- High leverage for major currency pairs

- Narrow spreads on all account types

- Cent and demo accounts available

- Options for passive income

Cons

- Legal disputes must be resolved at broker’s location

- $100 minimum initial deposit

- No interaction with traders on social media

- Not a member of compensation funds

TNFX Customer Reviews

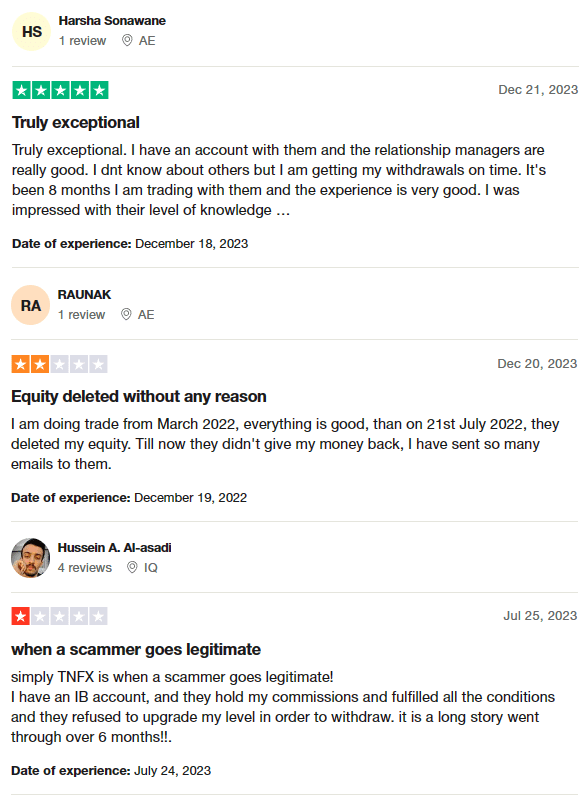

TNFX currently holds a 2.5-star rating on Trustpilot, reflecting a mixed bag of customer experiences. Some traders report positive experiences, praising the efficiency of withdrawals and the expertise of relationship managers. These customers have been trading with TNFX for several months and express satisfaction with the services provided. On the other hand, there are negative reviews highlighting issues such as unresolved disputes over equity deletion and challenges with withdrawing commissions. These contrasting reviews suggest that while some find TNFX reliable and efficient, others encounter significant challenges in their trading journey.

TNFX Spreads, Fees, and Commissions

When I explored TNFX’s fee structure, I found that they don’t charge non-trading fees for deposits and withdrawals, which is a significant advantage. The trading fees vary depending on the type of account you choose. For instance, in the Cent and Standard accounts, the spreads start floating from 1 pip. If you opt for a VIP account, the spreads are even lower, starting from just 0.4 pips.

For those preferring Fix Accounts, TNFX offers fixed spreads starting from 1 pip. A unique feature is their Zero account, where the spreads for major pairs like EUR/USD and USD/JPY are 0 pips. However, this account comes with a catch – there’s a $5 commission per lot traded.

What I appreciate is that on all other account types, any commission or additional fees are included within the spread. This makes it easier to understand the cost structure without worrying about hidden charges. Overall, TNFX seems to offer a competitive fee structure that caters to different types of traders, from beginners to more experienced ones.

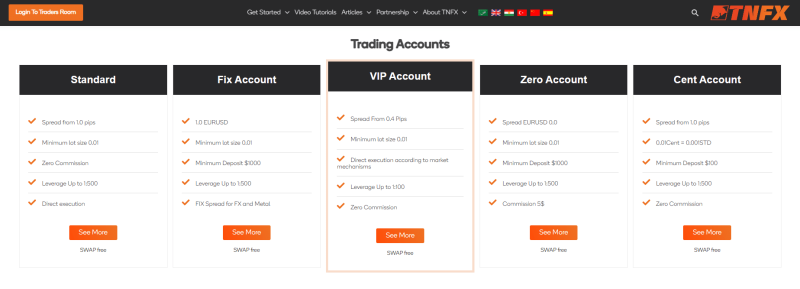

Account Types

Based on my testing, here’s a clear outline of the account types offered by TNFX:

- Cent Account

- Cent account format

- Minimum deposit: $100

- Standard Account

- Floating spreads

- Zero commission per lot

- Minimum deposit: $300

- Fix Account

- Fixed spreads

- Zero commission per lot

- Minimum deposit: $500

- Zero Account

- Ideal for experienced traders

- Floating near-zero spreads

- Commission per lot: $5

- Minimum deposit: $500

- VIP Account

- Designed for professional trading

- Very narrow spreads

- Zero commission per lot

- Minimum deposit: $100,000

Each account type is tailored to different trading needs and preferences, from the beginner-friendly Cent account to the high-stakes VIP account for professional traders.

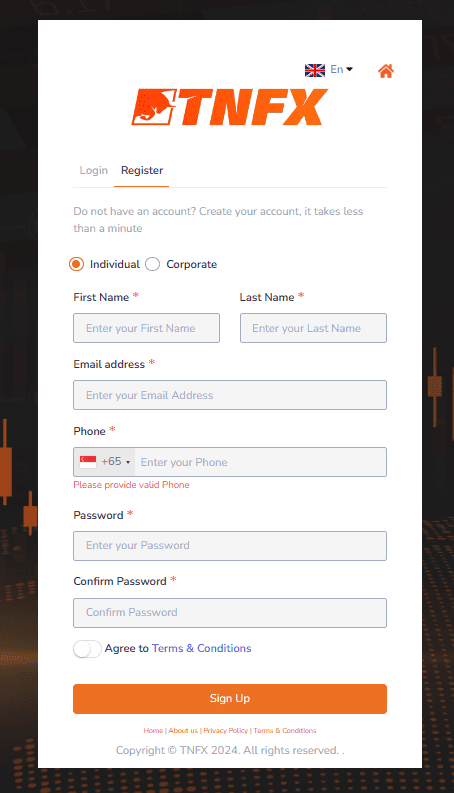

How to Open Your Account

- To open an account, first click on ‘Open Live Account’ on TNFX’s homepage.

- Fill in the registration form by selecting ‘Individual account’ and entering your first name, last name, email, and phone number.

- Create a password, agree to the Terms and Conditions, and complete the CAPTCHA.

- Confirm your phone number by entering the One-Time Password (OTP) sent to you.

- Proceed to email verification by entering the OTP received via email.

- Alternatively, you can click on the verification link provided in the email from TNFX.

- After email verification, access your user account using your email and password.

- Complete these steps to successfully create your TNFX trading account.

TNFX Trading Platforms

Based on my experience with TNFX, their trading platforms include both MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are well-regarded in the trading community for their robust features and user-friendly interfaces. MT4 is known for its excellent charting tools, while MT5 offers advanced financial trading functions and superior analytical tools. Both platforms cater to traders of all levels, from beginners to professionals, providing a seamless and efficient trading experience.

What Can You Trade on TNFX

Based on my experience, TNFX offers a diverse range of trading instruments that cater to various interests and strategies. Firstly, they provide a substantial selection of Currency Pairs, which is ideal for those who specialize in forex trading. This includes major pairs, minors, and exotics, offering a broad market scope.

Additionally, TNFX gives traders the opportunity to trade Options. This is particularly useful for those looking to hedge or take on different types of risk-reward strategies. CFDs (Contracts for Difference) are also available, allowing traders to speculate on the rising or falling prices of fast-moving global financial markets.

Moreover, for those interested in the digital currency space, TNFX includes Crypto trading. This adds an exciting dimension for traders to engage with the dynamic and rapidly evolving cryptocurrency markets. Overall, the range of instruments available on TNFX makes it a versatile platform suitable for various trading styles and preferences.

TNFX Customer Support

Based on my personal experience with TNFX, their customer support is accessible through multiple channels. They offer Live Chat, which is great for instant assistance and quick queries. This feature is particularly useful for real-time problem solving.

For more detailed discussions or urgent issues, I found that making a phone call to their support team is effective. They are responsive and knowledgeable, providing thorough assistance. Additionally, there’s the option to send a request via email. This is suitable for less urgent matters or when detailed documentation is needed.

Moreover, for traders who have opened an account with TNFX, there’s an added convenience of raising support tickets directly from their user profile. This feature streamlines the process of getting help and ensures that issues are tracked and resolved systematically. Overall, TNFX’s customer support structure is comprehensive, catering to different needs and preferences of traders.

Advantages and Disadvantages of TNFX Customer Support

Withdrawal Options and Fees

Based on my experience, TNFX has a straightforward withdrawal process, but it’s important to note that only verified users who have passed the KYC (Know Your Customer) process are eligible for fund withdrawals. This is a standard practice in the industry to ensure safety and compliance.

When it comes to withdrawal options, TNFX offers flexibility. You can withdraw your funds to a bank account, credit card, electronic wallet, or even a cryptocurrency wallet. This variety caters to different preferences and needs. However, the minimum amount you can withdraw, regardless of the method, is $50.

Regarding the timing, once your withdrawal request is approved, the funds are usually credited within 24 hours. This quick turnaround is quite efficient. It’s also important to note that withdrawals are processed in USD, so keep this in mind if your primary currency is different, as it might affect conversion rates or fees.

TNFX Vs Other Brokers

#1. TNFX vs AvaTrade

TNFX is known for its wide selection of trading instruments, including currency pairs, options, CFDs, and cryptocurrencies. It offers various account types and is notable for its low spreads, especially on its VIP accounts. AvaTrade, since 2006, has established itself as a major player with a strong focus on providing a comprehensive online trading experience. It offers more than 1,250 financial instruments and caters to a large global clientele. AvaTrade is heavily regulated and licensed, indicating a strong emphasis on trader security and compliance.

Verdict: For traders prioritizing a wide range of instruments and low spreads, TNFX might be the better choice. However, for those valuing regulatory security and a more extensive range of financial instruments, AvaTrade could be preferable.

#2. TNFX vs RoboForex

RoboForex, established in 2009, is known for its cutting-edge technologies and a vast array of trading options, boasting more than 12,000 trading instruments. Its standout features include a variety of trading platforms and customizability for different trading styles and volumes. Comparing this to TNFX, which offers a more streamlined selection of trading instruments and platforms, the key difference lies in the diversity and technological edge provided by RoboForex.

Verdict: If a trader is looking for advanced technology and a vast range of trading instruments, RoboForex is a better choice. However, for those seeking straightforward trading with a focus on currency pairs and traditional instruments, TNFX could be more suitable.

#3. TNFX vs Exness

Exness boasts a high trading volume and offers an extensive range of more than 120 currency pairings, including stocks, CFDs, and cryptocurrencies. It stands out for offering infinite leverage on small deposits and multiple account types catering to various trader needs. TNFX provides a simpler, more focused trading environment with a selection of key trading instruments and account types, including options for high leverage but not to the extent of Exness’s offerings.

Verdict: For traders who are looking for high leverage options and a vast array of currency pairs, Exness could be the more appropriate choice. In contrast, TNFX would suit traders looking for a more straightforward trading environment with a focus on essential trading instruments.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: TNFX Review

TNFX emerges as a competitive player in the Forex brokerage market, particularly notable for its diverse range of trading instruments and account types. The broker’s strengths lie in offering low spreads, especially in its VIP accounts, and providing access to popular trading platforms like MetaTrader 4 and MetaTrader 5. This makes TNFX an appealing option for traders at various levels, from beginners to more experienced individuals.

However, it’s important for potential users to be aware of certain drawbacks. The mixed customer reviews, highlighting issues such as challenges in withdrawals and limited customer support, are aspects to consider. Additionally, while TNFX offers flexibility in trading instruments, it doesn’t have the extensive regulatory framework and technological prowess seen in some other brokers.

Also Read: NS Broker Review 2024 – Expert Trader Insights

TNFX Review: FAQs

What trading platforms does TNFX offer?

TNFX provides the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their user-friendly interfaces and robust features.

What is the minimum deposit for TNFX?

The minimum deposit at TNFX varies by account type, starting from $100 for a Cent account.

Does TNFX offer customer support in multiple languages?

TNFX’s customer support is available in Arabic and English, catering to a wide range of traders.

OPEN AN ACCOUNT NOW WITH TNFX AND GET YOUR BONUS