TMS Brokers Review

Choosing the right Forex broker is crucial for success in the Forex market. A good broker ensures secure transactions, reliable customer support, and access to essential trading tools. With numerous options available, finding a broker that meets your needs can significantly impact your trading outcomes.

TMS Brokers is a Forex and CFD broker that offers trading in currency pairs, stocks, and CFDs on stocks, indices, commodities, and cryptocurrencies. In this review, I will provide a comprehensive evaluation of TMS Brokers, highlighting its unique selling points and potential drawbacks. My goal is to provide you with essential insights about the broker, including its account options, deposit and withdrawal processes, commission structures, and other critical details.

By combining expert analysis with real trader experiences, this review will give you the information you need to make an informed decision about choosing TMS Brokers as your preferred brokerage service provider. Our balanced perspective ensures that you receive a thorough understanding of what TMS Brokers has to offer.

What is TMS Brokers?

TMS Brokers is a Forex and CFD broker that offers trading in currency pairs, stocks, and CFDs on stocks, indices, commodities, and cryptocurrencies. With spreads starting from 0 pips and no trading fees, it aims to provide cost-effective trading solutions.

Traders can choose between the popular MetaTrader 5 (MT5) platform and the broker’s proprietary OANDA TMS Brokers platform. A free demo account with virtual €50,000 is available for those who want to practice before trading with real money.

No minimum deposit is required to open a live account, making it accessible for all traders. Upon reaching a certain trading volume, traders can upgrade to a Pro account, which offers negative balance protection and increased leverage up to 1:200.

Benefits of Trading with TMS Brokers

Trading with TMS Brokers offers numerous advantages, making it an appealing choice for both novice and experienced traders. One of the primary benefits is the absence of trading fees, allowing traders to maximize their profits without worrying about additional costs. Additionally, spreads starting from 0 pips ensure that trading costs are kept minimal, which is especially beneficial for high-frequency and large-volume traders.

Another significant advantage is the availability of the MetaTrader 5 (MT5) platform alongside the proprietary OANDA TMS Brokers platform. MT5 is renowned for its advanced charting tools, technical indicators, and support for algorithmic trading, making it a preferred choice among seasoned traders. Meanwhile, the proprietary platform offers a user-friendly interface and seamless integration with TMS’s services, enhancing the overall trading experience.

TMS Brokers’ regulation by the Polish Financial Supervision Authority (UKNF) provides traders with a high level of security and transparency. This regulatory oversight ensures that the broker adheres to strict financial standards, protecting traders’ funds and promoting fair trading practices. The inclusion of negative balance protection adds an extra layer of security, ensuring that traders cannot lose more than their initial investment.

TMS Brokers Regulation and Safety

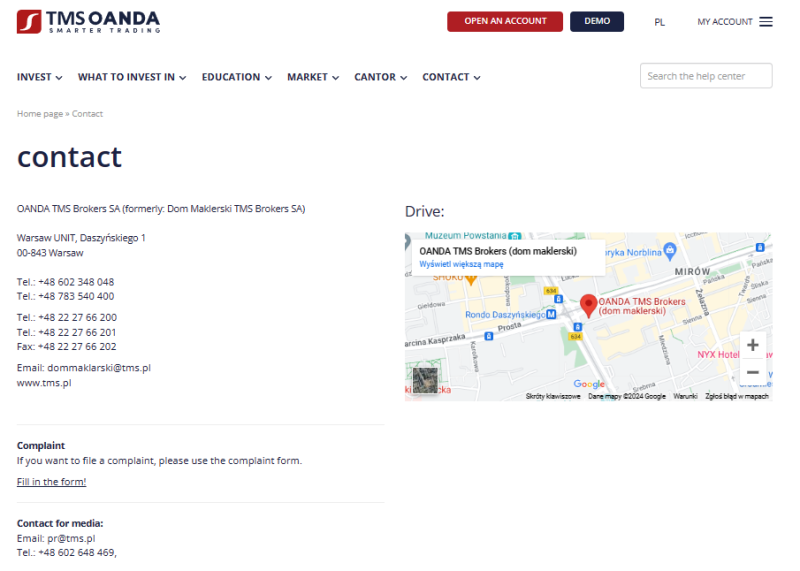

TMS Brokers is registered in Warsaw and its activities are supervised by the Polish Financial Supervision Authority (UKNF). This regulatory oversight ensures that the broker operates under strict financial standards, providing a layer of security for traders.

Knowing that TMS Brokers is regulated by a reputable authority like UKNF is crucial. It means the broker adheres to stringent guidelines, which can help protect your investments and ensure fair trading practices.

After trading with TMS Brokers, it became clear that this regulatory framework is a significant advantage. It offers traders peace of mind, knowing their funds are safeguarded and the broker’s operations are transparent and compliant with industry regulations.

TMS Brokers Pros and Cons

Pros

- No trading fees

- Spreads from 0 pips

- MetaTrader 5 (MT5) platform

- Proprietary mobile app

- Free demo account

- Multiple deposit methods

- Regulated by KNF

- Negative balance protection

Cons

- Limited account types

- Customer support hours

- No Islamic accounts

- Lack of transparency on costs

- No bonuses or promotions

TMS Brokers Customer Reviews

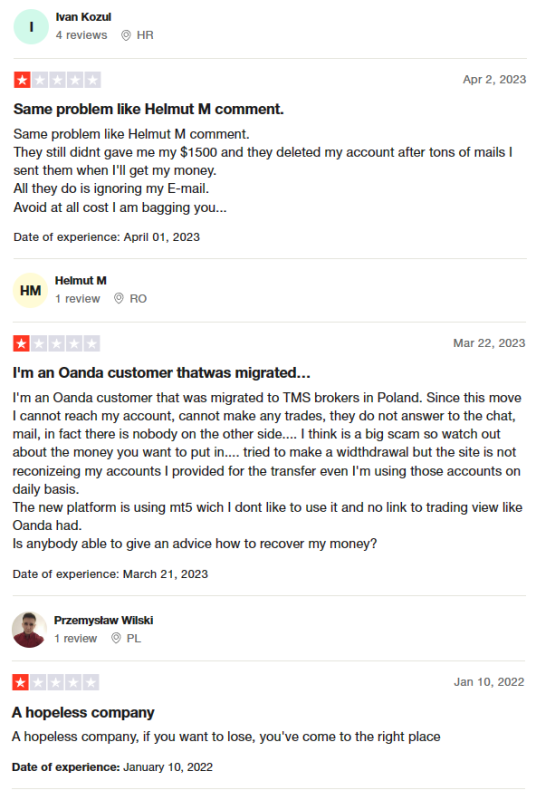

Customer reviews for TMS Brokers highlight significant concerns. Many users report issues with account access and unresponsive customer service, with some unable to withdraw their funds. Several customers feel the company is unreliable, with allegations of ignored emails and unaddressed problems. Migrated OANDA customers particularly struggle with the transition, experiencing technical difficulties and dissatisfaction with the new MT5 platform. Overall, reviews suggest potential risks, urging caution when considering TMS Brokers.

TMS Brokers Spreads, Fees, and Commissions

TMS Brokers offers highly competitive trading conditions with floating spreads starting from 0 pips. This low-spread structure helps keep trading costs minimal, which is especially beneficial for traders who engage in high-frequency or large-volume trades.

One of the key advantages is that TMS Brokers charges no trading fees, ensuring that overall expenses remain low. This fee structure makes it an attractive option for those looking to maximize their trading profits.

Additionally, TMS Brokers does not impose fees for deposits, though there might be currency conversion costs for non-Euro deposits. Withdrawals are generally free, but there is a €20 fee for withdrawals under €100. This cost-effective fee model and no commissions on most trades make TMS Brokers appealing for traders aiming to minimize their trading costs while accessing a wide range of trading instruments.

Account Types

Demo Account

- Identical to the Standard account

- Traders work with virtual €50,000

- Allows practice without financial risk

Standard Account

- No minimum deposit requirements

- Floating spread from 0 pips

- No trading fees

- Maximum leverage is 1:20

- No restrictions on trading strategies and methods

Pro Account

- Requires compliance with trading volume and activity requirements

- Maximum leverage is 1:200

- Additional conditions differ from the Standard account

How to Open Your Account

- Visit the TMS Brokers website and click the “OPEN DEMO ACCOUNT” button.

- Fill in your name, email, and phone number, agree to the terms of service, and click the “OPEN DEMO ACCOUNT” button.

- Check your email for a confirmation link and follow the instructions to activate your demo account.

- To open a live account, click the appropriate button on the main page and provide detailed personal information, including your registration address.

- Follow the on-screen instructions to upload photos of your ID documents for identity verification.

- Once your identity is verified, log into your account and proceed to make a deposit.

- Go to the corresponding section in your user account to fund your account using your preferred payment method.

- Download the OANDA TMS Brokers or MetaTrader 5 platform from the broker’s website, install it on your device, enter your registration details, and start trading.

TMS Brokers Trading Platforms

Based on my experience, TMS Brokers provides access to two robust trading platforms: MetaTrader 5 (MT5) and the proprietary OANDA TMS Brokers platform. MT5 is widely known for its advanced charting tools, technical indicators, and support for algorithmic trading, making it a favorite among experienced traders.

The OANDA TMS Brokers platform offers a user-friendly interface and seamless integration with TMS’s services. It includes various features designed to enhance the trading experience, such as real-time market data and customizable trading tools. For more details on the platforms, you can visit their website.

What Can You Trade on TMS Brokers

Based on my experience, TMS Brokers offers a diverse range of trading instruments. You can trade currency pairs, which is ideal for those who enjoy forex trading with various major, minor, and exotic pairs available.

The platform also provides access to stocks and CFDs on stocks, allowing you to invest in individual companies or speculate on price movements without owning the shares. Additionally, you can trade indices, which offer exposure to broader market movements and can be a great way to diversify your portfolio.

For those interested in commodities, TMS Brokers lets you trade commodities like gold, silver, and oil, giving you the opportunity to hedge against inflation or market volatility. Finally, the platform supports cryptocurrencies, enabling you to trade popular digital currencies like Bitcoin and Ethereum. This wide range of instruments ensures that you have plenty of options to suit your trading strategies and goals.

TMS Brokers Customer Support

Based on my experience, TMS Brokers provides multiple communication methods to ensure effective customer support. You can reach out via telephone or email for direct assistance with your trading needs. This offers a straightforward way to get in touch with the support team quickly.

Additionally, TMS Brokers maintains active profiles on Facebook, X (formerly Twitter), and LinkedIn. These social media platforms allow users to contact the broker’s technical support team and stay updated on the latest news and announcements. This multi-channel approach enhances accessibility and convenience.

A live chat feature is also available on the bottom right corner of the broker’s website and within the user account portal. This feature enables you to get instant responses to your queries, improving the overall customer support experience.

Advantages and Disadvantages of TMS Brokers Customer Support

Withdrawal Options and Fees

When trading on a live account with TMS Brokers, I can execute real trades and receive actual profits, unlike a demo account where only virtual money is used. This means I can withdraw my earnings at any time by submitting a request in my user account on the website.

I have the flexibility to withdraw my funds in full or partially, and all broker fees are clearly stated in advance. Withdrawals can be made to bank accounts, Visa, Mastercard, and through Trustly, providing several convenient options.

It’s important to note that while TMS Brokers does not charge for most withdrawals, third-party providers involved in the transaction, like banks or payment processors, may impose their own fees. The broker is not responsible for these additional charges.

TMS Brokers Vs Other Brokers

#1. TMS Brokers vs AvaTrade

TMS Brokers stands out with its competitive trading conditions, including no trading fees and spreads starting from 0 pips. It offers the MetaTrader 5 (MT5) platform and a proprietary platform, providing flexibility and advanced trading tools. Additionally, TMS Brokers’ regulation by the Polish Financial Supervision Authority (UKNF) ensures a high level of security and transparency, appealing to traders who prioritize regulatory oversight. On the other hand, AvaTrade has been a leading online Forex and CFD broker since 2006, with more than 300,000 registered customers from over 150 countries. AvaTrade offers over 1,250 financial instruments and executes roughly two million monthly transactions.

Verdict: AvaTrade is the better choice due to its extensive range of financial instruments, global reach, and long-standing reputation. Its comprehensive regulatory oversight across multiple jurisdictions provides an added layer of security and confidence for traders, making it a superior option for those seeking a robust and reliable trading platform.

#2. TMS Brokers vs RoboForex

RoboForex has been operating since 2009, offering superb trading conditions with cutting-edge technologies. It provides more than 12,000 trading options across eight asset classes and is regulated by the FSC. RoboForex is known for its wide selection of trading platforms, including MetaTrader, cTrader, and RTrader. It also conducts unique contests, such as ContestFX, which help traders launch successful trading careers. TMS Brokers offers competitive spreads, no trading fees, and a variety of trading instruments. It is regulated by the Polish Financial Supervision Authority (UKNF) and provides the MetaTrader 5 and a proprietary platform.

Verdict: RoboForex is better due to its extensive range of trading options, diverse asset classes, and multiple advanced trading platforms. Its unique contest features and focus on cutting-edge technology provide added value for traders.

#3. TMS Brokers vs Exness

Exness is a Cyprus-based broker with a high ranking in forex ratings. It offers a wide range of CFDs for stocks, energy, metals, and more than 120 currency pairings, including cryptocurrencies. Exness is known for its low commissions, immediate order execution, and unlimited leverage for small deposits. It provides a comfortable trading environment with various account types and a demo account for practice. TMS Brokers provides competitive spreads, no trading fees, and a variety of trading instruments, including currency pairs, stocks, and cryptocurrencies. It is regulated by the Polish Financial Supervision Authority (UKNF) and offers the MetaTrader 5 platform along with a proprietary platform.

Verdict: Exness is better due to its low commissions, immediate order execution, and flexible leverage options. Its extensive range of trading instruments and user-friendly environment make it a more attractive choice for traders seeking reliability and flexibility.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH TMS BROKERS

Conclusion: TMS Brokers Review

Based on my experience and user feedback, TMS Brokers offers a solid trading platform with a wide range of instruments, including currency pairs, stocks, and cryptocurrencies. Their competitive spreads starting from 0 pips and no trading fees make it an attractive option for cost-conscious traders. Additionally, the availability of MetaTrader 5 and a proprietary platform provides flexibility in trading preferences.

However, there are notable drawbacks. Users have reported issues with customer support responsiveness and difficulties in withdrawing funds. Limited account types and the absence of round-the-clock support are other concerns. While TMS Brokers has strong regulatory oversight and a user-friendly trading environment, potential traders should weigh these pros and cons carefully before deciding.

Also Read: Hankotrade Review 2024 – Expert Trader Insights

TMS Brokers Review: FAQs

What trading platforms does TMS Brokers offer?

TMS Brokers offers MetaTrader 5 and their proprietary OANDA TMS Brokers platform.

Are there any fees for trading with TMS Brokers?

No, TMS Brokers does not charge trading fees, and spreads start from 0 pips.

Is TMS Brokers regulated?

Yes, TMS Brokers is regulated by the Polish Financial Supervision Authority (UKNF).

OPEN AN ACCOUNT NOW WITH TMS BROKERS AND GET YOUR BONUS